Table of Contents

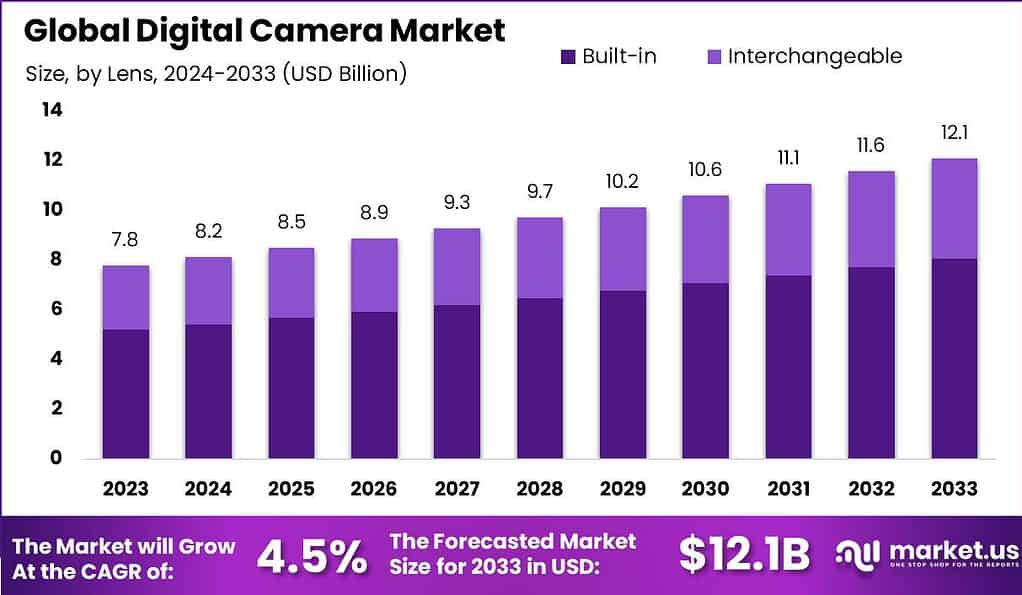

The global digital camera market was valued at approximately USD 7.8 billion in 2023, reflecting a resilient demand despite the growing popularity of smartphone photography. The Asia-Pacific (APAC) region maintained a leading position in the market, accounting for over 40.2% share and generating close to USD 3.1 billion in revenue during the year. This dominance is supported by strong consumer electronics manufacturing hubs, rising disposable incomes, and increasing interest in professional and hobbyist photography across key countries in the region.

The market is projected to grow at a moderate yet steady 4.5% CAGR between 2024 and 2033, reaching an estimated value of around USD 12.1 billion by the end of the forecast period. The adoption of advanced mirrorless cameras, improvements in image sensor technology, and the expanding trend of content creation for social media platforms are expected to drive this growth. Additionally, growing demand from professional photographers and the continued innovation in compact, high-resolution models are anticipated to sustain consumer interest in dedicated cameras over the coming years.

The digital camera market today stands as a robust and ever-evolving industry, serving everyone from novice hobbyists to creative professionals. With a blend of innovation and accessibility, the sector now caters to content creators, enthusiasts, and those who value high-quality visual storytelling. Digital cameras have increasingly found their role in fields such as advertising, entertainment, travel, and documentation. Their evolution reflects not just advances in picture quality or design, but also the growing desire for authentic and visually compelling experiences.

A significant driving force in the digital camera market is the surge in demand for excellent image quality and creative control. As people become more visually fluent through social media and other platforms, the aspiration to capture moments in vivid detail keeps this sector lively. Advanced features like high-resolution sensors, image stabilization, and intuitive interfaces inspire both professionals and newcomers alike. The value placed on creativity and technological progress continues to fuel brand competition and product development, pushing the market forward.

Demand for digital cameras remains consistent, thanks to their unique advantages over mobile devices. Shoppers are drawn to digital cameras for their superior image clarity, adjustable manual settings, and customizable options, factors that delight enthusiasts and improve content quality for professionals. Global trends also reveal that emerging economies, with rising disposable incomes and a surge in tourism, are contributing to a heightened interest in photography – both as a hobby and a profession. The popularity of vlogging, content creation, and event photography sustains a vibrant market for both high-end and entry-level models.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 7.8 billion |

| Forecast Revenue (2033) | USD 12.1 Billion |

| CAGR (2024-2033) | 4.5% |

| Base Year for Estimation | 2023 |

| Historic Period | 2019-2022 |

| Forecast Period | 2023-2033 |

Key Takeaways

- The global digital camera market is projected to grow from USD 7.8 billion in 2023 to approximately USD 12.1 billion by 2033, registering a steady 4.5% CAGR, driven by sustained demand for high-quality imaging and technological advancements.

- In 2023, the Asia-Pacific (APAC) region led the market with over 40.2% share, generating around USD 3.1 billion, supported by strong consumer demand and a growing professional photography community.

- By product type, the built-in lens segment dominated with a significant 66.7% share, reflecting the popularity of compact, non-interchangeable lens cameras among general consumers.

- In the technology category, mirrorless cameras captured more than 48% share in 2023, favored for their lighter weight, portability, and competitive performance compared to traditional DSLRs.

- Professional photographers remained a key user group in 2023, sustaining a strong market presence and driving continued demand for premium, high-performance digital cameras.

Analysts’ Viewpoint

For investors and businesses, the digital camera sector presents opportunities in technology partnerships, accessory development, and expanding to regions where adoption is picking up pace. The growing ecosystem now goes beyond cameras to include lenses, bags, stands, and other gear, all of which feed off the market’s expansion. Alliances between camera makers and tech companies are expected to spark further innovations, especially in artificial intelligence and immersive media like virtual and augmented reality, making this an exciting space for forward-looking investment.

Businesses are leveraging advanced digital cameras to uplift the quality of their marketing materials and the effectiveness of their digital presentations. High-resolution images enhance branding, help real estate professionals close sales, and empower online retailers to attract discerning customers. Digital cameras offer economic advantages in the long run by eliminating ongoing film costs and enabling quick turnaround, which is critical in fast-paced industries. They also foster greater creativity and visual engagement in everything from internal communications to large-scale advertising campaigns.

The regulatory landscape for digital cameras generally involves import duties and standards for electronics that vary between countries. Several regions implement tariffs on imported camera equipment, influencing pricing, competition, and availability. International norms relating to electronic waste and sustainability are pushing manufacturers to adopt greener sourcing and recycling practices, especially as consumers increasingly prefer eco-friendly products. Adherence to data privacy and image use laws also affects both manufacturers and users, guiding responsible innovation and ethics in visual media.

Emerging Trends Analysis

AI-Powered Photography Rising

Artificial intelligence is transforming digital cameras at a rapid pace, emerging as one of the most significant trends in photography today. Cameras now use AI to automate complex editing processes, help users compose better shots, and sharpen images with enhanced detail. The software in newer digital cameras can recognize faces and objects, adjust focus automatically, and even select optimal settings for different scenes. This blend of smart automation and creative support enables both beginners and professionals to create stunning visuals with less effort, making photography more accessible and intuitive than ever before.

Driver Analysis

Enthusiast Demand for Creative Control

One of the strongest drivers in the digital camera sector is the desire among enthusiasts and professionals for more creative control over their photography. Users are looking for cameras that provide manual settings, higher image quality, and advanced shooting features that go far beyond what most smartphones can offer. This demand is pushing manufacturers to develop products that focus on performance, versatility, and customization, appealing to those who want to express their creativity without the technical limitations of basic devices.

Restraint Analysis

Competition from Smartphones

The biggest restraint in the digital camera market comes from the persistent and aggressive competition posed by smartphones. Modern smartphones are packed with advanced camera features, including multiple lenses, AI enhancements, and powerful image sensors. The convenience, portability, and instant sharing options of smartphones attract casual photographers, making it increasingly difficult for entry-level digital cameras to stand out in a crowded market. As a result, many consumers now rely primarily on the device already in their pocket, leading to a decline in sales of traditional cameras for everyday use.

Opportunity Analysis

Affordable Entry-Level Cameras Attract New Users

A promising opportunity for digital camera makers today lies in developing affordable entry-level models that offer a tangible step up from smartphone photography. As the quality gap between smartphones and entry-level cameras narrows, features like optical zoom, better image stabilization, and higher-resolution video draw in users seeking better photos and creative freedom. These models appeal to people who want better results for travel, vlogging, or special occasions but aren’t ready for professional gear, potentially opening up a wider audience for dedicated camera products.

Challenge Analysis

Market Saturation and Price Sensitivity

A major challenge facing the digital camera industry is the risk of market saturation, especially as price sensitivity grows among consumers. With so many capable devices competing for attention, buyers often hesitate to invest in another piece of specialized equipment. This, combined with intense competition and evolving technology, means camera makers need to innovate continuously while keeping prices attractive. Failing to address these pressures can make it difficult to maintain profitability and retain the interest of increasingly selective buyers.

Key Market Segments

Lens Type

- Built-in

- Interchangeable

Product Type

- Compact Digital Camera

- DSLR

- Mirrorless

End Use

- Pro Photographers

- Prosumers

- Hobbyists

Top Key Players in the Market

- Canon Inc.

- Eastman Kodak Company

- FUJIFILM Holdings Corporation

- Leica Camera AG

- Nikon Corporation

- Olympus Corporation

- OM Digital Solutions Corporation

- Panasonic Corporation

- Comp9RICOH IMAGING COMPANY, LTD.

- SIGMA CORPORATION

- Sony Corporation

- Hasselblad

Recent Developments

- In July 2024, Leica Camera AG launched the Leica D‑Lux 8, a compact camera that aligns with the brand’s signature design philosophy. The model features an intuitive control system, an improved user interface, optimized button layout, and ergonomically arranged controls—altogether enhancing user convenience and operational efficiency.

- Subsequently, in June 2024, Nikon Corporation expanded its product offering with the introduction of the NIKKOR Z 35 mm f/1.4 lens, tailored for full-frame/FX-format Z‑mount cameras. This premium wide-angle lens reinforces Nikon’s commitment to optical excellence and caters to both professional and enthusiast photographers seeking high-performance imaging solutions.

Explore More Reports

- Cloud-Based Receipt Management Market

- AI Necklace Market

- Digital Transformation in Social Auditing Market

- IT Spending In Oil and Gas Market

- Franchise Management Software Market

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)