Table of Contents

Introduction

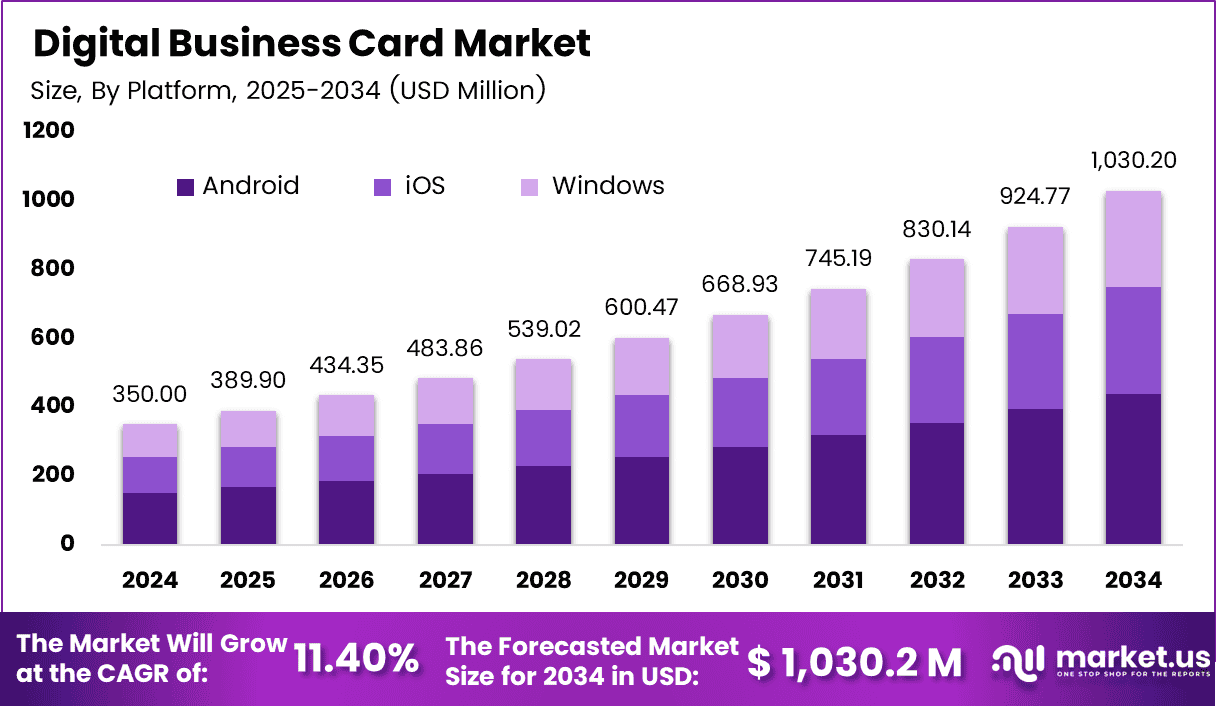

The Global Digital Business Card Market was valued at USD 350.0 million in 2024 and is projected to grow at a CAGR of 11.40%, reaching approximately USD 1,030.2 million by 2034. In 2024, North America held the largest share of the market, accounting for 37.9% with USD 132.6 million in revenue. This growth is fueled by the increasing shift toward digital networking, sustainability initiatives, and the demand for real-time contact updates in professional settings. Businesses and individuals are rapidly adopting digital business cards as cost-efficient, customizable, and eco-friendly alternatives to traditional paper cards.

How Growth is Impacting the Economy

The rising adoption of digital business cards is driving the digitalization of small and medium enterprises (SMEs), freelancers, and corporate networking infrastructure. By reducing print and distribution costs, organizations are reallocating budgets toward digital engagement and brand enhancement. The market is contributing to the development of app-based ecosystems and digital identity tools, promoting entrepreneurship and personal branding. Additionally, it supports environmental goals by reducing paper usage and promoting carbon-neutral networking. Economic impact is also seen in the growth of related industries such as SaaS platforms, NFC-based smart cards, and QR code technologies, creating new employment and investment opportunities.

➤ Unlock growth! Get your sample now! – https://market.us/report/digital-business-card-market/free-sample/

Impact on Global Businesses

Digital business cards are transforming how professionals and organizations manage connections. Enterprises are leveraging these tools for integrated contact management, CRM integration, and brand consistency. HR teams use them for recruiting events and onboarding processes, while sales professionals benefit from analytics on card interactions. However, global businesses must address data privacy, especially with cloud-hosted profiles and GDPR compliance. Industries such as real estate, tech, and financial services are seeing faster adoption, while traditional sectors are slower due to digital hesitancy. The ability to update contact details in real-time reduces communication friction and enhances follow-up success, improving business efficiency.

Strategies for Businesses

To maximize value, businesses are integrating digital business cards with CRM, email automation, and analytics platforms. Custom branding, team-level management, and centralized administrative control are key differentiators. Many organizations are embedding QR codes in email signatures, presentations, and virtual meetings to boost visibility. Partnerships with virtual event platforms and smart card providers are expanding reach. Companies are also investing in data encryption, role-based access, and offline access features to boost user trust. Some are offering dual-language or region-specific templates to cater to diverse client bases, enhancing global usability and professionalism.

Key Takeaways

- Market to reach USD 1,030.2 million by 2034 at an 11.40% CAGR

- North America led in 2024 with USD 132.6 million revenue and 37.9% share

- Adoption driven by sustainability, remote work, and digital networking trends

- CRM integration, QR/NFC tech, and analytics are reshaping professional identity tools

- Small businesses and freelancers represent fast-growing user segments

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=160113

Analyst Viewpoint

The digital business card market is evolving rapidly with the rise of hybrid work, digital-first branding, and sustainability-focused communication. Current adoption is concentrated in North America and Europe, but Asia Pacific shows rising momentum due to startup ecosystems and mobile-first behavior. The future will see more integration with identity verification tools, blockchain, and digital wallets. Long-term growth is expected to align with the broader movement toward paperless operations and smart contactless solutions. Providers offering seamless UX, cross-platform functionality, and secure sharing will dominate the competitive landscape.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Freelancer/Personal Branding | Affordable digital identity, easy updates, mobile sharing |

| Enterprise Team Management | Admin-level control, unified branding, analytics |

| Networking Events & Trade Shows | Contactless exchange, QR/NFC integration, lead capture |

| HR & Recruitment | Onboarding, quick sharing of roles & profiles, branding |

| Virtual Meetings | Real-time link sharing, email signature integration, CRM sync |

Regional Analysis

In 2024, North America led the market with a 37.9% share and USD 132.6 million in revenue. The region benefits from high smartphone usage, digital adoption, and eco-conscious business culture. The U.S. is the primary contributor due to early implementation in professional networking and enterprise HR tools. Europe follows with growing adoption in corporate sectors and support from green IT initiatives. Asia Pacific is expected to witness the fastest growth, driven by mobile-first usage patterns in India, China, and Southeast Asia. Latin America and the Middle East are emerging markets, especially in e-commerce, real estate, and digital events.

Business Opportunities

The market offers numerous opportunities for SaaS developers, mobile app builders, CRM vendors, and NFC-enabled card providers. Startups can cater to niche segments like creative professionals or bilingual networking needs. There’s increasing demand for integration with platforms like LinkedIn, Microsoft Teams, and Slack. Localized language support and compliance with regional data laws open new markets. Companies offering embedded analytics, video intro links, and social media aggregation features are likely to attract enterprise clients. Partnering with coworking spaces, accelerators, and professional associations offers a scalable entry point into new geographies and verticals.

Key Segmentation

The market is segmented by type, platform, technology, end-user, and region. By type, digital business cards can be app-based, web-based, or NFC-enabled smart cards. Platform segments include Android, iOS, and cross-platform solutions. Technologies include QR code-based, Bluetooth-enabled, and cloud-synced cards. End-users range from individual professionals and freelancers to SMEs and large enterprises. Industry adoption is particularly high in IT & telecom, consulting, real estate, healthcare, and education. As businesses prioritize automation and eco-friendly tools, smart card integration and AI-driven analytics are becoming key differentiators across segments.

Key Player Analysis

Key players in this market are enhancing user interfaces, offering team features, and enabling offline sharing to improve accessibility. Many are focused on B2B sales, targeting HR teams and marketing departments with bulk onboarding tools. Feature sets now include CRM sync, lead tracking, video embedding, and calendar integration. Security measures such as encrypted links and permission-based access are being prioritized. Players are also experimenting with blockchain-enabled credential verification and API-based partnerships with event platforms. Freemium models with paid professional upgrades are helping acquire users in price-sensitive markets.

- Blinq Technologies Pty Ltd.

- Haystack

- HiHello Inc.

- Itzme

- Mobilo

- Popl

- Spreadly GmbH

- Tapt

- Uniqode Phygital Inc. (Beaconstac)

- Virtual Business Card

- Others

Recent Developments

- In April 2025, a U.S.-based firm launched multilingual templates and video intro embedding features

- In June 2025, a smart card provider introduced NFC-enabled digital cards compatible with Apple and Google Wallets

- In March 2025, a European startup partnered with coworking spaces to deploy digital cards across 120 locations

- In February 2025, a top CRM platform integrated with a leading digital card service for automated lead capture

- In January 2025, a cloud-based tool added analytics dashboards for tracking card views and engagement metrics

Conclusion

The digital business card market is rapidly reshaping how professionals connect, share, and manage identities in a digital-first world. With growing emphasis on cost efficiency, sustainability, and data-driven networking, digital cards are positioned as essential tools for future-ready enterprises and individuals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)