“According to Market.us, The global cryptocurrency mining market was worth more than $7 billion in 2020 and is predicted to increase at a CAGR of more than 20% between 2021 and 2028.”

Cryptocurrency Mining Statistics and Facts

- In 2009, the world’s first and biggest cryptocurrency, Bitcoin, was mined for the very first time.

- There are 21 million bitcoins available for mining.

- There are currently 18.6 million bitcoins in circulation.

- Cryptocurrency mining necessitates a substantial amount of processing power, as measured in hashes per second (H/s).

- The Bitcoin network’s average hash rate has increased by 20% in the last year.

- The Bitcoin network’s current hash rate is 150 EH/s.

- The mining of cryptocurrency is a competitive sector, with miners striving to solve complicated mathematical issues and validate transactions.

- It takes about 10 minutes to create one single block of Bitcoin.

Cryptocurrency History

- American cryptographer David Chaum is widely regarded as having created “cash,” the first completely anonymous digital currency ever.

- In 1996, the National Security Agency published “How to Make a Mint: The Cryptography of Anonymous Electronic Cash.”

- In 2009, Bitcoin became the world’s first Cryptocurrency when created anonymously by Satoshi Nakamoto and released into circulation.

- Other popular cryptocurrencies were released into circulation in 2011, including Litecoin, Swiftcoin, and Namecoin.

- In 2011, Kraken, a crypto trading exchange was founded.

- Coinbase became one of the leading cryptocurrency exchanges shortly thereafter in June 2012.

- Dogecoin (DOGE) was initially released to parody cryptocurrencies such as Bitcoin and Litecoin in 2013. By March 2018 however, cryptocurrency had made it into the Merriam-Webster Dictionary for inclusion as an actual word.

- Coinbase became the first major crypto exchange to go public by being listed on Nasdaq in 2017.

Moreover

- UK cryptocurrency users have grown by 600% in 2018 when only 3% of the population had cryptocurrency.

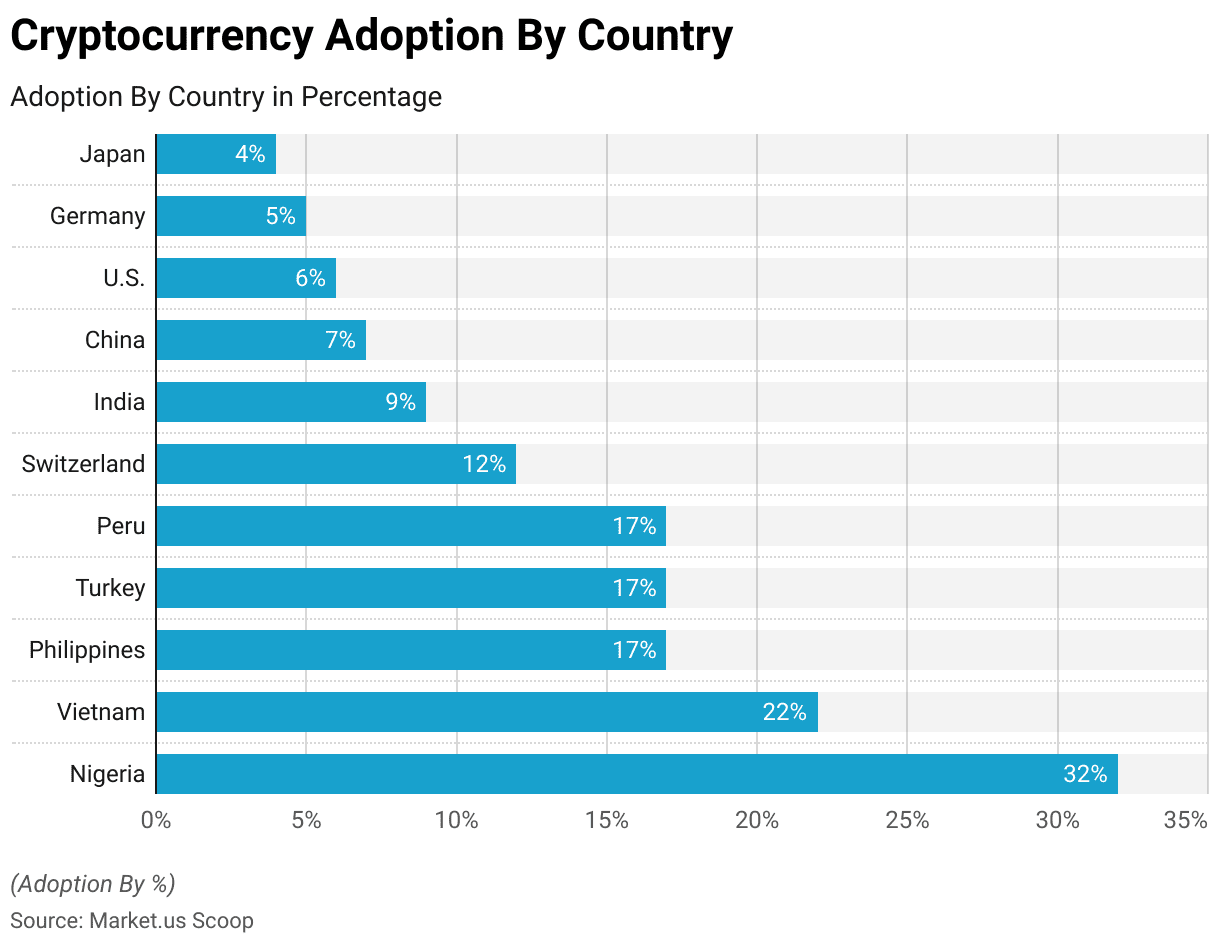

- Nigeria is the country with the highest volume of Google search results for “Cryptocurrency”.

- The most popular cryptocurrency within the USA is Bitcoin accounting for 72% of all cryptocurrency transactions.

- 79% of crypto users within the UK have made a bet in Bitcoin.

- Africa has the least cryptocurrency market of any other region, with an amount of $8 billion in bitcoins received and 8.1B of transactions made on the blockchain.

- Professional traders control market shares in the East Asia crypto market, which accounts for about 90% of the volume moved (above $2000 worth of cryptocurrency).

- Europe would prefer to see blockchain financing at $500 billion by 2030.

- The Middle East only accounts for 15% of the world’s cryptocurrency market in January 2022. Turkey is the most popular in terms of transactions.

- There are more than 2,000 US blockchain projects from corporations that are in the pipeline by the beginning of 2025.

- In January 2022 in 2022, the G20 countries with the highest number of cryptocurrency exchanges included The UK (70 exchanges), Singapore (47 exchanges) and the US (40 exchanges), the US (40 exchanges), and Hong Kong (27 exchanges).

- Mexico (5 exchanges), Argentina (4 exchanges), Indonesia (3 exchanges), and Russia (2 exchanges) registered the smallest number of exchanges.

The year 2013 was the most successful for cryptocurrency exchanges. G20 nations reported 85% for all crypto exchanges however the volume of G20 transactions fell to 30% by 2021.

Cryptocurrency Mining Statistics:

The United States boasts the highest concentration of cryptocurrency mining. (CBECI)

According to Cryptocurrency Mining Statistics, Hashrate measures the computational power needed to create and process blocks in Proof-of-Work blockchain networks, measured as hash/second.

As of August 20, 2021, according to the Cambridge Bitcoin Electricity Consumption Index (CBECI), The United States had 35.5%, Kazakhstan 18.1%, with Russia’s Federation accounting for 11.2% of the global hash rate.

The top three countries accounted for approximately 65% of the worldwide hash rate.

Blockchain.com estimates there are 21 million Bitcoins in total; of those only two million remain available for mining.

Satoshi Nakamoto set the limit of mineable bitcoins at 21 million. Since 19 million have already been mined, only 2 million remain available for mining.

Estimates put the daily mining of bitcoins at around 900. On average, approximately 144 new blocks are added daily, and the reward per block averages 6.25 Bitcoin.

By 2140, it is anticipated that the final Bitcoin will have been mined.

Polkadot cryptocurrency stands out as an efficient and carbon-neutral solution, according to the Crypto Carbon Ratings Institute. (CCRI).

According to the Crypto Carbon Ratings Institute, Polkadot(DOT) boasts one of the lowest total electric consumptions (70,237 annually in kWh) and the lowest CO2 emissions (33.36) annually tCO2e emissions.

Crodona had the lowest electricity usage per node at 199.45 Kilowatt-Hours per year while Solana achieved low transaction energy consumption at 0.166 Wh/Tx.

2021 proved the year’s most profitable yet for Bitcoin mining companies and Ethereum miners alike, as both earned nearly $20 billion each in profits (The Block | Research).

According to The Block and GSR’s Digital Asset Outlook 2022 report, Bitcoin miners earned USD 15.3 billion in 2021 while Ethereum miners collected an estimated total of USD 16.5 billion.

Compared to previous years, Bitcoin mining revenue increased 206% and Ethereum miners’ revenues skyrocketed 778%.

Miner earnings of Dogecoin had reached $1 billion as of November 20, an increase of 600% since March 2021.

Bitcoin mining produces 32.80 tonnes of electronic waste each year (Digiconomist)

According to the Digiconomist, on January 20, 2021, Bitcoin mining generated 32.80 kilograms of electronic waste annually which is comparable to the smaller IT equipment waste in the Netherlands.

In the first quarter of 2021, cyber-crime increased to 23% resulting in 51.1 million attempts. (2021 SonicWall Cyber Threat Report)

Cryptojacking is the practice of hacking into a computer to mine cryptocurrency against the users’ wishes.

According to a SonicWall study, Cryptojacking cases rose by 23% by 2021. The number of these attacks was 51.1 million during the first half of 2021.

Although the total attack number in North America rose by ~22%, the number of attacks in Asia was up by an astonishing 118% while in Europe by around 248%.

In 2021, at the end of the year, the crypto mining firms 16 were listed on NASDAQ. (Galaxy Digital Research)

Based on Galaxy Digital Research, the number of crypto mining firms that are listed on NASDAQ has increased from 6 in the first quarter of 2021 to 16 by Q2 2021. Seven additional listings are in the pipeline. The number of listings is projected to continue to increase throughout 2022.

F2Pool is the world’s largest mining pool by hash rate. (BTC.com)

As per BTC.com, F2Pool is the largest Bitcoin mining pool based on a percentage of the hash rate as well as the number of blocks that it has mined. F2Pool’s share of the total Bitcoin Network hash rate stands at 9.54%. It has mined 69.128 blocks to date.

FoundryUSA, F2Pool, AntPool, Poolin, and ViaBTC are the biggest mining pools around the globe located in the United States.

The mining difficulty has risen by a third since the lowest point was achieved following China’s ban. (blockchain.com)

Mining Difficulty measures the difficulty for a miner to get a Bitcoin block that is below a specific hash. As mining activity rises the difficulty in mining increases due to the fundamental principle of supply and demand.

In February 2022 bitcoin’s difficulty in mining Bitcoin was at ~27.96 trillion TH/s.

After China’s ban on crypto mining, Bitcoin mining difficulty fell from almost 25 trillion TH/s to 13.6 trillion T/s. This trend was evident in the majority of cryptocurrencies mined.

Following the normalization of mining activity in the last few months, the difficulty of mining Bitcoin increased by a staggering 105 percent in February 2022.

About 0.1 percent of miners manage nearly 50% of the mined capacity of Bitcoin. (NBER)

In an NBER study, The top 10 miners account for 90% of the mining capacity, while 0.1% (nearly fifty miners) are in charge of more than 50% of the capacity for mining used for Bitcoin

The amount of mining capacity is countercyclical and fluctuates with the Bitcoin price. There is an increase in mining capacity concentration to fall when the cost of Bitcoin rises (since the number of people mining increases when prices rise) as well as to increase as the price falls. This leaves Bitcoin vulnerable to attacks. The Bitcoin system is vulnerable to 51% of all attacks.

An attack of 51% occurs the case when a single person or group holds at least 50% of the blockchain’s hashing capacity. This enables the attacker to take advantage of, modify, and interfere with transactions or mining processes within the network.

In the past 10 years, the amount for mining bitcoin blocks has been reduced to fifty BTC up to 6.25 BTC (CoinMama)

Bitcoin halving is a standardized occasion in many blockchain networks in which the payout for mining specific cryptos is reduced to half the value of the previous.

Before 2013, the reward of mining had been 50 BTC which was halved to 25 BTC The reward was after which it was 12.5 BTC, and is currently down to 6.25 BTC.

The “halving event” is held every 210,000 blocks mined for an estimated four years. The last time halving occurred in May 2020.

New York has the most Bitcoin miners in the U.S., followed by Kentucky, Georgia, and Texas. (Foundry USA, CNBC)

Inside the U.S., New York, Kentucky, Georgia, and Texas are the most important Bitcoin mining hubs According to a company that has the largest miner pool within North America and is the fifth-largest in the world.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)