Table of Contents

Introduction

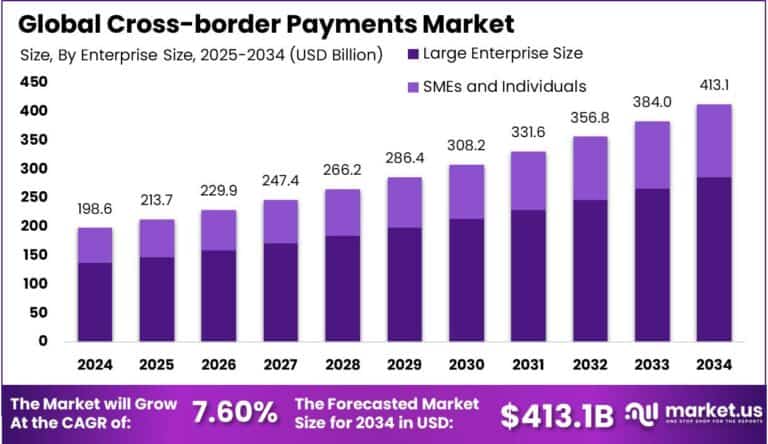

The Global Cross-border Payments Market is projected to grow from USD 198.6 billion in 2024 to USD 413.1 billion by 2034, with a CAGR of 7.6% during 2025-2034. In 2024, North America led the market with a 38.6% share, generating USD 76.6 billion. The U.S. market, valued at USD 68.9 billion, is expected to grow at a CAGR of 5.9%, driven by increasing trade activities, remittances, and e-commerce growth. Technological advancements and regulatory changes are fueling faster, more secure, and cost-effective cross-border payment solutions globally.

How Growth is Impacting the Economy

The growth of the cross-border payments market is significantly impacting the global economy by facilitating international trade and remittances, essential drivers of economic activity. Efficient cross-border payment systems lower transaction costs and reduce settlement times, enabling businesses and individuals to transfer funds swiftly and securely across borders. This accelerates cash flow, supports global supply chains, and boosts trade volumes.

The rise of e-commerce further amplifies demand for seamless international payments, encouraging global market participation for businesses of all sizes. The expansion of digital payment infrastructure generates employment in fintech, banking, and technology sectors, fostering innovation and economic diversification. Governments and regulatory bodies benefit from improved transparency and compliance capabilities, enhancing the integrity of the financial system and contributing to sustainable economic growth.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/cross-border-payments-market/free-sample/

(Use corporate mail ID for quicker response)

Impact on Global Businesses

Businesses face rising operational costs due to compliance with evolving regulations, cybersecurity investments, and managing complex international payment networks. Supply chain disruptions and geopolitical uncertainties affect cross-border transaction volumes and costs. However, companies benefit from faster payment settlements, improved liquidity management, and access to new markets via efficient cross-border payment systems.

Sectors such as retail, manufacturing, finance, and remittances leverage advanced payment platforms to enhance customer experience and operational efficiency. Delays in adopting modern payment solutions risk losing competitiveness as customers and partners expect real-time, transparent transactions. Firms investing in scalable, secure payment infrastructures gain market advantage.

Strategies for Businesses

To thrive, businesses should adopt cutting-edge cross-border payment technologies that offer speed, security, and regulatory compliance. Building partnerships with fintech providers and leveraging blockchain or API-driven platforms enhances transparency and reduces costs. Diversifying payment corridors and currencies mitigates geopolitical and currency risks. Investing in fraud prevention and cybersecurity is critical to protect transactions and data. Continuous training for staff on compliance and technology updates ensures operational resilience. Offering seamless, localized payment experiences improves customer satisfaction and expands global reach.

Take advantage of our unbeatable offer - buy now!

Key Takeaways

- The cross-border payments market is growing steadily, driven by trade, remittances, and e-commerce

- Market growth enhances global trade efficiency and liquidity

- Rising costs and regulatory complexity require strategic management

- Technology adoption and partnerships improve transparency and reduce costs

- Customer-centric, secure payment solutions are crucial for competitiveness

➤ Get full PDF access here @ https://market.us/purchase-report/?report_id=149158

Analyst Viewpoint

The cross-border payments market is on a stable growth trajectory fueled by increasing global trade and digital commerce. Firms that invest in innovative, compliant, and secure payment solutions will capture significant market share. Technological advances such as blockchain and API integrations will drive efficiency and transparency. The outlook remains positive as regulatory frameworks evolve to support digital payments. Businesses prioritizing agility, compliance, and customer experience are well-positioned for long-term success.

Regional Analysis

North America leads the market with a dominant share due to advanced financial infrastructure and high cross-border transaction volumes. Europe follows with strong regulatory frameworks and digital payment adoption. Asia-Pacific shows rapid growth propelled by expanding trade, remittances, and e-commerce, especially in China, India, and Southeast Asia. Latin America and the Middle East & Africa are emerging markets witnessing increasing cross-border payment activity supported by fintech innovation and financial inclusion efforts.

➤ Discover More Trending Research

- Task Management Agent Market

- Digital Subscriber Line (DSL) Chipsets Market

- Real Time Payments Market

- Drone Simulator Market

Business Opportunities

The market offers opportunities in blockchain-enabled payments, real-time settlement platforms, API integrations, and fraud detection solutions. Financial institutions and fintech companies can develop tailored services for remittances, trade finance, and e-commerce payments. Expansion into emerging markets with growing cross-border transaction volumes provides significant growth potential. Collaborations between banks, technology providers, and regulators foster innovation and market penetration. Sustainable and compliant payment solutions addressing regulatory changes present niche opportunities.

Key Segmentation

- By Type: Consumer-to-Consumer (C2C), Business-to-Business (B2B), Business-to-Consumer (B2C)

- By Mode: Bank Transfer, Card Payments, Digital Wallets, Mobile Payments

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Key Player Analysis

Leading companies focus on developing scalable, secure, and interoperable cross-border payment platforms with advanced fraud prevention and compliance features. Strategic partnerships with fintechs and banks accelerate adoption and expand service offerings. Investments in blockchain, AI, and API technologies enhance transaction speed and transparency. Compliance with global regulatory standards is prioritized to build trust and reduce risks. Companies provide customizable solutions catering to diverse industries and geographies, maintaining strong market presence and customer loyalty.

Recent Developments

In early 2025, major players launched real-time cross-border payment solutions leveraging blockchain and AI-driven fraud detection. Partnerships between fintech firms and traditional banks expanded payment corridor networks. Increased investments targeted regulatory compliance automation and customer experience enhancements.

Conclusion

The cross-border payments market is poised for sustained growth driven by rising global trade, remittances, and e-commerce. Strategic investments in technology, compliance, and partnerships will enable businesses to capitalize on evolving opportunities. As seamless and secure international payment solutions become critical, this market will continue to shape the future of global finance and economic connectivity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)