Table of Contents

Introduction

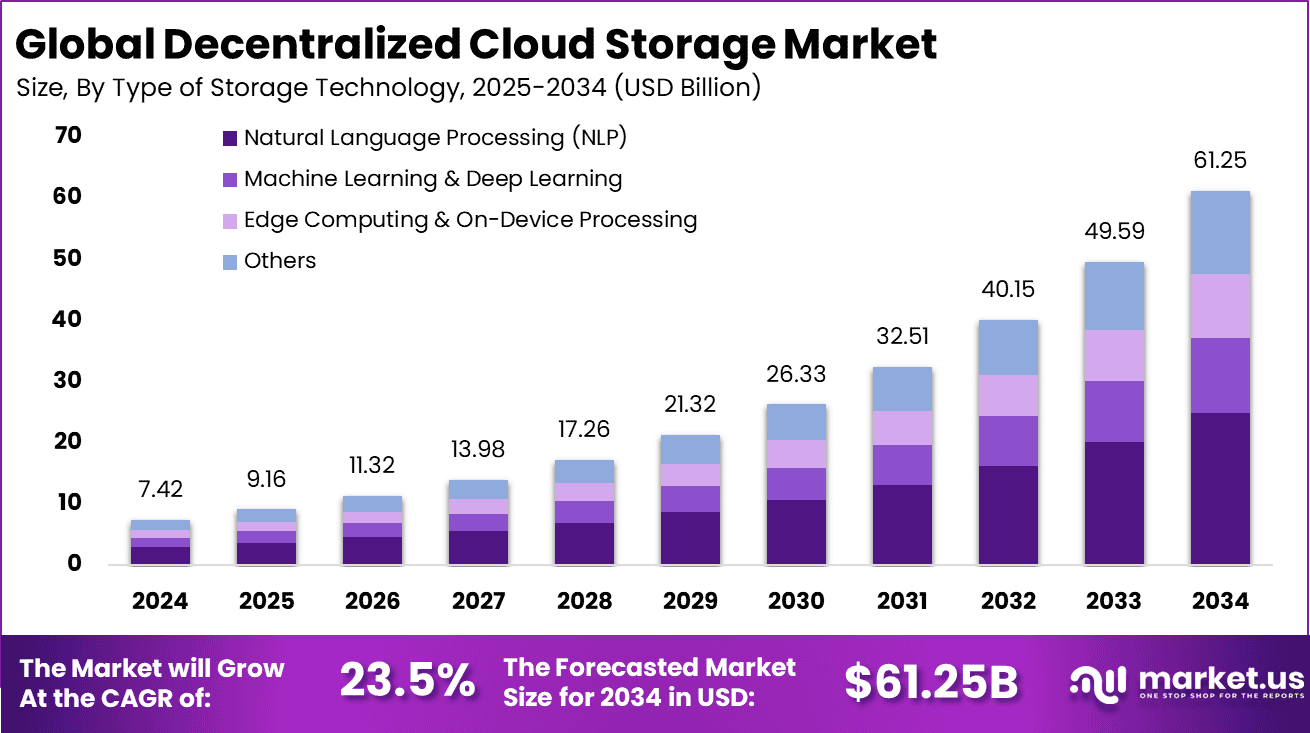

The Global Decentralized Cloud Storage Market was valued at USD 7.4 billion in 2024 and is forecast to grow from USD 9.1 billion in 2025 to approximately USD 61.2 billion by 2034, expanding at an impressive CAGR of 23.5% during the forecast period. North America led the global market in 2024 with a 35.2% share, generating USD 2.61 billion in revenue.

The growth is propelled by rising demand for secure, private, and cost-efficient cloud infrastructure, as well as the emergence of Web3 and blockchain-based storage protocols. The shift away from centralized hyperscaler models is reshaping global data ecosystems.

How Growth is Impacting the Economy

Decentralized cloud storage is positively impacting the global digital economy by enabling data sovereignty, reducing centralized control, and enhancing cross-border digital resilience. It empowers individuals and enterprises to own and monetize unused storage space, creating new micro-economies around data exchange. Decentralized networks reduce reliance on large data centers, driving down capital expenditure and environmental costs.

Countries promoting data localization and privacy compliance, such as those in the EU and Asia, are increasingly adopting these solutions. Additionally, decentralized storage supports digital infrastructure in underdeveloped regions by allowing peer-to-peer storage without heavy investments in physical servers. These economic impacts promote inclusivity and reduce monopolistic dependencies in the cloud services sector.

➤ Unlock growth! Get your sample now! – https://market.us/report/decentralized-cloud-storage-market/free-sample/

Impact on Global Businesses

For global businesses, decentralized cloud storage introduces a paradigm shift in data management. Rising costs in centralized cloud storage due to bandwidth fees, compliance overhead, and vendor lock-in are pushing firms toward decentralized alternatives. Supply chains are evolving as businesses integrate decentralized platforms with blockchain for secure data verification and timestamping.

Sector-specific impacts are evident in finance (DeFi data storage), healthcare (privacy-preserving medical records), and media (ownership of digital assets). However, businesses face interoperability and integration challenges with existing IT infrastructure, pushing them to adopt hybrid cloud models that blend centralized and decentralized systems.

Strategies for Businesses

To stay competitive, businesses are pursuing partnerships with blockchain-based storage networks to reduce storage costs and enhance data control. Many are piloting decentralized storage for non-critical data such as backups, archives, or static website content. Security-focused strategies include end-to-end encryption, distributed file sharding, and integration with decentralized identity solutions.

Forward-looking organizations are also investing in open-source storage protocols and collaborating with Web3 developers to future-proof infrastructure. Meanwhile, legal and compliance strategies revolve around understanding jurisdictional implications of globally distributed data and ensuring GDPR, HIPAA, or CCPA adherence through smart contracts and audit trails.

Key Takeaways

- Market projected to grow from USD 9.1B (2025) to USD 61.2B (2034)

- CAGR of 23.5% over forecast period

- North America led in 2024 with USD 2.61B, holding 35.2% market share

- Web3, blockchain, and privacy regulations driving adoption

- Hybrid models are bridging the gap between traditional and decentralized storage

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=160062

Analyst Viewpoint

The decentralized cloud storage market is at a transformative inflection point. In the present landscape, adoption is growing rapidly among blockchain-native enterprises and privacy-conscious sectors. With increasing distrust toward centralized data monopolies and stricter global data protection laws, decentralized architectures are gaining legitimacy.

Moving forward, we anticipate mass adoption among SMEs and public sector entities, especially as platforms evolve to support enterprise-grade performance, SLAs, and interoperability. The market’s future is strongly positive, particularly with rising demand for user-owned data, cross-border collaboration, and sustainable storage models.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Backup & Archive Storage | Cost-effective long-term storage, encryption, immutability |

| DeFi and Crypto Apps | Decentralized control, smart contract storage, zero downtime |

| Media & Content Storage | Ownership tracking, P2P file sharing, NFT hosting |

| Healthcare Data | Compliance with privacy laws, secure sharing of records |

| Academic & Research | Open data access, immutable results, tamper-proof collaboration |

Regional Analysis

North America accounted for 35.2% of the global market in 2024, driven by early blockchain adoption, strong startup ecosystems, and regulatory support for data innovation. The region generated USD 2.61 billion in revenue, led by the US, which remains a hub for Web3 infrastructure development. Europe follows, with decentralized storage being propelled by GDPR and a push for digital sovereignty.

Asia Pacific is witnessing significant traction due to rising investments in decentralized finance and enterprise blockchain. Countries like India, Singapore, and South Korea are supporting decentralized technologies as part of broader digital economy strategies. Latin America and Africa represent untapped opportunities, especially in cross-border financial services and community-based data ecosystems.

➤ Don’t Stop Here — Check Our Library

- Semiconductor Wafer Transfer Robots Market

- Social and Emotional Learning Market

- Home Automation Market

- Satellite Communication (SATCOM) Equipment Market

Business Opportunities

The market presents high-value opportunities for blockchain developers, edge computing providers, cybersecurity firms, and decentralized application (dApp) builders. Offering enterprise-ready APIs for decentralized storage integration is an emerging niche. Localized node hosting in data-restricted countries opens opportunities for compliance-driven deployment.

Token-based monetization models allow users to earn by leasing out unused storage, driving peer participation. For system integrators, offering hybrid storage orchestration services is a viable revenue model. Startups can innovate with user-friendly dashboards, developer SDKs, and energy-efficient validation protocols to expand adoption among SMEs and developers.

Key Segmentation

The market is segmented by deployment type, storage node type, enterprise size, application, and end-user industry. Deployment segments include public, private, and hybrid decentralized storage. Node types vary across consumer-grade, enterprise-grade, and edge storage nodes. Applications include backup & recovery, static web hosting, big data storage, and media streaming. End-user sectors include IT & telecom, healthcare, BFSI, government, media & entertainment, and education. As data sovereignty and user privacy become paramount, applications requiring zero-knowledge proofs and encryption-based storage are gaining prominence.

Key Player Analysis

Key companies are focused on improving storage availability, reducing retrieval latency, and ensuring multi-region data redundancy. Several firms are investing in satellite node connectivity and IPFS-based storage protocols to enhance decentralization. Emerging leaders are rolling out user incentive models, token rewards, and staking mechanisms to attract storage providers. Others are collaborating with enterprises to offer SLAs and on-chain audit tools for compliance. The landscape is competitive, with players differentiating based on encryption standards, node uptime guarantees, and UI/UX simplicity for developers and end-users alike.

- Agrosiaa Agri-commodities Online Services

- Storj

- MaidSafe

- Protocol Labs

- BitTorrent

- Ethereum

- Swarm

- Intext

- Arweave

- Siacoin

- Akash Network

- Qitchain

- Iagon

- Ocean Protocol

- MaidSafeCoin

- Opacity

- Others

Recent Developments

- In March 2025, a major decentralized storage provider announced integration with Layer-2 blockchain for faster file transactions

- In April 2025, a consortium of telecom operators began testing decentralized storage for 5G edge caching

- In January 2025, a platform introduced NFT-hosted metadata storage using decentralized cloud infrastructure

- In June 2025, a new smart contract auditing tool for decentralized file systems was released

- In February 2025, a Web3 cloud startup raised USD 42M to scale enterprise-ready decentralized storage solutions

Conclusion

Decentralized cloud storage is redefining how data is stored, accessed, and monetized across the globe. With rising concerns over privacy, vendor lock-in, and data localization, decentralized models offer a secure, efficient, and scalable alternative. As enterprise and developer adoption scales, the market is expected to experience sustained, long-term growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)