Table of Contents

- Introduction

- Editor’s Choice

- Global Device as a Service Market Overview

- The Most Important Network Infrastructure Providers Worldwide

- Leading Cloud Infrastructure Service Providers

- IoT Devices Offered as A Service Worldwide – By Region

- Types of Devices Incorporated in DaaS

- Device as a Service Penetration Statistics

- Drivers for Device as a Service Implementation Statistics

- Software/Services and DaaS Contracts

- The Device as a Service and Related Spending Statistics

- Device as a Service Purchases and Preferences Statistics

- Regulations for DaaS

- Recent Developments

- Conclusion

- FAQs

Introduction

Device as a Service Statistics: Device as a Service (DaaS) is a subscription-based model that offers businesses hardware devices. Like computers, smartphones, and tablets, along with services such as support, maintenance, and lifecycle management, for a fixed monthly fee.

With DaaS, organizations shift from purchasing devices outright to paying a recurring fee, which covers everything from device setup to disposal.

This comprehensive approach ensures businesses have access to up-to-date technology, reliable support, and scalable solutions. While simplifying vendor management and enhancing security and compliance measures.

Overall, DaaS provides a cost-effective and hassle-free solution for businesses to acquire, manage, and maintain their hardware infrastructure.

Editor’s Choice

- The Global Device as a Service (DaaS) market revenue is projected to reach USD 2,204.7 billion in 2032.

- The Global Device as a Service (DaaS) market is predominantly driven by large enterprises. Which holds a substantial 65.40% share of the market.

- In the Device as a Service (DaaS) market, Accenture holds the largest market share at 23%, demonstrating its significant influence and leadership in the industry.

- The regional distribution of the Device as a Service (DaaS) market reveals North America as the leading region, commanding a 29.0% market share.

- The usage of Device as a Service (DaaS) varies across different device form factors among organizations. Desktop PCs are the most prevalent, with 99% of current DaaS users, 91% of planners, and 96% of those with no plans using them.

- Current users of Device as a Service (DaaS) are primarily driven by the budget and payment flexibility it offers, with 29% citing this as a key factor.

- Among current DaaS users, 51% include productivity suites, either hosted or on-premise. Compared to 59% of DaaS planners who intend to bundle these suites.

Global Device as a Service Market Overview

Global Device as a Service Market Size Statistics

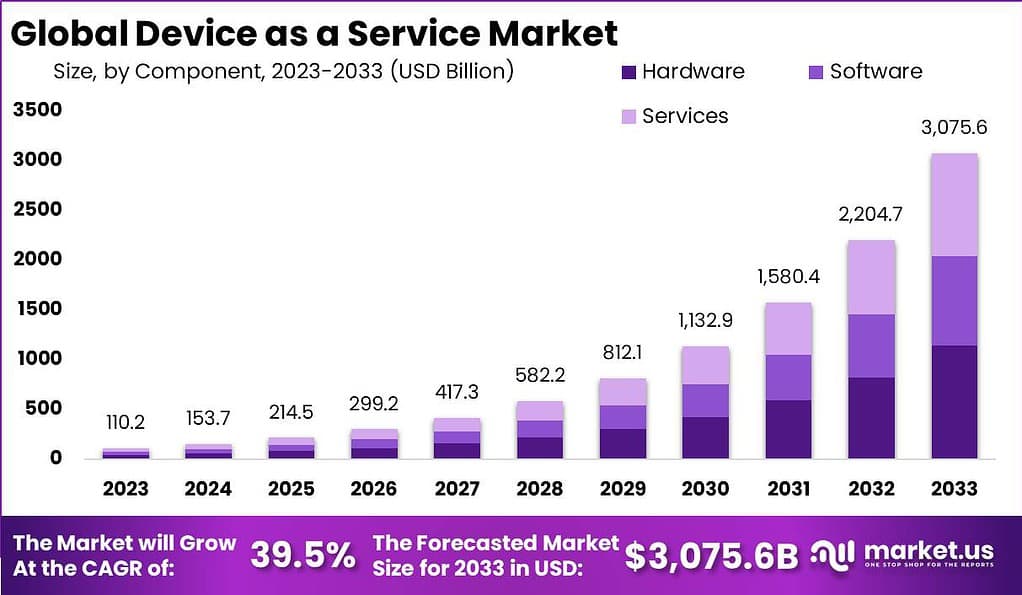

- The Global Device as a Service (DaaS) market has experienced significant growth over the past decade at a CAGR of 39.5%. With revenue increasing from USD 110.2 billion in 2023 to a projected USD 3,075.6 billion by 2033.

- In 2024, the market is expected to reach USD 153.7 billion. Continuing its upward trajectory to USD 214.5 billion in 2025.

- The growth accelerates further, with revenues estimated at USD 299.2 billion in 2026 and USD 417.3 billion in 2027.

- By 2028, the market is anticipated to expand to USD 582.2 billion. Followed by a substantial rise to USD 812.1 billion in 2029.

- The DaaS market is projected to surpass the USD 1 trillion mark by 2030, reaching USD 1,132.9 billion.

- This growth momentum is expected to continue, with revenues climbing to USD 1,580.4 billion in 2031 and USD 2,204.7 billion in 2032.

- By 2033, the market is forecasted to achieve a remarkable revenue of USD 3,075.6 billion, reflecting the increasing adoption and reliance on Device-as-a-service solutions globally.

(Source: market.us)

Global Device as a Service Market Share – By Enterprise Size Statistics

- The Global Device as a Service (DaaS) market is predominantly driven by large enterprises. Which holds a substantial 65.40% share of the market.

- This indicates a strong preference among larger organizations for outsourcing their device management needs to specialized service providers.

- Small and medium enterprises (SMEs) contribute to the remaining 34.60% of the market, reflecting their growing adoption of DaaS solutions.

- This distribution underscores the significant role that large enterprises play in the DaaS market. While highlighting the increasing interest and potential for growth among SMEs in leveraging these services.

(Source: market.us)

Competitive Landscape of Global Device as a Service Market Statistics

- In the Device as a Service (DaaS) market, Accenture holds the largest market share at 23%. Demonstrating its significant influence and leadership in the industry.

- Acer Inc. and Apple Inc. each account for 9% of the market, while Cisco and Cognizant each contribute 8%.

- Computacenter holds a 7% share, followed closely by Dell Technologies and Intel Corporation, both with 6%.

- Lenovo commands a 5% share, and Hewlett-Packard holds 3%.

- The remaining 16% of the market is distributed among other key players. Highlighting a diverse and competitive landscape within the DaaS industry.

(Source: market.us)

Regional Analysis of the Global Device as a Service Market Statistics

- The regional distribution of the Device as a Service (DaaS) market reveals North America as the leading region, commanding a 29.0% market share.

- Europe follows closely with a 28.6% share, reflecting its significant role in the market.

- The Asia-Pacific (APAC) region holds a substantial 23.8% share, showcasing its growing influence.

- South America accounts for 9.9% of the market, while the Middle East and Africa (MEA) region represents 8.6%.

- This distribution highlights the global reach and varied regional contributions to the DaaS market.

(Source: market.us)

The Most Important Network Infrastructure Providers Worldwide

- In 2020, Huawei led the global market share of network infrastructure providers. Which held a commanding 26.90% of the market share.

- Cisco followed with a 15.10% share, establishing itself as a significant player in the industry.

- Nokia accounted for 11.40% of the market, while Ericsson held a 9.60% share.

- ZTE contributed 5.90%, and NEC held a 3.20% share.

- Motorola Solutions rounded out the key players with a 2.60% share.

- This distribution underscores the competitive landscape of the network as a service infrastructure sector. With a few major companies dominating a significant portion of the market.

(Source: Statista)

Leading Cloud Infrastructure Service Providers

- In the first quarter of 2024, Amazon Web Services (AWS) led the global cloud infrastructure service market with a 31% share, underscoring its dominant position in the industry.

- Microsoft Azure followed, capturing a significant 25% of the market.

- Google Cloud held an 11% share, reflecting its growing presence.

- Alibaba Cloud accounted for 4% of the market, while Salesforce contributed 3%.

- Both IBM Cloud and Oracle each held a 2% share, matched by Tencent Cloud. Which also represented 2% of the market.

- This distribution highlights the competitive landscape among leading cloud infrastructure service providers. With AWS and Azure maintain substantial leads over their competitors.

(Source: Statista)

IoT Devices Offered as A Service Worldwide – By Region

- From 2020 to 2030, the number of IoT devices offered as a service worldwide has shown a remarkable increase. With notable growth across various regions.

- In North America, the number of IoT devices surged from 4 million in 2020 to an anticipated 61 million by 2030.

- Similarly, Greater China saw an increase from 5 million to 60 million during the same period.

- Europe also experienced significant growth, rising from 4 million devices in 2020 to 54 million by 2030.

- Japan’s IoT devices increased from 1 million in 2020 to 15 million in 2030. While Latin America grew from 1 million to 13 million.

- South East Asia’s numbers expanded from no significant count in 2020 to 6 million by 2030.

- South Korea saw a rise from 1 million to 6 million devices.

- Russia and Central Asia’s figures went from 0 to 5 million, reflecting a steady increase.

- India and South Asia started with no significant count in 2020, reaching 5 million by 2030.

- The MENA region also began with no significant count and grew to 5 million devices.

- Australasia’s numbers will increase from no significant count to 4 million devices by 2030.

- Sub-Saharan Africa, starting with no significant count in 2020, is projected to reach 2 million devices by 2030.

- Overall, the global total of IoT devices offered as a service is expected to grow from 16 million in 2020 to an impressive 236 million by 2030. Demonstrating the expansive adoption and integration of IoT solutions worldwide.

(Source: Statista)

Types of Devices Incorporated in DaaS

- Device as a Service (DaaS) encompasses a variety of hardware options tailored to different organizational needs, offering a streamlined approach to device management.

- The primary types of devices offered include desktops, laptops, tablets, and smartphones. Which come pre-installed with necessary software and security features.

- For instance, providers such as HP and Dell offer extensive hardware options with integrated management and security tools. Including antivirus software and secure data erasure capabilities.

- Additionally, specialized IoT devices, such as sensors and smart home systems, are also available under DaaS models.

- These devices often feature embedded CPUs and network adapters, facilitating real-time data exchange and remote management.

- The versatility of DaaS devices helps organizations reduce upfront costs and improve operational efficiency by ensuring regular technology refreshes and scalable device solutions to match their dynamic needs.

(Sources: Data Economy, Simpli Learn)

Devices Currently Used – By Form Factors

- The usage of Device as a Service (DaaS) varies across different device form factors among organizations.

- Desktop PCs are the most prevalent, with 99% of current DaaS users, 91% of planners, and 96% of those with no plans using them.

- Notebooks are also widely utilized, with 66% of current users, 68% of planners, and 72% of non-users.

- All-in-Ones (AIOs) are used by 24% of current users, 20% of planners, and 13% of non-users.

- Two-in-One devices have a notable presence, with 38% of current users, 29% of planners, and 24% of non-users employing them.

- Workstations are used by 24% of current users, 21% of planners, and 10% of non-users.

- This data highlights the varying preferences and plans for DaaS adoption across different types of devices. Reflecting the diverse needs and strategies of organizations.

(Source: Intel)

Device as a Service Penetration Statistics

Device as a Service Penetration – By Employee Size Statistics

- The penetration of Device as a Service (DaaS) varies significantly by employee size.

- Currently, only 0.30% of businesses with fewer than nine employees utilize DaaS, though 19% plan to adopt it.

- Among businesses with 10-19 employees, 6% currently use DaaS, and 17% are planning to implement it.

- For companies with 20-49 employees, 7% are already utilizing DaaS, and an additional 17% intend to do so.

- In larger organizations with 50-99 employees, 8% currently use DaaS, while 19% have plans for future adoption.

- This data highlights a growing interest in DaaS across all business sizes. With a notable intention to expand its use shortly.

(Source: Intel)

Device as a Service Penetration – By Vertical Statistics

- The penetration of Device as a Service (DaaS) varies across different industry verticals.

- The AMTUC sector (Agriculture, Mining, Transportation, Utilities, and Construction) has a penetration rate of 1.30%.

- In manufacturing, the penetration is slightly higher at 2.10%.

- The wholesale industry sees a penetration of 1.40%, while retail stands at 1.60%.

- The FIRE sector (Finance, Insurance, and Real Estate) also has a penetration rate of 1.60%. Matching that of other service industries.

- Professional services exhibit a slightly higher penetration at 1.70%.

- This data indicates a modest but growing adoption of DaaS across various sectors, with manufacturing leading the way.

(Source: Intel)

Drivers for Device as a Service Implementation Statistics

Current DaaS Users

- Current users of Device as a Service (DaaS) are primarily driven by the budget and payment flexibility it offers, with 29% citing this as a key factor.

- Additionally, 18% of users appreciate the operational flexibility and scalability. Enabling the deployment of devices, software, and services on an as-needed basis.

- Access to better technology with more features and advanced hardware is a significant driver for 13% of users.

- A preference for not directly owning computing devices motivates 10% of companies to adopt DaaS.

- Simplification of the device life cycle, including disposal and refresh management, is another driver, influencing 8% of current users.

- These factors collectively underscore the various advantages that make DaaS an attractive option for businesses.

(Source: Intel)

Drivers for DaaS Planners

- Organizations planning to implement Device as a Service (DaaS) are driven by several key factors.

- Budget and payment flexibility is the primary driver, with 28% of planners citing it as a crucial benefit.

- Access to better technology with more features and advanced hardware motivates 16% of planners.

- Additionally, 14% of companies prefer not to own computing devices directly, making DaaS an attractive option.

- Simplification of the device life cycle, including disposal and refresh management, is a significant driver for 10% of planners.

- Moreover, 9% of planners are attracted by data protection against device obsolescence, ensuring they have access to the latest technology.

- These drivers highlight the diverse advantages that DaaS offers to organizations looking to streamline their IT operations and enhance technological capabilities.

(Source: Intel)

Software/Services and DaaS Contracts

Software/Services Included (or planned for inclusion) with DaaS Contracts Software/Services.

- In Device as a Service (DaaS) contracts, both current users and planners include various software and services to enhance their device management solutions.

- Among current DaaS users, 43% incorporate services such as installation, configuration, on-site support, and remote monitoring.

- In comparison, 66% of DaaS planners intend to include these services in their contracts, indicating a strong future focus on comprehensive service integration.

- Software other than operating systems, including productivity suites, email, and antivirus programs, are included by 39% of current users, while 27% of planners plan to incorporate these.

- Additionally, 27% of current users and 14% of planners do not include or plan to include any additional software or services in their DaaS contracts.

- This data highlights the emphasis on adding value through services and software in DaaS contracts, particularly among planners looking to enhance their IT infrastructure.

(Source: Intel)

Software/Services Bundled with New PCs

- In Device as a Service (DaaS) contracts, various software and services are bundled with new PCs to enhance their value and functionality.

- Among current DaaS users, 51% include productivity suites, either hosted or on-premise, compared to 59% of DaaS planners who intend to bundle these suites.

- Online data storage is included by 35% of current users, while 27% of planners plan to incorporate it.

- Business applications are bundled by 32% of current users, with only 20% of planners intending to do the same.

- Hosted security services are included by 21% of current users and planned by 26% of future adopters.

- Additionally, hosted data backup and recovery services are bundled by 16% of current users and planned by 13% of DaaS planners.

- This distribution highlights the prioritization of productivity and security solutions in DaaS offerings, with planners indicating a higher future emphasis on comprehensive productivity suites and hosted security services.

(Source: Intel)

The Device as a Service and Related Spending Statistics

- The global end-user spending on public cloud Desktop as a Service (DaaS) has seen substantial growth from 2019 to 2024.

- In 2019, spending was recorded at $616 million.

- This figure nearly doubled to $1,235 million in 2020, reflecting the increasing adoption of remote work solutions driven by the COVID-19 pandemic.

- The trend continued in 2021, with spending reaching $2,509 million.

- In 2022, the growth stabilized slightly, with spending at $2,525 million.

- However, the upward trajectory resumed in 2023, with expenditures climbing to $3,122 million.

- Projections for 2024 indicate further growth, with end-user spending expected to reach $3,535 million.

- This data underscores the robust demand and expanding market for DaaS solutions globally.

(Source: Statista)

Device as a Service Purchases and Preferences Statistics

- Preferences for purchasing and using Device as a Service (DaaS) vary among organizations based on their current usage and plans.

- Among those currently using DaaS, 78% prefer to continue purchasing the PC and mobile device brands they currently use, while 60% of those planning to use DaaS and 68% of those with no plans to use DaaS share this preference.

- Additionally, 59% of current DaaS users seek advice from professionals and outside parties when making purchase decisions, compared to 36% of planners and 32% of non-users.

- Price is a critical factor for 57% of current users, 45% of planners, and 40% of non-users.

- Furthermore, calculating the total cost of operating/deploying (TCOD) before investing is important for 57% of current users, 52% of planners, and 35% of non-users.

- It is also crucial for service providers and dealers to understand the business needs, as indicated by 54% of current users, 57% of planners, and 39% of non-users.

- Aligning PCs, mobile devices, software, and IT solutions with business strategies and processes is essential for 53% of current users and planners and 57% of non-users.

- Lastly, using a formal process that requires competing bids and multiple decision-makers is preferred by 52% of current users, 38% of planners, and 15% of non-users.

- This data highlights the diverse considerations and priorities that influence DaaS adoption and purchasing decisions across different organizational segments.

(Source: Intel)

Regulations for DaaS

- Regulations for Device as a Service (DaaS) vary by country and are primarily concerned with ensuring the quality, safety, and efficacy of the devices offered under these services.

- In the United States, the FDA regulates medical and non-medical devices through the Quality System (QS) regulation, which includes establishment registration, premarket notifications, and adherence to good manufacturing practices.

- In Europe, the EU Medical Device Regulation (MDR) applies, mandating stringent compliance for devices’ lifecycle management, including their deployment under DaaS models.

- In China, the National Medical Products Administration (NMPA) oversees device regulations, ensuring they meet local standards before deployment.

- Brazil’s ANVISA and Health Canada’s regulatory frameworks also impose strict guidelines for devices provided as a service, focusing on comprehensive premarket approval and continuous post-market surveillance.

- These regulations aim to harmonize international standards and ensure that devices offered through DaaS models are safe and effective across different markets.

(Source: FDA, WHO, EMERGO)

Recent Developments

Acquisitions:

- HP Inc.’s Acquisition of Poly: In March 2022, HP Inc. announced the acquisition of Poly, a leading global provider of workplace collaboration solutions. This acquisition, valued at $3.3 billion, aims to enhance HP’s DaaS offerings by integrating Poly’s audio and video solutions and expanding HP’s presence in the hybrid work solutions market.

New Product Launches:

- Lenovo’s DaaS Solutions: In 2023, Lenovo expanded its DaaS portfolio by introducing new managed services that include device procurement, deployment, management, and support. This comprehensive solution is designed to reduce the IT burden for enterprises, providing seamless end-to-end management of the device lifecycle.

- Apple Business Essentials: Apple launched its Business Essentials service in March 2022, targeting small businesses with up to 500 employees. This subscription-based service combines device management, support, and iCloud storage, simplifying IT management for small and medium-sized enterprises (SMEs).

Funding:

- HP’s Investment in DaaS: HP announced an investment of $100 million over the next three years to enhance its DaaS offerings. This funding is aimed at developing new technologies and expanding service capabilities to meet the growing demand for managed device services.

Market Growth:

- Global Market Expansion: The growth is driven by the increasing adoption of remote work, which has accelerated the demand for flexible device management solutions.

- Regional Insights: North America is expected to hold the largest market share due to the early adoption of DaaS solutions by major enterprises. Meanwhile, the Asia-Pacific region is anticipated to witness the highest growth rate, driven by the rapid digital transformation and increasing number of SMEs in the region.

Innovation and Trends:

- Integration with AI and IoT: Companies are integrating AI and IoT technologies into their DaaS offerings to enhance predictive maintenance and real-time monitoring. These innovations help in reducing downtime and improving device performance, providing a more efficient and reliable service to customers.

- Sustainability Initiatives: There is a growing emphasis on sustainability within the DaaS market. Companies are focusing on providing eco-friendly devices and recycling programs as part of their service offerings to meet the increasing demand for sustainable IT solutions.

Conclusion

The Device as a Service (DaaS) market is growing rapidly, driven by the demand for cost-effective and scalable IT solutions.

This subscription-based model offers reduced capital expenditures, enhanced flexibility, and streamlined IT management, making it attractive amid the rise of remote work.

Key growth factors include the adoption of cloud computing, advancements in device management technologies, and efficient lifecycle management of IT assets.

While challenges like data security and dependency on providers exist, improved security measures and comprehensive service-level agreements are mitigating these issues.

Overall, DaaS enables businesses to achieve operational efficiencies, cost savings, and agility in their IT infrastructure, positioning them competitively in the digital age with Digital Twins-as-a-Service.

FAQs

Device as a Service (DaaS) is a subscription-based model that enables organizations to outsource the procurement, deployment, management, and lifecycle management of their end-user devices. This typically includes desktops, laptops, tablets, and other computing devices. DaaS providers handle the setup, maintenance, support, and eventual disposal or recycling of devices.

The main benefits of DaaS include reduced upfront costs, predictable monthly expenses, access to the latest technology, improved device management, enhanced security features, and scalability to match the dynamic needs of a business. These advantages help organizations streamline their IT operations and focus on core business activities.

DaaS offerings commonly include a range of devices such as desktop PCs, laptops, tablets, and smartphones. Some providers also offer specialized devices like IoT sensors and smart home systems, which are integrated with necessary software and security features.

While both DaaS and traditional leasing provide devices for a monthly fee, DaaS includes comprehensive management services such as deployment, maintenance, updates, and support. Traditional leasing generally does not include these services, requiring the lessee to handle device management and maintenance independently.

Organizations of all sizes can benefit from DaaS. Large enterprises appreciate the scalability and comprehensive management, while small and medium enterprises (SMEs) benefit from reduced capital expenditure and access to the latest technology. Additionally, sectors like education, healthcare, and retail find DaaS particularly useful for managing large fleets of devices efficiently.