Table of Contents

- Introduction

- Editor’s Choice

- Device as a Service Market Overview

- The Most Important Network Infrastructure Providers Worldwide

- IoT Devices Offered as A Service Worldwide – By Region

- Types of Devices Incorporated in DaaS

- Penetration of Device as a Service Statistics

- Drivers for Device as a Service Implementation

- Software/Services and DaaS Contracts

- Device as a Service and Related Spending

- DaaS Purchases and Preferences

- Regulations for DaaS

Introduction

According to Device-as-a-Service Statistics, Device as a Service (DaaS) is a subscription-based model that offers businesses hardware devices like computers, smartphones, and tablets, along with services such as support, maintenance, and lifecycle management, for a fixed monthly fee.

With DaaS, organizations shift from purchasing devices outright to paying a recurring fee, which covers everything from device setup to disposal.

This comprehensive approach ensures businesses have access to up-to-date technology, reliable support, and scalable solutions while simplifying vendor management and enhancing security and compliance measures.

Overall, DaaS provides a cost-effective and hassle-free solution for businesses to acquire, manage, and maintain their hardware infrastructure.

Editor’s Choice

- The Global Device as a Service (DaaS) market revenue is projected to reach USD 2,204.7 billion in 2032.

- The Global Device as a Service (DaaS) market is predominantly driven by large enterprises, which hold a substantial 65.40% share of the market.

- In the Device as a Service (DaaS) market, Accenture holds the largest market share at 23%, demonstrating its significant influence and leadership in the industry.

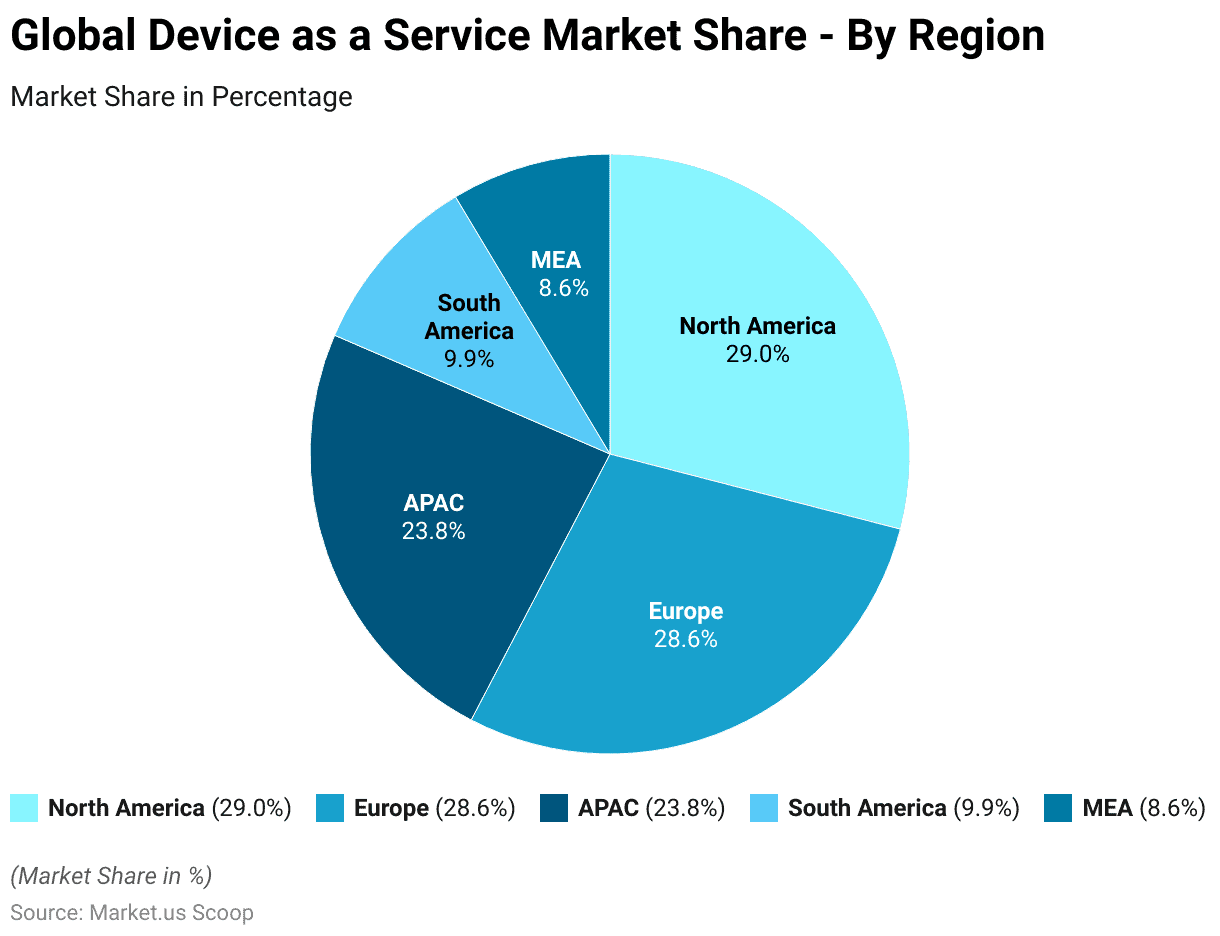

- The regional distribution of the Device as a Service (DaaS) market reveals North America as the leading region, commanding a 29.0% market share.

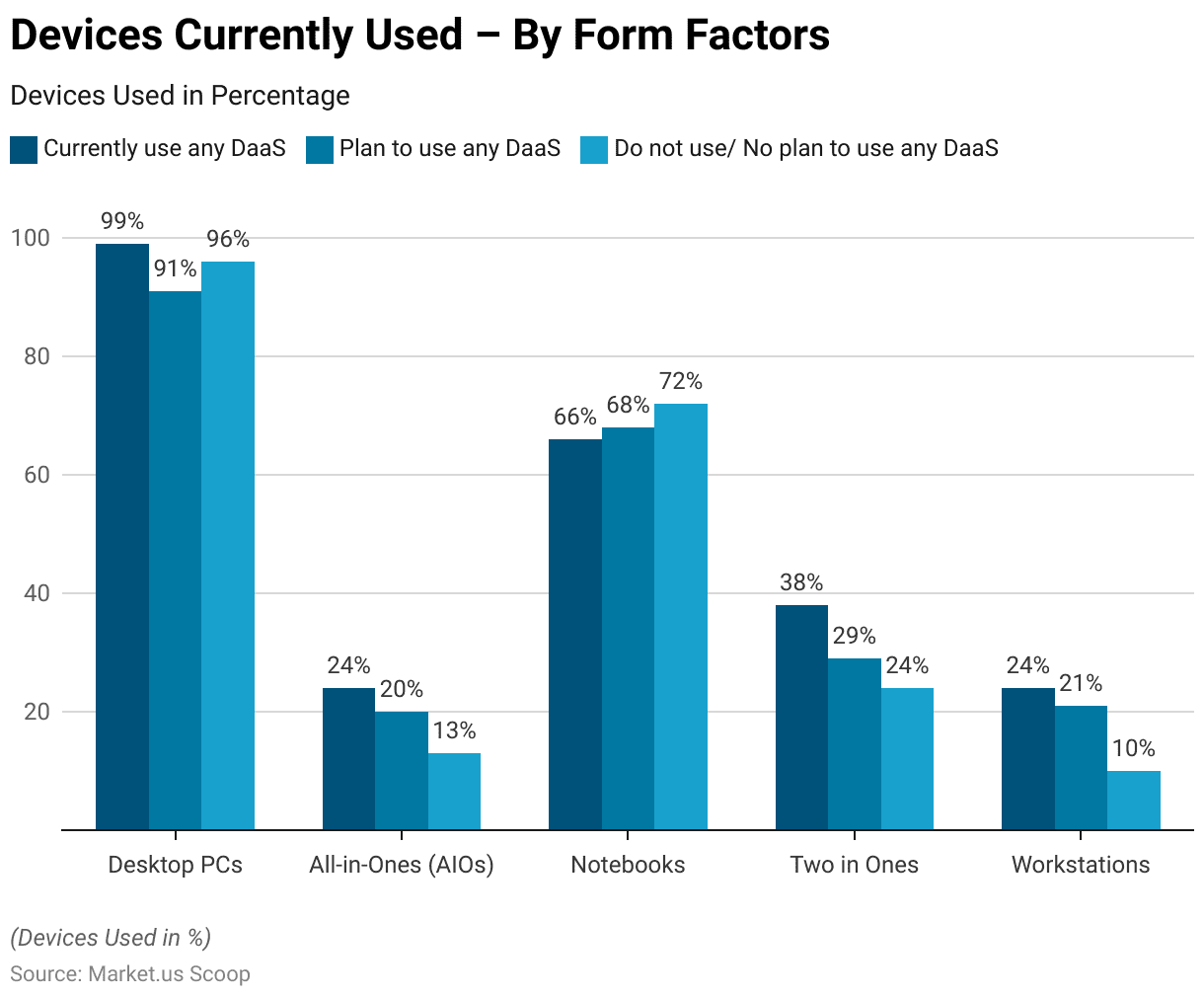

- The usage of Device as a Service (DaaS) varies across different device form factors among organizations. Desktop PCs are the most prevalent, with 99% of current DaaS users, 91% of planners, and 96% of those with no plans using them.

- Current users of Device as a Service (DaaS) are primarily driven by the budget and payment flexibility it offers, with 29% citing this as a key factor.

- Among current DaaS users, 51% include productivity suites, either hosted or on-premise, compared to 59% of DaaS planners who intend to bundle these suites.

Device as a Service Market Overview

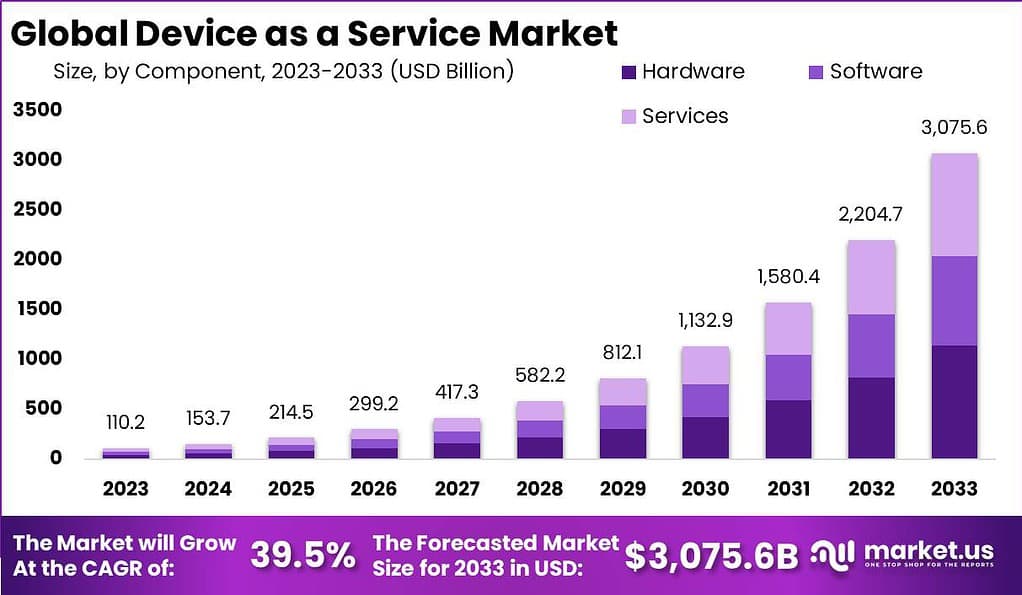

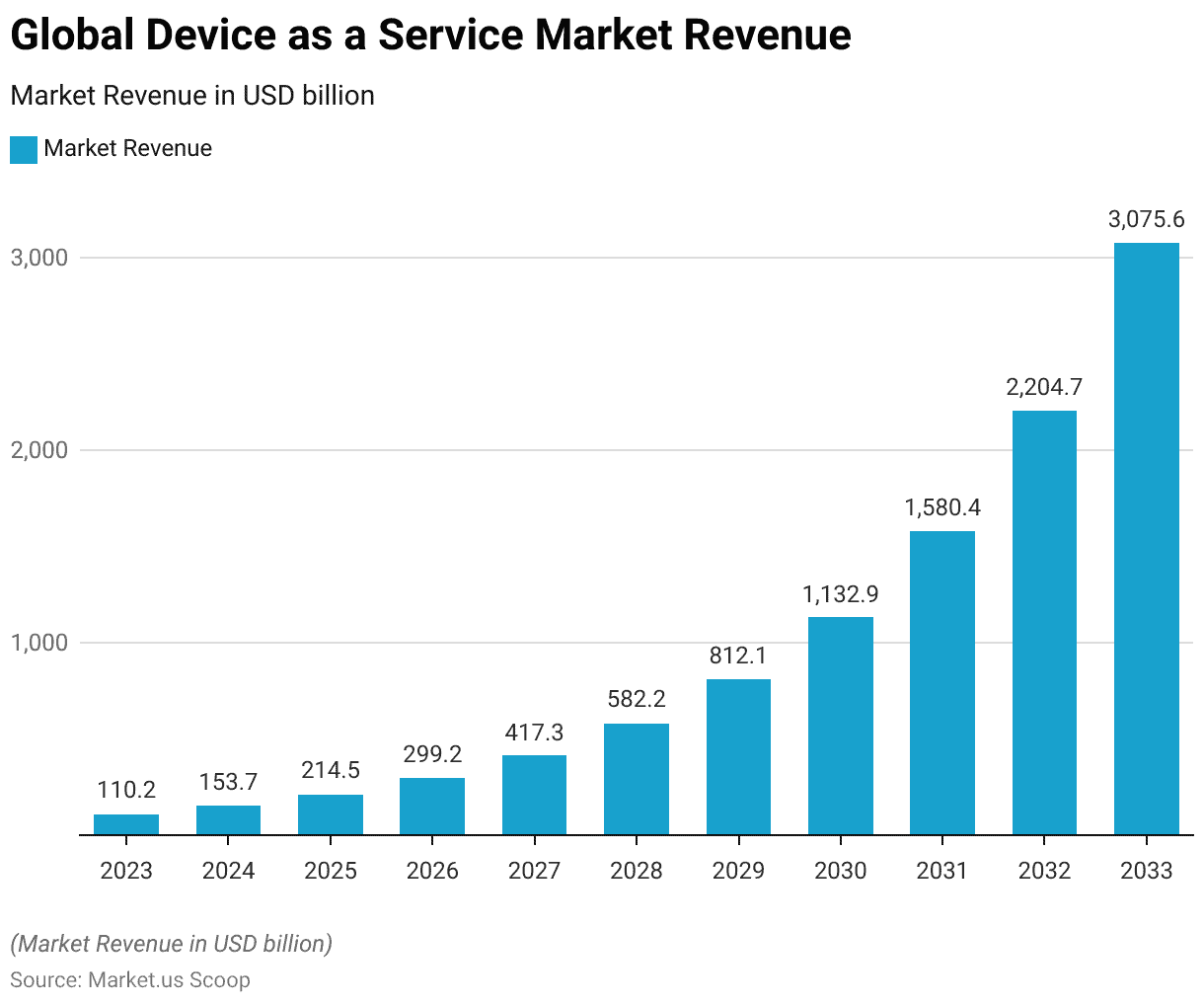

Global Device as a Service Market Size

- The Global Device as a Service (DaaS) market has experienced significant growth over the past decade at a CAGR of 39.5%, with revenue increasing from USD 110.2 billion in 2023 to a projected USD 3,075.6 billion by 2033.

- In 2024, the market is expected to reach USD 153.7 billion, continuing its upward trajectory to USD 214.5 billion in 2025.

- By 2033, the market is forecasted to achieve a remarkable revenue of USD 3,075.6 billion, reflecting the increasing adoption and reliance on Device-as-a-service solutions globally.

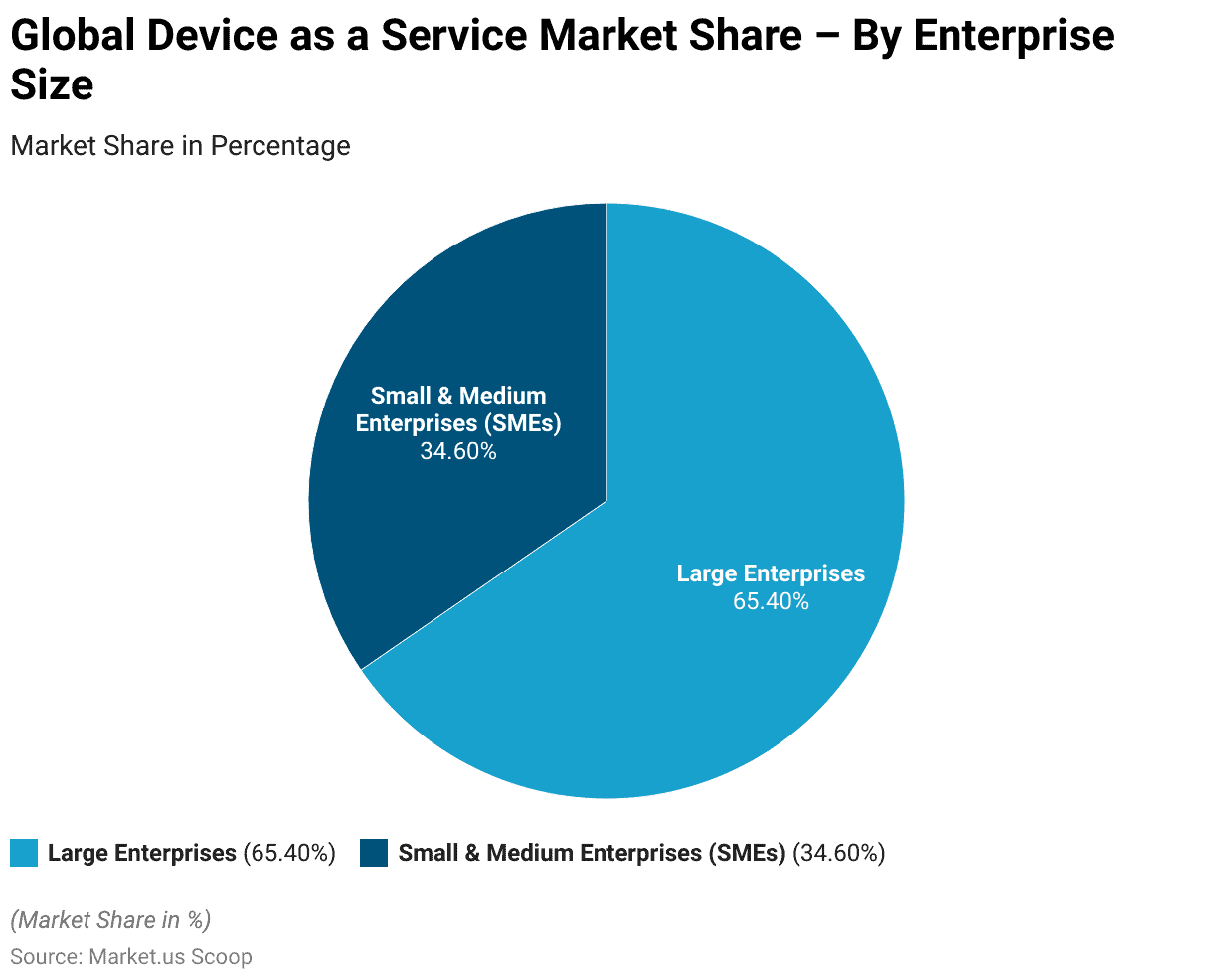

Global Device as a Service Market Share – By Enterprise Size

- The Global Device as a Service (DaaS) market is predominantly driven by large enterprises, which hold a substantial 65.40% share of the market.

- Small and medium enterprises (SMEs) contribute to the remaining 34.60% of the market, reflecting their growing adoption of DaaS solutions.

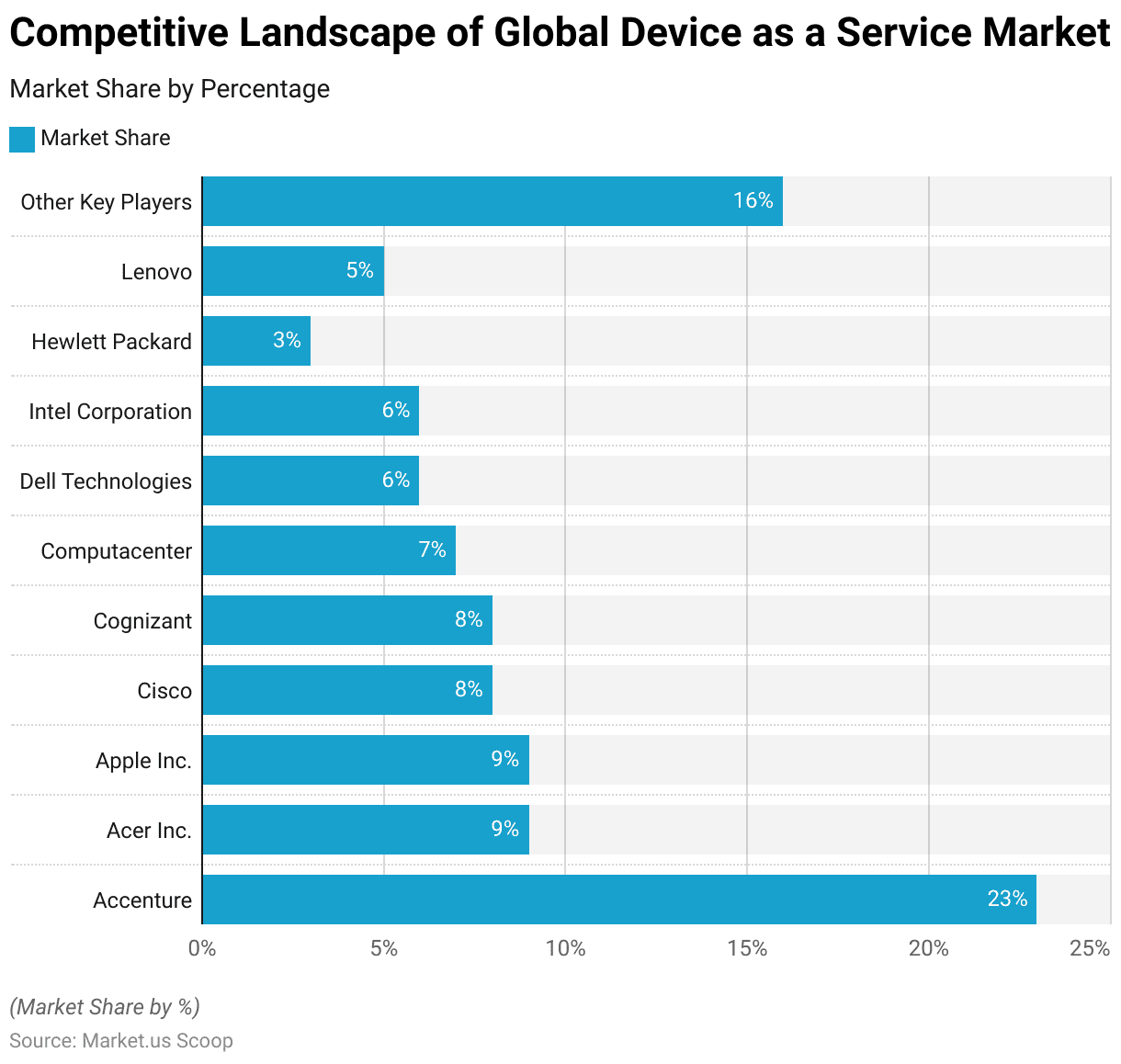

Competitive Landscape of Global Device as a Service Market

- In the Device as a Service (DaaS) market, Accenture holds the largest market share at 23%, demonstrating its significant influence and leadership in the industry.

- Acer Inc. and Apple Inc. each account for 9% of the market, while Cisco and Cognizant each contribute 8%.

- Computacenter holds a 7% share, followed closely by Dell Technologies and Intel Corporation, both with 6%.

- Lenovo commands a 5% share, and Hewlett-Packard holds 3%.

- The remaining 16% of the market is distributed among other key players, highlighting a diverse and competitive landscape within the DaaS industry.

Regional Analysis of the Global Device as a Service Market

- The regional distribution of the Device as a Service (DaaS) market reveals North America as the leading region, commanding a 29.0% market share.

- Europe follows closely with a 28.6% share, reflecting its significant role in the market.

- The Asia-Pacific (APAC) region holds a substantial 23.8% share, showcasing its growing influence.

- South America accounts for 9.9% of the market, while the Middle East and Africa (MEA) region represents 8.6%.

The Most Important Network Infrastructure Providers Worldwide

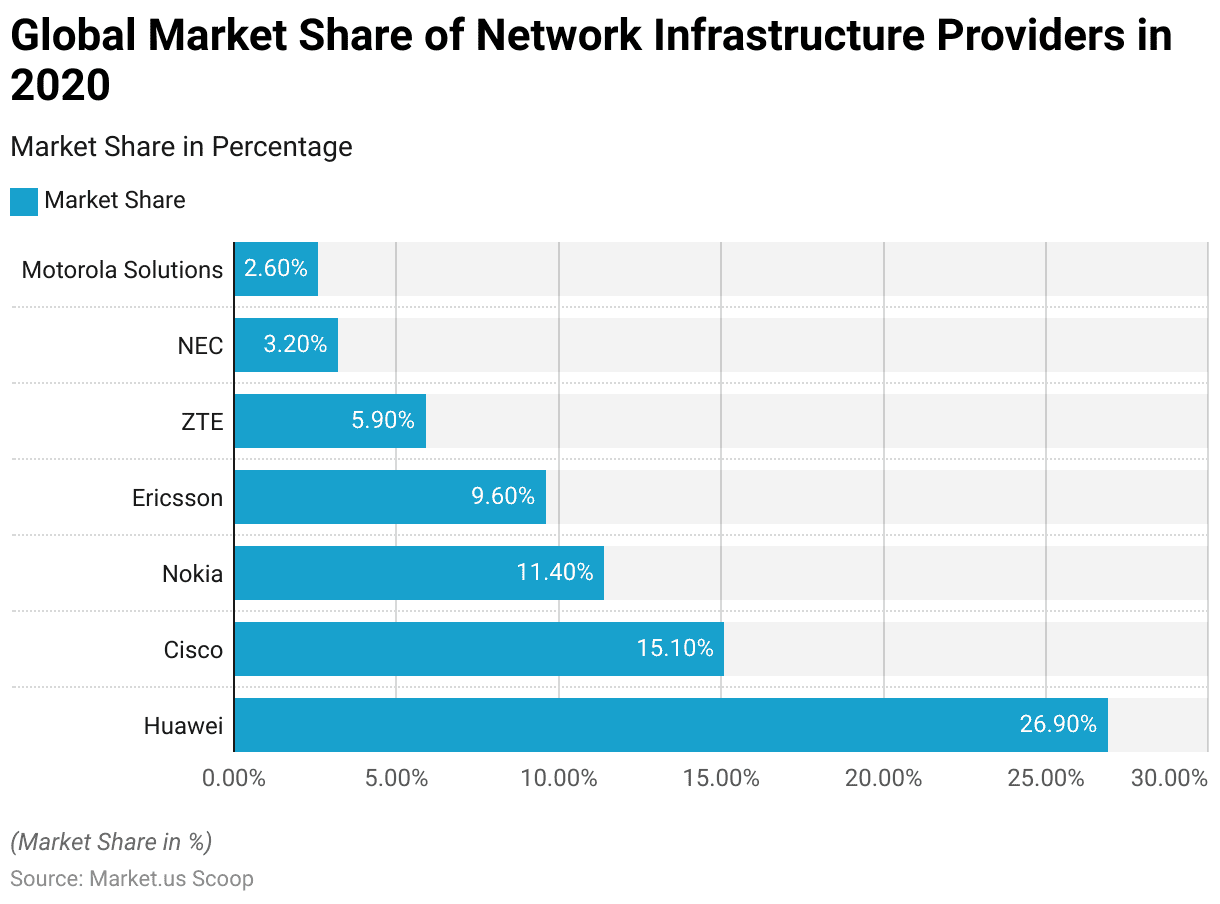

- In 2020, Huawei led the global market share of a network as a service infrastructure provider, which held a commanding 26.90% of the market share.

- Cisco followed with a 15.10% share, establishing itself as a significant player in the industry.

- Nokia accounted for 11.40% of the market, while Ericsson held a 9.60% share.

- ZTE contributed 5.90%, and NEC held a 3.20% share.

- Motorola Solutions rounded out the key players with a 2.60% share.

IoT Devices Offered as A Service Worldwide – By Region

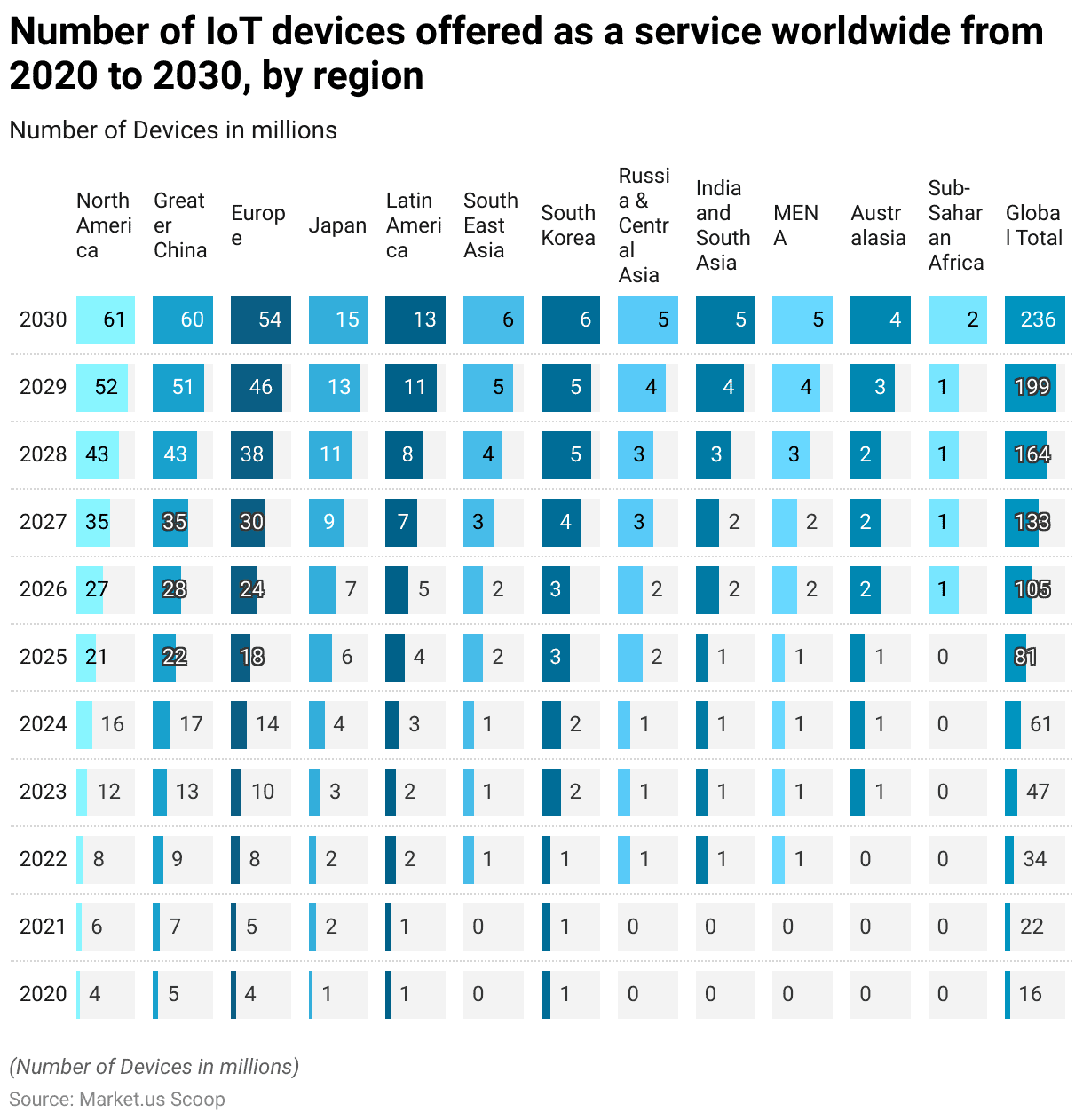

- In North America, the number of IoT devices surged from 4 million in 2020 to an anticipated 61 million by 2030.

- Similarly, Greater China saw an increase from 5 million to 60 million during the same period.

- Europe also experienced significant growth, rising from 4 million devices in 2020 to 54 million by 2030.

- Japan’s IoT devices increased from 1 million in 2020 to 15 million in 2030, while Latin America grew from 1 million to 13 million.

- South East Asia’s numbers expanded from no significant count in 2020 to 6 million by 2030.

- Overall, the global total of IoT devices offered as a service is expected to grow from 16 million in 2020 to an impressive 236 million by 2030, demonstrating the expansive adoption and integration of IoT solutions worldwide.

Types of Devices Incorporated in DaaS

Devices Currently Used – By Form Factors

- The usage of Device as a Service (DaaS) varies across different device form factors among organizations.

- Desktop PCs are the most prevalent, with 99% of current DaaS users, 91% of planners, and 96% of those with no plans using them.

- Notebooks are also widely utilized, with 66% of current users, 68% of planners, and 72% of non-users.

- All-in-Ones (AIOs) are used by 24% of current users, 20% of planners, and 13% of non-users.

- Two-in-One devices have a notable presence, with 38% of current users, 29% of planners, and 24% of non-users employing them.

- Workstations are used by 24% of current users, 21% of planners, and 10% of non-users.

Penetration of Device as a Service Statistics

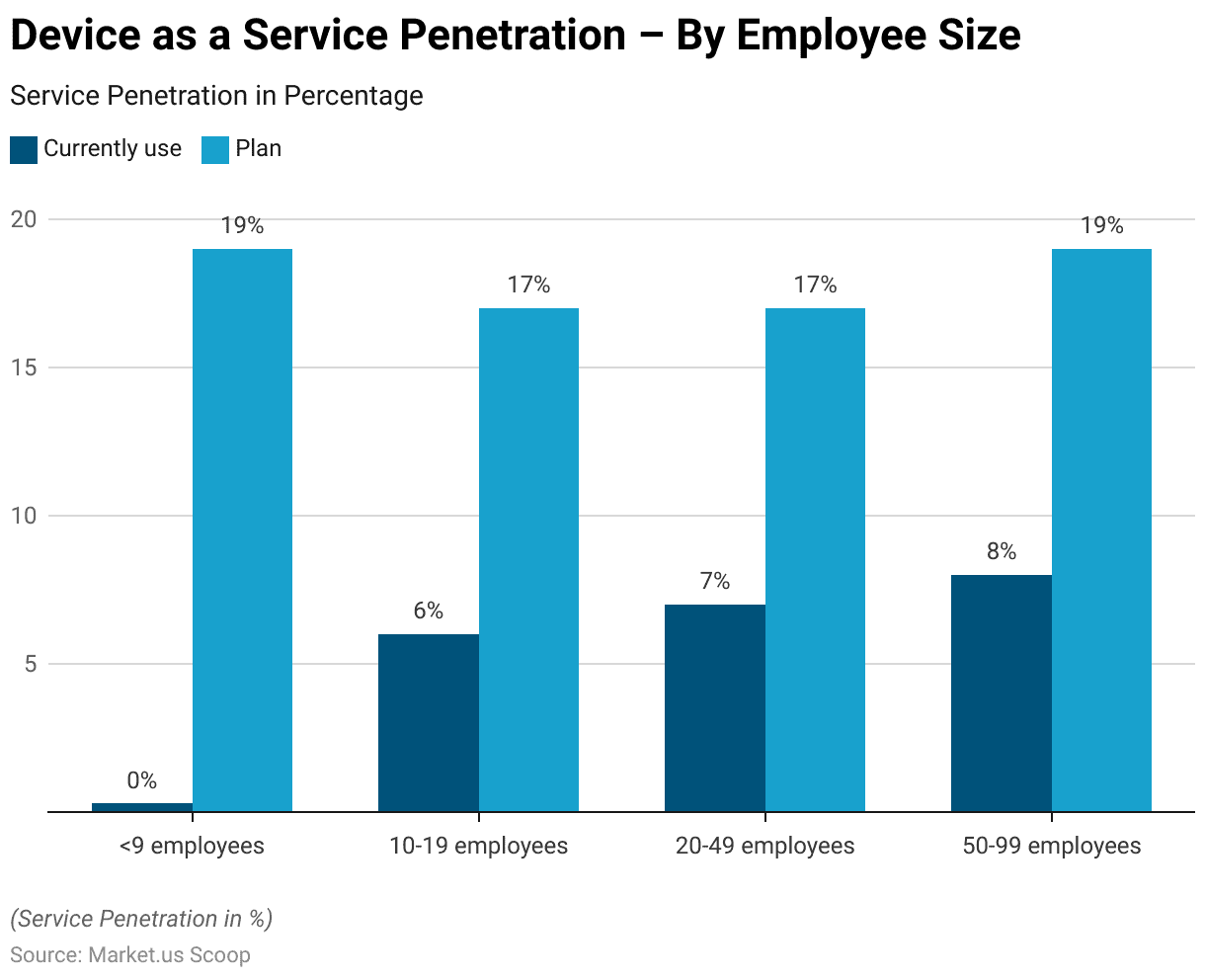

Device as a Service Penetration – By Employee Size

- The penetration of Device as a Service (DaaS) varies significantly by employee size.

- Currently, only 0.30% of businesses with fewer than nine employees utilize DaaS, though 19% plan to adopt it.

- Among businesses with 10-19 employees, 6% currently use DaaS, and 17% are planning to implement it.

- For companies with 20-49 employees, 7% are already utilizing DaaS, and an additional 17% intend to do so.

- In larger organizations with 50-99 employees, 8% currently use DaaS, while 19% have plans for future adoption.

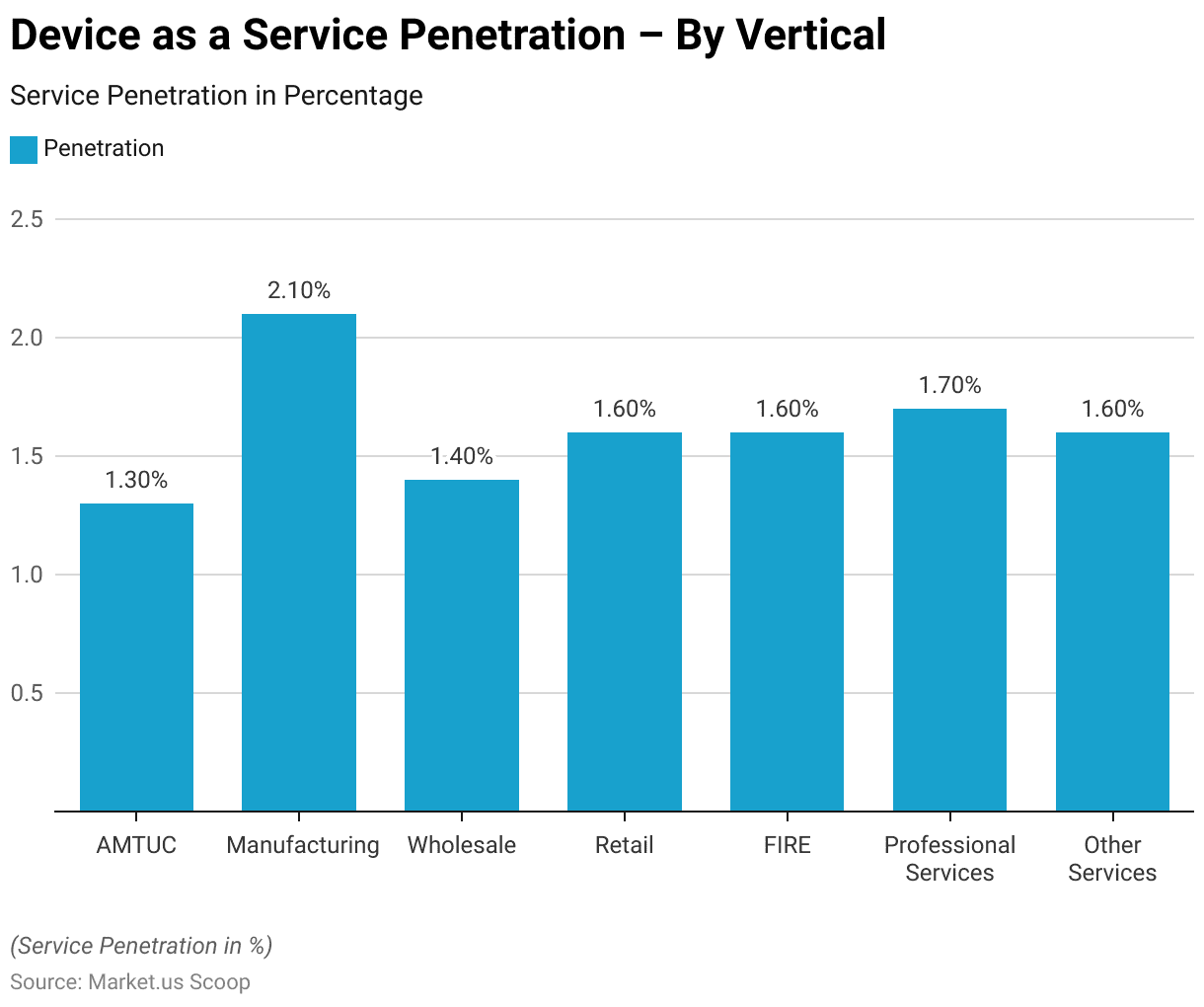

Device as a Service Penetration – By Vertical

- The penetration of Device as a Service (DaaS) varies across different industry verticals.

- The AMTUC sector (Agriculture, Mining, Transportation, Utilities, and Construction) has a penetration rate of 1.30%.

- In manufacturing, the penetration is slightly higher at 2.10%.

- The wholesale industry sees a penetration of 1.40%, while retail stands at 1.60%.

- The FIRE sector (Finance, Insurance, and Real Estate) also has a penetration rate of 1.60%, matching that of other service industries.

- Professional services exhibit a slightly higher penetration at 1.70%.

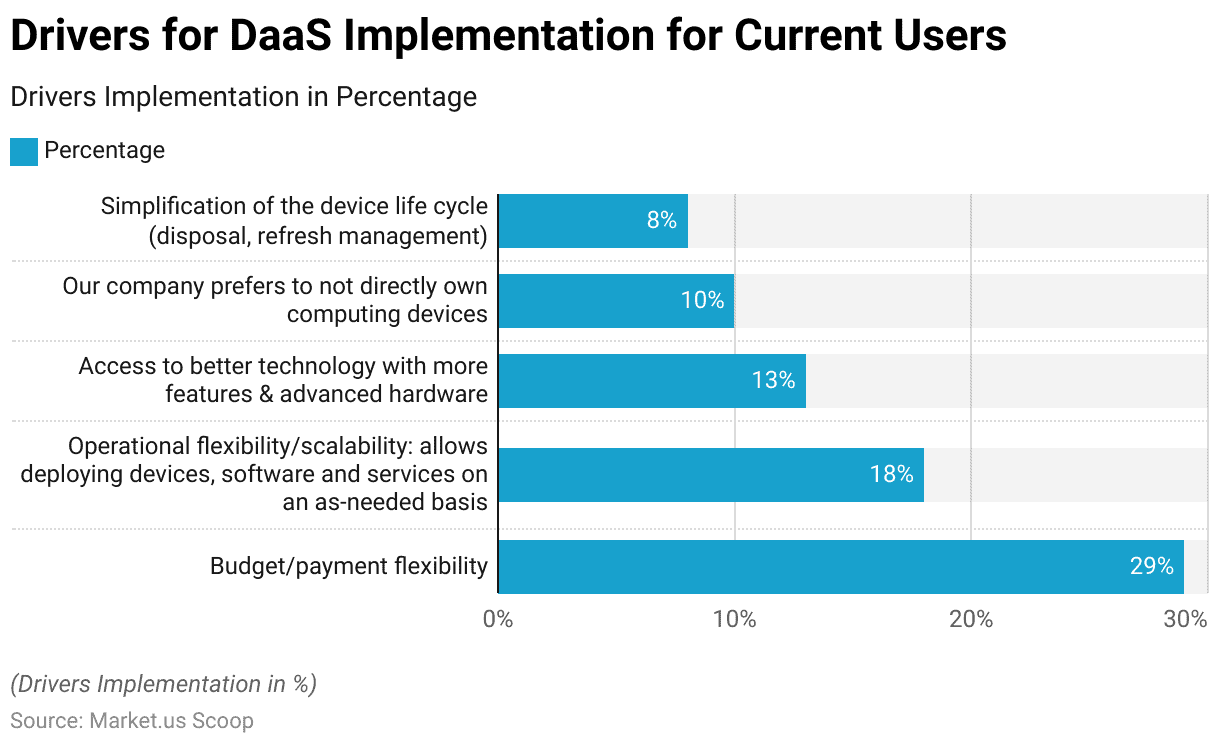

Drivers for Device as a Service Implementation

- Current users of Device as a Service (DaaS) are primarily driven by the budget and payment flexibility it offers, with 29% citing this as a key factor.

- Additionally, 18% of users appreciate the operational flexibility and scalability, enabling the deployment of devices, software, and services on an as-needed basis.

- Access to better technology with more features and advanced hardware is a significant driver for 13% of users.

- A preference for not directly owning computing devices motivates 10% of companies to adopt DaaS.

- Simplification of the device life cycle, including disposal and refresh management, is another driver, influencing 8% of current users.

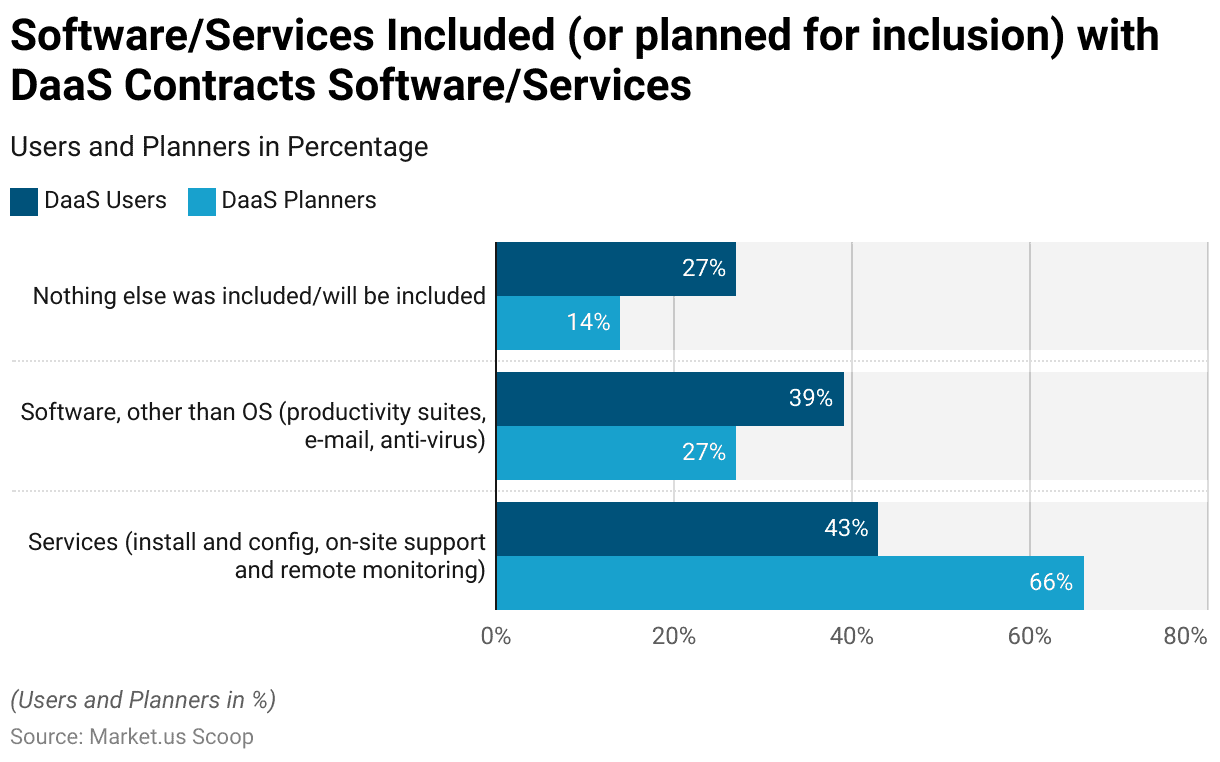

Software/Services and DaaS Contracts

Software/Services Included (or planned for inclusion) with DaaS Contracts Software/Services.

- In Device as a Service (DaaS) contracts, both current users and planners include various software and services to enhance their device management solutions.

- Among current DaaS users, 43% incorporate services such as installation, configuration, on-site support, and remote monitoring.

- In comparison, 66% of DaaS planners intend to include these services in their contracts, indicating a strong future focus on comprehensive service integration.

- Software other than operating systems, including productivity suites, email, and antivirus programs, are included by 39% of current users, while 27% of planners plan to incorporate these.

- Additionally, 27% of current users and 14% of planners do not include or plan to include any additional software or services in their DaaS contracts.

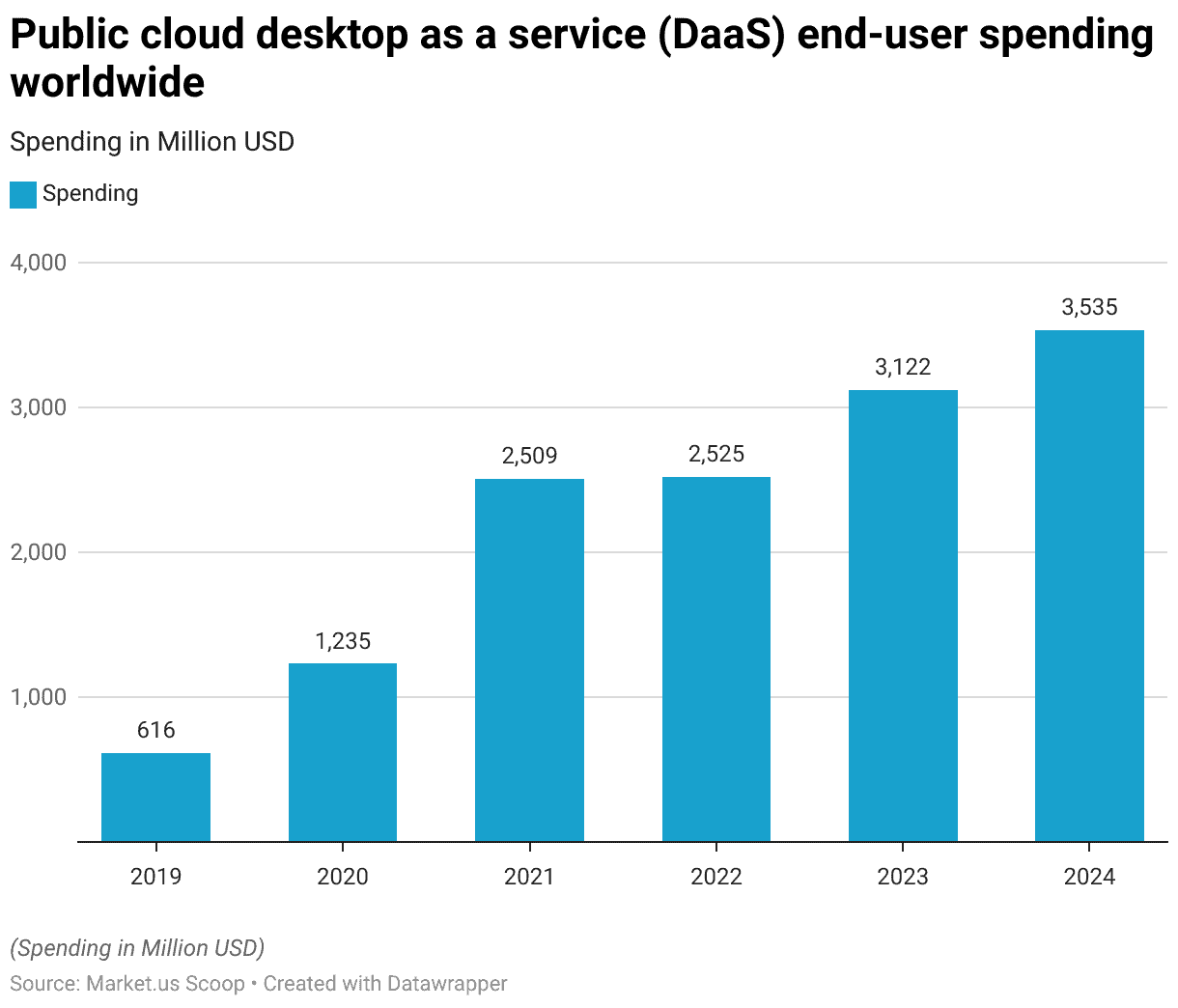

Device as a Service and Related Spending

- The global end-user spending on public cloud Desktop as a Service (DaaS) has seen substantial growth from 2019 to 2024.

- In 2019, spending was recorded at $616 million.

- Projections for 2024 indicate further growth, with end-user spending expected to reach $3,535 million.

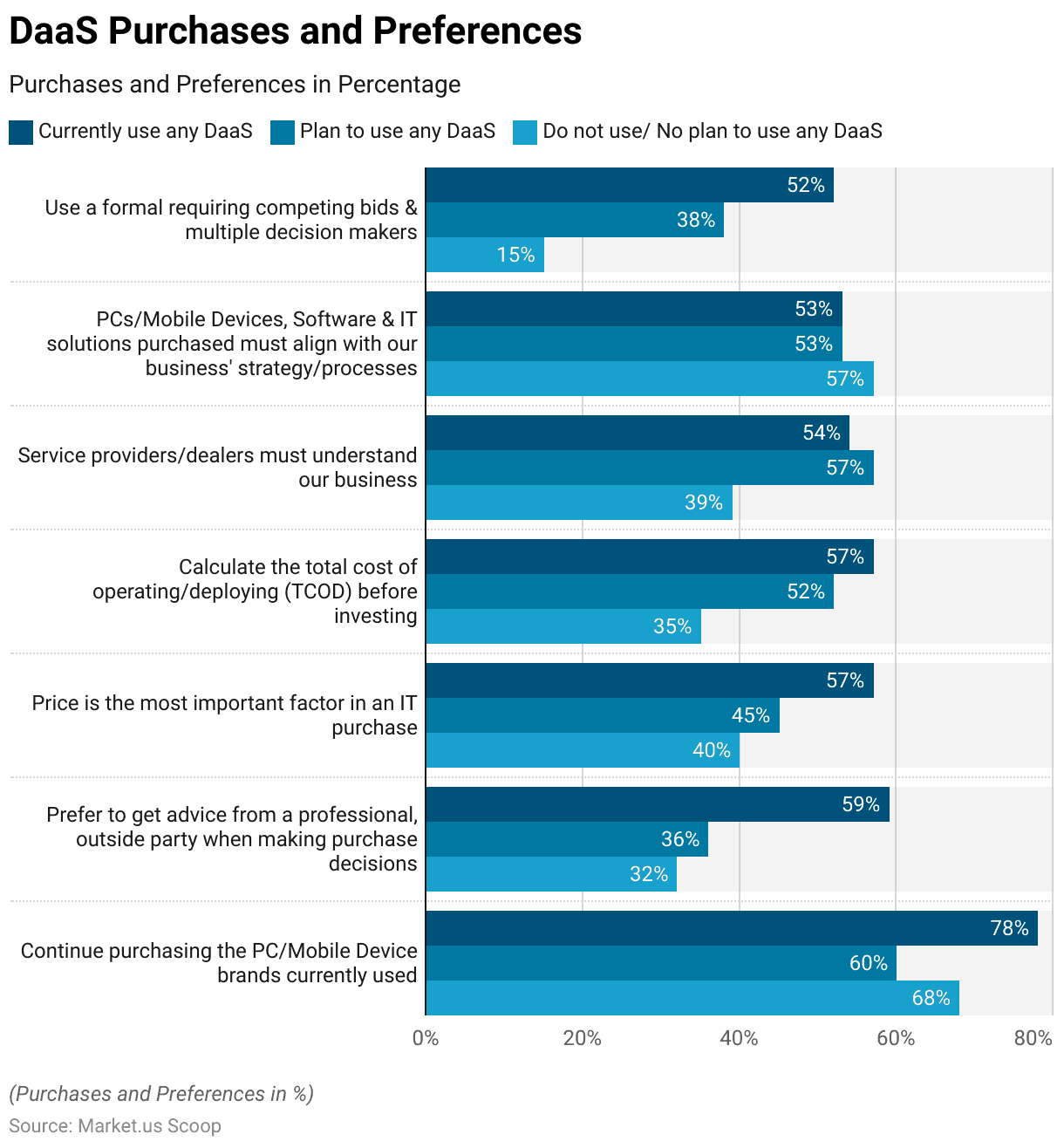

DaaS Purchases and Preferences

- Preferences for purchasing and using Device as a Service (DaaS) vary among organizations based on their current usage and plans.

- Among those currently using DaaS, 78% prefer to continue purchasing the PC and mobile device brands they currently use, while 60% of those planning to use DaaS and 68% of those with no plans to use DaaS share this preference.

- Additionally, 59% of current DaaS users seek advice from professionals and outside parties when making purchase decisions, compared to 36% of planners and 32% of non-users.

- Price is a critical factor for 57% of current users, 45% of planners, and 40% of non-users.

- Furthermore, calculating the total cost of operating/deploying (TCOD) before investing is important for 57% of current users, 52% of planners, and 35% of non-users.

- It is also crucial for service providers and dealers to understand the business needs, as indicated by 54% of current users, 57% of planners, and 39% of non-users.

Regulations for DaaS

- Regulations for Device as a Service (DaaS) vary by country and are primarily concerned with ensuring the quality, safety, and efficacy of the devices offered under these services.

- In the United States, the FDA regulates medical and non-medical devices through the Quality System (QS) regulation, which includes establishment registration, premarket notifications, and adherence to good manufacturing practices.

- In Europe, the EU Medical Device Regulation (MDR) applies, mandating stringent compliance for devices’ lifecycle management, including their deployment under DaaS models.

- In China, the National Medical Products Administration (NMPA) oversees device regulations, ensuring they meet local standards before deployment.

- Brazil’s ANVISA and Health Canada’s regulatory frameworks also impose strict guidelines for devices provided as a service, focusing on comprehensive premarket approval and continuous post-market surveillance.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)