Table of Contents

- Introduction

- Editor’s Choice

- Global Digital Identity Solutions Market Overview

- Knowledge Regarding the Term “Digital Identity”

- People’s Definition of Digital Identity Solution Statistics

- People’s Trust in Digital Identity Solutions Statistics

- Issues Driving the Demand for Digital Identity Solutions

- Identity Verification for AML/KYC Purposes

- Popular Digital Identity Solutions Schemes Statistics

- Technological Advancements in Digital Identity Solutions

- Regulatory Standards for Digital Identity Solutions

- Challenges in Implementing Digital Identity Solutions

- Conclusion

- FAQs

Introduction

Digital Identity Solutions Statistics: Digital identity solutions are vital for confirming and overseeing identities in today’s digital landscape. They utilize technologies such as biometrics and cryptography to validate users securely.

These solutions are pivotal in establishing trust and security in online transactions, spanning from online shopping to governmental activities. Critical elements encompass methods for authentication, processes for verifying identities, and systems for managing identities.

Emerging patterns consist of decentralized identity, biometric validation, the zero-trust security model, and endeavors to enhance interoperability. In essence, digital identity solutions serve as the cornerstone of the digital economy, ensuring protected and smooth online interactions while preserving user confidentiality.

Editor’s Choice

- In 2022, the global digital identity solutions market stood at a total revenue of USD 28.0 billion, with solutions accounting for USD 17.0 billion and services for USD 11.0 billion.

- By 2032, the global digital identity solutions market is forecasted to exceed $131.6 billion, reflecting the increasing importance and adoption of digital identity technologies across various industries and sectors.

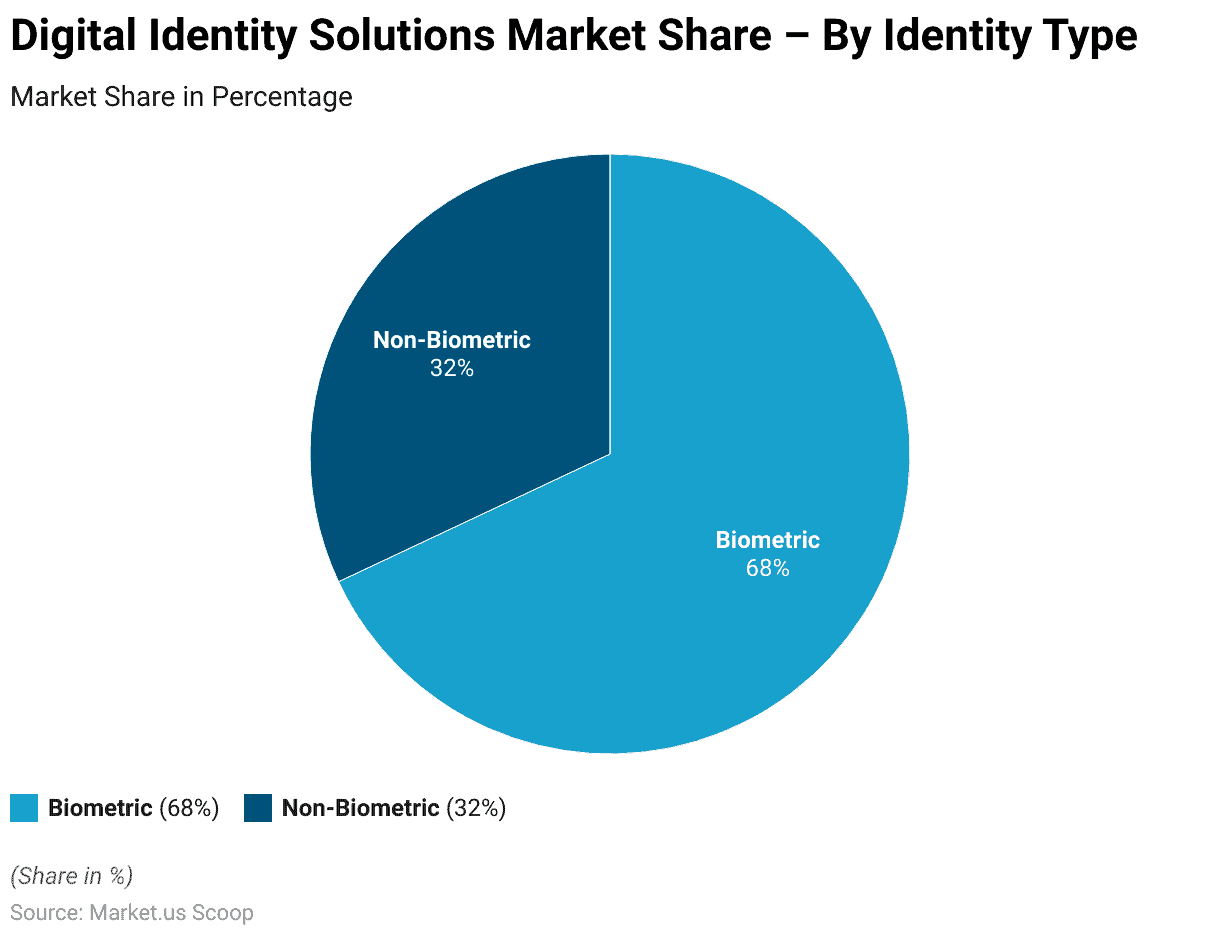

- The global digital identity solutions market is characterized by a dominant presence of biometric identity types, which command a substantial market share of 68%.

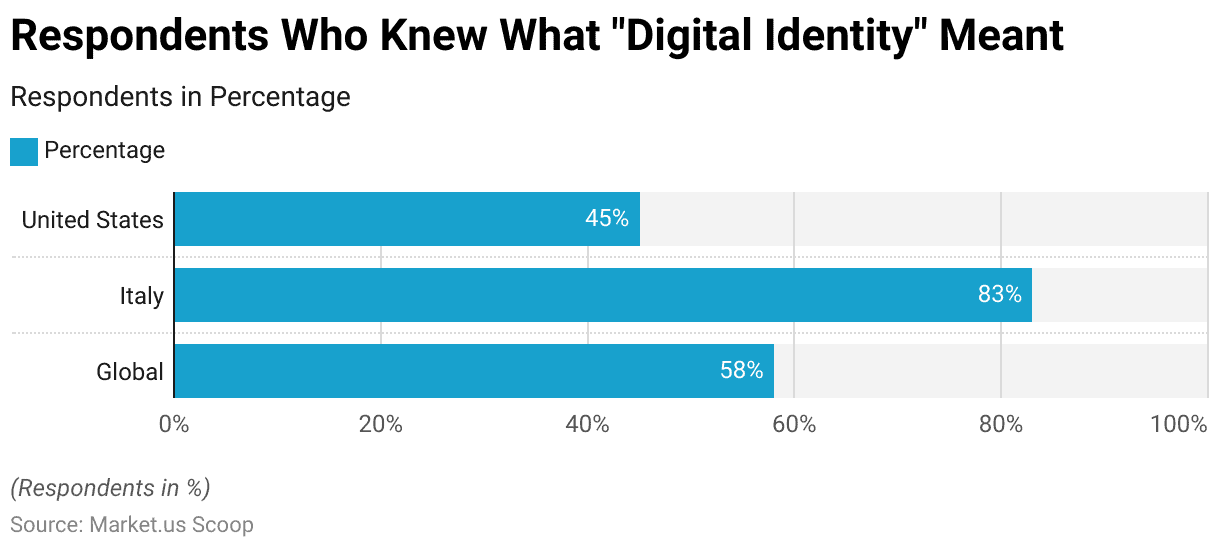

- Globally, only 58% of the respondents reported understanding the term ‘digital identity’ in a survey. However, this understanding varied significantly across countries.

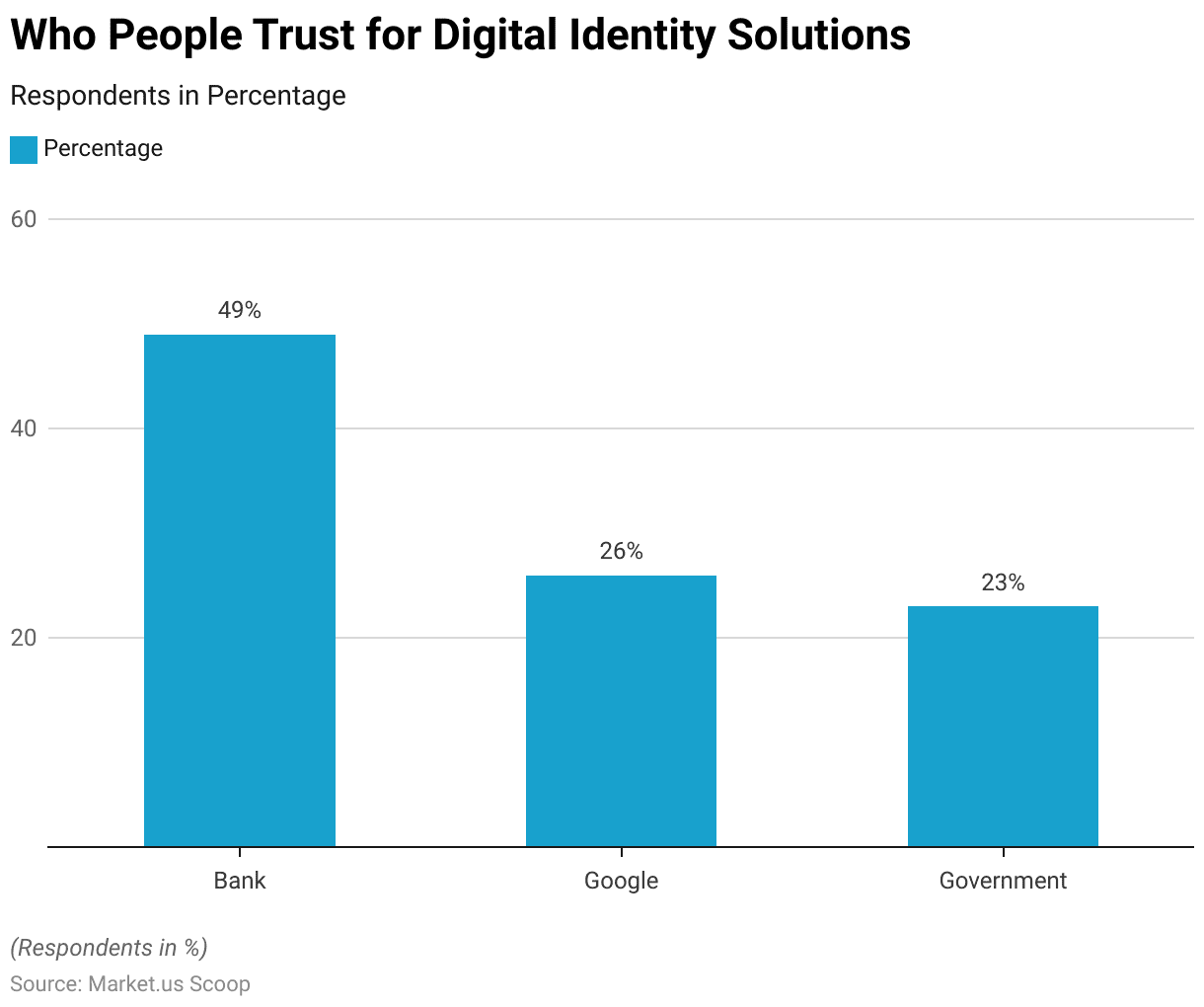

- In terms of trust in delivering a single digital identity service, respondents across all countries indicated their bank as the most preferred choice, with 49% expressing confidence in this option.

- The primary culprit behind significant insider data breaches is human error, according to 84% of organizations reporting security incidents stemming from mistakes.

- The UN and World Bank’s ID4D initiative, in collaboration, aims to ensure that every individual worldwide possesses a legal identity by the year 2030.

Global Digital Identity Solutions Market Overview

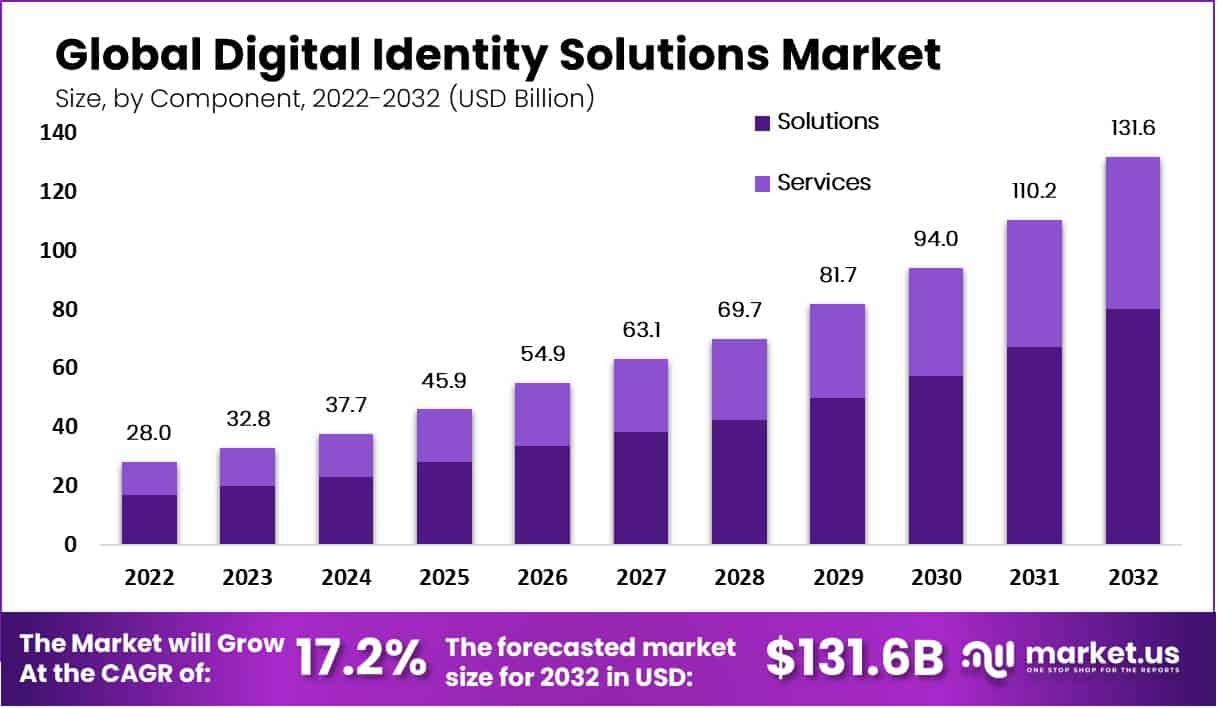

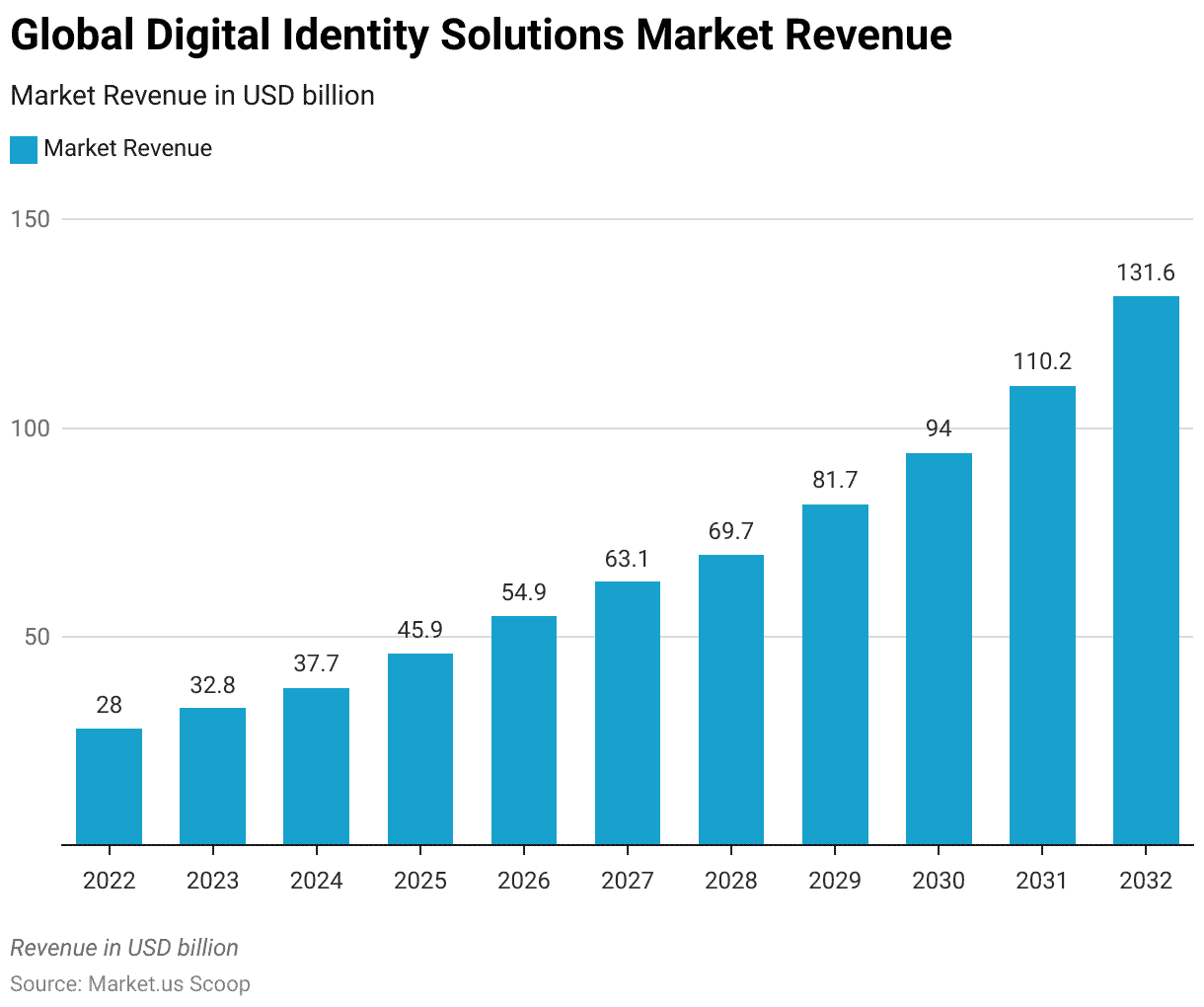

Digital Identity Solutions Market Size Statistics

- The global digital identity solutions market has experienced significant growth at a CAGR of 17.2 %, with revenues climbing steadily over the years.

- Starting at $28.0 billion in 2022, the market saw an increase to $32.8 billion in 2023, followed by a further rise to $37.7 billion in 2024.

- Projections indicate continued expansion, with anticipated revenues reaching $45.9 billion in 2025 and climbing to $54.9 billion by 2026.

- The trend persists, with the market expected to surpass $63.1 billion in 2027 and $69.7 billion in 2028.

- By 2029, revenues are forecasted to reach $81.7 billion, marking substantial growth.

- Looking ahead, the market is expected to continue its upward trajectory, with revenues projected to hit $94.0 billion in 2030 and reach $110.2 billion by 2031.

- By 2032, the global digital identity solutions market is forecasted to exceed $131.6 billion, reflecting the increasing importance and adoption of digital identity technologies across various industries and sectors.

(Source: Market.us)

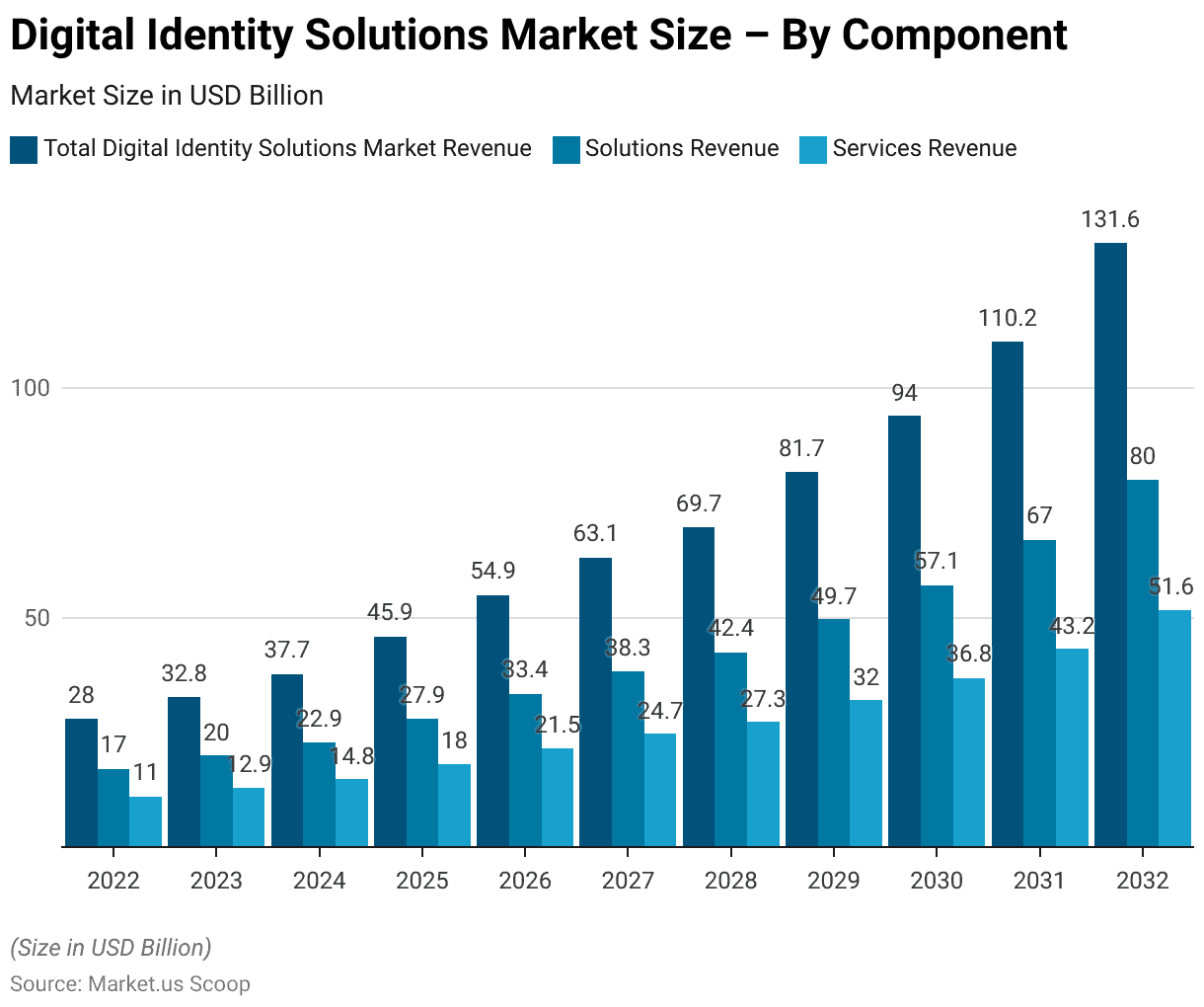

Global Digital Identity Solutions Market Size – By Component Statistics

- The global digital identity solutions market demonstrates robust growth, as evidenced by its escalating revenue figures over the forecast period from 2022 to 2032.

- In 2022, the market stood at a total revenue of USD 28.0 billion, with solutions accounting for USD 17.0 billion and services for USD 11.0 billion.

- The market continued to expand, reaching USD 32.8 billion in 2023, with solutions generating USD 20.0 billion and services USD 12.9 billion.

- This growth trajectory persisted, with the market size climbing to USD 37.7 billion in 2024, comprising USD 22.9 billion from solutions and USD 14.8 billion from services.

- Over the subsequent years, the market is projected to witness exponential growth, with revenue reaching USD 131.6 billion by 2032.

- This growth is driven by increasing digitization across industries, heightened concerns for security and privacy, and the growing adoption of digital identity solutions to facilitate seamless and secure transactions.

- Moreover, the increasing demand for digital identity verification in various sectors such as finance, healthcare, and e-commerce further propels market expansion.

- Additionally, advancements in technologies such as blockchain, biometrics, and artificial intelligence are expected to enhance the capabilities and adoption of digital identity solutions globally, fostering a landscape ripe with opportunities for market players.

(Source: Market.us)

Global Digital Identity Solutions Market Share – By Identity Type Statistics

- The global digital identity solutions market is characterized by a dominant presence of biometric identity types, which command a substantial market share of 68%.

- Biometric solutions, leveraging unique physiological or behavioral characteristics for identity verification, are widely adopted across various sectors due to their high level of accuracy and security.

- Conversely, non-biometric identity solutions account for the remaining 32% of the market share.

- While non-biometric methods encompass a range of identity verification techniques such as knowledge-based authentication and tokenization, they often serve as complementary approaches to biometric technologies or are preferred in scenarios where biometric data collection is impractical or less feasible.

- This market distribution underscores the significant reliance on biometric authentication methods in the digital identity landscape, driven by increasing concerns for security and the need for seamless and reliable identity verification processes.

(Source: Market.us)

Knowledge Regarding the Term “Digital Identity”

- Globally, only 58% of the respondents reported understanding the term ‘digital identity’ in a survey. However, this understanding varied significantly across countries.

- For example, Italian participants demonstrated greater confidence, with 83% expressing familiarity with the concept.

- In contrast, respondents from the United States showed the least certainty in their comprehension of digital identity, with only 45% indicating that they understood the term.

- These findings highlight the divergent levels of awareness and understanding of digital identity among different populations.

(Source: iProov)

People’s Definition of Digital Identity Solution Statistics

- Among the respondents, 42% identified ‘any information existing online about oneself’ as the definition of digital identity, which was deemed the most accurate option provided.

- Notably, German participants were the most likely to select this definition, with 52% agreeing.

- Alternatively, 14% of respondents viewed their e-signature as their digital identity, while 5% associated it with their email address.

- These findings highlight varying perceptions of digital identity among respondents, with a significant proportion recognizing the concept as linked to online information, particularly among the German cohort.

(Source: iProov)

People’s Trust in Digital Identity Solutions Statistics

- In terms of trust in delivering a single digital identity service, respondents across all countries indicated their bank as the most preferred choice, with 49% expressing confidence in this option.

- Google garnered 26% of trust, ranking highest in Mexico but lowest in Germany.

- Conversely, government agencies were selected by 23% of respondents, with Australia reporting the highest trust level and Mexico and the United States showing the lowest levels of confidence in government entities for providing digital identity services.

- These findings underscore the varying levels of trust across different sectors for managing individuals’ digital identities.

(Source: iProov)

Issues Driving the Demand for Digital Identity Solutions

- The primary culprit behind significant insider data breaches is human error, according to 84% of organizations reporting security incidents stemming from mistakes.

- Concerns loom over the implications of remote and hybrid work arrangements for future breaches.

- A considerable 54% anticipate increased difficulty in thwarting data breaches caused by human error due to remote or hybrid work setups.

- Additionally, 50% foresee heightened challenges in preventing phishing attacks, while 49% express concerns about enforcing security protocols among remote employees.

- These findings underscore the apprehensions of organizations regarding the impact of remote and hybrid work models on cybersecurity, particularly in mitigating human error and phishing threats, as well as ensuring adherence to security policies.

(Source: Continuity Central Research)

Identity Verification for AML/KYC Purposes

- In 2021, organizations invested approximately $1.4 billion in AML and KYC data and services.

- A significant 92% of Americans have made online purchases, while over 75% have engaged in some form of online banking, prompting financial institutions to implement stricter identity verification measures.

- Moreover, 62% of highly connected consumers reported receiving payments through mobile wallets at least once within the preceding 12 months, according to the survey conducted.

(Source: Burton-Taylor International Consulting, PYMNTS)

Popular Digital Identity Solutions Schemes Statistics

United Nations

- The ID2020 summit held in New York in May 2016 saw the United Nations initiate discussions on digital identity, blockchain technology, and cryptographic advancements, emphasizing their potential benefits for marginalized communities.

- With the participation of 400 experts, the summit aimed to facilitate the exchange of best practices and ideas to ensure universal access to identity for all individuals.

- Subsequently, numerous countries began implementing or enhancing national electronic identification (eID) programs, encompassing traditional card-based systems and mobile-based initiatives, irrespective of the ID2020 initiative.

- These initiatives included diverse projects in various countries, with many integrating biometric authentication methods, primarily fingerprint recognition technology.

(Source: UN, Thales Group)

United Kingdom

- Notable programs such as the Gov.UK Verify initiative were launched in 2016, with the British government unveiling an updated version of its digital identity and attributes trust framework in August 2021.

(Source: Gov.UK)

Germany

- Germany announced plans in February 2021 for citizens to store a digital copy of their national ID card on mobile devices for use as a digital ID, authenticated via a personal identification number (PIN).

(Source: AP)

Canada

- Canada has also made progress with its federal digital identity initiative, the Pan-Canadian Trust Framework, led by the Digital ID Authentication Council of Canada (DIACC).

- A national proof-of-concept project for a unified login authentication service, sign in Canada, began in the fall of 2018.

(Source: Digital ID & Authentication Council of Canada (DIACC)

India

- India’s national eID scheme, Aadhaar, exceeded one billion users in 2016, with over 1.3 billion Aadhaar electronic IDs issued as of August 2021, covering 99% of adults.

- The mAadhaar app, available in 13 languages on Android and iOS platforms since 2019, serves as a virtual ID card, leveraging biometric and demographic data.

(Source: Unique Identification Authority of India)

Technological Advancements in Digital Identity Solutions

- The UN and World Bank’s ID4D initiative, in collaboration, aims to ensure that every individual worldwide possesses a legal identity by the year 2030.

- Additionally, momentum has been building for digital driver’s license projects, also referred to as mobile driver’s licenses, in various countries such as the UK, USA, Korea, Australia, Denmark, and the Netherlands.

- In April 2021, the US Department of Homeland Security Office of Strategy and Policy initiated a public request for comment regarding digital ID security standards and platforms.

- The objective is to facilitate Federal agencies, notably the TSA (Transit Security Administration), in accepting these credentials nationwide for official purposes.

- Smart borders and airports have rapidly emerged, facilitated by the widespread adoption of biometrics, especially face recognition technology, and the circulation of over 1.2 billion ePassports. These advancements provide travelers with a secure and efficient cross-border experience.

- The security industry has made significant strides in enhancing Identity and Access Management (IAM) and ID verification solutions, notably through the development of secure onboarding applications, including facial recognition with liveness recognition capabilities.

- Notably, the accuracy of leading facial recognition algorithms has increased significantly, by a factor of 50 in less than six years, driven by advancements in artificial intelligence technology.

(Source: World Bank, Thales Group, Federal Register- The Daily Journal of the United States Government)

Regulatory Standards for Digital Identity Solutions

- Australia took the lead in forming a new ICAO working group concentrating on digital travel credentials.

- The ICAO (Sub-Group) NTWG Logical Data Structure 2 initiated the preliminary stage of the LDS2 conception to influence the future direction of ePassports.

- Furthermore, the “Mobile Driving Licence” (ISO SC17 WG10 – Task Force 14) initiated endeavors to establish verification standards for Mobile DL, defining the parameters of offline verification.

- Draft specifications for both offline and online verification surfaced as a new task during the years 2018 and 2019.

- In Japan, interoperability tests were conducted in 2018, followed by similar tests in the USA and Australia in 2019, and then in the Netherlands and the USA again in 2021.

- The ISO/IEC 18013-5 standard was completed and released in September 2021. Originally intended to outline specifications for mobile driver licenses, this ISO standard extends its scope by clearly outlining security and communication protocols for digitalized documents, ensuring their verification and trustworthiness.

(Source: Thales Group, ISO)

Challenges in Implementing Digital Identity Solutions

- Among banks, 62% cite “increased regulatory expectations and enforcement of current regulations” as the primary challenge in Anti-Money Laundering (AML) compliance.

- Additionally, 55% highlight the difficulty of having an adequate number of well-trained AML staff.

- Another significant challenge, identified by 48% of respondents, is the lack of sufficient or updated technology to manage AML compliance obligations.

- Regarding operational challenges in AML compliance, 80% mention the time-consuming nature of manual processes.

- Additionally, 74% express concerns about the poor quality of available data or the absence of a unified view of customer processes.

- Finally, 50% mention issues related to screening technology or processes generating excessive false-positive results.

(Source: Deloitte)

Conclusion

Digital Identity Solutions Statistics – In today’s digital era, digital identity solutions are essential for secure online interactions and user privacy. With increasing digitization and the adoption of technologies like biometrics and cryptography, the global market for these solutions is rapidly growing.

Organizations worldwide are investing in digital identity to bolster security, streamline operations, and comply with regulations. Key trends include decentralized identity, biometric authentication, and efforts to improve interoperability.

Challenges such as regulatory compliance, data security, and complexity management persist. However, digital identity solutions play a critical role in driving innovation and industry growth in the digital economy. As technology advances, these solutions will continue to be vital for ensuring smooth and secure online experiences.

FAQs

Digital identity solutions refer to technologies and systems used to authenticate and manage the identities of individuals or entities in the digital realm. These solutions often incorporate various methods such as biometrics, cryptography, and authentication mechanisms to verify and protect identities online.

Digital identity solutions are crucial for ensuring secure online interactions and protecting user privacy. They help verify the identities of individuals or entities accessing digital services, preventing unauthorized access and fraudulent activities. Additionally, digital identity solutions are essential for compliance with regulatory requirements and maintaining trust in digital transactions.

Key components of digital identity solutions include authentication mechanisms, identity verification processes, identity management systems, and security protocols. These components work together to verify the identity of users and protect sensitive information from unauthorized access or misuse.

Emerging trends in digital identity solutions include decentralized identity, biometric authentication, zero-trust security models, and efforts to promote interoperability among different systems. Additionally, advancements in technologies such as artificial intelligence and machine learning are shaping the future of digital identity solutions.

Challenges in digital identity solutions include regulatory compliance, data security, complexity management, and ensuring user privacy. Organizations must navigate these challenges to effectively implement and maintain digital identity solutions while balancing security and usability.