Table of Contents

Introduction

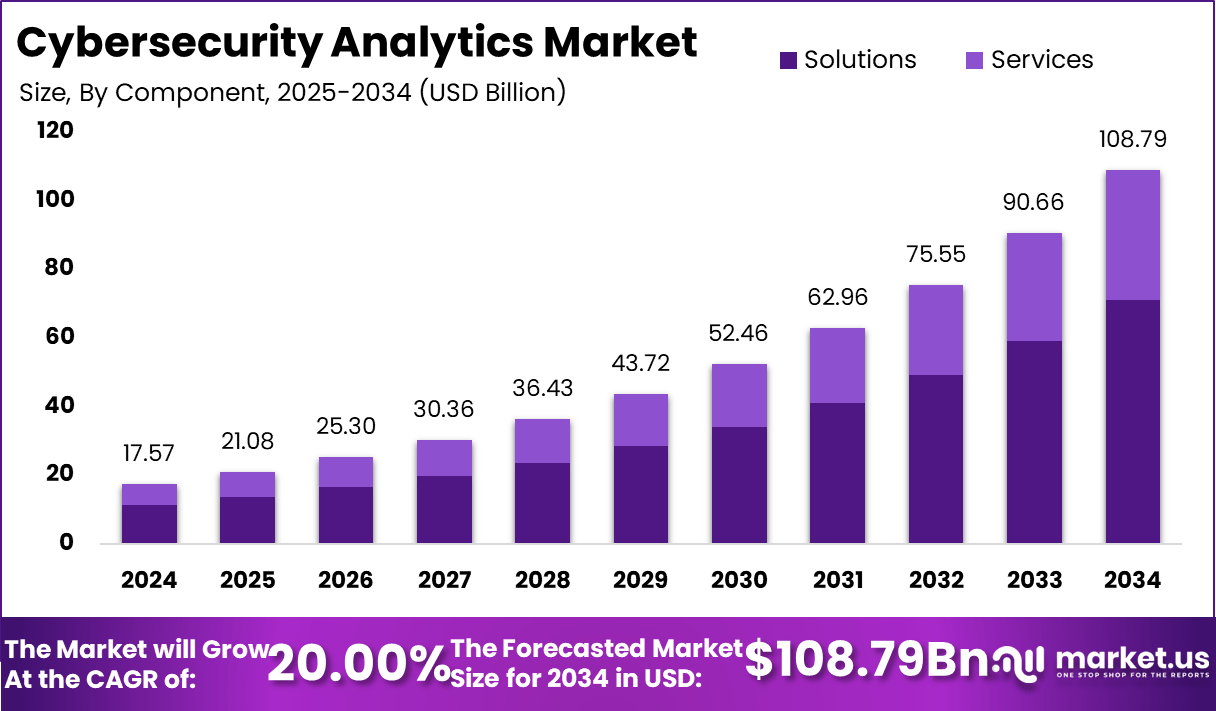

The global Cybersecurity Analytics market reached USD 17.57 billion in 2024, driven by the rapid adoption of behavioral analytics, automated incident response, anomaly detection, and real-time monitoring. With the accelerating integration of AI, big data, and machine learning models, the market is set to grow at a strong 20% CAGR, reaching USD 108.79 billion by 2034. North America led with a 40.8% share (USD 7.16 billion), while the US alone generated USD 6.38 billion in 2024. Rising cyberattacks, cloud expansion, and enterprise digitalization are fueling market growth and transforming security operations globally.

How Growth Is Impacting the Economy

The market’s rapid expansion is reshaping the global economic landscape by strengthening digital infrastructure, driving cybersecurity readiness, and fostering high-value employment in AI, data engineering, and security operations. Increased investment in advanced threat-detection tools stimulates innovation across software development, analytics, and SOC automation. Government cybersecurity mandates are pushing enterprises to adopt scalable security frameworks, boosting IT spending and accelerating digital transformation across public and private sectors.

The rise in cyberattack frequency is prompting nations to allocate larger budgets for national security and digital resilience. This shift is elevating the economic importance of cybersecurity technologies, making them essential for safeguarding commerce, financial systems, and critical infrastructure. The ripple effect supports productivity gains, operational continuity, and long-term economic stability.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/cybersecurity-analytics-market/free-sample/

Impact on Global Businesses

Rising technology costs, increasing dependence on AI-driven monitoring, and shortages of skilled cybersecurity professionals are pressuring global enterprises. Supply chains face disruptions due to the demand surge for analytics platforms, cloud-native SIEM tools, and advanced security automation systems.

Organizations in finance, healthcare, manufacturing, and retail face heightened exposure, driving accelerated adoption of threat-intelligence platforms and real-time detection tools. Cloud-focused companies are forced to re-evaluate vendor dependencies to reduce risks from data breaches and cross-border compliance requirements. Defense and government sectors experience heavy strain from rapidly evolving threat vectors, prompting large-scale modernization of mission-critical cybersecurity architectures.

Strategies for Businesses

- Prioritize AI-driven security automation to reduce incident response times.

- Diversify security vendors to minimize supply chain vulnerabilities.

- Invest in workforce upskilling for advanced threat analytics capabilities.

- Implement continuous monitoring for cloud, edge, and hybrid environments.

- Align cybersecurity investments with regulatory and risk-management frameworks.

Key Takeaways

- Market to hit USD 108.79 billion by 2034.

- North America leads with strong regulatory backing.

- AI and ML are central to next-gen threat detection.

- Rising cyberattacks are accelerating enterprise adoption.

- Cloud-native and automated security tools are gaining dominance.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=165741

Analyst Viewpoint

The current market momentum is strong as enterprises prioritize automation, zero-trust frameworks, and AI-led security intelligence. Present growth reflects rising breach incidents and mandatory compliance reforms across major economies. Prospects remain highly positive, driven by cloud modernization, AI-powered SOC transformation, and scalable analytics solutions that enhance threat prediction accuracy. With increasing digital interconnectivity, the market is expected to evolve into a fully automated defense ecosystem that supports real-time detection at a global scale.

Use Case and Growth Factors

| Category | Details |

|---|---|

| Use Case | Real-time anomaly detection for enterprise networks |

| Use Case | Automated incident response for SOC operations |

| Use Case | Behavioral analytics to detect insider threats |

| Growth Factor | Rising volume and complexity of cyberattacks |

| Growth Factor | Integration of AI, ML, and big data platforms |

| Growth Factor | Increasing cloud adoption and digital transformation |

| Growth Factor | Strong government cybersecurity mandates |

Regional Analysis

North America dominates with a 40.8% share, supported by federal mandates, enterprise-scale digitalization, and advanced security infrastructure. The US leads regional growth due to heavy investments in AI-enabled SOCs and increasing cyberattack severity. Europe follows with growing adoption of automated threat-monitoring systems driven by GDPR compliance and rising ransomware events. Asia Pacific is emerging as a high-growth region, propelled by rapid cloud migration, IoT expansion, and government-backed cybersecurity frameworks. Latin America and the Middle East show steady progress as enterprises modernize digital operations.

➤ Want more market wisdom? Browse reports –

- Octocopter Drone Market

- Wage Streaming Platforms Market

- AI in Self-Driving Cars Market

- Real-Time Wage Access Market

Business Opportunities

Significant opportunities exist in cloud-native SIEM platforms, AI-driven threat detection solutions, user behavior analytics, and endpoint protection technologies. Vendors can capitalize on rising enterprise demand for automated SOC tools and unified security orchestration platforms. Growing hybrid-cloud adoption creates opportunities for cross-environment monitoring tools and secure access architecture. Government funding for cybersecurity preparedness programs further supports innovation in next-generation detection engines, identity protection systems, and predictive analytics technologies.

Key Segmentation

The market spans behavior-based analytics tools, automated response platforms, anomaly detection software, and real-time monitoring systems. Key applications include threat detection, insider-risk management, compliance monitoring, and SOC automation. End-user segments include BFSI, healthcare, government, IT & telecom, manufacturing, and retail. The strongest growth lies in AI-enabled analytics and cloud-native security tools, driven by expanding digital ecosystems and the urgent need for rapid, predictive threat identification.

Key Player Analysis

Leading players focus on enhancing AI models for faster detection accuracy, improving cloud-native platforms, and expanding real-time visibility across hybrid infrastructures. Their strategies emphasize integrating automation into SOC workflows, scaling threat intelligence datasets, and strengthening behavioral analytics capabilities. These companies invest heavily in R&D to build adaptive detection engines while reinforcing partnerships with cloud service providers. Their competitive edge lies in delivering scalable, modular platforms capable of evolving with complex cyber risks.

- Splunk

- International Business Machines Corporation

- Microsoft Corporation

- Palo Alto Networks

- Rapid7

- Exabeam

- LogRhythm

- Darktrace

- RSA Security

- Google Chronicle

- CrowdStrike

- Elastic

- Securonix

- Devo

- ArcSight Micro Focus

- SentinelOne

- Snowflake

- Others

Recent Developments

- January 2025: New AI-driven anomaly detection framework introduced for hybrid-cloud environments.

- March 2025: Enhanced SOC automation suite launched with predictive incident-response algorithms.

- May 2025: Large enterprise deployed a nationwide behavioral analytics system for insider-risk detection.

- July 2025: A Cloud security provider released a unified monitoring platform for multi-cloud ecosystems.

- September 2025: Next-gen threat-intelligence engine rolled out with real-time ML-driven correlation.

Conclusion

The market is entering a high-growth decade driven by AI, digitalization, and escalating cyber threats. Strong regional investments, advanced analytics, and automation adoption continue to reshape global security operations and create substantial long-term opportunities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)