Table of Contents

Introduction

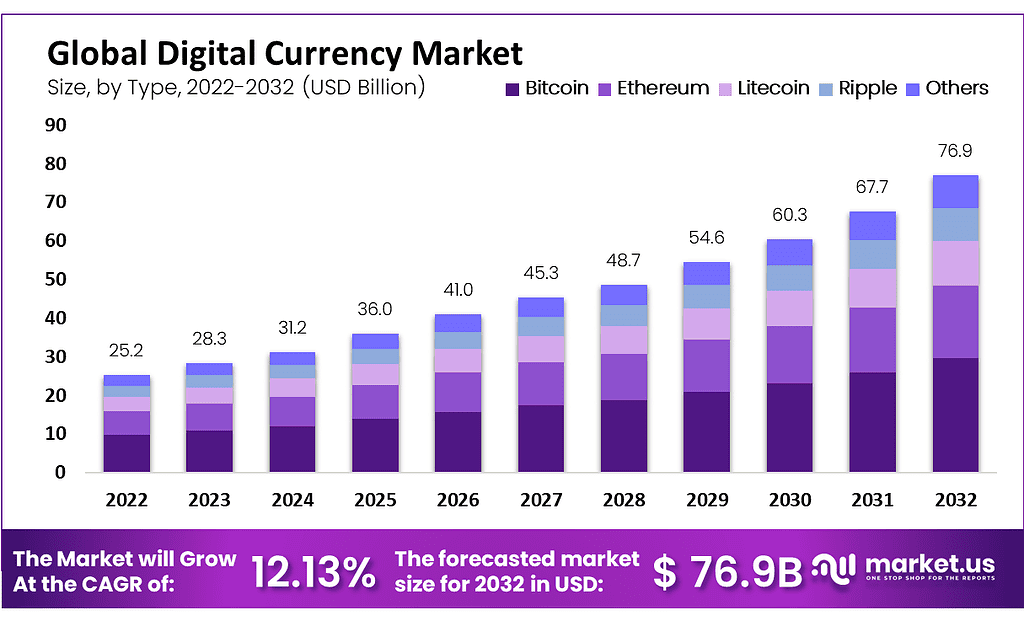

The digital currency market is experiencing rapid expansion, poised to achieve a substantial value of approximately USD 76.9 billion by 2032, with a robust Compound Annual Growth Rate (CAGR) of 12.13% throughout the forecast period. This market encompasses various types of digital currencies, including Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, and others, operating on decentralized platforms and utilizing cryptographic technology for security and transaction control. Unlike traditional currencies, digital currencies are decentralized and function on a distributed ledger called a blockchain.

The digital currency market presents both opportunities and challenges. On one hand, increasing currency volumes and investor interest fuel market growth, especially with the rising popularity of Bitcoin and supportive regulations. Conversely, concerns surrounding decentralized and unauthorized platforms, along with security issues and potential misuse, pose constraints to market expansion.

However, the market remains optimistic about growth prospects, with rising demand for digital currencies driven by technological advancements, increasing consumer awareness, and the adoption of cryptocurrencies in various sectors such as trading, e-commerce, and remittance. Moreover, the flexibility and ease of use offered by digital currencies, coupled with their popularity in developed countries, contribute to market expansion.

Regionally, Asia Pacific emerges as the dominant player in the digital currency market, capturing the largest revenue share. The region’s market dominance is attributed to factors such as partnerships between Chinese crypto mining hardware manufacturers and technological advancements in crypto mining. However, significant growth is also observed in North America, driven by the acceptance and utilization of cryptocurrencies in Non-Fungible Tokens (NFTs) and other applications.

Digital Currency Statistics

- Market Capitalization Trends: As of January 2022, the total market capitalization of stablecoins experienced a decline, decreasing by ~$29.5 billion. Despite this downturn in stablecoins, the overall cryptocurrency market cap exhibited robust growth, rising by 108.1% in 2023, from ~$829 billion to ~$1.72 trillion.

- Transaction Volume and Activity: Ethereum has demonstrated a noteworthy increase in transaction volume. In August 2023, it processed over one million daily on-chain transactions, notably surpassing Bitcoin, which recorded approximately 550,000 transactions in the same month. This surge in activity positions Ethereum as a leading platform in the digital transaction space.

- Bitcoin’s Market Dominance: Throughout 2023, Bitcoin reinforced its position within the cryptocurrency market, increasing its market share from approximately 40% at the beginning of the year to over 52% by year-end. This growth highlights growing investor confidence, partly fueled by anticipation of potential regulatory approvals for Bitcoin exchange-traded funds (ETFs).

- Investment and Funding Developments: The investment landscape within the cryptocurrency sector has remained active. Coinbase secured a substantial ~$100 million in Series C funding, aimed at expanding its platform and developing new products. Similarly, Bitstamp raised an undisclosed amount in a Series A funding round on August 8, 2023, signaling continued investor interest in established digital currency exchanges.

- Trading Volume Insights: The trading dynamics within the cryptocurrency market have shown resilience despite overarching volatility. The average daily trading volume in Q4 of 2023 reached ~$75.1 billion, marking a 91.9% increase over the previous quarter. However, the overall daily trading volume for 2023 was nearly ~$59 billion, still down by 31.6% compared to 2022 figures.

- Future Projections: Looking forward, industry experts are optimistic about the growth of tokenized digital securities. Estimates suggest that the issuance of these digital assets could potentially reach between ~$4 trillion and ~$5 trillion by 2030, indicating a substantial opportunity for growth in this nascent sector.

Emerging Trends

- Increased Regulation and Compliance: As digital currencies gain popularity, regulatory frameworks are evolving. Governments and financial bodies are developing stricter regulations to manage the operational and security aspects of digital currencies, aiming to protect investors and integrate digital currencies into the formal financial system.

- Growth in Decentralized Finance (DeFi): DeFi platforms, which allow financial transactions without traditional intermediaries like banks, are rapidly growing. These platforms use digital currencies and blockchain technology to offer services such as lending, borrowing, and trading.

- Enhanced Privacy Features: There is a rising trend towards enhancing privacy in digital transactions. New technologies and protocols are being developed to improve anonymity in digital currency transactions, making them more secure against tracking and hacking.

- Mainstream Adoption: More businesses across various sectors are accepting digital currencies as payment methods. This trend is facilitated by the increasing availability of digital currency payment tools, making transactions easier and more accessible for consumers and businesses alike.

- Technological Innovations: Innovations such as faster blockchain protocols, energy-efficient transaction mechanisms, and enhanced security measures are becoming pivotal in the digital currency space. These advancements are making digital currencies more practical and appealing for everyday use.

Top Use Cases

- Online Payments: Digital currencies are increasingly used for online purchases, allowing users to transact without the need for traditional banking systems. This use case is particularly popular in regions with less developed banking infrastructure.

- Remittances: Digital currencies offer a cost-effective and fast alternative for sending money across borders. They bypass the fees and time constraints associated with traditional banking systems, making them ideal for remittances.

- Wealth Management: The ability to quickly and easily transfer wealth without intermediary banks and at minimal cost has made digital currencies an attractive option for wealth management.

- Supply Chain Transparency: Blockchain, the underlying technology of many digital currencies, provides a transparent and immutable ledger, which is useful for tracking the authenticity and movement of goods in a supply chain.

- Programmable Money: Digital currencies can be programmed with specific conditions for their use, which is useful in applications such as automated payments when conditions are met, or for creating complex financial instruments.

Major Challenges

- Regulatory Uncertainty: The digital currency industry faces significant challenges due to the lack of clear regulatory frameworks in many countries. Governments and financial authorities are still figuring out how to classify, regulate, and tax these currencies, which creates uncertainty for investors and users.

- Security Concerns: Despite the advanced encryption techniques that underpin digital currencies, the industry is prone to high-profile security breaches and cyber-attacks. These incidents can lead to substantial financial losses for investors and diminish trust in digital currencies.

- Market Volatility: Digital currencies are known for their extreme price fluctuations. This volatility can deter new investors and can make it difficult for businesses to accept these currencies as a stable form of payment.

- Scalability Issues: Many digital currency networks face significant challenges in scaling their operations to handle a larger number of transactions. This can result in slow transaction times and higher costs, impacting user experience and adoption.

- Public Perception and Adoption: Despite growing awareness, there remains a substantial portion of the population that is skeptical about the legitimacy and utility of digital currencies. Overcoming this skepticism is crucial for wider adoption.

Market Opportunities

- Expansion of Blockchain Applications: Beyond just serving as a medium for financial transactions, digital currencies are built on blockchain technology, which has a wide array of potential applications in industries like supply chain management, healthcare, and more. This expansion presents significant growth opportunities.

- Financial Inclusion: Digital currencies offer a unique opportunity to provide financial services to those without access to traditional banking systems, particularly in underbanked regions of the world. This can help in improving global economic inclusivity.

- Institutional Adoption: As more financial institutions, such as banks and investment funds, begin to recognize and integrate digital currencies into their services, there is a considerable opportunity for growth and stabilization of the market.

- Technological Advancements: Continuous improvements in blockchain technology, including enhanced security measures and solutions to scalability issues, are likely to boost the efficiency and appeal of digital currencies.

- Integration with Existing Financial Systems: Developing more seamless integrations with traditional financial systems could enhance the usability and acceptance of digital currencies, thereby expanding their market presence and utility.

Top Key Players Analysis

- Advanced Micro Devices, Inc.: A multinational semiconductor company known for its CPUs and GPUs, which are widely used in cryptocurrency mining rigs.

- Finance: The term “Finance” likely refers to various financial institutions and organizations involved in digital currency transactions and investments.

- Bit Fury Group Limited: A leading provider of hardware solutions and infrastructure for the blockchain and cryptocurrency industries.

- Bit Go, Inc.: A blockchain security company offering institutional-grade custody and liquidity services for digital assets.

- Bit Main Technologies Holding Company: A major player in the cryptocurrency mining industry, known for producing ASIC miners and other hardware for mining Bitcoin and other cryptocurrencies.

- Intel Corporation: A technology giant renowned for its semiconductor products, including CPUs and integrated graphics solutions, which are utilized in various aspects of the digital currency ecosystem.

- NVIDIA Corporation: A leading manufacturer of GPUs, widely used in cryptocurrency mining due to their high computational power and efficiency.

- Ripple: A fintech company that provides solutions for cross-border payments using blockchain technology, with its native digital currency XRP being utilized in its network.

- Xapo Holdings Limited: A company providing digital wallet and cold storage solutions for cryptocurrencies, offering secure storage options for investors and traders.

- Xilinx, Inc.: A semiconductor company specializing in programmable devices and associated technologies, with applications in various fields including digital currency mining and blockchain infrastructure.

Conclusion

In conclusion, the digital currency market is on a robust growth trajectory, supported by technological advancements and a shift in consumer and business behaviors towards digital financial solutions. This growth is expected to continue, fueled by increasing acceptance and the continuous development of new digital currency solutions.

The adoption of digital currencies has led to the emergence of new industries and applications. Decentralized finance (DeFi) has gained momentum, offering financial services like lending, borrowing, and trading without traditional intermediaries. Blockchain technology, which underpins digital currencies, has shown promise in sectors beyond finance, including supply chain management, healthcare, and voting systems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)