Table of Contents

- Introduction

- Editor’s Choice

- Data Center Accelerator Market Overview

- Competitive Landscape of Overall Data Center Market

- Regional Landscape of Overall Data Center Market

- Leading Countries by Number of Data Centers

- Data Center Traffic Statistics

- Components of Data Center Accelerator

- Key Investments

- Regulations for Data Center Accelerators

Introduction

According to Data Center Accelerator Statistics, Datacenter accelerators, integral to modern computing infrastructure, optimize specific computational tasks by offloading them from the central processing unit (CPU).

Types include GPUs, FPGAs, and ASICs, each tailored for different workloads such as AI, machine learning, and scientific simulations.

Their parallel processing capabilities expedite computations, enhancing performance and efficiency. Accelerators integrate into data centers through dedicated cards, integrated designs, or cloud services.

Supported by software frameworks like CUDA and TensorFlow, they offer benefits like improved performance, energy efficiency, and scalability.

Overall, data center accelerators are pivotal for accelerating complex tasks and driving advancements in computing across various industries.

Editor’s Choice

- The global data center accelerator market revenue reached USD 19.8 billion in 2023.

- By 2032, the market is expected to attain a significant milestone of USD 130.3 billion, with cloud data centers generating USD 77.66 billion and HPC data centers USD 52.64 billion.

- In the global data center accelerator market, the distribution of market share among various processor types is quite distinct. Central Processing Units (CPUs) hold the largest share, accounting for 33% of the market.

- In the data center market, Dell leads with a significant 13% share, underscoring its strong influence in the industry.

- The data center market revenue distribution across various countries highlights significant regional differences in market size. The United States leads the global market with a substantial revenue of USD 99.16 billion.

- By 2020, the cloud data center IP traffic had escalated to 16.09K exabytes, and in 2021, it further surged to 19.51K exabytes.

- The AMD Alveo U280 Data Center Accelerator Card features 8GB of HBM2 memory with up to 460GB/s bandwidth, designed for memory-bound, compute-intensive applications like database analytics and machine learning inference.

Data Center Accelerator Market Overview

Global Data Center Accelerator Market Size

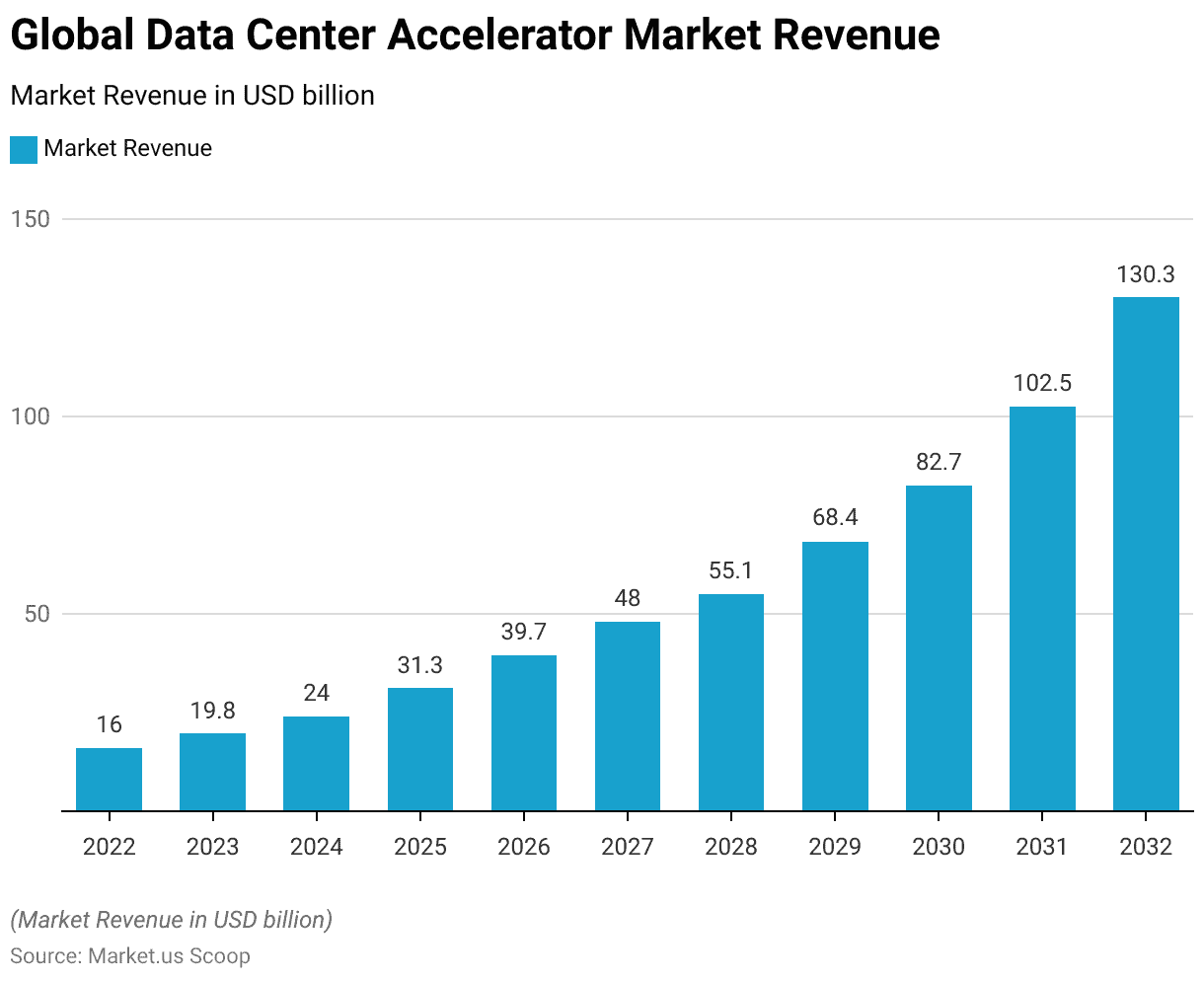

- The global data center accelerator market has witnessed significant growth over the past few years at a CAGR of 24%, with revenues increasing from USD 16.0 billion in 2022 to USD 19.8 billion in 2023.

- By 2032, the global data center accelerator market is poised to achieve a remarkable USD 130.3 billion, reflecting a robust growth trend driven by increasing demand for advanced computing capabilities and data processing efficiency.

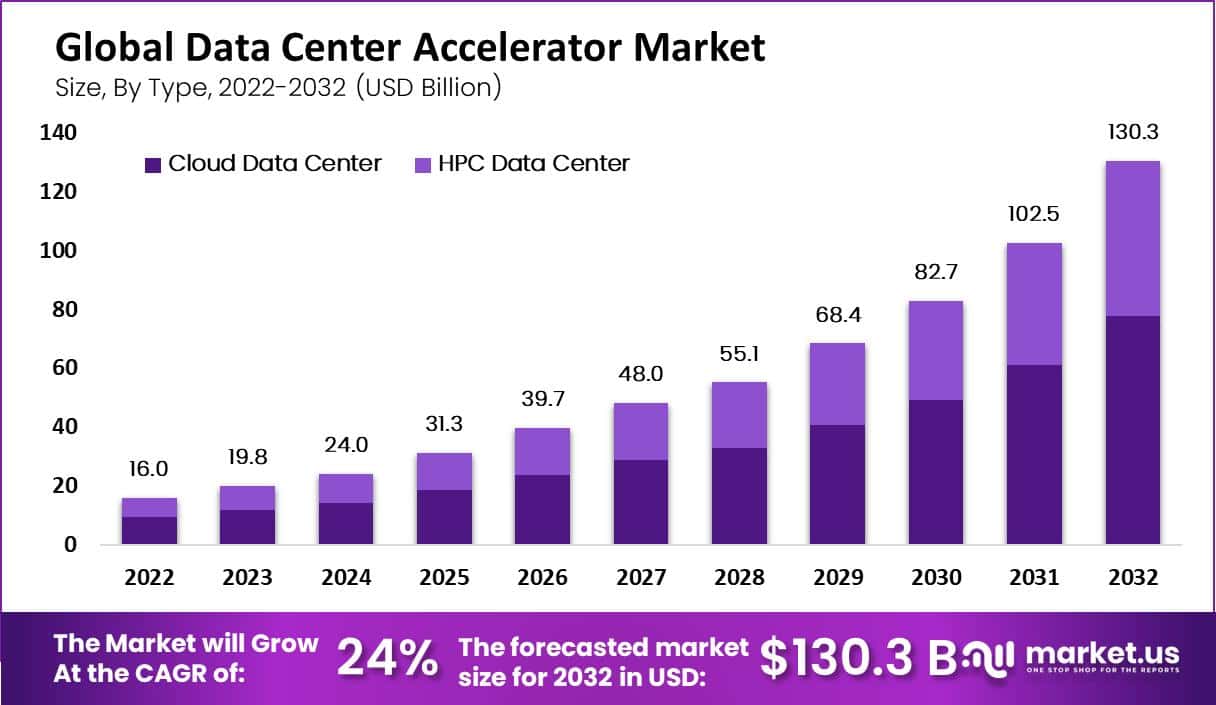

Data Center Accelerator Market Size – By Type

- The global data center accelerator market, segmented by type, has shown remarkable growth in both the cloud and high-performance computing (HPC) data center segments.

- In 2022, the total market revenue was USD 16.0 billion, with cloud data centers contributing USD 9.54 billion and HPC data centers accounting for USD 6.46 billion.

- By 2032, the market is expected to attain a significant milestone of USD 130.3 billion, with cloud data centers generating USD 77.66 billion and HPC data centers USD 52.64 billion.

Data Center Accelerator Market Share – By Processor Type

- In the global data center accelerator market, the distribution of market share among various processor types is quite distinct.

- Central Processing Units (CPUs) hold the largest share, accounting for 33% of the market.

- Graphics Processing Units (GPUs) follow closely, capturing 27% of the market share.

- Application-Specific Integrated Circuits (ASICs) contribute 16% to the market, while Field-Programmable Gate Arrays (FPGAs) hold a significant 24% share.

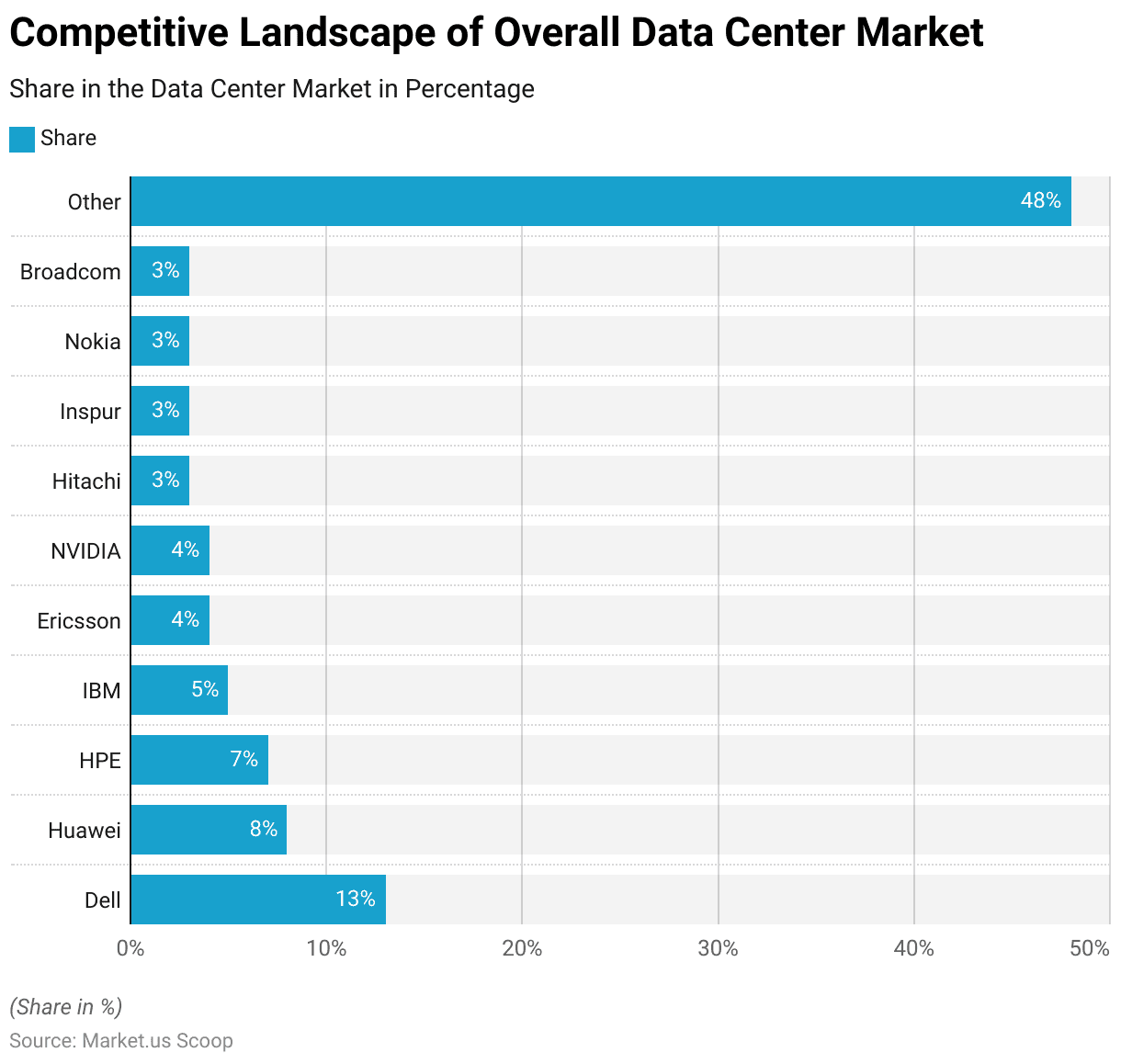

Competitive Landscape of Overall Data Center Market

- In the data center market, Dell leads with a significant 13% share, underscoring its strong influence in the industry.

- Huawei follows with an 8% share, while Hewlett Packard Enterprise (HPE) holds 7% of the market.

- IBM captures 5%, and both Ericsson and NVIDIA each contribute 4% to the market.

- Hitachi, Inspur, Nokia, and Broadcom each hold a 3% share.

- Collectively, these companies account for 52% of the market, leaving the remaining 48% distributed among various other players.

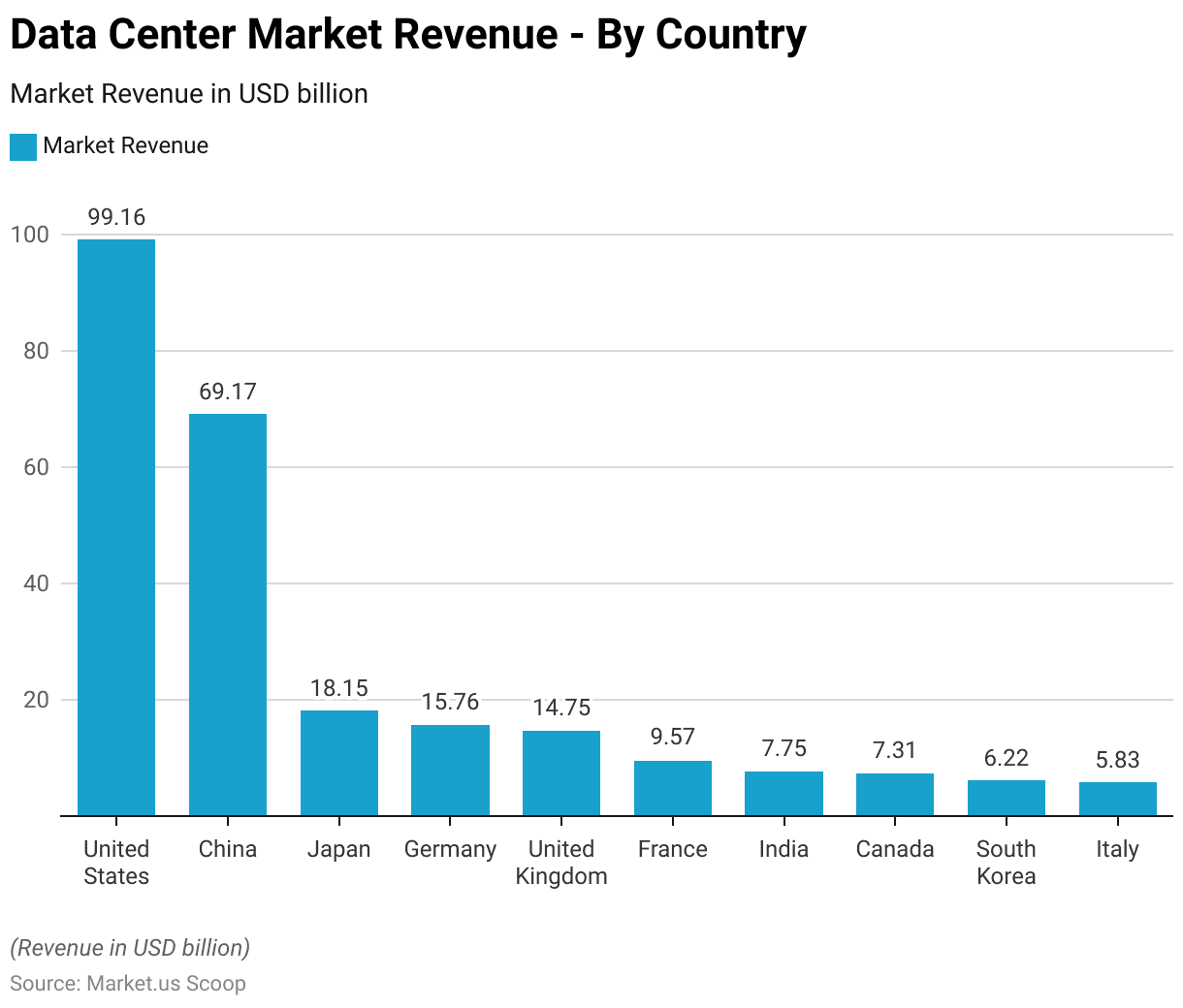

Regional Landscape of Overall Data Center Market

- The data center market revenue distribution across various countries highlights significant regional differences in market size.

- The United States leads the global market with a substantial revenue of USD 99.16 billion, followed by China, which generates USD 69.17 billion.

- Japan holds a notable position with a revenue of USD 18.15 billion, while Germany and the United Kingdom contribute USD 15.76 billion and USD 14.75 billion, respectively.

- France’s data center market revenue stands at USD 9.57 billion, and India follows with USD 7.75 billion.

- Canada and South Korea generate USD 7.31 billion and USD 6.22 billion, respectively, while Italy’s market revenue amounts to USD 5.83 billion.

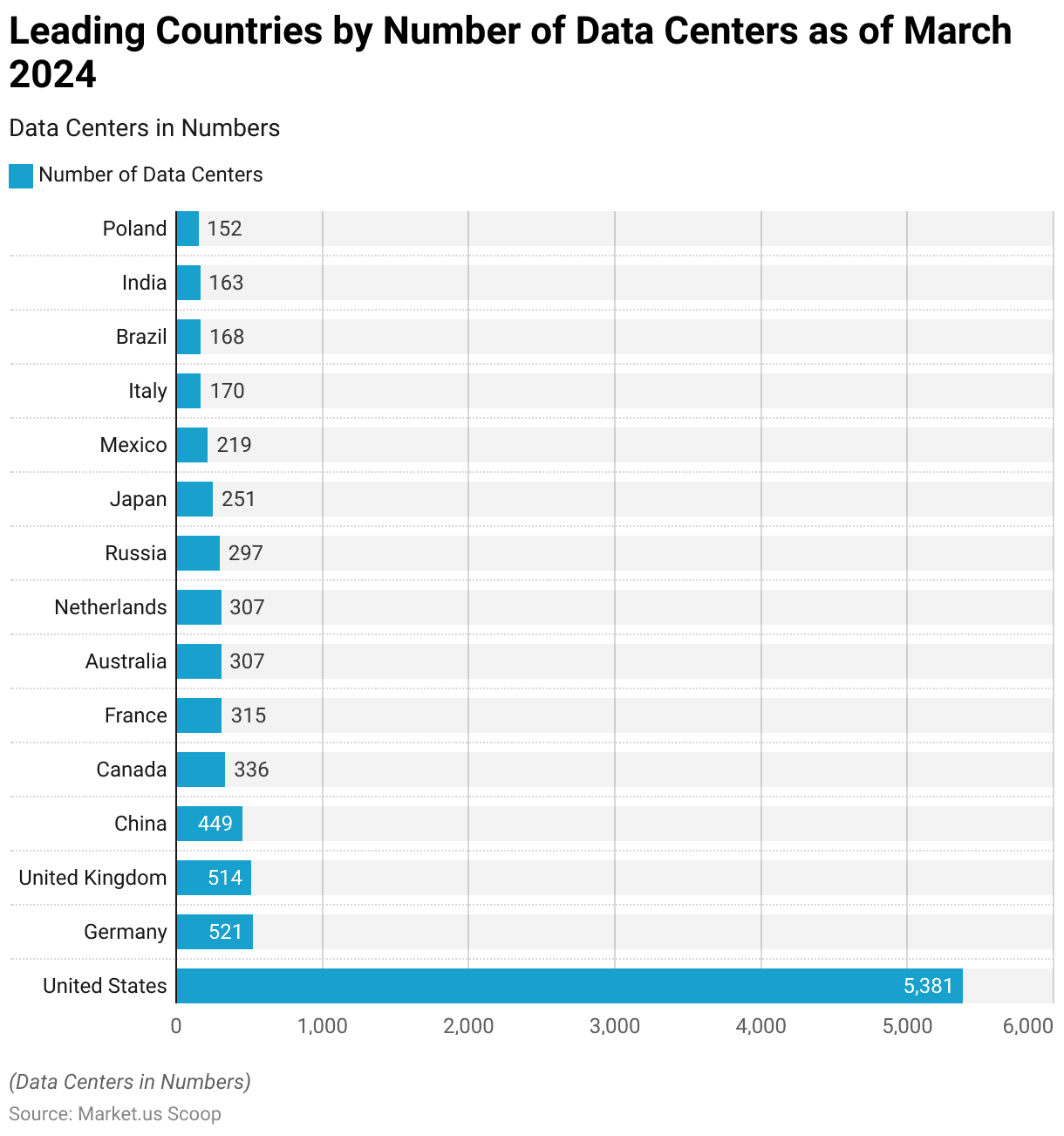

Leading Countries by Number of Data Centers

- As of March 2024, the United States leads the global data center landscape with an impressive total of 5,381 data centers.

- Germany and the United Kingdom follow, with 521 and 514 data centers, respectively.

- China has established 449 data centers, while Canada hosts 336 facilities.

- France and Australia each have 315 and 307 data centers, respectively, and the Netherlands matches Australia with 307 data centers as well.

- Russia operates 297 data centers, and Japan has 251.

- Mexico’s data center count stands at 219, while Italy has 170.

- Brazil and India have 168 and 163 data centers, respectively.

- Poland rounds out the list with 152 data centers.

Data Center Traffic Statistics

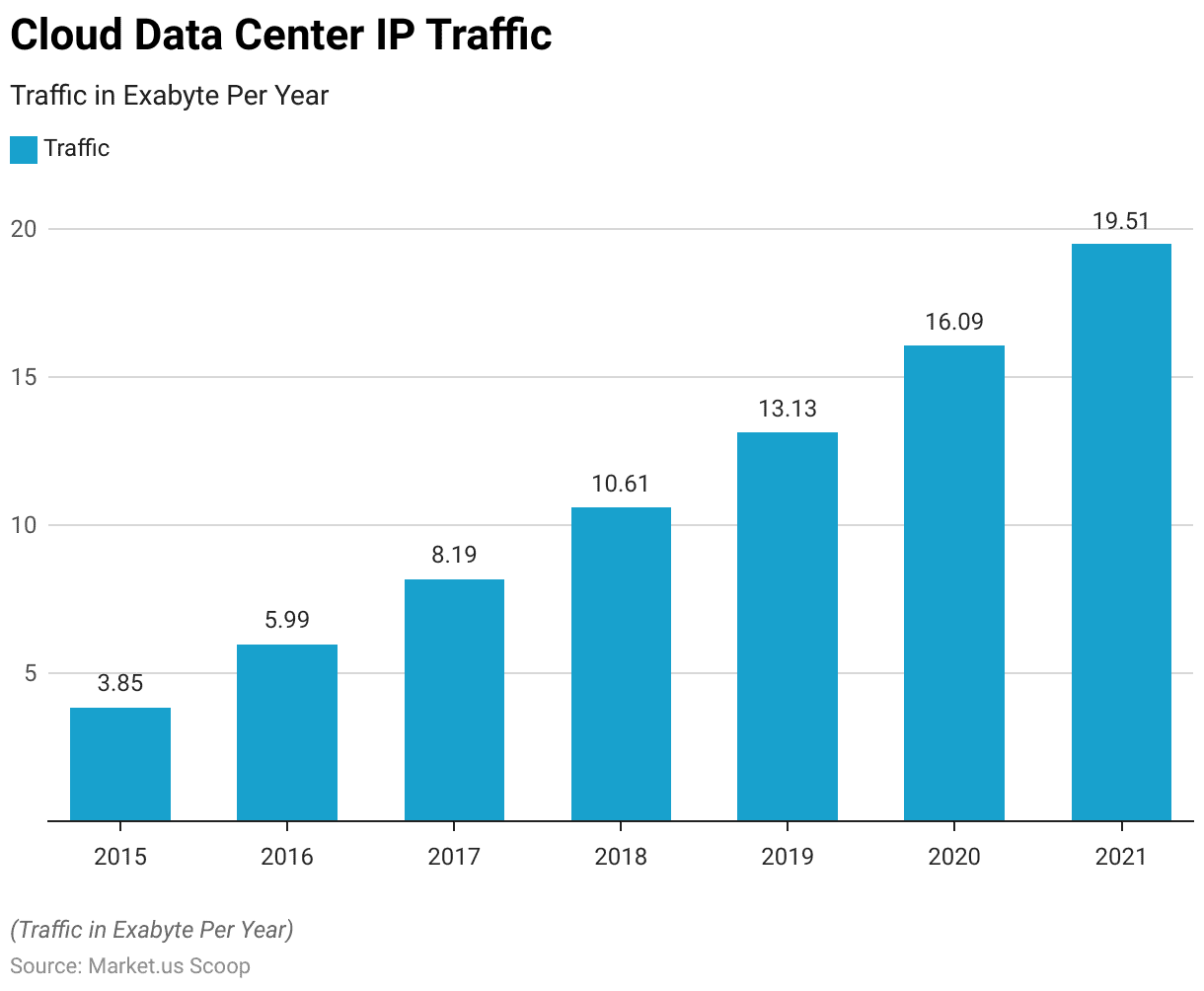

Cloud Data Center IP Traffic

- From 2015 to 2021, cloud data center IP traffic experienced substantial growth, as evidenced by the annual data traffic figures.

- In 2015, the traffic was recorded at 3.85K exabytes per year.

- This number saw a significant increase in the following years, reaching 5.99K exabytes in 2016 and 8.19K exabytes in 2017.

- The upward trend continued, with traffic volumes hitting 10.61K exabytes in 2018 and 13.13K exabytes in 2019.

- By 2020, the cloud data center IP traffic had escalated to 16.09K exabytes, and in 2021, it further surged to 19.51K exabytes.

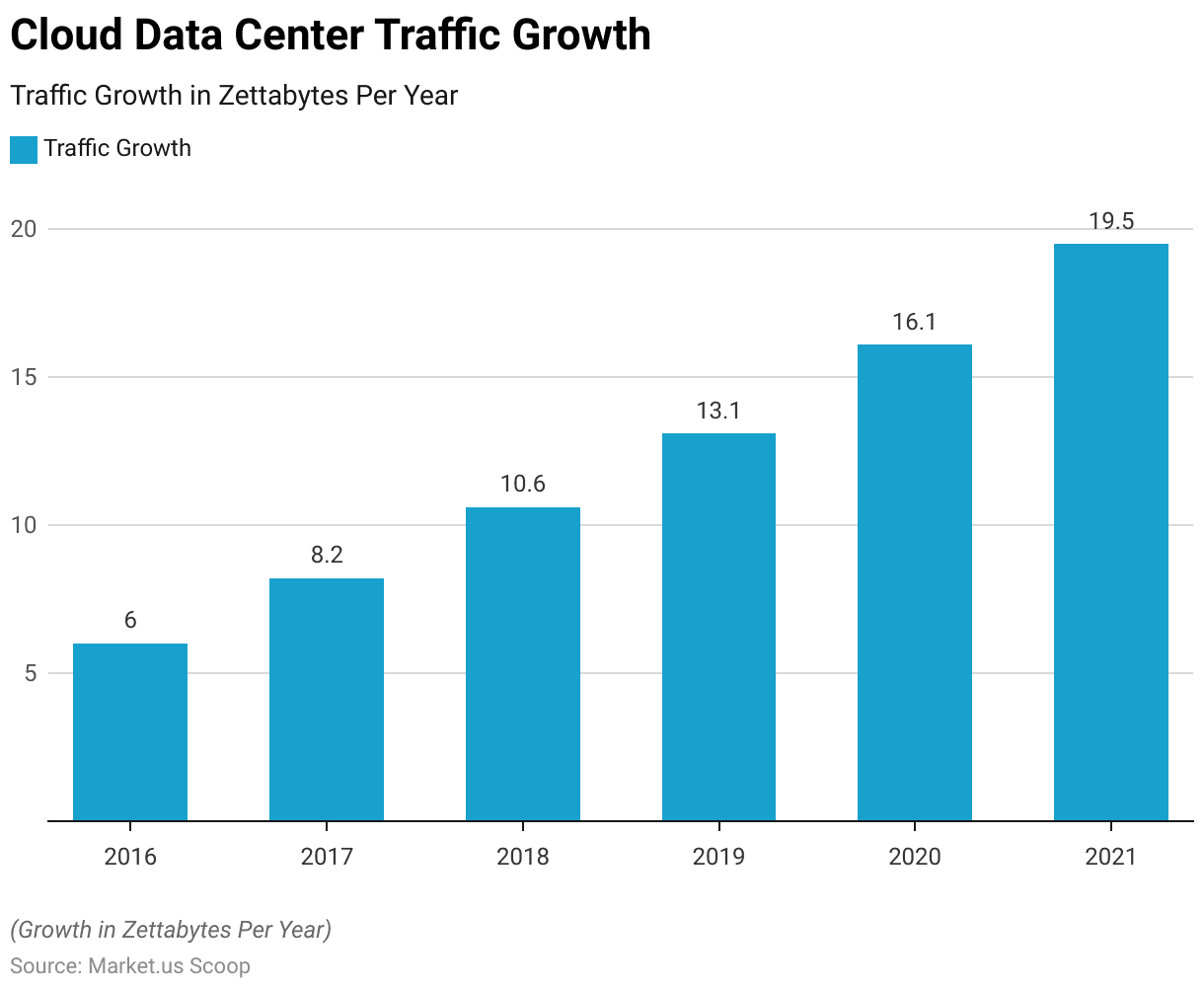

Global Cloud Data Center IP Traffic Growth

- The growth of cloud data center traffic has shown a significant upward trend from 2016 to 2021.

- In 2016, the traffic was recorded at 6.0 zettabytes per year, which increased to 8.2 zettabytes in 2017.

- This growth continued steadily, reaching 10.6 zettabytes in 2018 and 13.1 zettabytes in 2019.

- By 2020, the traffic had grown to 16.1 zettabytes, and in 2021, it reached 19.5 zettabytes per year.

Components of Data Center Accelerator

- Datacenter accelerators comprise several key components, each designed to enhance performance and efficiency.

- Key components include Central Processing Units (CPUs), Graphics Processing Units (GPUs), Application-Specific Integrated Circuits (ASICs), and Field-Programmable Gate Arrays (FPGAs).

- For instance, the AMD Alveo U280 Data Center Accelerator Card features 8GB of HBM2 memory with up to 460GB/s bandwidth, designed for memory-bound, compute-intensive applications like database analytics and machine learning inference.

- Another example is the NVIDIA H100 Tensor Core GPU, which offers up to 256 GPUs interconnected with NVLink for exascale workloads, enhancing scalability and security.

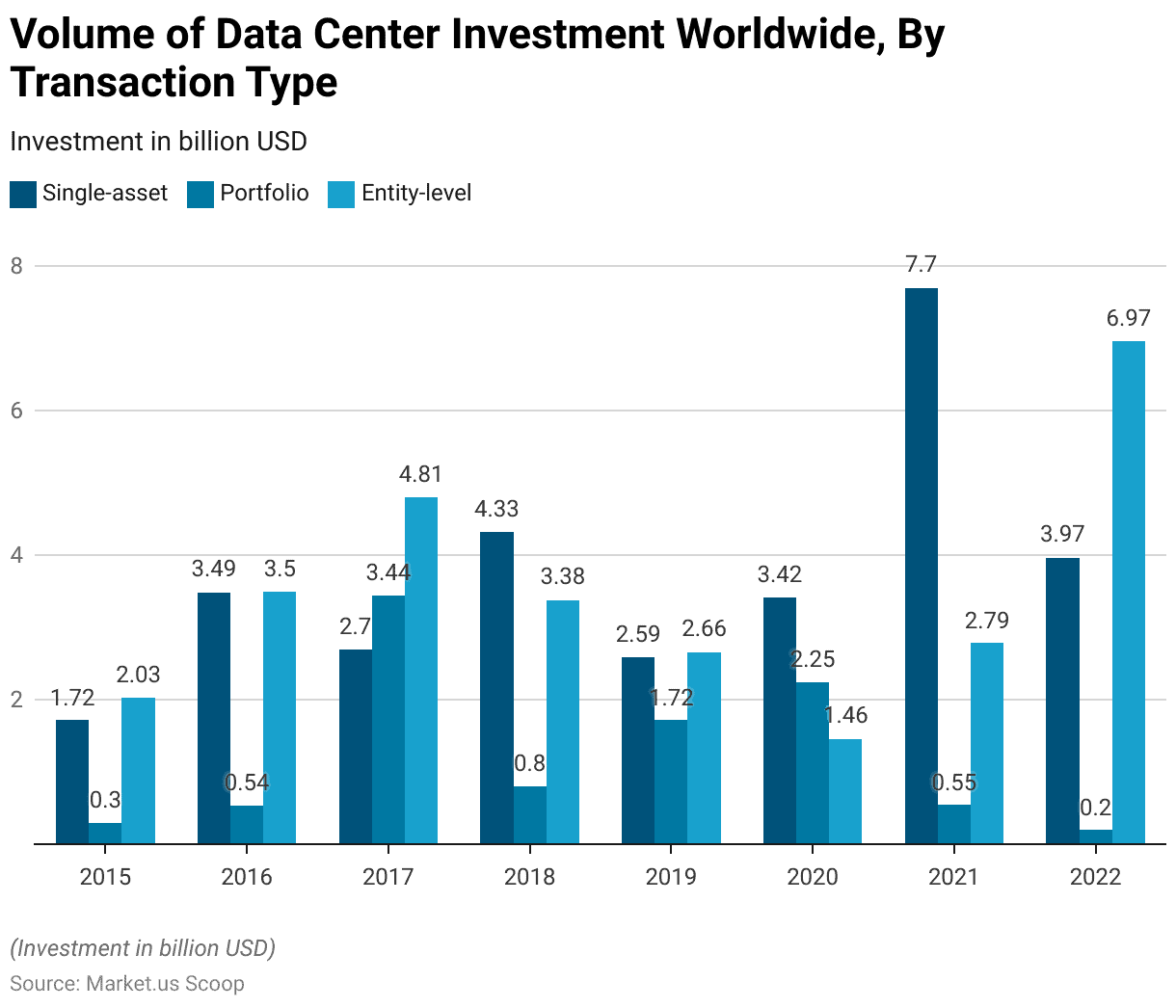

Key Investments

- Between 2015 and 2022, data center investments worldwide saw significant fluctuations across single-asset, portfolio, and entity-level transactions.

- Single-asset investments began at $1.72 billion in 2015, peaked at $7.7 billion in 2021, and settled at $3.97 billion in 2022.

- Portfolio transactions experienced notable highs and lows, starting from $0.3 billion in 2015, spiking to $3.44 billion in 2017, and dropping to $0.2 billion in 2022.

- Entity-level investments demonstrated considerable variability, commencing at $2.03 billion in 2015, reaching a high of $6.97 billion in 2022 despite a low of $1.46 billion in 2020.

Regulations for Data Center Accelerators

- Regulations for Data Center Accelerators vary by country and are influenced by factors such as data privacy, energy efficiency, and environmental sustainability.

- In the United States, data center regulations are primarily governed by industry standards such as the Uptime Institute’s Tier Classification System and the Energy Star program.

- Additionally, regulatory bodies like the Environmental Protection Agency (EPA) and the Department of Energy (DOE) set guidelines for energy efficiency and environmental impact.

- In Europe, the General Data Protection Regulation (GDPR) mandates stringent data privacy measures for data center operations.

- Countries like Germany have specific regulations for data processing and storage, ensuring compliance with EU data protection laws.

- In the Asia-Pacific region, countries like Singapore promote green data center initiatives through regulations like the Green Data Centre Standard (GDCS), which focuses on energy efficiency and sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)