Table of Contents

Introduction

Data Catalog Statistics: Data catalogs are critical metadata management tools that centralize and organize an organization’s data assets, enhancing data discovery, accessibility, and governance.

They automate the collection and management of metadata from diverse data sources, facilitating easy searchability and efficient data utilization across the organization.

Furthermore, data catalogs play a significant role in data governance and compliance, tracking data lineage for quality and reliability assessments, and fostering collaboration among the teams.

Key features of data catalogs include advanced search and discovery functions, user collaboration tools, data lineage visualization, seamless integration capabilities, and robust security and access controls.

These functionalities collectively empower the organizations to leverage their data more effectively, ensuring informed decision-making and operational efficiency.

Editor’s Choice

- The global data catalog market revenue reached USD 880.4 million in 2023.

- This growth trajectory aimed even higher in the subsequent years, reaching USD 4,169.7 million in 2031 and peaking at USD 5,235.2 million in 2032, with the solutions component consistently outpacing the services component, culminating in USD 4,198.6 million from solutions and USD 1,036.6 million from services in the final year.

- The distribution of the global data catalog market by deployment mode reveals a preference for on-premises solutions, which hold a 56% share, while cloud-based deployments account for the remaining 44%.

- The volume of data/information created, captured, copied, and consumed worldwide is anticipated to surge to 181 zettabytes by 2025.

- Over five years, in the landscape of big data technology, the non-relational analytic data store category has demonstrated an impressive CAGR of 38.60%,

- A striking 93% of organizations at Level 4 have established business data lineage, compared to only 26% at Level 1, with the overall adoption across respondents being 51%.

- Among Level 4 organizations, a robust 93% conduct regular auditing of data requests, a practice only observed in 27% of Level 1 organizations, leading to an overall adoption rate of 51%.

Data Catalog Market Statistics

Global Data Catalog Market Size Statistics

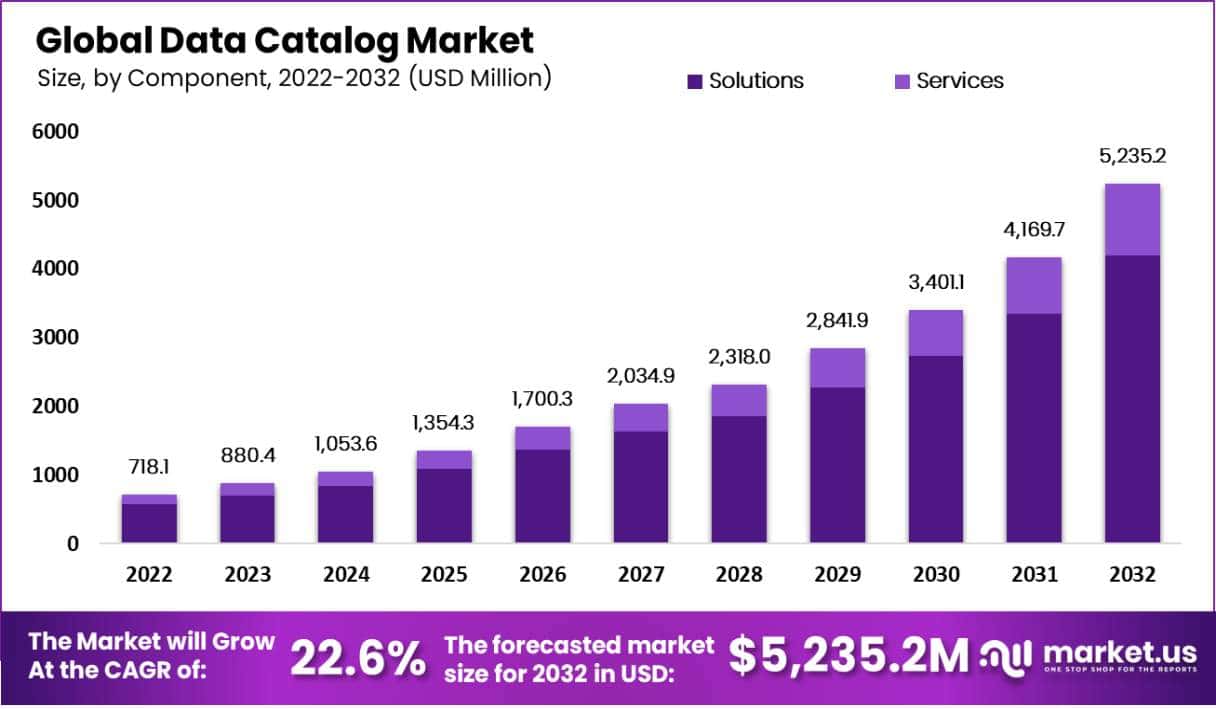

- The global data catalog market has exhibited a remarkable growth trajectory at a CAGR of 22.6%, with revenue expanding from USD 718.1 million in 2022 to an anticipated USD 5,235.2 million by 2032.

- This upward trend underscores the increasing significance of data catalogs in enabling efficient data catalog management and accessibility.

- The market experienced steady growth, with revenue climbing to USD 880.4 million in 2023 and then surpassing the billion-dollar mark in 2024 at USD 1,053.6 million.

- The momentum continued with substantial year-on-year increases, reaching USD 1,354.3 million in 2025 and extending to USD 1,700.3 million by 2026.

- The subsequent years saw the market advancing further, with revenues hitting USD 2,034.9 million in 2027, USD 2,318.0 million in 2028, and significantly jumping to USD 2,841.9 million in 2029.

- The growth pace accelerated towards the end of the forecast period, with market size expanding to USD 3,401.1 million in 2030 and ultimately soaring to USD 4,169.7 million in 2031 before reaching its peak at USD 5,235.2 million in 2032.

- This consistent expansion highlights the escalating demand for data catalog solutions across various industries, driven by the need for enhanced data discoverability, governance, and management.

(Source: Market.us)

Global Data Catalog Market Size – By Component Statistics

- The global data catalog market has demonstrated significant growth in both its solutions and services components from 2022 through 2032.

- In 2022, the market started at a total revenue of USD 718.1 million, divided into USD 575.9 million from solutions and USD 142.2 million from services.

- This growth trajectory continued upward, with the total market revenue reaching USD 880.4 million in 2023, comprising USD 706.1 million from solutions and USD 174.3 million from services.

- By 2024, the market expanded further to USD 1,053.6 million, with solutions contributing USD 845.0 million and services USD 208.6 million.

- The pattern of growth persisted, with the total revenue escalating to USD 1,354.3 million in 2025, then to USD 1,700.3 million in 2026, with solutions and services revenues also seeing proportional increases.

- The market reached USD 2,034.9 million in 2027, with solutions accounting for USD 1,632.0 million and services for USD 402.9 million.

- By 2028, the market size was USD 2,318.0 million, leading to a notable jump in 2029 to USD 2,841.9 million and an even larger leap in 2030 to USD 3,401.1 million, highlighting the growing reliance on data catalog solutions and services.

- This growth trajectory aimed even higher in the subsequent years, reaching USD 4,169.7 million in 2031 and peaking at USD 5,235.2 million in 2032, with the solutions component consistently outpacing the services component, culminating in USD 4,198.6 million from solutions and USD 1,036.6 million from services in the final year.

- This sustained growth underscores the increasing importance of data catalog solutions and services in facilitating effective data management and utilization across various sectors.

(Source: Market.us)

Global Data Catalog Market Share – By Deployment Mode Statistics

- The distribution of the global data catalog market by deployment mode reveals a preference for on-premises solutions, which hold a 56% share, while cloud-based deployments account for the remaining 44%.

- This delineation underscores the ongoing significance of on-premises infrastructure in the realm of data cataloging, reflecting organizational priorities for control, security, and data sovereignty.

- Conversely, the substantial market share occupied by cloud deployments indicates a robust and growing acceptance of cloud services, driven by their scalability, flexibility, and cost-efficiency.

- The market’s division between on-premises and cloud deployments highlights the diverse requirements and strategic approaches organizations use to manage and access their data assets.

(Source: Market.us)

Volume of Data-information Created, Captured, Copied, and Consumed

- From 2015 to 2025, the volume of data/information created, captured, copied, and consumed worldwide experienced exponential growth, as measured in zettabytes.

- Beginning with 15.5 zettabytes in 2015, the global data volume saw a steady increase to 18 zettabytes in 2016, followed by a significant jump to 26 zettabytes in 2017.

- This upward trajectory continued, with the volume reaching 33 zettabytes in 2018 and further expanding to 41 zettabytes in 2019.

- The year 2020 marked a substantial rise to 64.2 zettabytes, underscoring the rapid acceleration in data generation and consumption.

- The subsequent years witnessed even more pronounced growth, with volumes climbing to 79 zettabytes in 2021, 97 zettabytes in 2022, and an estimated 120 zettabytes in 2023.

- Forecasts for the following years indicate a continued increase, reaching 147 zettabytes in 2024 and anticipated to surge to 181 zettabytes by 2025.

- This decade-long surge reflects the expanding digital footprint of global activities fueled by advancements in technology, the proliferation of digital devices, and the increasing digitization of information across various sectors.

(Source: Statista)

Fastest Growing Categories of Big Data by Technology

- Over five years, the landscape of big data technology has seen varying rates of growth across different categories, as measured by their compound annual growth rate (CAGR).

- Leading the charge is the non-relational analytic data store category, which has demonstrated an impressive CAGR of 38.60%, indicating a strong and growing interest in flexible, scalable alternatives to traditional database systems that can handle diverse data types and large volumes of data efficiently.

- Following this, cognitive software platforms have experienced a substantial growth rate of 23.30%, reflecting the rising demand for AI and machine learning technologies that can interpret and learn from data, driving intelligent decision-making processes.

- Content analytics, with a CAGR of 17.30%, and search systems, at 16.60%, also show notable growth, highlighting the importance of deriving insights from unstructured data and the need for advanced search capabilities across vast data repositories.

- IT services related to big data have seen a growth rate of 14.60%, underscoring the crucial role of services in implementing, managing, and optimizing big data technologies.

- Lastly, the “Others” category, encompassing various other big data technologies, has grown at a CAGR of 9.30%, indicating a healthy expansion across the broader big data ecosystem.

- This distribution of growth rates reflects the dynamic and evolving nature of big data technology, with particular emphasis on non-relational databases and cognitive computing as key drivers of innovation and efficiency in data management and analysis.

(Source: Statista)

Adoption of Data Catalog Capabilities Statistics

Data Intelligence Maturity Levels

- The distribution of data intelligence maturity levels among respondents showcases a varied landscape in the proficiency and sophistication of data intelligence capabilities.

- At the foundational level, Level 1, 20% of respondents find themselves at the beginning stages of their data intelligence journey, indicating a developing understanding and implementation of data intelligence practices.

- A significant portion, 40%, is at Level 2, suggesting that a plurality of respondents have developed a basic but solid framework for leveraging data intelligence within their operations.

- Progressing to Level 3, 30% of respondents demonstrate a more advanced application of data intelligence principles, highlighting a higher degree of integration and strategic utilization of data insights in decision-making processes.

- Lastly, at the pinnacle, Level 4, a smaller fraction, 10%, exemplifies the highest maturity level in data intelligence. These entities have likely mastered the art of data intelligence, utilizing sophisticated tools and methodologies to drive innovation and competitive advantage.

- This distribution underscores a general trend toward increasing data intelligence maturity, although it also highlights the challenges and complexities organizations face as they strive to elevate their data intelligence capabilities.

(Source: Collibra)

Capabilities Organizations Have in Place for Data Catalog Statistics

- The capabilities organizations have in place for data cataloging vary significantly between those at the highest maturity level (Level 4) and those at the initial stage (Level 1), reflecting the depth of data management practices across different stages of maturity.

- A striking 93% of organizations at Level 4 have established business data lineage, compared to only 26% at Level 1, with the overall adoption across respondents being 51%.

- Similarly, formal reviews for new data sources are implemented by 92% of Level 4 organizations, nearly mirroring the adoption rate for technical data lineage at the same level, but only by 25% at Level 1, resulting in overall adoption of 52% and 53% respectively for these capabilities.

- The concept of an internal data marketplace is embraced by 83% of those at Level 4, significantly higher than the 25% at Level 1, indicating a total of 45% across respondents.

- Notably, while 69% of Level 4 organizations have all listed capabilities in place, none at Level 1 report the same, underscoring a stark contrast in comprehensive data management capabilities between maturity levels, with an overall 10% of respondents indicating full adoption of all capabilities.

- This data highlights the progressive enhancement in data cataloging practices as organizations advance in their data intelligence maturity, from foundational approaches to sophisticated, integrated data management strategies.

(Source: Collibra)

Capabilities Organizations Have in Place for Data Governance

- In the realm of data governance, organizations exhibit a range of capabilities that starkly contrast between those at the highest maturity level (Level 4) and those just beginning their journey at Level 1.

- Among Level 4 organizations, a robust 93% conduct regular auditing of data requests, a practice only observed in 27% of Level 1 organizations, leading to an overall adoption rate of 51%.

- Similarly, the implementation of acceptable data use policies that enable data partners to self-manage data is reported by 90% of Level 4 entities compared to 24% at Level 1, with the total standing at 51%.

- Policies allowing customer self-management of data are in place for 89% of Level 4 organizations but fall to 19% for those at Level 1, resulting in an overall adoption of 48%.

- Formal data partner agreements are also more prevalent among Level 4 organizations (87%) than Level 1 (19%), with an aggregate adoption rate of 41%.

- Furthermore, 84% of Level 4 organizations have formal review processes for data requests, in contrast to 22% at Level 1, making the total adoption 46%.

- Notably, 60% of Level 4 organizations have all listed processes in place, demonstrating a comprehensive approach to data governance, whereas none at Level 1 report having all processes, culminating in a mere 9% overall adoption rate for all processes combined.

- This disparity underscores the significant evolution in data governance capabilities as organizations progress in their maturity, highlighting the sophisticated frameworks implemented by those at the forefront of data management.

(Source: Collibra)

Data Catalog Challenging Aspects Statistics

- A significant majority of data, approximately 88%, often remains underutilized and is not subjected to detailed scrutiny.

- This reveals that merely 12% of data within most organizations undergo in-depth analysis, pointing to a vast reservoir of untapped opportunities.

- Around 40% of companies regularly encounter difficulties in handling unstructured data, highlighting the prevalence of this issue.

- Moreover, an overwhelming 95% of companies recognize the management of unstructured data as a critical requirement.

- Additionally, there exists a degree of skepticism concerning the accuracy of data among 27% of individuals, reflecting concerns over data reliability.

(Source: IBM)

Recent Developments

Acquisitions and Mergers:

- Acquisition of a prominent data catalog software provider by a leading cloud computing company in September 2023, aiming to integrate data catalog capabilities into their cloud services.

- The merger between two established data catalog vendors in December 2023, consolidated their expertise and market share to offer comprehensive data management solutions.

New Product Launches:

- Introduction of a next-generation data catalog platform with advanced metadata management and data governance features by a software startup in January 2024, catering to the evolving needs of enterprise customers.

- Launch of industry-specific data catalog solutions targeting sectors such as healthcare, finance, and retail by established data management companies in March 2024, addressing sector-specific data challenges.

Funding Rounds:

- Series B funding round for a data catalog technology firm in February 2024, raising $40 million to fuel product innovation and expand market reach.

- Seed funding for a data catalog startup specializing in AI-driven data discovery and classification in April 2024, securing $12 million for product development and customer acquisition.

Partnerships and Collaborations:

- Collaboration between a data catalog provider and a leading business intelligence software company in November 2023 to integrate data cataloging capabilities into BI tools, enabling seamless data exploration and analysis.

- The partnership between a data catalog vendor and a data privacy compliance firm in March 2024 to develop solutions for regulatory compliance and data protection in data catalog environments.

Enterprise Adoption and Use Cases:

- Increasing demand for data catalog solutions among enterprises seeking to improve data discovery, governance, and collaboration across distributed data environments.

- Use cases for data catalogs expanding beyond traditional data management to include advanced analytics, machine learning model development, and regulatory compliance initiatives.

Investment Landscape:

- Venture capital investments in data catalog startups totaled $1.2 billion in 2023, with a focus on companies offering innovative solutions for data cataloging, metadata management, and data governance.

- Strategic acquisitions by technology giants and established software vendors accounted for 40% of total investment activity in the data catalog market in 2023, reflecting growing interest in data management and analytics capabilities.

Conclusion

Data Catalog Statistics – The shift towards data catalogs marks a pivotal change in data management, underlining their importance in structuring, accessing, and managing extensive data within firms. Market projections indicate robust growth for these solutions, highlighting their value across industries.

Despite obstacles like implementation hurdles and managing unstructured data, the benefits of improved governance and decision-making are undeniable, especially in organizations with advanced data intelligence.

As the digital landscape evolves with more sophisticated analytics and AI, the indispensability of data catalogs for strategic advantage becomes increasingly evident.

Furthermore, the trend toward cloud solutions showcases the adaptability of data catalogs to contemporary needs for security and operational efficiency in a data-focused world.

FAQs

A data catalog is a centralized repository designed to help organizations manage their data assets. It provides a detailed inventory of available data across the enterprise, including metadata, to enhance data discoverability and governance.

A data catalog automatically collects metadata from various data sources within an organization. It allows users to search for and access data using this metadata, facilitating easier data discovery, understanding, and management.

Essential features include metadata management, search and discovery capabilities, data lineage and quality insights, user collaboration tools, and integration with existing data management systems.

It streamlines data management, improves data quality and accessibility, supports compliance with data governance policies, and fosters a data-driven culture by making data easily discoverable and understandable.

Data catalogs are used by data scientists, analysts, IT professionals, and business users who need to find, understand, and trust the data they use for decision-making.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)