Table of Contents

Introduction

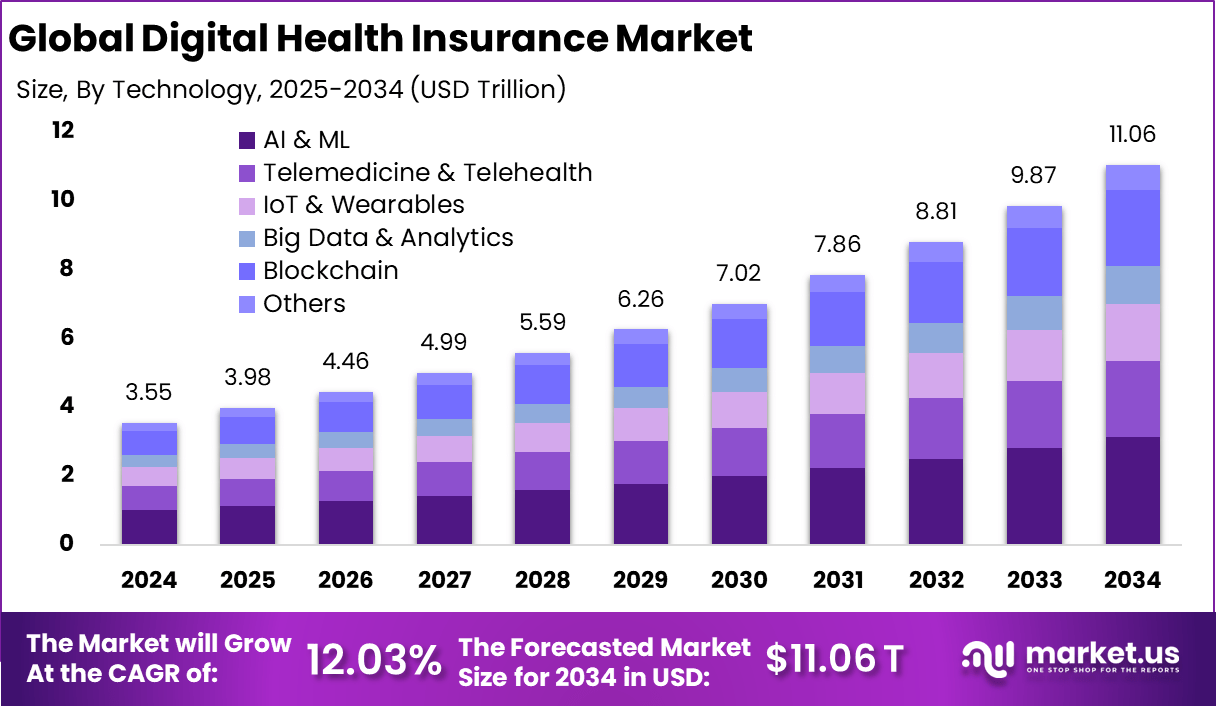

The global digital health insurance market was valued at USD 3.55 trillion in 2024 and is projected to grow from USD 3.98 trillion in 2025 to approximately USD 11.06 trillion by 2034, registering a CAGR of 12.03%. North America held a dominant position in 2024, accounting for USD 1.44 trillion and a 40.6% market share.

This growth is fueled by rising adoption of telemedicine, AI-based underwriting, wearable-driven health tracking, and digital claim processing. Increasing internet penetration, expansion of e-health platforms, and integration of big-data analytics in insurance operations are transforming the global healthcare and insurance landscape.

How Growth is Impacting the Economy

The expansion of digital health insurance is significantly influencing global economic structures. Enhanced digital infrastructure and AI adoption are spurring investments in data-driven health ecosystems, boosting employment across insurance technology, telehealth, and analytics sectors. Cost-efficiency from automation and predictive risk modeling improves insurer profitability while reducing healthcare costs for consumers.

Economically, it strengthens preventive healthcare measures and reduces public-health expenditure through early diagnostics and digital health monitoring. The transition toward digital ecosystems fosters fintech-healthtech convergence, enabling faster claim settlements and expanding coverage to underserved populations. Additionally, government initiatives for health-digitization, such as national electronic health records and AI-enabled claim management systems, promote economic stability by improving transparency, reducing fraud, and fostering inclusive healthcare financing.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/digital-health-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

While digital transformation lowers long-term operational costs, initial adoption involves high capital outlay for IT infrastructure, cybersecurity, and regulatory compliance. Insurers and healthcare providers face expenses in cloud migration, AI model training, and data integration. Supply chains within health insurance ecosystems are shifting toward API-based interoperability between hospitals, pharmacies, and insurers, increasing operational efficiency and data transparency.

Sector-Specific Impacts

Healthcare providers gain through streamlined patient data exchange and automated reimbursement, reducing delays and administrative costs. Employers benefit from digitally managed health plans that support workforce wellness programs. The pharmaceutical and diagnostics sectors experience enhanced reimbursement efficiency via blockchain-based claim systems. However, digital dependence heightens cyber-risk exposure, compelling businesses to invest in advanced data protection and risk-management solutions.

Strategies for Businesses

Businesses must integrate robust digital-first strategies to remain competitive. Key actions include adopting AI and predictive analytics for personalized insurance offerings, developing secure cloud-based claim platforms, and integrating telemedicine partnerships to enhance value-added services. Continuous investment in cybersecurity, regulatory compliance, and digital literacy among employees ensures operational resilience. Insurers should leverage blockchain for transparent transactions, while collaboration with digital health startups can accelerate innovation. Measuring customer satisfaction and claim turnaround time through data-driven dashboards will help refine user experience and retain clients in an increasingly competitive market.

Key Takeaways

- Global digital health insurance market expected to surpass USD 11 trillion by 2034, growing at a 12.03% CAGR.

- North America leads with over 40.6% market share in 2024.

- Growth driven by telemedicine, AI-based underwriting, wearables, and claim automation.

- Economic impact includes cost efficiency, fraud reduction, and healthtech job creation.

- Businesses face high upfront digital investment but gain long-term efficiency.

- Strategies should focus on AI integration, cybersecurity, partnerships, and compliance frameworks.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=163118

Analyst Viewpoint

At present, the digital health insurance market is undergoing rapid transformation as data analytics and AI reshape traditional risk-assessment models. The market is witnessing significant synergy between insurers, digital-health providers, and fintech ecosystems. Looking ahead, the outlook remains positive: cloud computing, wearables, and personalized policy design are anticipated to make digital health insurance more inclusive and efficient. As regulatory clarity improves and digital literacy rises globally, insurers that embrace transparency and AI-enabled automation are expected to lead future growth, redefining how healthcare and insurance intersect to deliver preventive and patient-centric outcomes.

Use Case & Growth Factors

| Use Case | Growth Factor |

|---|---|

| AI-driven underwriting & predictive health scoring | Rising demand for personalized and data-based policy pricing |

| Blockchain-enabled claims management | Need for fraud prevention and faster claim settlement |

| Telemedicine-integrated health insurance plans | Expansion of remote healthcare access |

| Wearable-based premium adjustment programs | Growth in fitness tracking and proactive wellness adoption |

| Cloud-based policy administration platforms | Increasing need for real-time data access and scalability |

Regional Analysis

North America dominates the global digital health insurance market with USD 1.44 trillion in 2024, supported by early digital adoption, advanced healthcare IT infrastructure, and regulatory incentives for data transparency. Europe follows, with rapid expansion in telehealth coverage and e-claim management systems. Asia Pacific is witnessing accelerated growth due to rising digital-insurance startups in India, China, and Japan, coupled with national health-digitization programs. Latin America and the Middle East & Africa show emerging potential, primarily driven by mobile health applications and digital payment adoption. Regional growth disparities hinge on regulatory readiness, digital infrastructure, and consumer trust in data-sharing models.

➤ More data, more decisions! see what’s next –

- Logistics Finance Market

- Puddling Robot Market

- RPA in Insurance Market

- Travel Guard Insurance Market

Business Opportunities

Expanding digital health insurance presents vast opportunities for technology developers, insurers, and healthcare providers. Insurtech startups can introduce AI-driven risk analytics and telehealth integration platforms, while established insurers can diversify offerings through hybrid health-fintech models. Data-security companies can capitalize on the increasing demand for secure cloud-based health data systems.

Governments and private investors can collaborate to enhance digital-inclusion initiatives, bringing affordable, technology-enabled insurance solutions to rural and underserved populations. The convergence of IoT, wearable devices, and data analytics will unlock new revenue streams through health-monitoring subscriptions and performance-based premium models.

Key Segmentation

The digital health insurance market can be segmented by deployment, technology, end-user, and region. By Deployment: cloud-based platforms and on-premises systems. By Technology: AI-powered analytics, blockchain, telemedicine integration, IoT & wearable connectivity. By End-User: individuals, corporations, hospitals, and government health programs.

By Region: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Cloud-based solutions dominate due to scalability, while AI analytics drives innovation in claim prediction and fraud prevention. Corporations increasingly adopt digital employee-wellness insurance platforms, while governments integrate health insurance with national e-health frameworks to enhance universal coverage.

Key Player Analysis

Leading companies in the digital health insurance ecosystem are focusing on integrating AI-driven decision engines, cloud-native architectures, and user-centric mobile applications. These players are expanding their global reach through partnerships with telehealth providers and fintech firms. Their competitive advantage lies in predictive analytics, data-security standards, and customer-centric digital interfaces.

Heavy investment in R&D and strategic acquisitions strengthens product portfolios across emerging markets. Players also focus on omnichannel platforms combining policy issuance, claim tracking, and virtual consultation. Firms that offer interoperability with digital-health ecosystems and comply with evolving data-privacy laws are expected to capture significant market share over the next decade.

- Oscar Health

- Cigna

- Aetna (CVS Health)

- UnitedHealth Group

- Anthem Inc.

- Humana

- Bupa Global

- Benevolent Health

- Lemonade Health

- Clover Health

- Zocdoc

- Forward

- Alan

- Metromile

- Bright Health

- Lively

- MediSprout

- Gusto Health

- Kaiser Permanente

- Truvian Health

- HealthSherpa

- One Medical

- Others

Recent Developments

- A leading digital insurer launched an AI-driven policy engine that personalizes premiums based on health-tracking data.

- Blockchain technology was introduced in claim-verification systems to reduce fraud and accelerate settlements.

- Governments in the EU and Asia initiated digital-insurance regulations to expand e-claim adoption.

- Integration between wearable manufacturers and insurers enabled dynamic premium adjustments.

- Cloud migration of policy management systems improved scalability and real-time claim processing efficiency.

Conclusion

The digital health insurance market is revolutionizing global healthcare delivery through technology integration, AI automation, and customer-centric models. With strong economic impact and policy innovation, it is poised to create a resilient, transparent, and inclusive global insurance ecosystem over the next decade.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)