Table of Contents

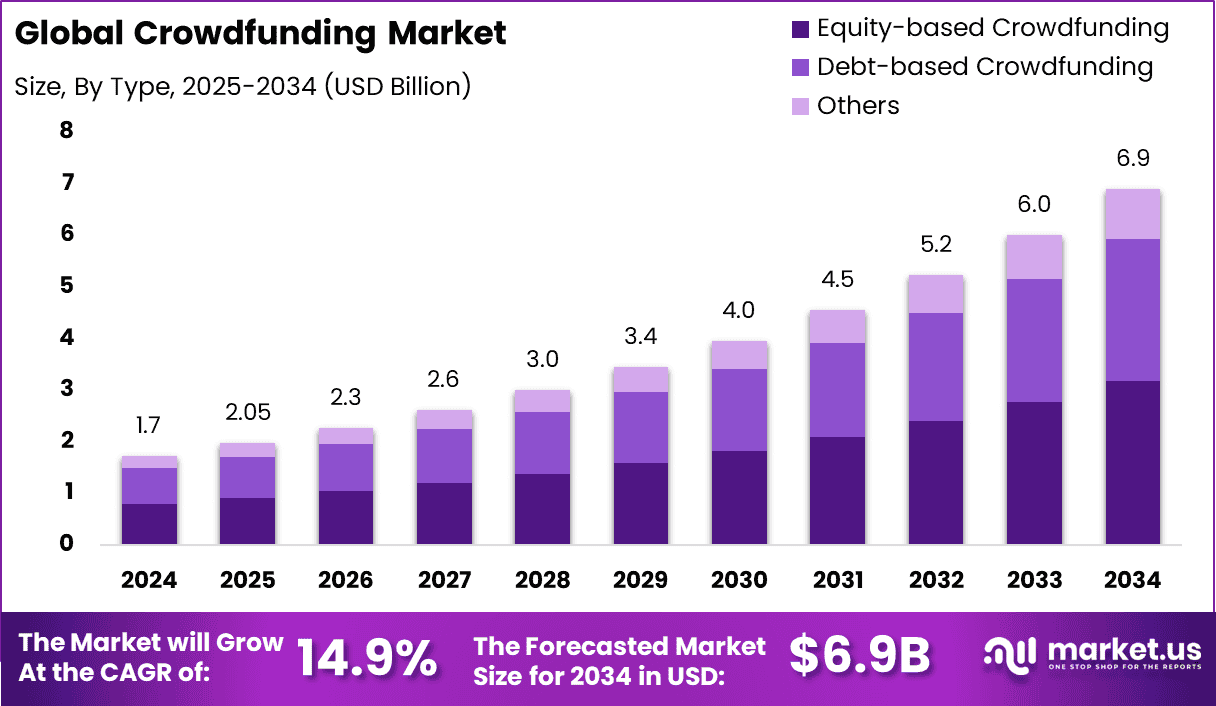

The global crowdfunding market is projected to grow significantly, reaching USD 6.9 billion by 2034, up from USD 1.7 billion in 2024, with a robust CAGR of 14.9%. North America led the market in 2024, capturing more than 40% of the global market share, generating USD 0.68 billion in revenue.

The U.S. market alone was valued at USD 0.65 billion, with a growth forecast of 12.2% CAGR. The increasing popularity of equity-based crowdfunding, particularly in sectors like food & beverage, and the rising interest in early-stage investments are key drivers of this market’s growth.

How Tariffs Are Impacting the Economy

Tariffs have had a substantial impact on the global economy, driving up costs for businesses and consumers. In the U.S., tariffs on imports have resulted in higher prices for raw materials, components, and finished products, leading to inflationary pressures across industries.

Companies that rely on international supply chains, such as manufacturing and technology, have experienced increased production costs, which have been passed on to consumers in the form of higher prices. This has reduced consumer purchasing power, making it more difficult for businesses to attract customers in price-sensitive sectors. Tariffs have also disrupted global supply chains, causing delays and inefficiencies, especially in industries that require timely product delivery, such as retail and technology.

In the crowdfunding market, these disruptions have affected the capital raising process for startups, particularly in sectors like food & beverage, where product development and distribution are often dependent on international suppliers. As a result, businesses are reconsidering their global operations and seeking alternative supply chains to minimize tariff-related risks.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/crowdfunding-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Tariffs have caused a rise in production costs for businesses globally, especially those reliant on imports. Companies across sectors, including retail, manufacturing, and technology, are experiencing increased expenses on raw materials and components.

As a result, many businesses are reassessing their supply chain strategies, looking to source materials from regions with lower tariff rates or nearshore operations to reduce costs. These supply chain shifts are creating inefficiencies and adding complexity to operations.

Sector-Specific Impacts

In the crowdfunding market, tariffs have affected sectors like food & beverage, where product development often involves international sourcing for ingredients, packaging, and equipment. Small-scale food producers and craft brands, which heavily rely on crowdfunding to validate their concepts and raise capital, are facing challenges due to higher production costs.

Startups in these sectors are increasingly using crowdfunding platforms to bridge funding gaps created by rising tariffs and supply chain disruptions. As tariffs increase operational costs, businesses are turning to equity-based crowdfunding models to attract investors and raise capital without taking on debt.

Strategies for Businesses

To navigate the impact of tariffs, businesses are implementing several strategies:

- Supply Chain Diversification: Exploring new suppliers and manufacturing locations outside of tariff-heavy regions to reduce cost exposure.

- Nearshoring: Relocating production closer to home markets to reduce tariffs and shipping costs.

- Product Innovation: Modifying product designs to reduce dependence on foreign materials subject to tariffs.

- Crowdfunding: Turning to crowdfunding platforms to raise capital for expansion, innovation, or to offset tariff-induced costs without the burden of debt.

➤ Explore more strategies get full access now @ https://market.us/purchase-report/?report_id=147731

Key Takeaways

- Strong Growth: The global crowdfunding market is expected to reach USD 6.9 billion by 2034, growing at a CAGR of 14.9%.

- Regional Dominance: North America captured over 40% of the market share in 2024, generating USD 0.68 billion.

- Equity-Based Crowdfunding: Leading model with 46% market share, appealing to both investors and startups.

- Industry Focus: The food & beverage sector accounts for 32% of the crowdfunding market, with small businesses turning to public funding for validation and growth.

Analyst Viewpoint

The crowdfunding market is positioned for strong growth, particularly in North America, driven by the increasing adoption of equity-based funding models and investor interest in early-stage innovation. As tariffs continue to impact businesses, crowdfunding will play an essential role in helping startups raise capital while avoiding traditional financing routes.

The growing food & beverage sector’s reliance on crowdfunding platforms highlights a broader trend of consumer-driven innovation. The market outlook remains positive, with crowdfunding emerging as a key tool for entrepreneurs to bypass traditional funding barriers and bring new products to market.

Regional Analysis

North America led the crowdfunding market in 2024, capturing over 40% of the global market share, generating USD 0.68 billion in revenue. The U.S. alone represented the majority of this share, valued at USD 0.65 billion. The rapid growth of equity-based crowdfunding in North America is driving the expansion, particularly in sectors like food & beverage and technology.

Other regions, particularly Europe and Asia-Pacific, are also experiencing growth, but North America remains the dominant market for crowdfunding activities. The rise of digital platforms and favorable regulations in North America will continue to drive market leadership in the coming years.

➤ Discover More Trending Research

- K-12 Robotic Toolkits Market

- Renewable Drone Market

- Digital Education Content Market

- K-12 Game-Based Learning Market

Business Opportunities

The crowdfunding market offers significant opportunities for businesses, especially in sectors like food & beverage, technology, and entertainment. Startups in these industries can leverage crowdfunding to secure capital for product development, market testing, and expansion.

Equity-based crowdfunding models are gaining popularity as investors seek to fund innovative, high-growth companies without the risks associated with traditional financing. Additionally, the growth of online platforms is creating new opportunities for global investment, enabling businesses to tap into a broader pool of investors and raise capital more efficiently.

Key Segmentation

The global crowdfunding market is segmented by funding model, industry, and region:

- Funding Model: Equity-based crowdfunding is the leading model, capturing over 46% of the market share due to its appeal to both startups and investors.

- Industry: The food & beverage sector holds the largest share, with over 32% of the market, driven by consumer demand for innovative products.

- Region: North America leads the global crowdfunding market with more than 40% share, driven by favorable regulations, high internet penetration, and widespread platform adoption.

Key Player Analysis

Leading players in the crowdfunding market are focusing on enhancing platform functionality to attract both investors and entrepreneurs. These companies are leveraging technology to streamline the fundraising process, improve transparency, and increase investor confidence.

By offering specialized crowdfunding models, such as equity-based funding. They provide startups with a platform to raise capital without taking on traditional debt. Additionally, players are expanding their global reach by offering multi-currency options and localized services to cater to international markets.

Top Key Players in the Market

- Kickstarter PBC

- Indiegogo Inc.

- GoFundMe Inc.

- Fundable LLC

- Crowdcube Limited

- GoGetFunding

- Crowdfunder Inc.

- Alibaba Group Holding Limited

- Wefunder Inc.

- Fundly

- Jingdong Inc.

- Suning.com Co. Ltd

- Owners Circle

- Realcrowd Inc.

- Others

Recent Developments

In 2024, the crowdfunding market saw significant growth in the U.S.. Driven by increased interest in equity-based models and higher investor appetite for early-stage ventures. The food & beverage sector, in particular, demonstrated strong reliance on crowdfunding platforms for product validation and consumer engagement.

Conclusion

The crowdfunding market is on a robust growth trajectory, driven by increasing demand for equity-based funding solutions and a rising number of startups seeking capital. North America remains the leader, but global adoption is expanding. The market outlook is positive, offering numerous opportunities for businesses across sectors to innovate and secure funding.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)