Table of Contents

- Digital Asset Custody Market Size

- Quick Market Facts

- Analysts’ Viewpoint

- Investment and Business benefits

- Role of Generative AI

- Emerging trends

- Growth Factors

- By Type of Custody

- By Asset Type

- By Service Type

- By Deployment

- By End Use

- North America Market

- U.S. Market Specifics

- Key Players Analysis

- Key Market Segments

Digital Asset Custody Market Size

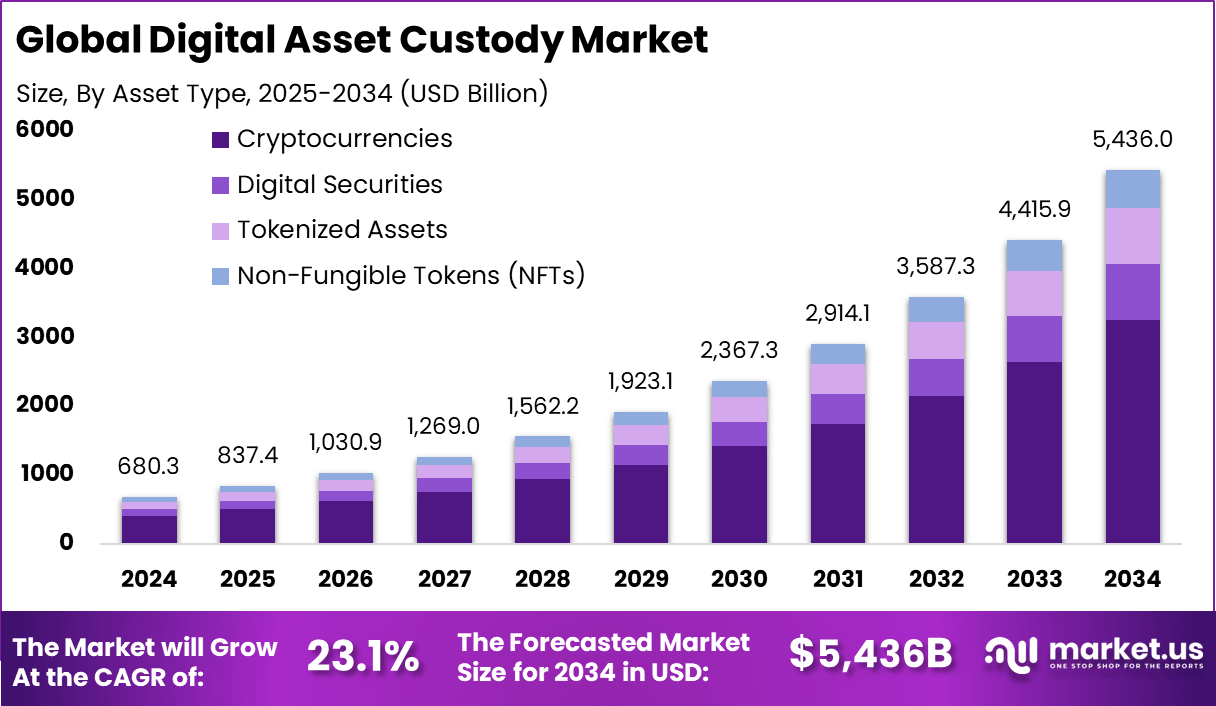

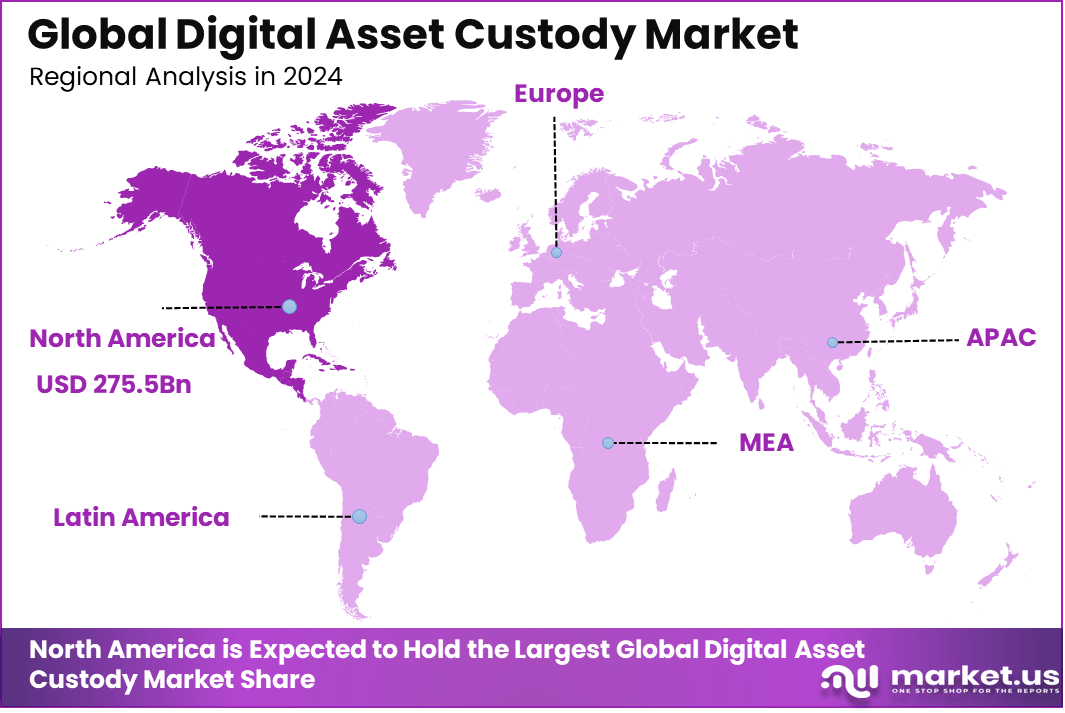

According to Market.us, The Global Digital Asset Custody Market was valued at USD 680.3 billion in 2024 and is projected to grow from USD 837.4 billion in 2025 to nearly USD 5,436 billion by 2034, reflecting a 23.1% CAGR, with North America holding a dominant 40.5% share and generating USD 275.5 billion in revenue in 2024.

The Digital Asset Custody Market is a rapidly evolving sector that focuses on the safe storage and management of digital assets such as cryptocurrencies and tokenized securities. This market has grown significantly as institutions seek reliable custody solutions that ensure asset security and regulatory compliance. Digital asset custodians have incorporated technologies like hardware security modules, multi-party computation, and multi-signature wallets to provide institutional-grade security and operational controls. Demand extends across custody types including self-custody with hot and cold wallets as well as third-party custodians offering comprehensive security and compliance features.

Top driving factors for this market include increasing institutional interest, regulatory clarity, and technological innovations. More than 75% of institutional investors plan to increase allocations to digital assets in 2025, driven by clearer regulations and maturing technologies. Regulatory developments such as the US SEC’s proposed custody frameworks and Europe’s MiCA regulation bring credibility and operational standards, encouraging wider adoption by family offices, funds, and banks. These factors fuel confidence in secure custody solutions, as 59% of investors plan to allocate over 5% of their assets under management to digital assets or related products within this year.

Quick Market Facts

- Hot wallet custody holds about 74.2%, driven by the need for fast transfers and immediate liquidity.

- Cryptocurrencies account for nearly 60%, confirming that they remain the primary focus of asset protection.

- Custody services capture around 70%, showing that secure storage remains the core offering in this market.

- Cloud-based deployment stands at roughly 60.3%, reflecting preference for scalable and cost-efficient infrastructure.

- Institutional investors make up close to 45.5%, indicating rising confidence in regulated digital asset storage.

- North America leads with approximately 40.5%, supported by compliance frameworks and established financial players.

Analysts’ Viewpoint

Demand analysis shows strong growth projected from North America and Europe, regions distinguished by advanced regulatory frameworks and institutional engagements. North America, particularly the US, leads due to robust technology infrastructure and increasing bank involvement enabled by regulatory easing. Meanwhile, Europe’s MiCA regulation fosters growth with licensing standards for custodians, enabling fintech firms and banks to expand their services. Interest is also rising in Asia Pacific, with growing fintech adoption surrounding digital assets. More than 84% of institutions express interest or usage of stablecoins for yield and transactional use cases, highlighting diversified demand drivers beyond direct cryptocurrency holdings.

Key technologies driving adoption include hardware security modules (HSM), multi-party computations (MPC), and multi-signature solutions, which collectively enhance security by distributing control over private keys and minimizing risks of unauthorized access. The move from purely cold storage to more accessible custody 2.0 models enables institutional clients to access assets securely but with improved operational efficiency. Blockchain automation and integration of artificial intelligence for risk monitoring are also gaining traction, addressing increasing complexity in asset types and regulatory requirements. These technologies respond directly to demands for security, ease of access, and operational transparency.

Investment and Business benefits

Business benefits of digital asset custody include enhanced security through institutional-grade protections, regulatory compliance facilitating broader investor confidence, and the potential for operational scalability. Custodians offer insurance coverage, customized transaction policies, and audit-ready compliance tools.

For banks and financial institutions, custody services present new revenue streams and deepen client engagement by aligning with digital asset investment trends. Customer demand for trusted custody solutions, especially from institutional clients, continues to grow as they seek to safeguard increasingly significant digital portfolios.

Investment opportunities abound in digital asset custody technology development, platform integration, and service expansion to institutional and family office clients. The regulatory momentum enables more players, including traditional banks, to enter custody services, creating competitive dynamics to innovate user experience and security features. Tokenization of various asset classes also opens fresh custody needs and investment prospects. Given institutional interest, ongoing innovation in custody technology, and evolving global regulations, strategic investments in custody infrastructure and partnerships represent significant growth potential.

Role of Generative AI

Generative AI is becoming a vital part of digital asset custody by improving how data is analyzed and decisions are made. Around 32-39% of tasks in asset management today involve AI, with generative AI enhancing predictive analytics, portfolio creation, and real-time risk evaluation. This technology also supports better communication with investors by enabling natural language interactions and dynamic reporting. These improvements help custody providers detect threats and anomalies faster, making asset protection stronger and more reliable in the fast-changing digital space.

Moreover, generative AI automates routine operations such as data handling and compliance reporting, saving significant time and resources. Institutions using this technology can focus more on critical strategic choices while reducing errors caused by humans. Its integration makes custody services more efficient and competitive by providing timely, precise, and tailored asset management solutions, helping build trust and scale securely.

Emerging trends

Emerging trends in digital asset custody show a clear shift towards integrating advanced security technologies like multi-signature wallets and cold storage. About 40.5% of the market revenue comes from North America, which leads due to its mature regulatory environment and technology adoption. The market is also seeing growth in APIs, real-time monitoring, and insurance layers to address increasing cyber threats while supporting complex assets beyond cryptocurrency.

Another significant trend is expanding institutional interest, with many traditional financial players entering digital asset custody to meet demand for secure and compliant storage. This broadening acceptance is driving service providers to innovate, including wallet-as-a-service and multi-party computation solutions, which enhance security and operational flexibility.

Growth Factors

Growth in the digital asset custody market is fueled by rising institutional investment. Many asset managers and wealth funds are adding digital assets for diversification and higher returns, elevating the need for trusted custody solutions that ensure regulatory compliance and safety. The increasing complexity of digital assets, including tokenized securities and DeFi products, pushes providers to develop more sophisticated custody infrastructures.

Furthermore, regulatory clarity is another important growth factor. As clearer legal frameworks emerge worldwide, more institutions feel confident to enter this space. This regulatory progress helps lower barriers, encourage innovation, and promotes adoption, enabling firms to expand their digital asset offerings securely and efficiently. Growth is particularly strong where robust policies support innovation, especially in North America.

By Type of Custody

Hot wallet custody dominates the digital asset custody market with a significant 74.2% share. Hot wallets are favored because they provide immediate access to assets, enabling quick transactions and ease of use. Their connection to the internet makes them ideal for active traders and entities requiring rapid asset movement, though they come with security trade-offs compared to cold storage solutions. This convenience has established hot wallets as the preferred custody method, especially where liquidity is a priority.

While hot wallets account for the majority, security concerns remain a critical factor, leading to innovations around multi-factor authentication and secured key management. These enhancements aim to reduce vulnerabilities while maintaining ease of access for users, addressing the delicate balance between security and accessibility demanded by institutional and retail investors alike.

By Asset Type

The cryptocurrencies segment commands a dominant 60% of the digital asset custody market. Given that cryptocurrencies are the most established and widely recognized digital assets, institutional and retail custody providers focus heavily on securing these assets. The growing acceptance of cryptocurrencies as an investment class has further driven the demand for custody solutions that can safely manage volatile and valuable digital tokens.

With cryptocurrencies’ expanding roles in portfolios, custody solutions are evolving to support regulatory compliance, seamless asset transfers, and integration with decentralized finance platforms. This ongoing evolution ensures that custodians not only secure assets but also facilitate their active use in trading, lending, and other financial activities.

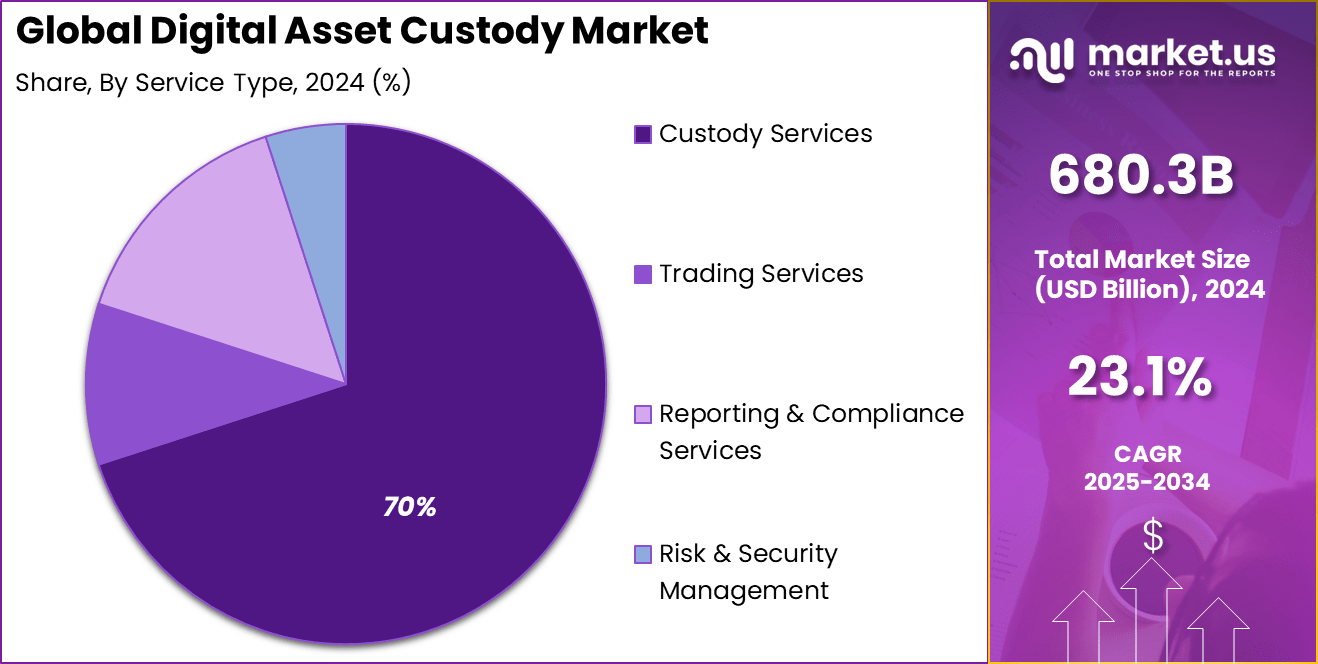

By Service Type

Custody services make up about 70% of the market, reflecting a high level of demand for secure storage combined with value-added services. These services include key management, transaction processing, analytics, and compliance support, which together provide a comprehensive package for asset owners. The preference for custody services highlights the market’s trust in professional custodians over self-custody options, particularly for larger institutional players.

The emphasis on custody services reflects a driving need for expertise in managing the operational complexities of digital assets. Providers also focus on developing features such as insurance coverage, audit trails, and regulatory reporting, which reinforce confidence among investors and regulatory bodies.

By Deployment

Cloud-based deployment accounts for 60.3% of the market, driven by the scalability, flexibility, and cost efficiencies cloud solutions offer. Cloud custody platforms enable institutions to access digital asset management systems without heavy investments in infrastructure, while maintaining strong security protocols through encryption and secure access controls.

Cloud adoption aligns with broader trends of digital transformation in financial services, allowing custodian firms to quickly scale and update their offerings. Enhanced automation and remote access features further support global operations, making cloud deployment the preferred choice especially for institutions with diverse geographical footprints.

By End Use

Institutional investors form a substantial 45.5% of the user base in the digital asset custody market. These investors demand high levels of security, compliance, and service reliability to manage growing allocations to digital assets. Their participation has fueled innovation and professionalization within the custody industry, pushing providers to meet rigorous standards for safeguards and governance.

The rise of institutional investors marks a significant shift from retail-dominated digital asset use, underscoring the mainstreaming of these assets. Education, regulatory clarity, and improved custody infrastructure continue to encourage deeper engagement from pension funds, hedge funds, and family offices.

North America Market

North America holds a commanding 40.5% share of the digital asset custody market. This region benefits from a mature financial ecosystem, supportive regulatory developments, and a dense concentration of institutional investors actively deploying digital assets in their portfolios. The presence of major financial centers also spurs innovation and adoption of advanced custody technologies.

The U.S. specifically is a major hub within this landscape, where regulatory advancements are fostering a more favorable environment for digital asset custody services. Increased interest from banks and traditional financial custodians has led to more robust custody offerings, making the U.S. a key driver of market growth and innovation globally.

U.S. Market Specifics

In the U.S., the digital asset custody market mirrors the broader North American dominance with significant revenue contributions from hot wallet custody and institutional clients. Regulatory clarity and better-defined compliance frameworks have encouraged veterans of traditional finance to enter the custodial space.

This has also led to extensive investments in security architectures and operational frameworks tailored for digital assets, supporting an increasingly diverse range of digital currencies and tokens. The U.S. market serves as a benchmark for evolving custody standards with a focus on security, customer trust, and operational excellence.

Key Players Analysis

The Digital Asset Custody Market is led by major institutional custodians such as Coinbase, Anchorage Digital, and BitGo Technologies, LLC. These companies provide secure storage solutions for cryptocurrencies and tokenized assets through cold storage infrastructure, regulatory compliance, and institutional-grade security protocols. Their platforms serve exchanges, hedge funds, asset managers, and enterprises adopting digital assets.

Financial and fintech-driven custodians such as FMR LLC (Fidelity Investments), Sygnum Bank, and Bitcoin Suisse are expanding institutional adoption by integrating custody with trading, staking, and asset management services. Their regulated frameworks support high-net-worth clients, banks, and corporate treasuries seeking secure and compliant exposure to digital assets.

Specialized custody providers including Ledger Enterprise, Fireblocks, Aegis Custody, and Tangany GmbH, along with other emerging players, focus on multi-party computation (MPC), key management systems, and tokenization support. Their offerings enable secure transfer workflows, DeFi access, and enterprise asset onboarding. Collectively, these firms strengthen the digital asset ecosystem through trusted storage, transaction security, and regulatory alignment.

Top Key Players in the Market

- Coinbase

- BitGo Technologies, LLC

- FMR LLC

- Anchorage Digital

- Ledger Enterprise

- Fireblocks

- Aegis Custody

- Bitcoin Suisse

- Tangany GmbH

- Sygnum Bank

- Other Players

Key Market Segments

By Type of Custody

- Hot Wallet Custody

- Cold Wallet Custody

By Asset Type

- Cryptocurrencies

- Digital Securities

- Tokenized Assets

- Non-Fungible Tokens (NFTs)

By Service Type

- Custody Services

- Trading Services

- Reporting & Compliance Services

- Risk & Security Management

By Deployment

- On-Premise

- Cloud-based

By End Use

- Institutional Investors

- Hedge Funds

- Asset Managers

- Banks

- Family Offices

- Exchanges & Trading Platforms

Explore More Reports

| AI TV Market | https://market.us/report/ai-tv-market/ |

| North America AI Watermarking Market | https://market.us/report/north-america-ai-watermarking-market/ |

| Artificial General Intelligence Market | https://market.us/report/artificial-general-intelligence-market/ |

| Wrist Wearable Devices Market | https://market.us/report/wrist-wearable-devices-market/ |

| Quantum Cloud Computing Market | https://market.us/report/quantum-cloud-computing-market/ |

| AI Career Coach Market | https://market.us/report/ai-career-coach-market/ |

| AI Mirror Market | https://market.us/report/ai-mirror-market/ |

| AI-Based Weather Modelling Market | https://market.us/report/ai-based-weather-modelling-market/ |

| Neuromorphic Hardware Market | https://market.us/report/neuromorphic-hardware-market/ |

| Digital Asset Custody Market | https://market.us/report/digital-asset-custody-market/ |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)