Table of Contents

Introduction

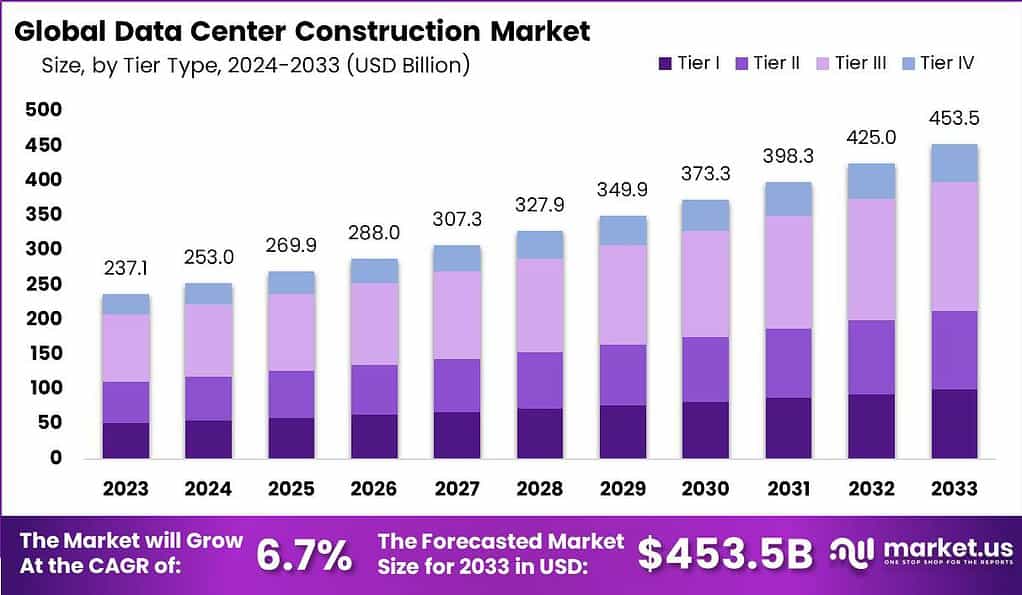

According to Market.us, The Global Data Center Construction Market size is expected to be worth around USD 453.5 Billion by 2033, growing from USD 237.1 Billion in 2023 at a CAGR of 6.7% during the forecast period from 2024 to 2033.

The Data Center Construction Market is experiencing substantial growth driven by the increasing demand for cloud services, big data analytics, and the proliferation of Internet of Things (IoT) devices. The surge in data generation has necessitated robust infrastructure to handle vast volumes of data securely and efficiently, thus propelling the expansion of data center construction. Companies are heavily investing in building state-of-the-art facilities that incorporate advanced energy-efficient technologies and adhere to strict regulatory standards regarding data security and environmental impact.

A significant growth factor for this market is the escalating need for data processing power in industries such as finance, healthcare, and e-commerce, which rely heavily on real-time data processing. The trend towards digital transformation, emphasizing cybersecurity, and sustainable practices is pushing businesses to invest in modernizing their data centers or constructing new ones that are better equipped to handle future technological advancements.

The opportunity in this sector lies in adopting green construction practices and energy-efficient technologies. As environmental concerns become more pressing, the industry is moving towards sustainable development. Innovations such as the use of renewable energy sources, advanced cooling mechanisms, and energy management systems are not only environmentally friendly but also cost-effective in the long run, presenting significant opportunities for market growth and differentiation.

Key Takeaways

- The Data Center Construction Market is poised for significant growth, anticipated to attain a market valuation of USD 453.5 Billion by 2033, up from USD 237.1 Billion in 2023. This escalation represents a Compound Annual Growth Rate (CAGR) of 6.7% from 2024 to 2033.

- In the segmentation analysis, Colocation Data Centers have taken a prominent position, securing over 46% of the total market share in 2023. The prominence of colocation facilities is attributed to their scalability, flexibility, and cost-efficiency, which are increasingly preferred by enterprises aiming for effective capital and operational expenditures.

- Furthermore, the Tier III category of data centers has demonstrated considerable market presence, capturing more than 41% of the market share. These facilities are particularly appealing for their balance between cost-efficiency and operational redundancy, offering concurrent maintainability which is critical for continuous operation without excessive capital investment.

- From an industry application perspective, the IT & Telecom sector dominates the end-user segment, accounting for more than 38% of the market demand. This sector’s substantial reliance on high-capacity data processing and robust data management solutions significantly drives this dominance.

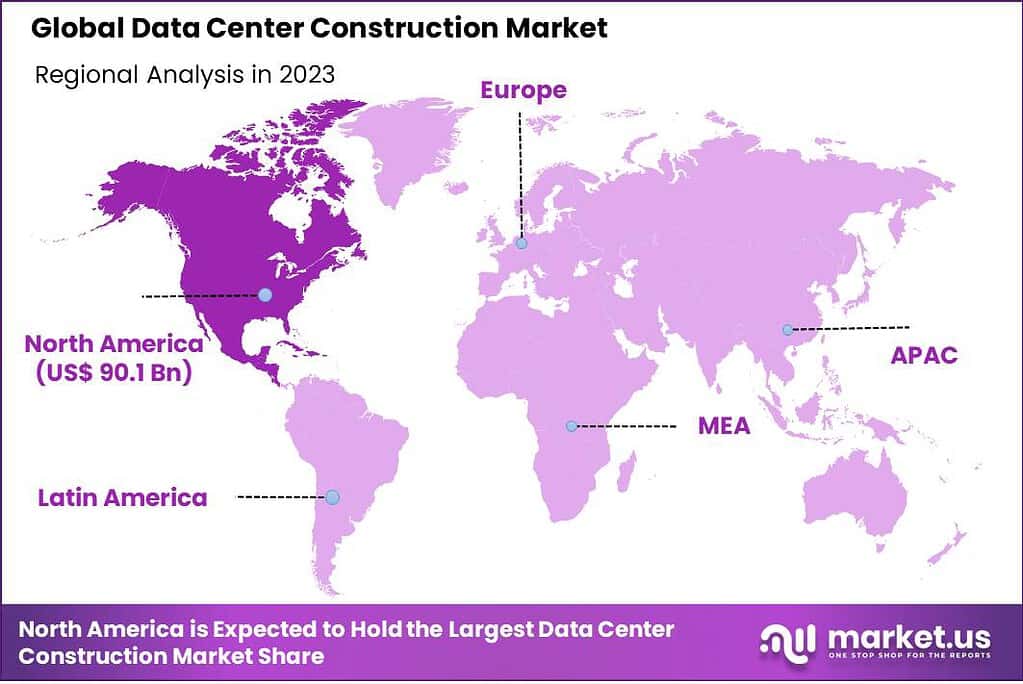

- Geographically, North America maintains a leading position in the global data center construction landscape, holding more than 38% of the market share in 2023. This leadership is propelled by the region’s advanced technological infrastructure and comprehensive data regulation policies, which encourage significant investments in the construction and expansion of data center facilities.

Data Center Construction Statistics

- Data Center Size Evolution: Data centers have drastically increased in size, moving from 100,000 square feet and 25 megawatts capacity to modern facilities that often exceed 250,000 square feet and support 80-100+ megawatts.

- Network Infrastructure Growth: This segment is the largest and fastest-growing, expected to generate $256.1 billion by 2028, reflecting nearly 30% growth from 2024.

- Server Market Expansion: Data center servers are projected to bring in $120 billion in revenue by 2028, marking a 24% increase over the four-year period.

- Storage Segment Development: Although trailing in revenue, data center storage will see significant growth, increasing by 22% to reach $62 billion in revenue by 2028.

- U.S. Market Dominance: The United States is poised to remain the largest single market, generating $100 billion in 2024 and expected to grow by 25% to over $125 billion by 2028.

- China’s Market Surge: The fastest growth is anticipated in China, where data center revenue is expected to increase by 33%, reaching $93 billion by 2028.

- GDP Growth Influence: In 2023, GDP growth contributed a 3.2% share to overall market growth.

- Rising Power Consumption: Data center power consumption in the U.S. is projected to increase from around 2% of national electricity usage today to 7.5% by 2030.

- Saudi Arabian Project: The GASTAT Data Center Project involved the construction of a 1 MW Tier II facility by Alfanar in Saudi Arabia.

- US Market Value: In 2023, the U.S. data center market is valued at approximately $99.97 billion.

- Global Power Consumption: Data centers are forecasted to consume 20% of the global power supply by 2025.

- Global Data Center Count: There are 8,000 data centers worldwide, with 33% located in the United States.

- Renewable Energy Adoption: Over 73% of survey respondents in the 2024 State of the Data Center Report plan to use renewable energy sources, with solar (59%) and wind (28%) being the preferred options.

- CBRE’s latest North American Data Center Trends Report reveals a significant surge in data center construction, with 2,287.6 megawatts (MW) of supply currently under construction in primary markets. This represents a new all-time high, with over 70% of this capacity already preleased, indicating strong demand and confidence in the future of data center infrastructure.

North America Data Center Construction Market Growth

In North America, the market remains robust, commanding a significant 38% market share. This dominance translates to revenues nearing USD 90.1 Billion. This region’s leadership in the market is primarily due to the high concentration of technology companies and a strong emphasis on data security and storage solutions, which fuel the demand for advanced and scalable data center infrastructures.

North America’s dominance in the Data Center Construction Market can be attributed to several key factors:

- Technological Leadership: The region is home to numerous global technology giants and startups, fostering a continual demand for data processing and storage capabilities. This high concentration of tech companies necessitates advanced data center infrastructures to handle large volumes of data with optimal efficiency.

- Robust IT Infrastructure: North America boasts a well-established IT infrastructure, which is critical for supporting sophisticated data center operations. The region’s advanced telecommunications and network systems facilitate seamless data center connectivity and operations.

- Regulatory Environment: The region benefits from a favorable regulatory environment that supports data center construction through incentives and streamlined approval processes. For example, tax incentives for building data centers can significantly reduce costs for operators, making the region more attractive for new constructions.

- High Demand for Cloud Services: There is a significant shift towards cloud-based solutions in North America, driven by both enterprises and government entities. This shift increases the need for data centers that can support cloud services efficiently, leading to more construction projects.

- Energy Availability and Sustainability Initiatives: North America has access to reliable and relatively inexpensive energy sources, which are crucial for data center operations given their high power demands. Additionally, there is a growing focus on building green data centers, which use renewable energy sources and innovative cooling technologies to reduce environmental impact.

Emerging Trends

- Sustainability and Renewable Energy Initiatives: Data center operators are increasingly focusing on sustainable building practices and the integration of renewable energy sources. This trend is driven by both environmental considerations and potential cost savings associated with energy efficiency.

- Edge Computing: The demand for edge computing is rising as data processing needs move closer to the source of data generation. This shift is aimed at reducing latency and increasing the efficiency of data-intensive applications like IoT and mobile computing.

- Hybrid and Multicloud Solutions: There is a growing trend towards hybrid cloud environments, which combine private and public cloud solutions to optimize performance and security. Multicloud strategies are also becoming more prevalent, allowing businesses to use services from multiple cloud providers simultaneously.

- AI and Machine Learning Integration: Artificial intelligence (AI) and machine learning (ML) are becoming integral to data center operations, enhancing everything from security to operational efficiency. AI is particularly influential in optimizing energy usage and improving the management of data center resources.

- Technological Innovations in Cooling Systems: Innovations in cooling technologies, especially liquid-based cooling systems, are critical as data centers handle higher densities and more power-hungry processors. These advancements help manage increased heat loads more efficiently and sustainably.

Top Use Cases

- Cloud Computing Platforms: Data centers provide the backbone for cloud computing services, hosting and managing the infrastructure that supports everything from enterprise applications to personal storage solutions.

- Disaster Recovery and Business Continuity: Modern data centers are designed to support disaster recovery (DR) and business continuity planning (BCP). They ensure data redundancy and high availability across multiple geographical locations to maintain service continuity in any event.

- Big Data Analytics and Processing: Data centers facilitate big data analytics by providing the necessary infrastructure to store, process, and analyze vast amounts of data. This capability is essential for businesses looking to gain insights and drive decision-making based on large datasets.

- Internet of Things (IoT) and Smart Devices: As IoT devices proliferate, data centers are crucial for processing and analyzing the data generated by these devices. This use case is increasingly important in smart city initiatives and industrial IoT applications.

- Artificial Intelligence and Machine Learning Workloads: Dedicated AI and ML workloads require significant computational power and data processing capabilities, which modern data centers are increasingly equipped to handle. This includes training complex models and deploying AI-driven applications.

Major Challenges

- Energy Constraints: Access to reliable and ample power sources is increasingly problematic, hampering growth in the data center construction sector. This challenge compels operators to explore alternative energy sources and locations outside primary markets.

- Supply Chain Delays: The global supply chain disruptions affect the timely delivery of critical construction materials, leading to project delays and increased costs.

- Workforce Shortages: There is a significant shortage of skilled labor necessary to meet the expanding needs of data center construction, which can slow down project timelines and increase labor costs.

- Environmental Concerns: The data center industry faces pressure to adopt sustainable practices. The environmental impact of large-scale construction and operation, including energy consumption and carbon footprint, is a significant concern.

- Technological Adaptation: Rapid technological advancements necessitate continuous updates in data center design and infrastructure to accommodate new computing technologies like AI, which can strain existing facilities and complicate new constructions.

Top Opportunities

- Expansion into Emerging Markets: As primary markets become saturated, there is a growing opportunity for data center operators to expand into secondary and tertiary markets, where power and land are more readily available and cheaper.

- Adoption of Green Technologies: Implementing sustainable technologies such as renewable energy sources and advanced cooling systems presents a significant opportunity for differentiation and compliance with global sustainability standards.

- Edge Computing: The rise of IoT and mobile applications drives the need for edge data centers, which are located closer to users to reduce latency and increase the speed of data processing.

- Government Incentives: Various government initiatives to boost digital infrastructure can provide financial and regulatory support for data center construction, particularly in regions aiming to enhance their technological capabilities.

- Modular Data Centers: These offer a flexible and scalable alternative to traditional data centers, allowing for rapid deployment and adaptation to varying demand, which is particularly useful in unpredictable markets.

Recent Developments

- Holder Construction Group: New Product Launch: In June 2023, Holder Construction launched an advanced prefabrication unit specifically designed to speed up the construction of large-scale data centers. This innovation has enhanced their ability to deliver high-quality, scalable data center projects more efficiently.

- DPR Construction:

- Acquisition: In April 2024, DPR Construction acquired a specialized data center design firm, bolstering its capabilities in the planning and construction of cutting-edge data centers. This acquisition allows DPR to offer more integrated services to its tech clients .

- New Product Launch: In February 2024, DPR introduced a new modular construction system for data centers, which significantly reduces on-site construction time and improves overall project sustainability.

- Skanska AB: Merger: In March 2024, Skanska AB merged with a leading European renewable energy firm to integrate sustainable energy solutions into their data center projects. This strategic move enhances Skanska’s ability to deliver data centers that are fully powered by renewable energy sources.

- Mortenson Construction: New Product Launch: In January 2024, Mortenson introduced a new construction management software tailored for data center projects. This software improves project tracking, resource allocation, and ensures that data centers meet the latest industry standards.

- AECOM: Acquisition: In May 2023, AECOM acquired a U.S.-based electrical infrastructure firm to strengthen its capabilities in delivering complex data center projects. This acquisition helps AECOM offer more comprehensive services, particularly in power distribution and management within data centers.

- Jacobs Engineering Group: Merger: In August 2023, Jacobs Engineering merged with a technology consulting firm to expand its data center construction capabilities. This merger enhances Jacobs’ expertise in integrating advanced IT systems and infrastructure into their data center projects.

- Hensel Phelps Construction Co.: New Product Launch: In November 2023, Hensel Phelps launched a new line of eco-friendly construction materials specifically for data centers. These materials are designed to reduce the environmental impact of large-scale data center projects.

Conclusion

The data center construction market is poised at a critical juncture where it faces significant challenges like power limitations and workforce shortages, which are intensified by the rapid pace of technological advancements. However, these challenges also open up substantial opportunities, such as the potential for expansion into new markets and the adoption of innovative, sustainable technologies. Companies that navigate these challenges effectively while capitalizing on emerging opportunities are likely to lead the market in resilience and growth. As the demand for data processing and storage continues to surge, the ability to adapt and innovate remains crucial.

You May Also Like To Read

- Edge AI Market Projections Point to USD 143.6 Bn Valuation by 2032

- Artificial Intelligence Market towards a USD 2,745 billion by 2032

- Semiconductor Market To Cross 1 Trillion By 2030

- Metaverse Market Surges Towards USD 2,346.2 billion by 2032

- EdTech Market Is Expected To Be Worth Around USD 549.6 Billion By 2033

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)