Table of Contents

Introduction

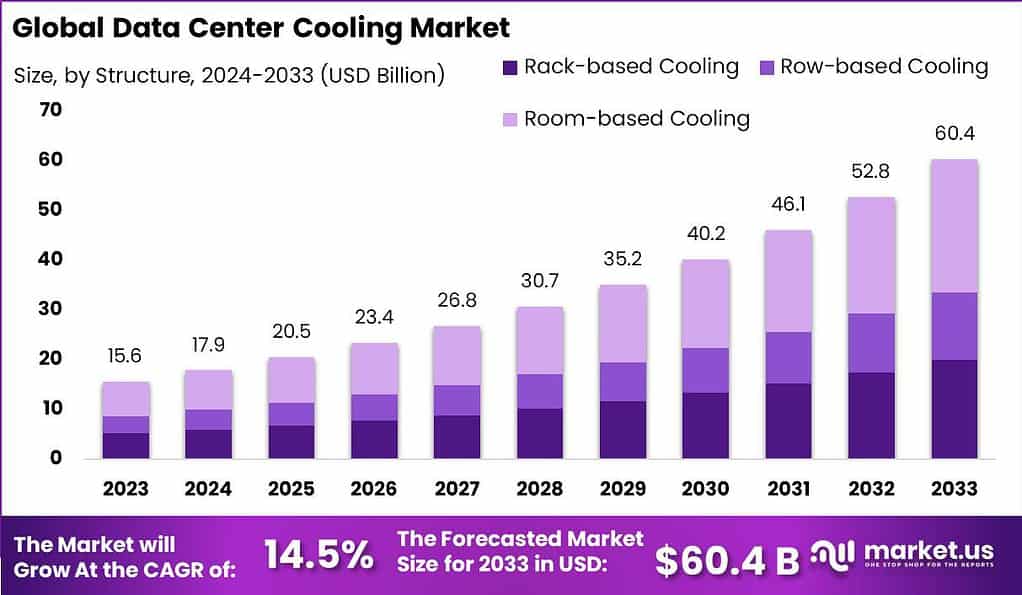

The Data Center Cooling Market is anticipated to reach USD 60.4 billion by 2033, growing at a robust CAGR of 14.5%. This growth is fueled by the escalating demand for cloud computing, big data analytics, and artificial intelligence, which necessitate efficient cooling solutions to manage the increasing heat generated by data centers.

The data center cooling market plays a crucial role in maintaining the optimum temperature and ensuring the efficient operation of data centers, which are vital for storing and processing vast amounts of digital information. With the rapid growth in data generation and the increasing demand for cloud-based services, the need for effective cooling solutions in data centers has become paramount. The market for data center cooling is experiencing significant growth, driven by various factors.

One of the primary growth factors for the data center cooling market is the escalating demand for energy-efficient solutions. Data centers consume substantial amounts of energy, and cooling represents a significant portion of their power usage. As energy costs rise and environmental concerns intensify, there is a growing emphasis on implementing energy-efficient cooling technologies. These solutions aim to reduce power consumption, lower carbon footprints, and optimize cooling efficiency without compromising the performance and reliability of data centers.

Additionally, the increasing density of IT equipment and the trend towards hyper-converged infrastructure have led to higher heat loads in data centers. Traditional cooling methods may no longer suffice, necessitating innovative and advanced cooling techniques. Liquid cooling, in particular, is gaining traction as it offers higher cooling capacity and improved energy efficiency compared to traditional air-based cooling systems. The adoption of liquid cooling solutions is expected to drive the growth of the data center cooling market.

To learn more about this report – request a sample report PDF

Furthermore, the demand for modular and scalable data center cooling solutions is on the rise. Organizations require flexible cooling systems that can adapt to changing needs and accommodate future expansion. Modular cooling solutions provide the flexibility to add or remove cooling capacity as required, enabling data center operators to scale their cooling infrastructure without disrupting operations.

In terms of opportunities for new entrants, the data center cooling market presents several avenues for innovation. With the increasing complexity of data center environments and the need for energy efficiency, there is a demand for specialized cooling solutions, intelligent cooling management systems, and predictive analytics for optimizing cooling operations. New entrants can focus on developing cutting-edge technologies, such as AI-driven cooling optimization, smart sensors, and advanced airflow management solutions, to address the evolving needs of data centers.

However, the data center cooling market also faces challenges. The design and implementation of efficient cooling systems require expertise and careful planning. Achieving the right balance between cooling capacity, energy efficiency, and cost-effectiveness can be complex. Moreover, retrofitting existing data centers with advanced cooling solutions can be challenging due to space constraints and the need for minimal disruption to ongoing operations.

Key Takeaways

- The Data Center Cooling Market is projected to expand significantly, reaching an estimated value of USD 60.4 billion by 2033. This growth represents a compound annual growth rate (CAGR) of 14.5% from a base of USD 15.6 billion in 2023.

- In terms of product types, Air Conditioners have led the market, holding a 32.5% share in 2023. This segment continues to be a crucial part of the industry’s infrastructure.

- Looking at the installation environment, the Non-Raised Floors style was most common, accounting for 53.4% of the market in 2023. This design has been preferred for its various benefits in managing airflow and cooling efficiency.

- Regarding the cooling setup, Room-based Cooling systems were the most adopted, with a 44.5% market share in 2023. These systems provide effective temperature and humidity control for larger areas within data centers.

- Focusing on specific sectors, the IT & Telecom industry has been the largest user of data center cooling solutions, with a 24.3% share of the application market in 2023.

- Geographically, North America has been a leader in this industry, with a market share of over 37.8%, translating to revenues of about USD 5.8 billion in 2023. This dominance is due to the high concentration of data centers and advanced technology infrastructure in the region.

Data Center Cooling Statistics

- Up to 50% of the power used in data centers is devoted to maintaining optimal temperatures within these facilities. This finding highlights the urgent need for changes in cooling methodologies or even their complete replacement.

- The Global e-Sustainability Initiative (GESI) has conducted comprehensive research, as outlined in their Smarter 2030 report. They reveal that our current digital world, consisting of a staggering 34 billion pieces of equipment and an impressive user base exceeding 4 billion individuals, contributes a substantial 2.3% to global greenhouse gas (GHG) emissions.

- Data centers alone are responsible for 1% of worldwide electricity consumption and 0.5% of CO2 emissions. It is widely recognized in scientific circles that reducing GHG emissions is an essential mandate to mitigate climate change’s adverse effects.

- Data centers are renowned as major energy consumers on a global scale. Estimates suggest that the data center industry currently accounts for 1-1.5% of worldwide electricity usage. This percentage is anticipated to rise significantly as cloud services, edge computing, IoT, artificial intelligence (AI), and other transformative technologies gain prominence.

- Forecasts indicate that by 2025, data centers will contribute a staggering 3.2% to the total global carbon emissions. This projection underscores the urgent need for the industry to address its environmental impact.

- Market reports reveal that room-based cooling methods are prevalent in more than 80% of data centers. Considering the energy-intensive nature of these cooling approaches, there is a pressing demand for alternative solutions that are more energy-efficient and environmentally sustainable.

- A critical finding from market research is that data center cooling is responsible for approximately 40% of the total energy consumption within these facilities. This statistic underscores the significance of optimizing cooling systems to minimize energy wastage and enhance overall operational efficiency.

Emerging Trends

- Liquid Cooling Adoption: Increasingly, data centers are turning to liquid cooling solutions to manage the high heat output from densely packed hardware, particularly in high-density scenarios. This method is recognized for its efficiency over traditional air cooling, especially where space and energy consumption are concerns.

- Sustainable Practices: There’s a strong push towards sustainability in data center operations, emphasizing renewable energy sources and energy-efficient technologies. Innovations in cooling technology are particularly focused on reducing water usage and optimizing energy use.

- AI and Automation: Artificial intelligence and automation are becoming integral in optimizing data center operations, including cooling systems. AI is employed for predictive maintenance and improving energy efficiency, which can substantially reduce cooling requirements and costs.

- Advanced Cooling Technologies: The market is seeing innovative cooling strategies, such as immersion cooling, where server components are submerged in a thermally conductive but electrically insulating liquid. This technology is gaining traction due to its ability to dramatically reduce cooling energy consumption.

- Edge Computing: With the rise of edge computing, there is a need for cooling solutions that can operate effectively in various environments, including remote and smaller-scale facilities. This drives demand for more versatile and robust cooling options.

Top 5 Use Cases

- High-Density Computing: As servers become more powerful and compact, they generate more heat. Advanced cooling solutions like liquid cooling are crucial for managing these high-density setups to ensure reliability and performance.

- Sustainable Data Centers: For data centers aiming to minimize their environmental impact, advanced cooling techniques are vital. They help reduce the overall energy consumption and carbon footprint of these facilities.

- AI-Driven Facilities: Data centers that use intensive AI and machine learning processes require advanced cooling due to the significant heat produced by AI hardware, such as GPUs. Efficient cooling is essential to maintain system stability and efficiency.

- Edge Locations: Cooling solutions in edge computing environments allow for the deployment of computing resources closer to data sources. This setup requires cooling systems that can adapt to smaller and possibly harsher environments compared to traditional data centers.

- Hybrid and Multi-Cloud Environments: As organizations use a mix of public and private clouds, the physical infrastructure, including cooling, must be highly reliable and flexible to manage the varying workloads and associated heat output effectively.

Major Challenges

- Cooling Requirements Assessment: There’s a common challenge of either underestimating or overestimating the cooling needs within data centers, which can lead to inefficiencies or inadequate cooling capacity.

- Specialized Infrastructure: The necessity for specialized cooling infrastructure, such as advanced liquid cooling systems and direct-to-chip technologies, adds complexity and cost to data center operations.

- Energy Efficiency and Environmental Impact: As data centers consume a significant amount of energy, finding efficient cooling solutions that minimize environmental impact remains a pressing challenge. This includes integrating sustainable practices and technologies to reduce the carbon footprint of data centers.

- High Operational Costs: Maintaining and operating cooling systems, especially advanced solutions like liquid and immersion cooling, often incurs high operational costs.

- Scalability and Flexibility: Adapting cooling systems to evolving technology and increasing data loads without significant disruptions or redesigns poses a challenge. This includes the ability to integrate new cooling technologies with existing infrastructure.

Market Opportunities

- High-Performance Computing (HPC) and AI Applications: The growing demand for HPC and AI applications is driving the need for advanced cooling solutions that can handle intense computational workloads, offering significant opportunities for market growth.

- Internet of Things (IoT) Integration: With IoT technologies becoming more prevalent, there’s an increased opportunity for smart cooling solutions that leverage IoT for better monitoring, management, and optimization of cooling processes.

- Hybrid Cooling Solutions: The trend towards hybrid cooling solutions, which combine traditional and innovative cooling methods, presents opportunities for companies to offer more cost-effective and energy-efficient options.

- Geographical Expansion: Regions like Asia-Pacific are experiencing rapid growth in data center demand, providing ample opportunities for cooling solution providers to expand their presence and capitalize on emerging markets.

- Sustainability Initiatives: As sustainability becomes a critical consideration for businesses, offering green cooling solutions that meet regulatory standards and reduce environmental impact can differentiate providers in the market.

Recent Developments

- Collaboration between Asetek and TEAMGROUP: In March 2023, Asetek announced a collaboration with TEAMGROUP, an original equipment manufacturer (OEM) partner. Together, they introduced the T-FORCE SIREN GA360 CPU Cooler, which utilizes Asetek’s advanced liquid cooling technology. This collaboration aims to enhance CPU performance for computer enthusiasts through overclocking, while ensuring stable and reliable operation for gamers seeking an immersive gaming experience.

- Investment by Schneider Electric in Sustainable Tropical Data Centre Testbed (STDCT): In October 2023, Schneider Electric revealed an investment of USD 1.2 million in a partnership with the Sustainable Tropical Data Centre Testbed (STDCT). Located at the National University of Singapore (NUS) and supported by the National Research Foundation of Singapore, this testbed involves collaboration among various business partners. The aim is to explore sustainable solutions for tropical data centers, addressing environmental concerns and advancing energy-efficient cooling technologies.

- Introduction of Liebert PKDX by Vertiv Group Corp.: In May 2023, Vertiv Group Corp. introduced the Liebert PKDX, a new thermal management unit specifically designed for data centers. This innovative cooling unit plays a critical role in ensuring the efficient operation of electronic equipment within data centers by preventing overheating. With its introduction, Vertiv aims to address the evolving cooling needs of modern data centers and enhance their operational reliability.

Conclusion

In conclusion, the data center cooling market is witnessing significant growth driven by factors such as the demand for energy-efficient solutions, increasing heat loads, and the need for modular scalability. New entrants have opportunities to innovate and provide specialized cooling technologies and management systems to optimize cooling efficiency and reduce energy consumption. However, addressing the challenges associated with designing and implementing efficient cooling solutions remains a key consideration. As the demand for data centers continues to grow, the data center cooling market is poised for further expansion and advancements in cooling technologies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)