Table of Contents

Data Center Robotic Market Size

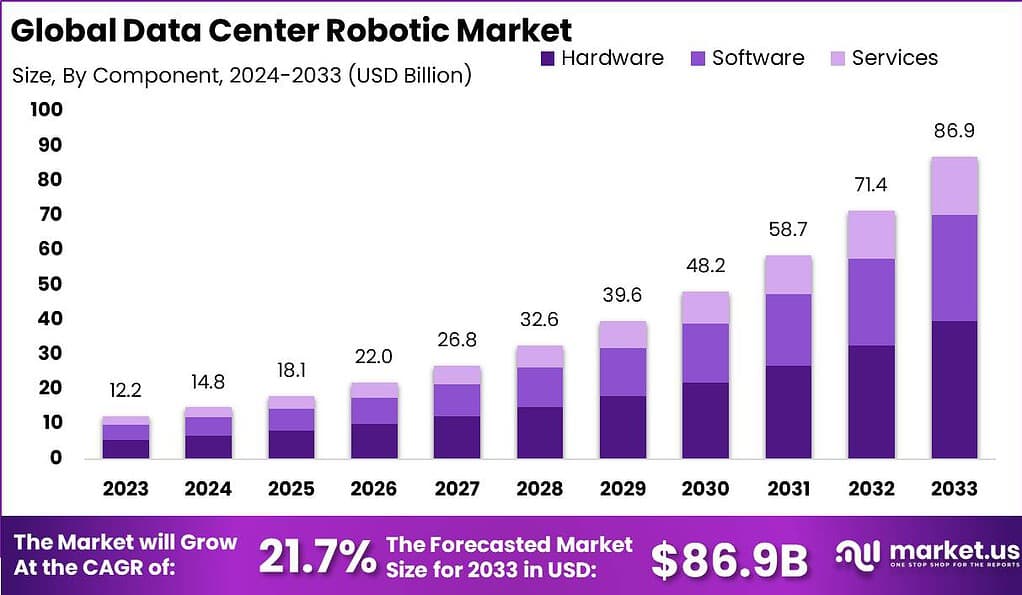

The Global Data Center Robotic Market is witnessing significant expansion, driven by the growing need for automation, scalability, and real-time operational efficiency across hyperscale and enterprise data centers. In 2023, the market was valued at USD 12.2 billion, with projections indicating it will reach approximately USD 86.9 billion by 2033, reflecting a strong CAGR of 21.7% over the forecast period. This growth is primarily fueled by the rising deployment of robotic solutions for server maintenance, physical security, hardware replacement, and autonomous monitoring.

Data center robotics refers to the integration of advanced robotic systems that automate physical and operational tasks across data centers. These robotics solutions handle activities like server maintenance, cable management, temperature monitoring, and security surveillance without human intervention. By utilizing technologies such as artificial intelligence, robotics, and the Internet of Things, data centers achieve high efficiency, enhanced safety, and more reliable operations.

The primary driver behind adopting data center robotics is the pressure to boost operational efficiency in an increasingly digitalized world. As data traffic grows rapidly with cloud computing and artificial intelligence workloads, traditional manual management is proving inadequate for today’s scale and complexity. Companies are motivated by the need to reduce operational downtime, lower costs, and ensure 24/7 reliability.

Demand for data center robotics is soaring as organizations strive to process and store vast amounts of digital information efficiently. The exponential increase in data generation, driven by trends like edge computing and IoT, puts immense strain on existing resources. Businesses across sectors are realizing that automation is essential for managing larger and more distributed data assets while maintaining high security and uptime requirements. The ability of robotics to handle repetitive, time-consuming, and even hazardous tasks effectively fuels their widespread adoption.

Investment opportunities in the field of data center robotics are robust and growing. Companies investing in the development and deployment of intelligent robotic technologies position themselves at the forefront of digital transformation. There is significant potential for return, especially in the area of automation platforms, predictive maintenance innovations, and energy-efficient solutions. Furthermore, as emerging markets expand their digital footprints, new opportunities arise for startups and established firms alike to supply robotics tailored to the specific needs of different regions or industry sectors.

Key Takeaways

- The global data center robotics market is witnessing rapid growth. In 2023, it was valued at USD 12.2 billion and is projected to reach USD 86.9 billion by 2033. This marks a strong CAGR of 21.7% between 2024 and 2033.

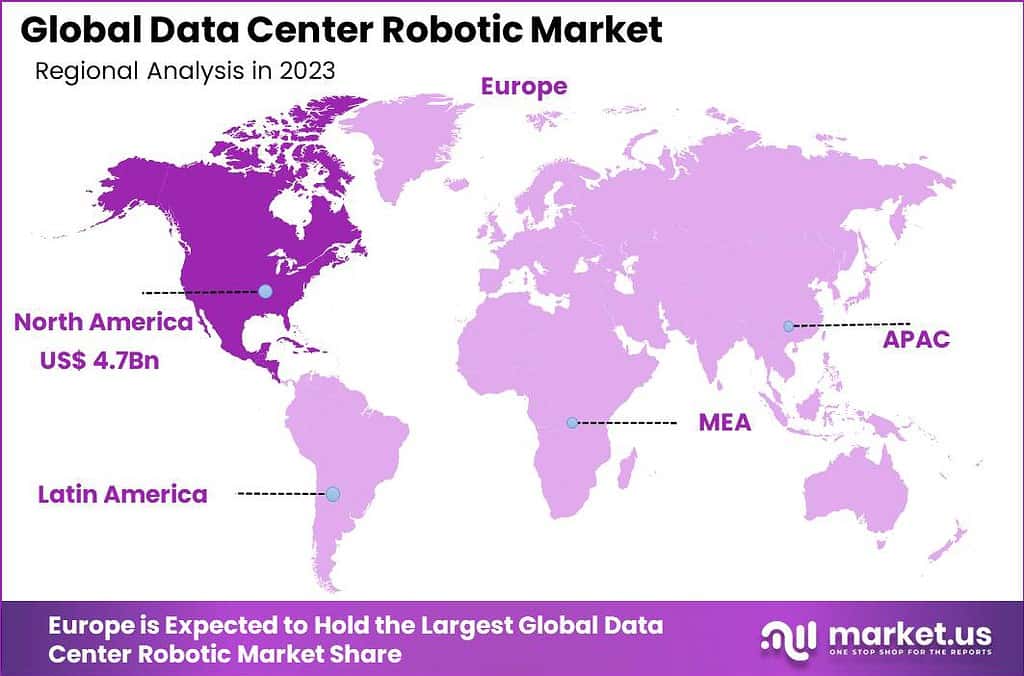

- North America led the market in 2023, capturing 38.6% of the global share. The region generated USD 4.7 billion in revenue, driven by early adoption and advanced digital infrastructure.

- The hardware segment was the largest contributor in 2023. It accounted for 45.7% of the market. This includes robotic arms, sensors, and automation tools used to handle physical data center tasks.

- Large enterprises dominated the user base in 2023. They contributed 64.2% of the total share. Their complex data needs and high investment levels drive large-scale robotic adoption.

- By type, industrial robots held the lead in 2023. These robots commanded 37.2% of the market. They automate repetitive processes and help reduce operational downtime.

- The IT and telecom sector emerged as a major application area. It accounted for over 21% of the market in 2023. Rising data loads in this sector are increasing the demand for robotic automation.

Recent Developments

- In February 2025, Tata Consultancy Services partnered with MassRobotics to drive innovation in robotics and connected devices. The collaboration focuses on engaging startups and researchers in sectors like retail, travel, and consumer goods. TCS will offer technical guidance and gain early access to trends in physical AI and specialized robotics applications.

- In May 2024, SoftBank invested in Indian data centers and industrial robotics companies to strengthen AI infrastructure. The move aims to improve automation in manufacturing and boost the efficiency of industrial processes using robotics.

- In June 2024, ABB introduced its OmniCore platform for data center robotics. This new system enhances speed, flexibility, and energy efficiency in tasks such as server handling and environmental monitoring, using advanced AI and motion control to reduce downtime and improve performance.

Regional Analysis

In 2023, North America held a dominant position in the global market, accounting for 38.6% of the share with USD 4.7 billion in revenue. This leadership is supported by early technology adoption, a dense concentration of cloud and colocation data centers, and increasing investments in AI-driven robotics by key operators. The demand for higher uptime, coupled with labor shortage concerns and the complexity of large-scale data environments, has accelerated the region’s focus on robotic automation to enhance operational reliability and reduce human intervention.

Emerging Trends Analysis

Smarter and More Autonomous Data Centers

One of the most noticeable trends in data center robotics is the rapid evolution towards smarter, greener, and more autonomous facilities. Robotics are now handling a growing range of daily tasks such as equipment monitoring, maintenance, and even optimizing cooling systems through advanced sensors and AI decision-making.

This trend reflects the sector’s shift to technologies that can adapt to changing conditions and reduce human error, paving the way for fully integrated automation across operations. Enhanced automation also supports sustainability goals, as data centers leverage robotics to minimize energy use and environmental impact by distributing resources only where needed.

Key Driver Analysis

Increasing Complexity and Scale of Data Centers

The primary push for robotic adoption in data centers comes from the escalating complexity and growth in digital infrastructure. As organizations handle more devices, networks, and data than ever before, managing these vast environments efficiently becomes a daunting challenge. Robotics offer a scalable solution to streamline manual workflows, ensure consistent uptime, and keep pace with expanding workloads.

By automating repetitive tasks and maintaining infrastructure around the clock, robots allow technical staff to focus on higher-level strategy, thereby supporting the continuous and secure operation of these digital nerve centers.

Restraint Analysis

Security and Privacy Concerns

Security and data privacy remain significant hurdles for the widespread use of robotics in data centers. Robotics platforms typically need remote connectivity and can access sensitive areas, increasing the risk of cyber threats or unauthorized access if not properly protected. With the growing integration of AI, IoT, and cloud-based systems into robotics, the potential for vulnerabilities expands. These risks are particularly concerning for highly regulated industries where strict compliance and data integrity are non-negotiable, often slowing the pace of robotic deployment in such settings.

Opportunity Analysis

Predictive Maintenance with AI-Driven Robotics

Integrating artificial intelligence with robotics opens a promising opportunity in predictive maintenance. By analyzing real-time sensor data and equipment performance, AI-powered robots can detect potential failures before they escalate, allowing for proactive repairs and fewer disruptions. This not only maintains uptime and reliability but also minimizes maintenance costs and extends the life of data center equipment. Predictive maintenance transforms operations from being reactive to proactive, creating new pathways for cost savings and improved operational continuity.

Challenge Analysis

Shortage of Skilled Professionals

One of the pressing challenges is the limited pool of talent skilled in robotics, automation, and related fields. Deploying, configuring, and maintaining robotic systems require a blend of mechanical, software, and IT expertise, which is currently in high demand across industries. Smaller or less-resourced data centers may struggle to attract or retain these professionals, slowing their ability to benefit fully from robotics. This skills gap also means existing staff often need substantial retraining, adding complexity and time to automation initiatives.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Robot Type

- Collaborative Robots

- Industrial Robots

- Service Robots

By Vertical

- BFSI

- Healthcare

- Education

- IT & Telecom

- Government

- Retail & E-commerce

- Others

Top Key Players in the Market

- Cisco Systems, Inc.

- Rockwell Automation Inc.

- ABB

- Hewlett Packard Enterprise Development LP

- Siemens AG

- Huawei Technologies Co., Ltd.

- ConnectWise, LLC

- BMC Software, Inc.

- Microsoft Corporation

- NTT Communications

- Amazon Web Services

Source – https://market.us/report/data-center-robotic-market/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 12.2 Bn |

| Forecast Revenue (2033) | USD 86.9 Bn |

| CAGR (2024-2033) | 21.7% |

| Largest Market | North America |

| Base Year for Estimation | 2023 |

| Historic Period | 2019-2022 |

| Forecast Period | 2024-2033 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)