Table of Contents

Introduction

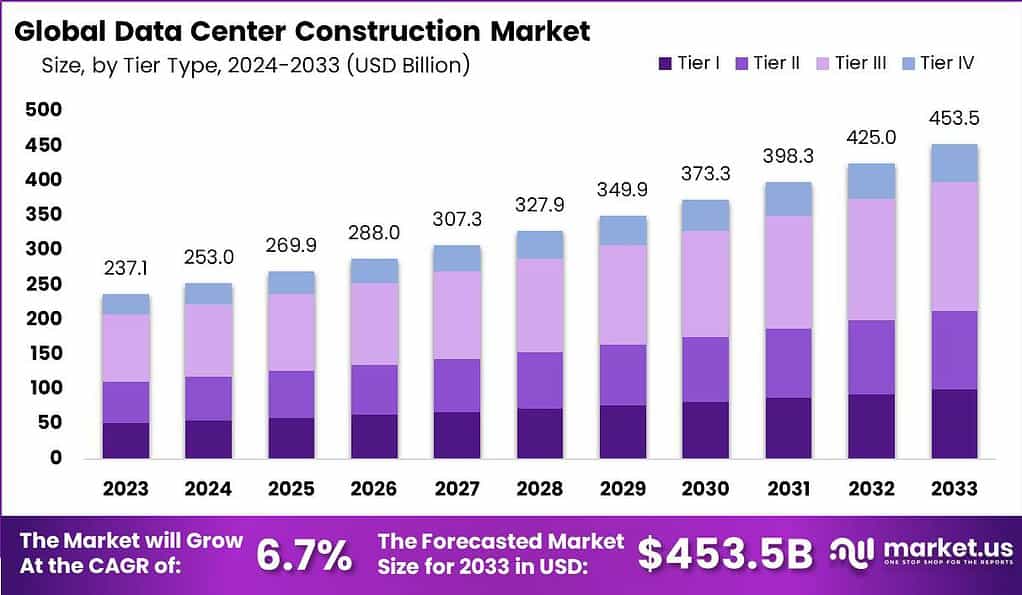

According to Market.us, The global data center construction market is expected to reach USD 453.5 Billion by 2033, representing a substantial Compound Annual Growth Rate (CAGR) of 6.7%. This growth trajectory reflects a significant increase from the valuation of USD 237.1 Billion in 2023.

The construction of data centers has become a pivotal aspect of modern infrastructure, catering to the exponentially growing demand for data processing and storage, driven by the surge in cloud computing, big data analytics, and the proliferation of digital services. The data center construction market is witnessing robust growth, characterized by the development of facilities that are not only scalable and efficient but also adhere to stringent standards of reliability and security. This expansion is propelled by the increasing reliance of businesses and governments on digital platforms, necessitating the availability of robust data handling capabilities.

From an analytical standpoint, several factors are driving the growth of the data center construction market. Firstly, the digital transformation initiatives across various sectors are augmenting the need for data centers, as organizations seek to harness the power of data for competitive advantage. Secondly, the advent of technologies such as 5G, Internet of Things (IoT), and artificial intelligence (AI) is further amplifying the demand for data processing power, thus fueling the construction of new data centers. Additionally, the emphasis on data sovereignty and the need for local data processing in compliance with regulatory requirements are prompting companies to invest in regional data centers, contributing to the market’s expansion.

Opportunities within the data center construction market are vast and varied. There is a growing interest in green data centers, driven by the global push towards sustainability. This shift offers substantial opportunities for innovations in energy-efficient design, renewable energy integration, and advanced cooling systems, presenting a significant area for development and investment. Furthermore, the increasing complexity of data center architecture, coupled with the demand for high levels of security and reliability, opens avenues for advancements in construction methodologies, materials, and technologies. The adoption of modular and prefabricated data centers is another area of opportunity, offering flexibility and scalability while reducing construction time and costs.

Data Center Construction Facts and “Latest” Statistics

- Colocation Data Centers: Dominated the market in 2023, holding over 46% market share, as businesses increasingly opt for renting server space and infrastructure for cost-efficiency and scalability.

- Tier III Data Centers: Led the market with over 41% share in 2023, providing a balance of affordability and reliability suitable for businesses requiring high availability.

- IT & Telecom: Held the largest market position in 2023, accounting for over 38% share, driven by the substantial demand for robust and scalable data center solutions.

- North America dominated with over 38% market share, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- Global Presence: The global count of data centers surpasses 7,500, with over 2,600 situated within the top 20 cities worldwide. This distribution underscores the strategic importance of geographic location in addressing latency and regional demand.

- Energy Consumption: Data centers are substantial electricity consumers, accounting for up to 3% of global electricity production, as estimated by the Natural Resources Defense Council (NRDC). This significant energy demand places emphasis on the integration of sustainable and efficient energy solutions.

- Financial Investment: IT spending on data center systems is projected to reach $222 billion by 2023. Additionally, investments in cloud IT infrastructure are expected to see sustained growth from 2013 to 2026, reflecting the ongoing shift towards cloud computing.

- Regional Developments: In the APAC region, Tokyo led data center construction in H1 2022, with facilities capable of 468.3MW, followed by Sydney with 250MW. This highlights the regional diversification of data center investments.

- Hyperscale Growth: Over 40% of new data center projects in 2023 are hyperscale facilities, driven by cloud service providers. The average size of these data centers expanded to more than 300,000 square feet in 2023.

- Design Innovations: The design of over 60% of new projects in 2023 focused on high-density computing, achieving higher power usage effectiveness (PUE). The adoption of prefabricated and modular solutions also grew by 35%, driven by efficiency and cost savings.

- Sustainability: Renewable energy integration in over 75% of new projects in 2023 reflects a commitment to environmental sustainability, with a significant focus on solar and wind power.

- Technological Integration: The application of AI and ML in over 40% of new constructions in 2023 enhances operational efficiency and predictive maintenance capabilities.

- Security and Edge Computing: Advanced security measures were incorporated in over 50% of new projects, while the adoption of edge data centers grew by 60%, catering to the demand for low-latency applications.

- Construction Costs and Timeframes: The average cost for constructing a hyperscale data center soared above $1 billion, with project durations spanning 12 to 18 months. Innovations like 3D printing and modular construction, growing by 25% in 2023, are pivotal in streamlining construction processes.

Key Trends

- AI and Hyperscale Data Centers: The proliferation of artificial intelligence (AI) and the need for hyperscale data centers are significant drivers. The demand for AI capabilities is pushing the construction of hyperscale data centers designed to support large AI workloads with thousands of GPUs for low-tail latency performance.

- Sustainability and Modular Designs: There’s a growing momentum for sustainable and modular data center construction. Prefabricated modules for power rooms and cooling equipment, along with sustainable materials like mass timber, are becoming more common. This trend is partly due to the need for rapid deployment and the industry’s shifting focus towards sustainability.

- Supply Chain Challenges: The data center construction industry faces supply chain challenges, with long lead times for critical components like power distribution equipment and generators. Creative dealmaking and strategic partnerships are emerging as solutions to these challenges.

- Edge Computing and On-Premises Solutions: There’s a noticeable shift towards edge computing and a return to on-premises data storage solutions. This trend is driven by the need for increased resilience, distributed infrastructure, and the direct protection of applications on the edge.

Major Challenges

- Supply Chain Constraints: The data center construction industry faces significant challenges in supply chain logistics, notably in procuring critical components like power distribution units, generators, and cooling systems. Extended lead times can delay projects and inflate costs.

- Rising Real Estate Costs: As the demand for data centers grows, so does the cost of suitable real estate. This challenge is particularly acute in densely populated or strategically important areas where land is at a premium.

- Environmental Concerns: Data centers consume a vast amount of energy, mainly for cooling purposes, which raises concerns about their environmental impact. The industry is under pressure to adopt more sustainable practices and technologies.

- Technology Advancements: Keeping pace with rapid technological advancements is a challenge. Data centers must constantly evolve to accommodate new hardware and software, requiring ongoing investment in infrastructure upgrades.

- Data Center Consolidation: The trend towards consolidation, driven by efficiencies and the move to cloud services, can reduce the demand for traditional data center spaces. This trend challenges data center construction by shifting focus towards larger, more efficient, and centralized facilities.

Broader Benefits

- Support for the Digital Economy: Data centers are the backbone of the digital economy, supporting everything from cloud computing and big data analytics to online services and the Internet of Things (IoT).

- Enhanced Connectivity and Reliability: By providing robust, high-speed connections and redundancy, data centers ensure that businesses and consumers enjoy reliable access to digital services.

- Economic Development: The construction of data centers can drive local economic development, creating jobs and stimulating growth in related sectors such as construction, IT, and telecommunications.

- Innovation Hub: Data centers can act as hubs of innovation, facilitating the development and deployment of new technologies and services, from AI to edge computing.

Use Cases

- Cloud Services: Data centers are integral to the delivery of cloud services, offering the physical infrastructure necessary for hosting services and applications accessible over the internet.

- Disaster Recovery and Business Continuity: They play a critical role in disaster recovery and business continuity planning, providing organizations with secure, redundant facilities to back up data and maintain operations during outages.

- AI and Machine Learning: With the need for substantial computational power, data centers enable the processing and analysis of large datasets, driving advancements in AI and machine learning.

- Edge Computing: Data centers support edge computing by processing data closer to the source, reducing latency and improving the performance of IoT devices and mobile applications.

- Enterprise IT: For enterprises, data centers offer a scalable, secure environment for hosting mission-critical applications, managing large data volumes, and supporting complex IT workloads.

Key Player’s Strategies

The strategies and recent developments of the listed key players highlight a collective commitment to excellence, innovation, and sustainability in data center construction.

- Turner Construction Company is leveraging its extensive experience in sustainable construction practices to deliver energy-efficient data centers. The company focuses on integrating renewable energy sources and achieving LEED certification for its projects, emphasizing environmental stewardship.

- Holder Construction Group has been at the forefront of adopting advanced technologies in data center construction. The company employs Building Information Modeling (BIM) to enhance project visualization, improve accuracy, and reduce construction timelines. Holder is known for its specialized focus on mission-critical facilities, emphasizing reliability and high performance.

- DPR Construction places a strong emphasis on innovation and flexibility. The company has been pioneering the use of prefabricated and modular components in data center construction, which allows for faster deployment and scalability. DPR’s approach is geared towards meeting the rapid scale-up demands of cloud and technology companies.

- Skanska AB has made significant strides in sustainable construction practices. The company is investing in green construction methods and materials, aiming to minimize environmental impact while maximizing energy efficiency. Skanska’s projects often feature advanced cooling systems and energy recovery technologies.

- Mortenson Construction is focusing on expanding its expertise in renewable energy integration within data centers. The company is actively involved in projects that incorporate solar and wind power solutions, underlining its commitment to sustainability and reducing carbon footprint.

- AECOM has been a leader in providing comprehensive design, consulting, and construction services for data centers. The company is pushing the boundaries of design excellence, focusing on creating facilities that are not only efficient but also resilient to changing climate conditions and natural disasters.

- Jacobs Engineering Group emphasizes custom solutions tailored to the specific needs of its clients. The company’s approach to data center construction incorporates the latest in energy-efficient technologies and smart building systems, ensuring that facilities are optimized for performance and sustainability.

- M. A. Mortenson Company, distinct from Mortenson Construction, has been focusing on innovation through its research and development efforts in energy efficiency and construction technology. The company is exploring cutting-edge solutions like artificial intelligence (AI) to optimize construction processes and operational efficiency.

- Hensel Phelps Construction Co. is known for its integrated project delivery approach, which fosters collaboration among all stakeholders from the early stages of design through construction. This methodology enhances efficiency, reduces waste, and ensures that projects are completed on time and within budget.

- Holder Construction Company, listed a second time, reiterates its prominence in the sector, underscoring its specialized expertise in building high-performance computing centers and its commitment to leveraging technology for project management and execution efficiency.

Conclusion

In conclusion, the data center construction market is witnessing significant growth and presents numerous opportunities for businesses in the technology and infrastructure sectors. The increasing demand for data storage, processing power, and cloud-based services is driving the construction of new data centers worldwide. The market is driven by several factors, including the exponential growth of data generated from various sources such as IoT devices, social media, and digital transactions. Additionally, the rising adoption of cloud computing, big data analytics, and artificial intelligence necessitates the construction of robust and scalable data centers to handle the massive influx of data and ensure optimal performance.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)