Table of Contents

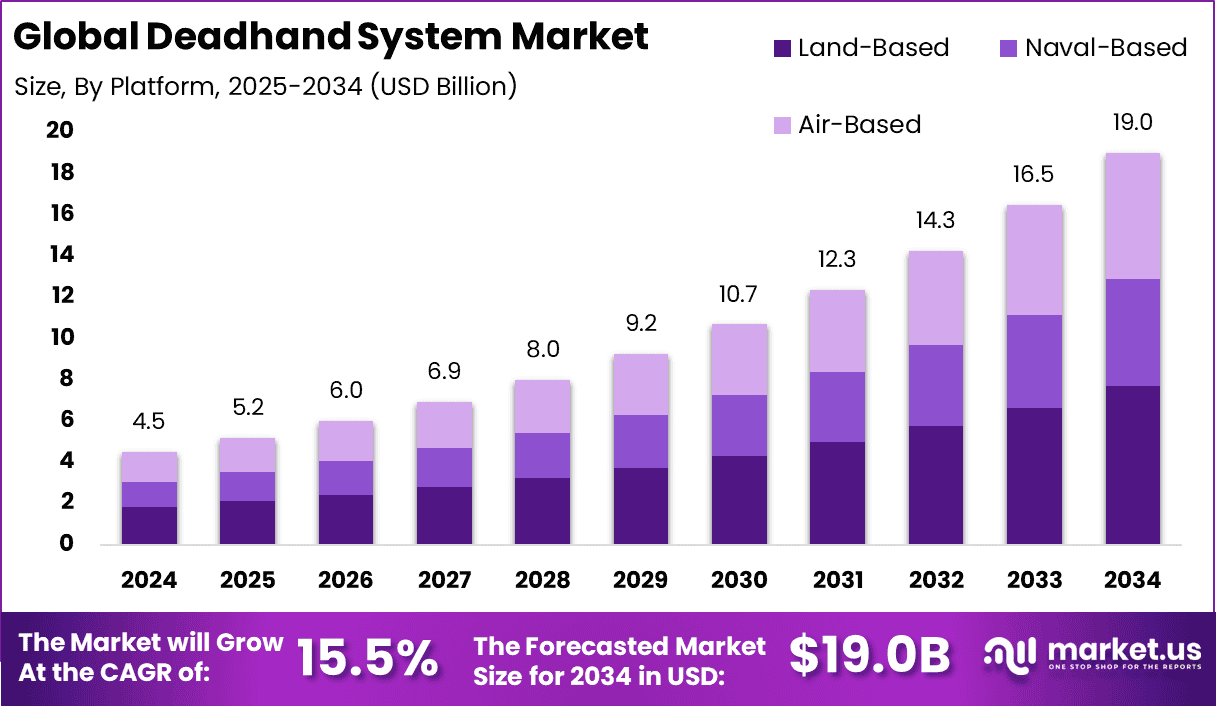

The Global Deadhand System Market is forecasted to grow from USD 4.5 billion in 2024 to USD 19.0 billion by 2034, reflecting a robust CAGR of 15.5% between 2025 and 2034. The market’s growth is driven by increasing investments in strategic defense technologies, the need for automated retaliatory systems, and geopolitical tensions fueling modernization of nuclear deterrent frameworks. In 2024, Europe held a leading market share of 28.5%, generating USD 1.2 billion in revenue, while Russia’s market valued at USD 0.55 billion is expected to grow at 12.8% CAGR during the forecast period.

How Tariffs Are Impacting the Economy

Tariffs imposed on critical defense components and electronic systems essential for Deadhand System manufacturing affect overall costs for defense contractors and governments. U.S. tariffs on imported precision electronics, communication devices, and computing hardware — often sourced from Asia and Europe — increase procurement costs and complicate supply chains.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/deadhand-system-market/free-sample/

(Use corporate mail ID for quicker response)

These tariffs may delay production timelines, increase project budgets, and limit access to cutting-edge technologies. Governments may face challenges in balancing cost control with the need to maintain operational readiness and system modernization. While tariffs aim to protect domestic industries, they can introduce inflationary pressures in defense spending, disrupt multinational supply networks, and slow down deployment of advanced strategic systems.

Impact on Global Businesses

Companies involved in Deadhand System components face rising costs and supply chain uncertainties due to tariffs. This impacts manufacturing schedules and contract negotiations. Defense sectors in Europe and Russia, heavily invested in such technologies, experience pressure to optimize costs without compromising system capabilities. Some businesses pivot to local sourcing and strategic partnerships to mitigate tariff risks. Sector-specific impacts include delayed R&D, longer lead times, and potential shifts toward more domestic production. These challenges necessitate agile supply chain management and innovation to sustain competitive advantage in a sensitive defense market.

Strategies for Businesses

Businesses are:

- Diversifying suppliers to reduce dependency on tariff-affected regions

- Increasing local manufacturing and assembly to mitigate import tariffs

- Investing in R&D to develop alternative technologies and components

- Enhancing supply chain transparency with digital tools

- Advocating with policymakers for tariff exemptions on defense-critical components

These strategies enable risk mitigation and continued growth amid trade restrictions.

Key Takeaways

- Deadhand System market growing at 15.5% CAGR through 2034

- Tariffs increase costs and disrupt complex supply chains

- Local sourcing and supplier diversification are essential

- R&D investment critical to overcoming tariff-related challenges

- Policy engagement aids in mitigating trade impact

➤ Get full access now @ https://market.us/purchase-report/?report_id=148599

Analyst Viewpoint

Despite tariff-related challenges, the strategic importance of Deadhand Systems drives sustained investment. Growth prospects remain strong as nations modernize nuclear deterrents. Businesses adapting through agile supply chains and technological innovation will outperform. Expected trade policy stabilization will ease supply disruptions. Overall, the outlook is positive with steady market expansion driven by defense modernization needs.

Regional Analysis

Europe dominates the Deadhand System market with 28.5% share due to advanced defense infrastructure and modernization programs. Russia holds a significant position, growing steadily with a 12.8% CAGR backed by state-funded defense projects. North America invests heavily in strategic defense technologies but is affected by tariff dynamics. Asia-Pacific shows emerging interest amid geopolitical developments. Latin America and Middle East represent smaller markets but with potential as defense modernization progresses.

➤ Discover More Trending Research

- E-Commerce Payment Market

- Food E-Commerce Market

- Post Production Market

- AI in Cellular Networks Market

Business Opportunities

Opportunities arise in developing advanced automation, secure communication, and resilient computing components for Deadhand Systems. Increasing government budgets for nuclear deterrent upgrades fuel demand. Collaborations between defense contractors and tech firms to innovate AI and cybersecurity solutions offer growth avenues. Emerging markets present potential for modernization programs. Furthermore, digitalization and simulation-based testing expand market scope by improving system reliability and cost efficiency.

Key Segmentation

Segments include:

By Component

- Command and Control Systems

- Communication Equipment

- Automation and Control Hardware

- Security and Cyber Defense Solutions

By End-User

- Military & Defense Agencies

- Government Strategic Units

By Region

- Europe

- Russia

- North America

- Asia-Pacific

- Others

Each segment experiences unique growth drivers tied to geopolitical priorities and technological advances.

Key Player Analysis

Market leaders emphasize innovation in automation, cybersecurity, and communication for reliable Deadhand Systems. Strong government contracts and partnerships with technology providers enhance market positioning. Investments focus on scalable, secure, and interoperable solutions complying with defense regulations. Competitive differentiation stems from advanced R&D, robust product portfolios, and strategic alliances, ensuring capability enhancement and sustained market leadership.

Recent Developments

In 2024, key defense contractors unveiled upgraded AI-driven command and control modules and strengthened alliances with cybersecurity firms to enhance system resilience.

Conclusion

The Global Deadhand System Market is set for strong growth driven by geopolitical tensions and defense modernization. Firms prioritizing supply chain agility, innovation, and policy engagement will capitalize on expanding opportunities despite tariff challenges.