Table of Contents

Introduction

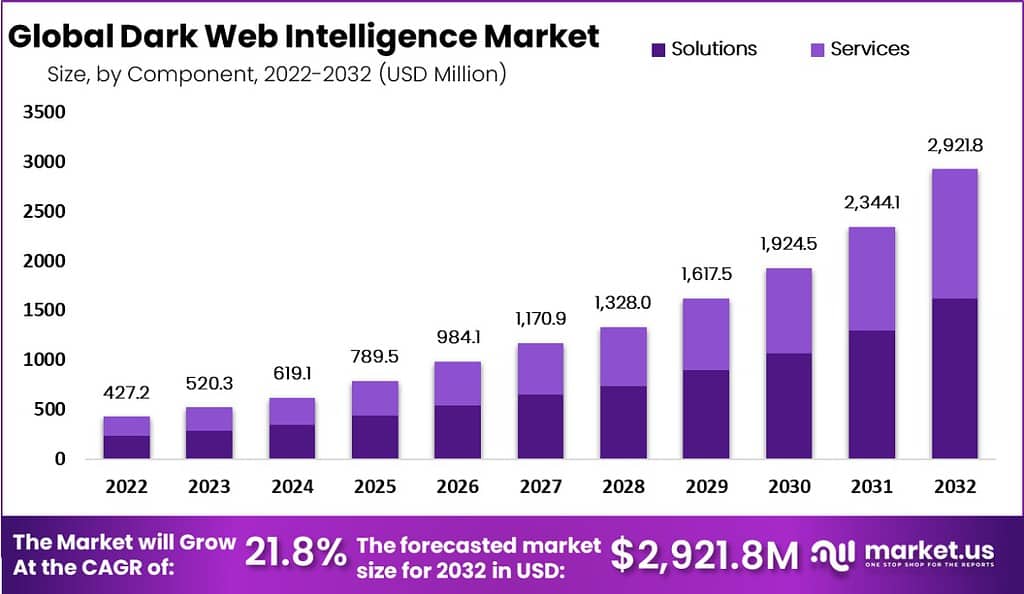

The Dark Web Intelligence Market has become a crucial element in the global cybersecurity landscape. In 2023, the market size reached USD 520.3 Million, and it is projected to grow significantly to USD 2,921.8 Million by 2032, with a CAGR of 21.8% during the forecast period. This robust growth is driven by several factors, including the increasing number of online fraudulent activities and the rising adoption of dark web intelligence solutions by different sectors such as large enterprises and industries like IT and Telecom, which represent the largest market share. The rising sophistication of cybercriminals and their targeted attacks on large enterprises due to their extensive assets and brand reputation underline the urgent need for advanced dark web intelligence solutions.

The market is also experiencing a surge in demand for cloud-based deployment models due to their scalability, flexibility, and cost-effectiveness, allowing for remote access and collaboration on intelligence data across the globe. North America dominates the market, attributed to its high dependency on internet of things (IoT) devices, rising cybercrime rates, and widespread adoption of dark web intelligence solutions across various sectors to safeguard data and intellectual property.

Recently, the cybersecurity sector has witnessed notable mergers and acquisitions aimed at enhancing capabilities and expanding market presence. For instance, Delinea acquired Authomize to add identity threat detection and response technologies. Similarly, Hewlett Packard Enterprise’s acquisition of Juniper Networks for $14 billion signifies a significant expansion in network equipment. Other significant transactions include HID’s acquisition of ZeroSSL, enhancing website communication security, and SentinelOne’s purchase of PingSafe, introducing cloud-native application protection platform capabilities. These moves underscore a trend towards consolidating expertise and broadening cybersecurity solutions.

Key Takeaways

- The Dark Web Intelligence market size surged to USD 520.3 million in 2023, and it’s projected to soar to a whopping USD 2,921.8 million by 2032, showcasing a robust growth rate (CAGR) of 21.8% between 2023 and 2032.

- According to 4iQ, stolen account credentials available on the dark web spiked by 82% in 2022 compared to the previous year, reaching a staggering 15 billion.

- Identity theft comprises over 65% of monitored activities on the dark web, with credit card fraud closely following at 15%, as reported by Sixgill.

- According to Sixgill, the availability of card dumps containing credit card information escalated by 6% from 2021 to surpass 192 million in 2022, with an average credit limit of $8,700.

- Cryptocurrency transactions on the dark web nearly doubled from 2020 levels, reaching an estimated value of nearly USD 25 billion in 2022, as per Chainalysis.

- An exploit for a fully patched iPhone 13 was sold for an astonishing USD 2.5 million on a dark web forum in 2022.

- Drug sales on the dark web surged by approximately 15% in 2022, amounting to an estimated $1.7 billion in transactions, according to DarknetStats.

- As reported by cybersecurity firm Digital Shadows, over 15,000 data breaches were detected across the open, deep, and dark web in 2022, exposing nearly 3 petabytes of data.

- North America leads the global dark web intelligence market, securing a major revenue share of 36.7%, with the demand valued at USD 156.7 billion in 2023.

Dark Web Intelligence Statistics

- In 2022, approximately 52% of companies in the United States had a dark web threat intelligence policy in place, indicating a significant awareness of cybersecurity risks.

- Outsourcing to specialized service providers focused on the dark web was the primary method for monitoring dark web threats, demonstrating a reliance on external expertise for cybersecurity measures.

- 16.8% of respondents had direct access to the dark web via TOR, highlighting a notable proportion of individuals with potential exposure to hidden online activities.

- Kaspersky Digital Footprint Intelligence experts observed an average of 1,731 dark web messages per month related to the sale, purchase, and distribution of internal corporate databases and documents between January 2022 and November 2023,

totaling almost 40,000 messages during this period. - Over 6,000 dark web messages advertised access to corporate infrastructures from January 2022 to November 2023, with the average monthly message witnessing a 16% rise from 246 in 2022 to 286 in 2023. This indicates an increasing trend in offers for pre-existing access to companies.

- 233 out of 700 randomly selected companies were mentioned in dark web posts related to data breaches or compromised accounts in 2022, revealing that approximately one-third of companies faced cyberthreats originating from the dark web.

- NICE Actimize delivers real, actionable data on compromised customer accounts using Dark Web Intelligence, helping to defend against fraud and financial crime proactively.

- The Identity Fraud & Account Takeovers data feed includes details such as name, email address, phone number, IP address, or SSN, to identify customers at high risk of account takeover before it occurs.

- The Compromised Payment Cards data feed contains debit, prepaid, credit, and gift cards at high risk of fraud, harvested by cybercriminals or traded on the dark web.

Use Cases

Dark Web Intelligence plays a crucial role in cybersecurity by providing organizations with insights into threats lurking in the hidden corners of the internet. Leveraging this intelligence can significantly enhance an organization’s security posture through various use cases. Here are some key applications, supported by findings from industry research and expert insights:

- Detecting and Mitigating Exposed Credentials Before Use: One of the primary uses of Dark Web Intelligence is to identify exposed credentials. With billions of credentials circulating in the dark web, organizations can proactively detect and mitigate potential breaches by monitoring for their presence. This not only helps in preventing credential stuffing attacks but also aids in safeguarding against unauthorized access.

- Monitoring Insider Threats: Insider threats, whether malicious or accidental, can lead to significant data breaches. By monitoring dark web forums and marketplaces, organizations can detect if any insider is attempting to sell access or sensitive information. This early detection allows for swift action, potentially stopping a breach before it happens.

- Detecting Ransomware Dump Site Listings: The rise of ransomware has seen attackers not only encrypting data but also threatening to release it on the dark web. By monitoring these dump sites, organizations can be alerted to breaches involving their data, enabling them to respond more quickly to mitigate the damage.

- Vulnerability and Exploits Chatter Monitoring: The dark web is a hotbed for discussions about vulnerabilities and exploits. Monitoring these conversations can give organizations a heads-up about new vulnerabilities and zero-day threats, allowing them to patch their systems before attackers can exploit these weaknesses.

- Neutralizing Initial Access Brokers (IABs): IABs facilitate cyber attacks by selling access to compromised systems. By monitoring IABs’ activities, organizations can identify and address vulnerabilities in their systems that these brokers could exploit.

- Brand Monitoring: Monitoring open sources and social media channels for mentions of your brand can reveal subtle threats that rely on social engineering rather than software exploits. This includes identifying malicious profiles or links that could harm your organization’s reputation or lead to data breaches.

- Open, Deep, and Dark Web Monitoring: Gathering intelligence from all corners of the internet, including the open, deep, and dark web, is essential for a comprehensive security strategy. This enables organizations to stay aware of new threats and vulnerabilities being discussed or traded in these hidden spaces.

Key Players Analysis

Searchlight Cyber

Searchlight Cyber is a well-known player in the dark web intelligence industry. The company has recently taken significant steps to expand its capabilities and improve its offerings. One of these steps was the introduction of a new feature in its DarkIQ platform, which added 450 billion additional exposure data points. This improvement aims to help organizations identify and respond to threats more effectively, by providing a comprehensive view of data exposure across the clear, deep, and dark web.

In addition to this, Searchlight Cyber has also launched The Dark Web Hub, an online platform created to educate cybersecurity and law enforcement professionals about the dark web. The hub provides valuable information, including insights into dark web sites, and has resources like podcasts and videos to help combat dark web criminality.

ZeroFox

ZeroFox, a leading organization in the external cybersecurity domain, has made significant contributions to the Dark Web intelligence sector through its advanced threat intelligence and cybersecurity solutions. The company, renowned for its ability to identify risks on social media and other digital platforms, has undergone substantial expansion by merging with IDX, a prominent provider of data breach response services. This merger aims to create a publicly traded entity through a SPAC deal with L&F Acquisition Corp, positioning ZeroFox to offer a comprehensive suite of external threat protection and breach response services. This strategic move is expected to enhance ZeroFox’s footprint in the cybersecurity market, improving its offerings to nearly 2,000 customers, including five of the Fortune Top 10.

Aside from the IDX acquisition, ZeroFox has further expanded its cybersecurity portfolio by acquiring LookingGlass Cyber Solutions, Inc., an innovator in external attack surface management and global threat intelligence. Completed in April 2023, this acquisition not only cements ZeroFox’s position in the external cybersecurity market but also enhances its platform with advanced attack surface intelligence capabilities. The integration of LookingGlass into ZeroFox’s operations aims to provide a seamless customer experience while delivering valuable benefits to customers, employees, and shareholders alike. Through these strategic expansions, ZeroFox is improving its platform’s efficacy in protecting against a wide range of external cyber threats, including phishing, fraud, and account hijacking, thus affirming its commitment to safeguarding digital assets in a rapidly evolving cyber landscape.

DarkOwl

DarkOwl has been actively improving its dark web intelligence capabilities with a series of important developments that demonstrate its commitment to providing advanced cybersecurity solutions. In May 2023, DarkOwl launched a new threat intelligence platform designed to provide up-to-date insights into dark web activities and threats, showcasing its dedication to proactive cybersecurity measures. Building on this progress, in October 2023, DarkOwl partnered with a leading cybersecurity company to offer integrated dark web monitoring and incident response solutions. This collaboration will strengthen the company’s comprehensive approach to external cyber threat protection. Additionally, in December 2023, DarkOwl secured $15 million in Series A funding, which will accelerate its product development and market expansion efforts, highlighting the growing recognition of DarkOwl’s innovative solutions in the cybersecurity domain.

Furthermore, DarkOwl has expanded its market presence through strategic partnerships, including one with Siren, provider of the Investigative Intelligence Platform, announced in February 2023. This collaboration combines Siren’s investigative capabilities with DarkOwl’s dark web expertise, improving the ability to address the complex threats posed by the darknet. This partnership is especially significant as it enables the integration of DarkOwl’s data into Siren’s platform, facilitating the transformation of dark web data into actionable intelligence for threat intelligence analysts. These collaborations demonstrate DarkOwl’s role in advancing the field of dark web intelligence by leveraging synergies with other cybersecurity innovators.

Proofpoint Inc

Proofpoint Inc is a cybersecurity and compliance leader that has been actively expanding its offerings in the dark web intelligence and broader cybersecurity sectors through strategic acquisitions. One of their significant moves was the acquisition of Illusive in December 2022, aimed at strengthening their identity threat detection and response capabilities. This acquisition was expected to close by January 2023 and would bolster Proofpoint’s threat and information protection platforms, offering a more unified solution that extends protection across the entire attack chain for critical threats like ransomware and data breaches.

In January 2022, Proofpoint completed its acquisition of Dathena, a company that specializes in AI-powered data protection. This strategic move aimed to strengthen Proofpoint’s enterprise information protection offering, address legacy endpoint data loss prevention challenges, and deliver real security value through detection, response, and compliance.

Another noteworthy acquisition was ObserveIT in November 2019, a leading insider threat management platform. By integrating ObserveIT’s technology with Proofpoint’s solutions, the company aimed to provide unprecedented insight into user activity with sensitive data across organizations, enhancing the ability to immediately remediate risk.

NICE Actimize

NICE Actimize is a company that specializes in Autonomous Financial Crime Management. Over time, the company has expanded its capabilities and offerings through strategic acquisitions and product innovations. In June 2020, NICE Actimize announced its plan to acquire Guardian Analytics, a provider of cloud-based financial crime risk management solutions that use artificial intelligence (AI). This acquisition was meant to revolutionize financial crime risk management by offering a comprehensive cloud platform with advanced machine learning and analytics. This was designed to expand AI cloud solutions for financial crime risk management across all market segments, enhancing detection accuracy and operational efficiency for financial institutions of all sizes.

In February 2024, NICE Actimize introduced three advanced generative AI-based solutions to combat financial crime more efficiently. These solutions are part of NICE Actimize’s efforts to reduce manual and labor-intensive tasks in financial crime investigations and reporting. By leveraging generative AI, these solutions can transform financial crime investigations, promising up to a 50% reduction in investigation time and 70% time savings in Suspicious Activity Report (SAR) filing. The introduction of these solutions is a significant stride towards efficiency and effectiveness in compliance risk management programs.

Cybersixgill

Cybersixgill is a company that specializes in cyber threat intelligence, with a focus on dark web intelligence. They offer real-time threat detection and management solutions by analyzing data from a broad range of sources, including the deep and dark web, messaging groups, and other online platforms. Their technology is designed to be fast and accurate, utilizing automation to process and update threat data continuously. This enables organizations to anticipate attacks and streamline their cybersecurity workflows.

Flashpoint

In 2023, Flashpoint showcased significant innovation in threat intelligence with the introduction of Flashpoint Ignite and developments like Ignite AI, VulnDB surpassing 100K non-CVEs, and the Flashpoint Firehose. These advancements, recognized by Frost & Sullivan, cement Flashpoint’s position in equipping organizations against various cyber and physical threats. Flashpoint’s efforts are grounded in a commitment to product excellence and client partnership, ensuring effective risk management across various sectors.

Conclusion

The Dark Web Intelligence Market is expected to experience significant growth due to the rising complexity of cyber threats and the crucial need for advanced security solutions. With its wide-ranging scope covering different deployment models, enterprise sizes, and industry verticals, the market is well-positioned to provide significant opportunities for stakeholders seeking to navigate the complexities of cybersecurity in the digital era.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)