Table of Contents

Introduction

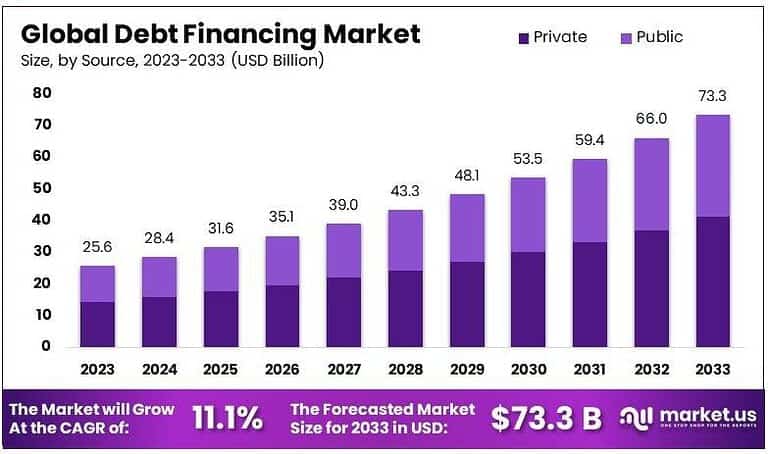

The global debt financing market is poised for substantial growth, projected to increase from USD 25.6 billion in 2023 to USD 73.3 billion by 2033. This growth represents a compound annual growth rate (CAGR) of 11.1% during the forecast period from 2024 to 2033.

Debt financing, which involves borrowing capital through loans, bonds, and other financial instruments, is becoming increasingly vital for businesses seeking capital for expansion, innovation, or restructuring. As organizations face rising capital demands, debt financing offers a flexible option to secure funds without diluting ownership.

How Growth is Impacting the Economy

The rapid expansion of the debt financing market is contributing positively to the global economy by facilitating access to capital for businesses, which in turn drives growth and innovation. The increased availability of debt capital enables companies to fund new projects, expand operations, and enhance productivity, directly impacting national and global GDP.

As businesses raise capital through bonds, loans, and other debt instruments, the demand for financial advisory services, legal expertise, and compliance systems has surged, creating additional economic activity. Furthermore, government policies promoting debt financing, such as favorable interest rates and regulatory frameworks, encourage investment in infrastructure, technology, and research & development.

However, with the rise in debt comes the risk of higher interest rates and growing levels of corporate debt, which could challenge businesses’ ability to maintain profitability. Nevertheless, the debt financing market’s growth is generally seen as a positive economic force, enabling businesses to scale operations and fostering job creation across various sectors.

➤ Uncover Business Opportunities Here @ https://market.us/report/debt-financing-market/free-sample/

Impact on Global Businesses

The increasing reliance on debt financing is having a mixed impact on global businesses. Rising interest rates and borrowing costs, influenced by central bank policies, could raise the overall cost of debt for businesses. This may impact companies’ profitability, especially those in capital-intensive sectors like manufacturing, real estate, and energy. The shifting landscape of global supply chains is also influencing the demand for debt financing, as businesses seek funds to restructure and adapt to new sourcing and distribution models.

The technology sector, for instance, is increasingly leveraging debt financing to fund innovation and scale operations, benefiting from lower initial costs. In the retail and consumer goods sectors, businesses are using debt to finance inventory expansion and optimize their supply chains, especially in response to demand fluctuations. Debt financing is also crucial for infrastructure projects and real estate development, where large capital investments are required upfront, making it an essential tool for businesses operating in these sectors.

Strategies for Businesses

- Diversify debt financing sources, exploring bonds, loans, and convertible securities to manage risk and costs effectively.

- Focus on reducing debt levels through efficient cash flow management and operational efficiency to maintain healthy financial leverage.

- Invest in technology and automation to improve operational performance and reduce dependency on external financing.

- Engage with financial advisors and legal teams to optimize debt structures and minimize risks.

- Monitor macroeconomic trends, especially interest rates, and adjust debt financing strategies to mitigate cost increases.

Key Takeaways

- The debt financing market is expected to grow at a CAGR of 11.1%, reaching USD 73.3 billion by 2033.

- Rising demand for capital is driving debt financing adoption across sectors like technology, real estate, and manufacturing.

- Businesses must navigate increasing borrowing costs and interest rate fluctuations.

- Debt financing provides businesses with the necessary capital but also exposes them to financial risk if not managed carefully.

- Strategic management of debt and diversified financing sources is essential for sustaining business growth.

➤ Get report at the best price @ https://market.us/purchase-report/?report_id=128858

Analyst Viewpoint

The debt financing market’s current growth trajectory is likely to continue, driven by increasing business capital requirements and a favorable economic environment in many regions. However, rising borrowing costs and inflationary pressures may pose challenges for businesses heavily reliant on debt. In the future, businesses that optimize debt structures and remain agile in responding to macroeconomic shifts will continue to thrive. The market will likely evolve to include more sustainable financing options, such as green bonds, offering new growth avenues for companies. Overall, the future of the debt financing market appears positive, especially for businesses that are financially prudent.

➤ Discover More Trending Research

- Blockchain Identity Management Market

- Swarm Robotics Market

- Ransomware Protection Market

- AI in Mass Communication Market

Regional Analysis

The debt financing market is expanding across various regions, with North America leading due to its robust financial infrastructure, including capital markets and low interest rates. Europe follows closely, where both government and corporate debt issuance are growing, particularly in countries with solid economic recovery post-pandemic. The Asia-Pacific region is witnessing the highest growth, driven by a surge in infrastructure projects and rising business investments, particularly in emerging economies like China and India. Latin America and the Middle East are also showing strong growth potential as both public and private sectors seek debt financing for development projects and business expansions.

Business Opportunities

The growth of the debt financing market presents numerous business opportunities. Companies that provide debt structuring and advisory services stand to benefit, as businesses increasingly seek specialized solutions to navigate the complexities of financing. Additionally, firms offering credit rating services, risk management tools, and debt management software will experience growing demand. As green finance and ESG-focused investments grow, there is an opportunity for businesses to introduce innovative debt products, such as green bonds, which cater to the increasing demand for sustainable finance. Furthermore, debt financing solutions targeting SMEs offer significant growth potential, as these businesses often face challenges accessing capital.

Key Segmentation

- By Debt Type: Corporate Bonds, Bank Loans, Convertible Debt, Other Debt Instruments

- By End-User: Small & Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector

- By Industry: Technology, Real Estate, Manufacturing, Healthcare, Energy

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Key Player Analysis

Leading players in the debt financing market are focusing on developing diversified financial products to cater to a broad range of business needs. These companies are leveraging data analytics and AI to assess credit risk more accurately and offer tailored financing solutions. Additionally, they are expanding their portfolios to include green and sustainable financing products, capitalizing on the growing demand for responsible investment options. Partnerships with fintech companies and the integration of digital platforms are enhancing the accessibility of debt financing for businesses of all sizes, enabling quicker and more efficient access to capital.

Recent Developments

- In February 2024, a major investment firm launched a new line of green bonds to support sustainable infrastructure projects.

- In March 2024, a global bank introduced an AI-driven debt financing solution to improve credit risk assessments and optimize lending decisions.

- In January 2024, a leading financial services provider partnered with a fintech startup to offer digital debt financing options for SMEs.

- In April 2024, a government-backed initiative in Europe was introduced to provide affordable debt financing for renewable energy projects.

- In May 2024, a financial institution expanded its debt restructuring services to assist businesses navigating the challenges of rising interest rates.

Conclusion

The debt financing market is set for significant growth, offering businesses new opportunities to raise capital while navigating challenges such as rising borrowing costs. By leveraging strategic debt management and diversifying financing sources, businesses can capitalize on market expansion and ensure long-term financial health.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)