Table of Contents

Introduction

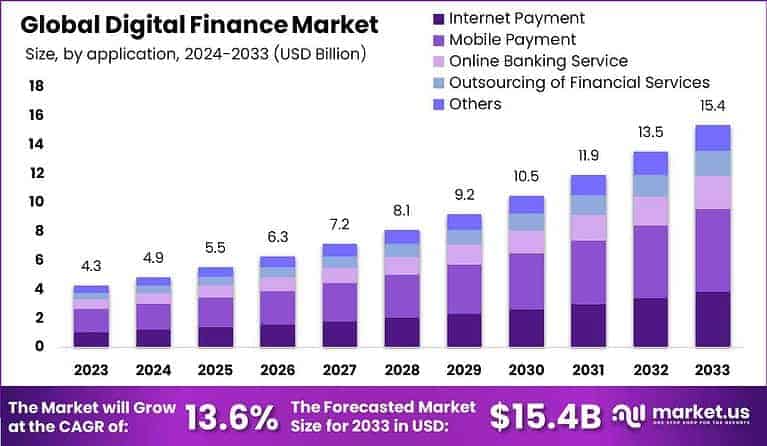

The Global Digital Finance Market is projected to grow from USD 4.3 billion in 2023 to approximately USD 15.4 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 13.60% from 2024 to 2033. In 2023, the Asia-Pacific region dominated the market, accounting for over 30% of the global share and generating USD 1.3 billion in revenues. The rapid adoption of digital payment solutions, blockchain technologies, and online banking services is fueling the market’s growth, offering a more efficient and accessible way for businesses and individuals to manage financial transactions.

How Growth is Impacting the Economy

The growth of the digital finance market is having a transformative impact on the global economy. As digital finance solutions, such as online banking, digital wallets, and blockchain, gain widespread adoption, they are streamlining financial services, improving access to capital, and enhancing financial inclusion.

This digital transformation is enabling more efficient transactions, reducing operational costs for businesses, and increasing the speed of financial services. Furthermore, the growing market for digital payments and cryptocurrencies is providing new business opportunities, generating significant revenue streams, and driving innovation within the financial sector. Additionally, digital finance platforms are improving access to credit for individuals and small businesses, helping to foster economic growth in emerging markets.

➤ Unlock growth! Get your sample now! @ https://market.us/report/digital-finance-market/free-sample/

Impact on Global Businesses

The digital finance market’s expansion is helping businesses navigate rising operational costs and shifts in global supply chains by offering more efficient, transparent, and secure financial solutions. Digital payments, for example, reduce transaction costs, streamline cross-border payments, and simplify the processing of financial transactions.

In sectors like retail, e-commerce, and banking, the integration of digital finance tools is enhancing customer experiences by providing quicker and more convenient payment methods. Furthermore, blockchain technologies are improving transparency and security in supply chain management by offering immutable records and reducing fraud. Businesses in emerging markets are particularly benefiting from digital finance as it facilitates financial inclusion and supports faster access to capital.

Strategies for Businesses

To capitalize on the growing digital finance market, businesses should focus on integrating digital payment systems, blockchain technologies, and mobile banking solutions into their operations. Companies in the banking, fintech, and e-commerce sectors can leverage digital finance tools to streamline transactions, reduce costs, and enhance customer satisfaction.

Additionally, businesses should prioritize enhancing cybersecurity measures to protect sensitive financial data and build customer trust. Partnerships with fintech firms and the adoption of AI-driven financial tools will help companies stay competitive in the rapidly evolving digital finance landscape. Lastly, expanding services to include cryptocurrency transactions and decentralized finance (DeFi) solutions can offer new growth avenues.

Key Takeaways

- The Digital Finance market is expected to grow from USD 4.3 billion in 2023 to USD 15.4 billion by 2033, at a CAGR of 13.60%.

- Asia-Pacific held the largest market share in 2023, contributing over 30% with USD 1.3 billion in revenue.

- Digital payment solutions, blockchain, and mobile banking are driving the market’s growth.

- Businesses can leverage digital finance tools to streamline transactions, enhance customer satisfaction, and improve cost efficiency.

- The increasing adoption of cryptocurrencies and DeFi is offering new opportunities for growth in the digital finance space.

➤ Stay ahead—secure your copy now @ https://market.us/purchase-report/?report_id=132640

Analyst Viewpoint

The digital finance market is currently experiencing robust growth, driven by advancements in blockchain, digital payments, and fintech services. As businesses and individuals increasingly embrace digital finance platforms for their convenience, speed, and security, the market is expected to continue its upward trajectory. The future outlook remains highly positive, with continued technological innovations, regulatory advancements, and a growing global user base. Digital finance solutions are expected to further integrate into the fabric of the global economy, offering new opportunities for financial inclusion, improved efficiency, and enhanced transparency across industries.

Regional Analysis

The Asia-Pacific region is leading the digital finance market, holding over 30% of the global market share in 2023. This dominance is driven by the rapid adoption of digital payment solutions, the growing e-commerce sector, and increased smartphone penetration in countries like China, India, and Japan. North America follows closely, with significant investments in fintech startups and blockchain technology.

Europe is also experiencing steady growth, primarily due to advancements in mobile banking and digital currencies. Latin America and the Middle East & and Africa are gradually adopting digital finance solutions, providing potential growth opportunities in these emerging markets.

Business Opportunities

The growing digital finance market presents several opportunities for businesses to innovate and expand their offerings. Companies can focus on developing or enhancing mobile payment platforms, blockchain-based financial solutions, and decentralized finance (DeFi) applications. Additionally, financial institutions can explore new revenue streams by offering cryptocurrency trading and digital asset management services.

As the market for digital payments continues to grow, opportunities also exist for businesses to integrate these solutions into global e-commerce platforms, enabling seamless transactions for consumers and businesses alike. The increasing demand for financial inclusion in emerging markets further creates opportunities for digital finance providers to expand their services.

Key Segmentation

The Digital Finance market is segmented by service type, technology, and region.

- By Service Type: Digital Payments, Blockchain Solutions, Mobile Banking, Cryptocurrency, and DeFi Services.

- By Technology: Blockchain, Artificial Intelligence, Machine Learning, Cloud Computing, and Mobile Technology.

- By Region: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Key Player Analysis

Leading players in the Digital Finance market are focusing on developing innovative digital payment platforms, blockchain technologies, and mobile banking solutions to meet the growing demand for financial services. These companies are investing in research and development to improve the speed, security, and convenience of digital finance solutions.

Strategic partnerships, acquisitions, and collaborations with fintech firms and technology providers are common strategies for expanding market presence and offering integrated services. Additionally, key players are working on expanding cryptocurrency and DeFi services to capture new revenue streams and stay ahead of the competition.

- PayPal Holdings, Inc.

- Square, Inc

- Ant Group Co., Ltd.

- Stripe, Inc.

- Adyen N.V.

- Robinhood Markets, Inc.

- Revolut Ltd

- TransferWise Ltd

- Klarna Bank AB

- SoFi Technologies, Inc.

- Adyen

- Mastercard

- Visa

- Tencent Holdings Ltd. Company Profile

- Google Pay

- Apple Pay

- Other Key Players

Recent Developments

- January 2024 – A major digital finance firm launched a blockchain-based solution to enhance cross-border payments.

- March 2024 – A fintech startup introduced an AI-powered mobile banking platform for seamless transactions.

- June 2024 – A global payments company expanded its services to include cryptocurrency payment processing.

- August 2024 – A prominent bank partnered with a fintech company to offer decentralized finance solutions to its customers.

- October 2024 – A digital finance platform introduced new features to enable instant peer-to-peer payments via mobile devices.

Conclusion

The Digital Finance market is set to experience significant growth, driven by the increasing adoption of digital payments, blockchain, and mobile banking solutions. As businesses and consumers increasingly embrace these technologies, the market will continue to expand, offering new opportunities for financial inclusion, improved efficiency, and innovation. The future of digital finance is promising, with emerging technologies paving the way for more accessible, secure, and efficient financial services.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)