Table of Contents

Introduction

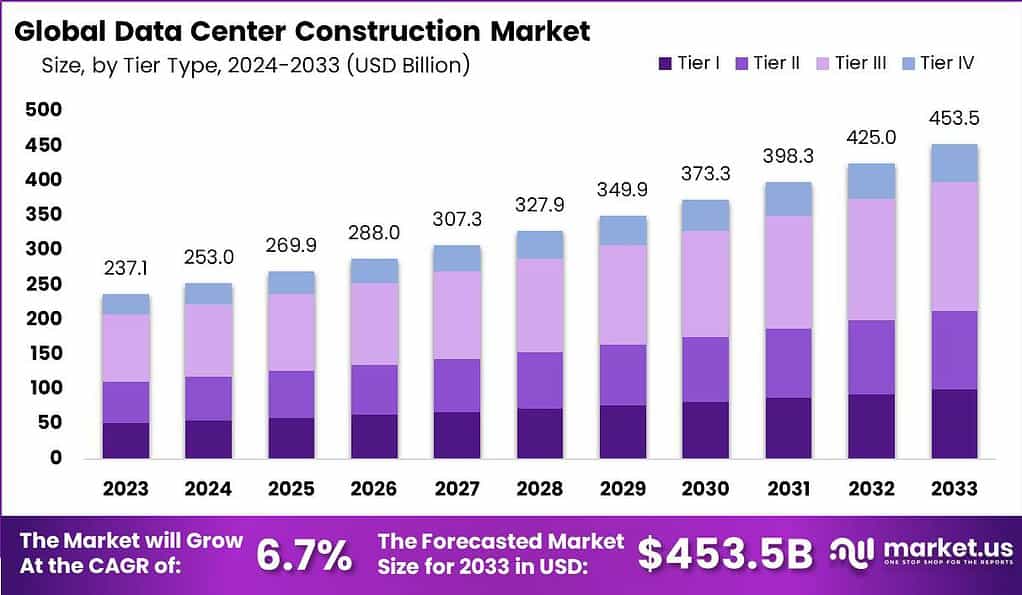

According to the findings of Market.us, the Global Data Center Construction Market is projected to expand significantly over the next decade. From a valuation of approximately USD 237.1 Billion in 2023, the market is anticipated to reach around USD 453.5 Billion by 2033. This growth trajectory suggests a steady compound annual growth rate (CAGR) of 6.7% during the forecast period from 2024 to 2033. Notably, North America has established a dominant presence in this market, holding more than 38% of the global share. This translates to revenues nearing USD 90.1 Billion.

The Data Center Construction Market is experiencing significant growth, driven by the increasing demand for data storage and cloud-based solutions. As businesses and consumers generate more data, the need for robust, scalable, and energy-efficient data centers increases. This market is also influenced by technological advancements and the shift towards sustainable building practices, which demand innovative construction methods to enhance energy efficiency and reduce environmental impact.

The demand for data center construction is bolstered by the exponential growth in data generation from various sources like social media, mobile devices, and IoT devices. This surge in data necessitates more extensive and efficient data storage facilities. Key market drivers include the increasing reliance on cloud services and the shift towards big data and AI technologies, which are prompting the growth of hyperscale data centers and investments in modernizing existing facilities.

Data centers have become increasingly popular as the backbone of IT infrastructure, supporting a wide range of applications from enterprise-level solutions to personal data storage. Their importance is magnified by the digital economy’s growth, where data storage, management, and processing are critical. The popularity of data centers is also bolstered by their role in enabling various technologies such as cloud services, IoT, and more, making them indispensable in today’s technology landscape.

The data center construction market offers substantial opportunities, particularly in the development of green data centers. These facilities focus on sustainability and energy efficiency, using renewable energy sources and advanced cooling mechanisms to reduce environmental impact. The shift towards modular data centers, which allow for scalability and rapid deployment, also presents new business opportunities for construction firms and investors looking to capitalize on quick-to-market strategies.

The data center construction market is set to expand significantly in the coming years. This growth is expected not only in traditional markets like North America and Europe but also in emerging markets in Asia-Pacific and the Middle East, where digital services are seeing rapid adoption. Expansion efforts are further supported by government initiatives in various countries that promote digital infrastructure development as a part of broader economic growth strategies. This global expansion is indicative of the data center sector’s robust and pivotal role in the worldwide digital economy.

Key Takeaways

- The Data Center Construction Market is projected to grow from USD 237.1 Billion in 2023 to USD 453.5 Billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 6.7% during the forecast period from 2024 to 2033.

- Colocation Data Centers: These facilities dominated the market in 2023, capturing over 46% of the market share. The preference for colocation data centers is attributed to their scalability, flexibility, and cost-efficiency, factors that are vital in their increased adoption.

- Tier III Data Centers: This category also demonstrated significant market leadership, accounting for more than 41% of the market share. Tier III data centers are preferred for their optimal balance between cost and redundancy, offering concurrent maintainability without substantial capital expenditure increases.

- Industry Applications: The IT & Telecom sector emerged as the most significant end-user, commanding more than 38% of the market share. The sector’s dependence on robust data management and processing capabilities is a key driver for this dominance.

- North America: The region led the global market with a share exceeding 38% in 2023. This leadership is supported by the region’s advanced technological infrastructure and stringent data regulation policies, which encourage significant investments in data center construction.

Data Center Construction Statistics

- Data centers are projected to consume 20% of the world’s power supply by 2025.

- There are 8,000 data centers globally, with 33% of them located in the United States.

- The top five drivers of data center demand are remote work, digitization, digital technologies, OTT services, and IoT.

- The global data center colocation market is expected to reach USD 227.4 billion by 2033, up from USD 57.2 billion in 2023, with a CAGR of 14.8% over the forecast period.

- The Global Green Data Center Market is projected to be worth USD 434.1 billion by 2033, growing from USD 73.1 billion in 2023 at a CAGR of 19.5%.

- The Natural Resources Defense Council (NRDC) estimates that data centers account for up to 3% of total global electricity consumption.

- The Global Containerized Data Center Market is anticipated to grow to USD 81.2 billion by 2033, increasing from USD 11.3 billion in 2023, with a CAGR of 21.8% during the forecast period.

- London, England, has the largest concentration of data centers worldwide, with 337 locations.

- California leads in the U.S. with the largest concentration of data centers, totaling over 300 locations.

- The average data center consumes over 100 times the power of a large commercial office building, and large data centers use the equivalent electricity of a small U.S. town.

- The New York-New Jersey metropolitan area has the highest concentration of data centers in a U.S. city, with approximately 306 centers.

- Data centers are increasingly adopting in-flight wire speed encryption, ensuring data protection from departure to arrival.

- The largest data center in the world (Langfang, China) spans 6.3 million square feet, nearly the size of the Pentagon.

- The Global Data Center Power Management Market is expected to grow to USD 14.5 billion by 2033, up from USD 7.5 billion in 2023, with a CAGR of 6.8%.

- In 2023, North America held a 37.1% market share in the data center power management sector, generating USD 2.78 billion in revenue.

- The Global Data Center Accelerator Market, valued at USD 16.0 billion in 2022, is expected to reach USD 130.3 billion by 2032, registering a CAGR of 24% from 2023 to 2032.

- The Global Data Center Cooling Market is anticipated to reach USD 60.4 billion by 2033, up from USD 15.6 billion in 2023, with a CAGR of 14.5%.

- The Global Data Center Physical Security Market is forecasted to grow to USD 6.9 billion by 2033, increasing from USD 1.7 billion in 2023, with a CAGR of 15.1%.

- Singapore, the most power-constrained market, has only 7.2 MW of available capacity and a near record-low 1% vacancy rate.

- Colocation facilities accounted for over 46% of the market share in 2023, driven by their scalability and cost-efficiency.

- There is currently about 2,287.6 MW of supply under construction in primary markets, with over 70% preleased capacity, indicating strong demand.

- Large corporations face growing challenges in securing data center capacity due to low supply, construction delays, and power constraints. For example, Querétaro, Mexico has only 0.6 MW available for lease.

- North American data center vacancy rates have hit new lows. Chicago led with a decrease to 2.4% from 6.7%, while Northern Virginia saw a decline to 0.9% from 1.8%, despite an 18% inventory increase

Data Center Spending Worldwide

| Year | Data Center Spending, $US billions |

| 2012 | 140 |

| 2013 | 163 |

| 2014 | 166 |

| 2015 | 171 |

| 2016 | 170 |

| 2017 | 181 |

| 2018 | 210 |

| 2019 | 215 |

| 2020 | 179 |

| 2021 | 216 |

| 2022* | 212 |

| 2023* | 222 |

Impact of Generative AI

The impact of generative AI on data center construction is substantial and multifaceted:

- Increased Build-Outs: The deployment of generative AI is driving a significant expansion in data center construction. The need for powerful computing to support AI workloads has led to a threefold anticipated growth in hyperscale data center footprints over the next five to six years. This expansion is critical to accommodate the heavy data and compute demands of AI applications.

- Sustainability Challenges: As data centers grow to support AI, the industry faces increased scrutiny over energy consumption and environmental impact. Companies are pushed to adopt more sustainable practices throughout the data center lifecycle, from site selection to construction and operation. This shift is essential to balance growth with ecological responsibility.

- Regulatory and Operational Pressures: The global spread of data centers for AI applications is also encountering regulatory challenges, especially concerning data sovereignty and environmental regulations. These issues compel data centers to be more localized, impacting where and how they operate. Adapting to these regulations while trying to remain efficient is a key challenge for the sector.

- Efficiency as a Priority: With rising operational and macroeconomic pressures, the drive for efficiency in data center design and management is more critical than ever. Efficient use of resources, from power to construction materials, is seen as the only way forward to sustain growth and manage costs effectively.

Emerging Trends

- AI-Driven Efficiency: Artificial intelligence is playing a pivotal role in optimizing data center operations. This includes using AI for predictive maintenance and security, helping to anticipate and mitigate potential issues before they occur. Such integration enhances operational resilience and reduces downtime.

- IoT and Smart Technology Integration: The Internet of Things is transforming data centers into smart facilities. Real-time monitoring through sensors and devices allows for the automatic adjustment of cooling, power, and other parameters, improving efficiency and reducing the need for manual intervention.

- Blockchain for Security: Blockchain technology is increasingly used in data centers to bolster security and provide transparent, decentralized data storage solutions. This helps mitigate risks associated with data tampering and cyber threats(Data Center International).

- 5G Deployment: The rollout of 5G technology is crucial as it supports faster data transfer speeds and enables real-time data processing, which is vital for edge computing and other immediate data needs.

- Energy Efficiency and Sustainability: Data centers are under increasing pressure to improve energy efficiency and integrate sustainable practices. This involves innovative cooling techniques and the strategic use of renewable energy sources to meet operational demands and environmental goals.

Top Use Cases

- Enhanced Cloud Services: With the increasing reliance on cloud computing, modern data centers are pivotal in providing the necessary infrastructure to support various cloud-based applications and services from web hosting to software-as-a-service (SaaS) solutions.

- Support for AI and Machine Learning Workloads: Data centers are being designed to handle the high power and cooling demands of AI and ML applications, which are significantly higher than traditional computing workloads.

- Edge Computing: As computing moves closer to data sources to reduce latency, data centers are adapting to support edge computing. This involves the deployment of smaller, localized data centers that process data near its source, beneficial for IoT and real-time applications.

Major Challenges

- Scalability and Flexibility Issues: As technology evolves, data centers must remain flexible and scalable to accommodate growing and changing demands. This includes physical space for expansion and the technological capability to support newer hardware and software configurations.

- Security Risks: With the increasing sophistication of cyber threats, data centers face significant challenges in ensuring robust security measures are in place to protect sensitive data and infrastructure.

- Energy and Cooling Requirements: The energy demand of modern data centers is enormous, driven by high-density racks that require advanced cooling solutions to prevent overheating and maintain system reliability.

- Regulatory and Compliance Pressures: Data centers must comply with a growing number of regulations concerning data protection, energy use, and building codes, which can complicate construction and operational practices.

- Resource Limitations: Manpower and raw material shortages can delay construction projects and increase costs, impacting the overall timeline and budget for new data center developments.

Top Opportunities

The data center construction market is poised for robust growth, presenting several key opportunities:

- Expansion of Hyperscale Data Centers: With the rising demand for cloud services and big data applications, there is a significant push towards the expansion of hyperscale data centers. These facilities are essential for supporting large-scale cloud environments, which require extensive data processing capabilities.

- Adoption of Sustainable and Energy-Efficient Technologies: As the focus on sustainability intensifies, there is a growing opportunity for incorporating green building practices and renewable energy sources in data center construction. This not only reduces the environmental impact but also helps in achieving energy efficiency and cost savings over time.

- Edge Computing Developments: The increasing deployment of IoT devices and the need for real-time computing power closer to the data source are driving the growth of edge data centers. These facilities help in reducing latency and improving the speed of data processing, offering considerable market opportunities.

- Technological Advancements in Construction Techniques: Innovative construction methods, such as modular and prefabricated data centers, are becoming more prevalent. These techniques allow for quicker deployment and can be particularly advantageous in regions with harsh climates or logistical challenges.

- Governmental Support for Digital Infrastructure: Many governments are recognizing the importance of robust digital infrastructure and are providing support in the form of regulations and financial incentives, which can facilitate more investments in data center construction.

Conclusion

In conclusion, the Data Center Construction Market is poised for continued growth as the global demand for data storage and cloud services escalates. With advancements in technology and a growing emphasis on energy efficiency and sustainability, the market will see increased investments and innovation. North America remains a key player due to its strong IT infrastructure and regulatory environment, but other regions are also emerging as important contributors. As data generation continues to surge, the construction of scalable, secure, and eco-friendly data centers will be crucial in supporting the digital economy of the future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)