Table of Contents

- Cryptocurrency Mining Market Size Statistics

- Cryptocurrency Mining Regional Analysis Statistics

- Cryptocurrency Mining Statistics and Facts

- History of Cryptocurrency Mining Statistics

- Cryptocurrency Mining, Adoption By Country Statistics

- Cryptocurrency Mining Statistics:

- Bitcoin mining consumes around 150 TWh of electricity each year (Digiconomist)

- Bitcoin mining produces 32.80 tonnes of electronic waste each year (Digiconomist)

- Recent Developments

- Conclusion

- FAQ’s

Cryptocurrency Mining Statistics: The process of authenticating and verifying payments on the blockchain platform and adding them to the blockchain database is known as cryptocurrency mining. It is a basic feature of many cryptocurrencies, including Bitcoin and Ethereum.

Banks or central governments keep a ledger to record transactions in traditional financial systems. However, in decentralized cryptocurrencies such as Bitcoin. A network of computers maintains the record collectively using a distributed technology known as a blockchain.

Mining cryptocurrency entails using specific computer hardware and software to tackle complex mathematical problems.

Miners compete against one another to answer these challenges. The first to do so is awarded newly created cryptocurrency coins as a reward for their work. This is known as “proof-of-work.”

Cryptocurrency Mining Market Size Statistics

The global cryptocurrency mining sector was worth more than $7 billion in 2020 and is predicted to increase at a CAGR of more than 20% between 2021 and 2028.

The Global Digital Currency Market size is expected to be worth around USD 76.9 Billion by 2032, from USD 28.3 Billion in 2023. Growing at a CAGR of 12.13% during the forecast period from 2023 to 2032.

Cryptocurrency Mining Regional Analysis Statistics

China:

China has historically been a dominant player in the cryptocurrency mining industry. Primarily due to its abundant supply of cheap electricity. Favorable hardware manufacturing infrastructure, and access to mining equipment.

Several Chinese provinces, such as Sichuan and Inner Mongolia, have attracted significant mining operations.

However, in recent years, the Chinese government has taken steps to restrict and regulate mining activities due to concerns over energy consumption and financial risks associated with cryptocurrencies.

United States:

The United States has emerged as a prominent destination for cryptocurrency mining. Driven by its large market size, favorable regulations in some states, and the availability of diverse energy sources.

States such as Texas and Wyoming have attracted mining operations due to their cheap and abundant electricity from renewable sources.

Additionally, regions with access to cooler climates, such as the Pacific Northwest, are preferred for their cost-effective cooling solutions.

Russia:

Russia has also seen significant growth in cryptocurrency mining due to its low energy costs and vast natural resources. Regions such as Siberia and the Russian Far East have become popular mining destinations.

The Russian government has shown a mixed stance on cryptocurrency regulations, but overall, mining activities have been relatively unrestricted.

Kazakhstan:

Kazakhstan has become a major player in the global cryptocurrency mining industry. The country offers favorable regulations, low energy costs, and a surplus of electricity, making it an attractive destination for miners.

The region around the city of Nur-Sultan, as well as areas with access to coal and hydroelectric power, has seen a rise in mining activities.

Canada:

Canada has attracted cryptocurrency miners due to its cool climate, which helps with the natural cooling of mining equipment, and access to low-cost renewable energy.

Provinces like Quebec, Manitoba, and British Columbia have become popular mining hubs. The Canadian government has generally been supportive of the cryptocurrency industry, contributing to its growth.

Iran:

Iran has become a significant player in cryptocurrency mining, primarily driven by its subsidized electricity prices.

The country has taken a more permissive stance toward mining, allowing miners to operate with access to cheap energy from natural gas and oil.

However, the government has periodically imposed restrictions on mining operations due to concerns over energy consumption and potential money laundering.

Other regions:

Other countries such as Venezuela, Ukraine, and Iceland have also witnessed cryptocurrency mining activities.

Venezuela has seen mining as a way to navigate its economic crisis, utilizing its subsidized electricity. Ukraine has attracted miners due to its low energy costs, while Iceland has capitalized on its abundant renewable energy sources.

Cryptocurrency Mining Statistics and Facts

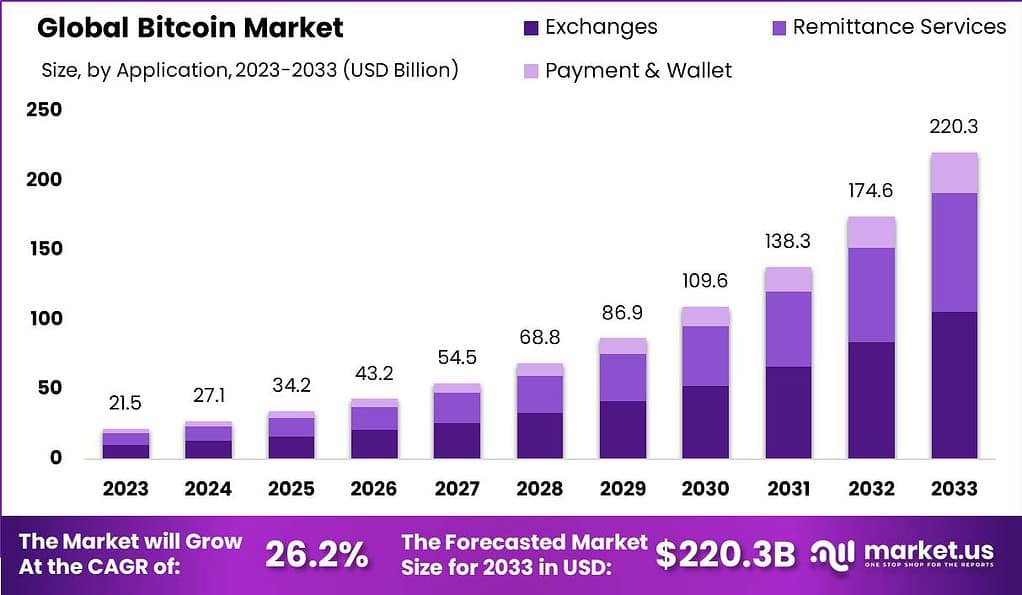

- Bitcoin Market size is poised to cross USD 27.1 Billion in 2024 and is likely to attain a valuation of USD 220.3 Billion by 2033.

- Bitcoin was mined for the first time in 2009.

- There are 21 million bitcoins set aside for mining.

- however, 18.6 million bitcoins are in circulation at present.

- Mining cryptocurrency requires significant processing power, measured in hashes per second (H/s).

- the average hash rate on the Bitcoin network has increased by 20% year over year.

- At present, the hash rate for Bitcoin’s network stands at 150 EH/s.

- Mining cryptocurrency is an intensely competitive industry in which miners attempt to solve complex mathematical puzzles and validate transactions to assemble blocks.

- It can take between 10-12 minutes before one block can be constructed and added to the blockchain.

History of Cryptocurrency Mining Statistics

- American cryptographer David Chaum is widely credited with inventing “cash,” the world’s first entirely anonymous digital currency.

- The National Security Agency released “How to Make a Mint: The Cryptography of Anonymous Electronic Cash” in 1996.

- When Satoshi Nakamoto created and distributed Bitcoin secretly in 2009, it became the world’s first cryptocurrency.

- Other notable cryptocurrencies, such as Litecoin, Swiftcoin, and Namecoin, entered the market in 2011.

- Kraken, a cryptocurrency trading exchange, was created in 2011.

- Coinbase quickly became one of the main Bitcoin exchanges in June 2012.

- Dogecoin (DOGE) was initially released to parody cryptocurrencies such as Bitcoin and Litecoin in 2013.

- By March 2018 however, cryptocurrency had made it into the Merriam-Webster Dictionary for inclusion as an actual word.

- Coinbase became the first major crypto exchange to go public by being listed on Nasdaq in 2017.

Cryptocurrency Mining, Adoption By Country Statistics

- UK cryptocurrency users increased by 600% in 2018 when only 3% of the population used cryptocurrencies.

- Nigeria has the biggest volume of Google search results for “cryptocurrency”.

- Bitcoin is the most popular cryptocurrency in the United States, accounting for 72% of all cryptocurrency transactions.

- 79 percent of UK crypto users have placed a wager on Bitcoin.

- Africa has the smallest cryptocurrency market of any other continent, with $8 billion in bitcoins received and 8.1 billion in blockchain transactions.

- Professional traders control market shares in the East Asian crypto market, accounting for over 90% of the volume moved (more than $2000 in cryptocurrency).

- There are more than 2000 US blockchain projects from corporations that are in the pipeline by the beginning of 2025.

- In January 2022 in 2022, the G20 countries with the highest number of cryptocurrency exchanges included The UK (70 exchanges), Singapore (47 exchanges) and the US (40 exchanges), the US (40 exchanges), and Hong Kong (27 exchanges).

- Mexico (5 exchanges), Argentina (4 exchanges), Indonesia (3 exchanges), and Russia only (2 exchanges) registered the smallest number of exchanges.

- The year 2013 was the most successful for cryptocurrency exchanges. G20 nations reported 85 percent for all crypto exchanges however the volume of G20 transactions fell to 30% by 2021.

Cryptocurrency Mining Statistics:

The US has the highest concentration of Bitcoin mining. (CBECI)

Hashrate, measured in hash/second, is the processing power required to construct and process blocks in Proof-of-Work blockchain networks.

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), the United States had 35.5 percent, Kazakhstan had 18.1 percent, and Russia’s Federation had 11.2% of the worldwide hash rate as of August 20, 2021.

The top three countries contributed to almost 65% of the global hash rate.

According to Blockchain.com, there are 21 million Bitcoins in total, with only two million remaining for mining.

Satoshi Nakamoto imposed a limit of 21 million mineable bitcoins. Only 2 million are still accessible for mining because 19 million have already been mined.

Estimates put the daily mining of bitcoins at around 900. On average, approximately 144 new blocks are added daily, and the reward per block averages 6.25 Bitcoin.

By 2140, it is anticipated that the final Bitcoin will have been mined.

HTML0 mining firms had an outstanding year in 2021, raising $2.3 billion in loans and $3.9 billion in equity investments.

According to Galaxy Digital Research, Bitcoin miners have raised USD 2.3 billion in publicly known debt, while private miners have made USD 914 million.

Market-traded miners saw their revenues increase by USD 1.4 billion, with nearly half raised through the sale of convertible notes and the majority raised through debt during Q4 2021.

Mining companies raised USD 3.9 billion in equity funding. USD 1.5 billion of this total came from publicly traded mining corporations raising funds for private miners, accounting for 94% of their entire fundraising totals.

Before the year 2000 prohibition on Cryptocurrency mining in China, its share of worldwide hash rates was over 75%. (CBECI)

China was responsible for about 75%, or roughly three-quarters, of the global hash rate. They have moved to tighten their grip on cryptocurrency, first forbidding financial institutions from engaging in bitcoin transactions.

China implemented a general moratorium on cryptocurrency mining in June 2021, resulting in China’s part in the overall hash rate dropping to zero. Following China’s ban on cryptocurrency mining, many Chinese miners shifted their equipment to Kazakhstan, resulting in a huge surge in mining activity in Kazakhstan.

Kazakhstan provides affordable real estate as well as lower electricity costs, making it ideal for the establishment of Bitcoin mining operations. The miners are anonymous, which means that one can’t see the full picture of China’s part in the world’s hash rate.

In the year 2018 Bitmain Technologies Ltd, a Chinese company was the world’s biggest producer of crypto mining equipment. Following the 2021 ban, it suffered a setback when the price of its best rigs fell by 75% because of the absence of demand.

Bitcoin mining consumes around 150 TWh of electricity each year (Digiconomist)

According to CBECI estimates, Bitcoin mining utilized 150 terawatt-hours of electricity in one year, accounting for around 0.6 percent of global electricity consumption and more electricity than 160 countries combined.

The computing power required to mine bitcoins has gradually increased over time. Mining has a finite supply; when more is mined than previously, mining gets more difficult as demand rises – an illustration of elastic supply and demand.

The amount of hash you use determines your chances of success. The hash rate is affected by a variety of factors, including processing power. Energy consumption rises dramatically as more computers participate in mining processes.

In February 2022, Ethereum’s estimated annual power usage was approximately 113 TWh. At one time it was an energy-efficient cryptocurrency but due to its exponential growth and technological advancements, it now requires even more power than before.

Renewable energy accounts for around 58% of total Bitcoin mining power (Bitcoin Mining Council).

According to a Q4-2021 Bitcoin Mining Council (BMC) study, the mining industry’s mix of sustainable and renewable energy reached 58.5 percent, up one percent from Q3 2021.

According to the research, the Bitcoin Network’s worldwide technological efficiency improved by 9% year on year during Q4 2014, reaching 19.3 petawatts per megawatt.

Bitcoin mining can take anywhere from 10 minutes to thirty days (Bitcoin: A Peer-to-Peer Electronic Cash System).

This Bitcoin mining algorithm utilizes the so-called Block Time system, in which new blocks are found every 10 minutes and mined. Within 10 minutes you may make one bitcoin (6.25 BTH) or absolutely nothing at all!

Mining Bitcoin may take anywhere between 10 minutes and 30 days, depending on how efficient or fast your mining pool or system is. Ethereum (ETH) blocks have an approximate block time of 12-14 minutes while Dogecoin blocks take only one minute!

Bitcoin and Ethereum are currently responsible for approximately four percent of carbon emissions each year (Digiconomist).

Bitcoin mining generated approximately 97.14 tons of carbon emissions on February 14th, 2022 – comparable to Kuwait’s carbon footprint. Ethereum contributed 53.85 tonnes – comparable with Singapore’s carbon footprint.

Together, Bitcoin and Ethereum contribute around 150 metric tons of CO2 emissions annually; considering that global CO2 emissions total 36 billion tonnes, that represents nearly 4 percent.

Bitcoin mining consumes three times more energy than gold mining (Max J. Krause & Thabet Tolaymat).

According to a research paper by Max J. Krause & Thabet Tolaymat, Bitcoin mining consumed around 17 megajoules to produce one USD worth of Bitcoin while gold only required 5 megajoules to mine $1 of gold.

As per a report by the same entity, mining for Ethereum, Litecoin, and Monero requires between 7,7 and 14 megajoules of energy in total while mining copper, aluminum platinum rare earth oxides took 122, 7 9 megajoules of energy to complete.

Polkadot cryptocurrency stands out as an efficient and carbon-neutral solution, according to the Crypto Carbon Ratings Institute. (CCRI).

According to the Crypto Carbon Ratings Institute, Polkadot(DOT) boasts one of the lowest total electric consumptions (70,237 annually in kWh) and the lowest CO2 emissions (33.36) annually tCO2e emissions.

Crodona had the lowest electricity usage per node at 199.45 Kilowatt-Hours per year while Solana achieved low transaction energy consumption at 0.166 Wh/Tx.

2021 proved the year’s most profitable yet for Bitcoin mining companies and Ethereum miners alike, as both earned nearly $20 billion each in profits (The Block | Research).

According to The Block and GSR’s Digital Asset Outlook 2022 report, Bitcoin miners earned USD 15.3 billion in 2021 while Ethereum miners collected an estimated total of USD 16.5 billion.

Compared to previous years, Bitcoin mining revenue increased 206% and Ethereum miners’ revenues skyrocketed 778 percent.

Miner earnings of Dogecoin had reached $1 billion as of November 20, an increase of 600% since March 2021.

Bitcoin mining produces 32.80 tonnes of electronic waste each year (Digiconomist)

According to the Digiconomist, on January 20, 2021, Bitcoin mining generated 32.80 kilograms of electronic waste annually which is comparable to the smaller IT equipment waste in the Netherlands.

In the first quarter of 2021, cyber-crime increased to 23% resulting in 51.1 million attempts. (2021 SonicWall Cyber Threat Report)

Cryptojacking is the practice of hacking into a computer to mine cryptocurrency against the users’ wishes.

According to a SonicWall study, Cryptojacking cases rose by 23% by 2021. The number of these attacks was 51.1 million during the first half of 2021.

Although the total attack number in North America rose by ~22 percent, the number of attacks in Asia was up by an astonishing 118% while in Europe by around 248%.

In 2021, at the end of the year, the crypto mining firms 16 were listed on NASDAQ. (Galaxy Digital Research)

Based on Galaxy Digital Research, the number of crypto mining firms that are listed on NASDAQ has increased from 6 in the first quarter of 2021 to 16 by Q2 2021. Seven additional listings are in the pipeline. The number of listings is projected to continue to increase throughout 2022.

F2Pool is the world’s largest Cryptocurrency Mining pool by hash rate statistics. (BTC.com)

As per BTC.com, F2Pool is the largest Bitcoin mining pool based on a percentage of the hash rate as well as the number of blocks that it has mined. F2Pool’s share of the total Bitcoin Network hash rate stands at 9.54 percent. It has mined 69.128 blocks to date.

FoundryUSA, F2Pool, AntPool, Poolin, and ViaBTC are the biggest mining pools around the globe located in the United States.

The Cryptocurrency Mining difficulty has risen by a third since the lowest point was achieved following China’s ban statistics. (blockchain.com)

Mining Difficulty measures the difficulty for a miner to get a Bitcoin block that is below a specific hash. As mining activity rises the difficulty in mining increases due to the fundamental principle of supply and demand.

In February 2022 bitcoin’s difficulty in mining Bitcoin was at ~27.96 trillion TH/s.

After China’s ban on crypto mining, Bitcoin mining difficulty fell from almost 25 trillion TH/s to 13.6 trillion T/s. This trend was evident in the majority of cryptocurrencies mined.

Following the normalization of mining activity in the last few months, the difficulty of mining Bitcoin increased by a staggering 105 percent in February 2022.

About 0.1 percent of miners manage nearly 50% of the mined capacity of Bitcoin. (NBER)

In an NBER study, The top 10 miners account for 90 percent of the mining capacity, while 0.1 percent (nearly fifty miners) are in charge of more than 50 percent of the capacity for mining used for Bitcoin

The amount of mining capacity is countercyclical and fluctuates with the Bitcoin price. There is an increase in mining capacity concentration to fall when the cost of Bitcoin rises (since the number of people mining increases when prices rise) as well as to increase as the price falls. This leaves Bitcoin vulnerable to attacks. The Bitcoin system is vulnerable to 51% of all attacks.

An attack of 51% occurs the case when a single person or group holds at least 50% of the blockchain’s hashing capacity. This enables the attacker to take advantage of, modify, and interfere with transactions or mining processes within the network.

In the past 10 years, the amount for Cryptocurrency Mining bitcoin blocks has been reduced to fifty BTC up to 6.25 BTC Statistics (CoinMama)

Bitcoin halving is a standardized occasion in many blockchain networks in which the payout for mining specific cryptos is reduced to half the value of the previous.

Before 2013, the reward of mining had been 50 BTC which was halved to 25 BTC The reward was after which it was 12.5 BTC, and is currently down to 6.25 BTC.

The “halving event” is held every 210,000 blocks mined for an estimated four years. The last time halving occurred in May 2020.

New York has the most Bitcoin miners in the U.S., followed by Kentucky, Georgia, and Texas. (Foundry USA, CNBC)

Inside the U.S., New York, Kentucky, Georgia, and Texas are the most important Bitcoin mining hubs According to a company that has the largest miner pool within North America and is the fifth-largest in the world.

Recent Developments

Acquisitions and Mergers:

- Bitmain, one of the largest cryptocurrency mining hardware manufacturers, acquired a minority stake in Foundry, a cryptocurrency mining and consulting firm, expanding its presence in the North American market.

New Product Launches:

- Bitmain launched the Antminer S19 XP, the latest addition to its Antminer series, boasting improved efficiency and hash rates for Bitcoin mining operations.

- Canaan Creative introduced the AvalonMiner 1246, featuring enhanced performance and energy efficiency for mining cryptocurrencies like Bitcoin and Bitcoin Cash.

Funding Rounds:

- Layer1, a Bitcoin mining company based in Texas, raised $50 million in Series A funding, signaling growing investor interest in sustainable cryptocurrency mining operations.

- Compass Mining, a platform that facilitates access to cryptocurrency mining hardware and hosting services, secured $80 million in Series B funding to expand its operations and services globally.

Strategic Partnerships:

- Riot Blockchain partnered with Enigma to develop a new Bitcoin mining facility powered by renewable energy sources, aligning with sustainability initiatives in the cryptocurrency mining sector.

- Marathon Digital Holdings entered into a strategic partnership with DMG Blockchain Solutions to launch the first North American Bitcoin mining pool fully compliant with U.S. regulations.

Regulatory Updates:

- China intensified its crackdown on cryptocurrency mining operations, leading to the closure of numerous mining facilities and the migration of mining operations to other regions with more favorable regulatory environments.

- The United States Securities and Exchange Commission (SEC) announced plans to enhance oversight of cryptocurrency mining companies, focusing on regulatory compliance and investor protection measures.

Conclusion

Cryptocurrency Mining Statistics – In conclusion, cryptocurrency mining can be a profitable venture for those with the necessary resources and expertise.

However, it also comes with environmental concerns, risks of centralization, and potential financial volatility.

It is essential to carefully consider these factors before engaging in mining activities and to stay informed about the evolving landscape of cryptocurrencies.

FAQ’s

Cryptocurrency mining is the process of validating transactions and adding them to the blockchain ledger of a particular cryptocurrency. Miners use specialized hardware and software to solve complex mathematical problems that verify transactions and secure the network.

Many cryptocurrencies can be mined, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Monero (XMR), and many others. However, the mining algorithms and hardware requirements may vary for each cryptocurrency.

Cryptocurrency mining involves using powerful computers (mining rigs) to solve complex mathematical problems. Miners compete to solve these problems, and the first one to find a valid solution broadcasts it to the network. Once the solution is verified, the miner adds a new block of transactions to the blockchain and receives a reward in the form of a newly minted cryptocurrency.

GPU mining refers to using graphics processing units (GPUs) to mine cryptocurrencies. GPUs are particularly efficient in solving the mathematical problems required for mining. They are commonly used for mining Ethereum and other altcoins.

ASIC mining involves using specialized hardware called Application-Specific Integrated Circuits (ASICs) designed solely for cryptocurrency mining. ASICs offer much higher computational power and energy efficiency compared to GPUs. ASICs are commonly used for mining Bitcoin and some other cryptocurrencies.

Yes, some cryptocurrencies can be mined using regular CPUs or GPUs. However, the mining rewards for such cryptocurrencies are often low, and they may not be economically viable due to the high energy costs and competition from specialized mining hardware.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)