Table of Contents

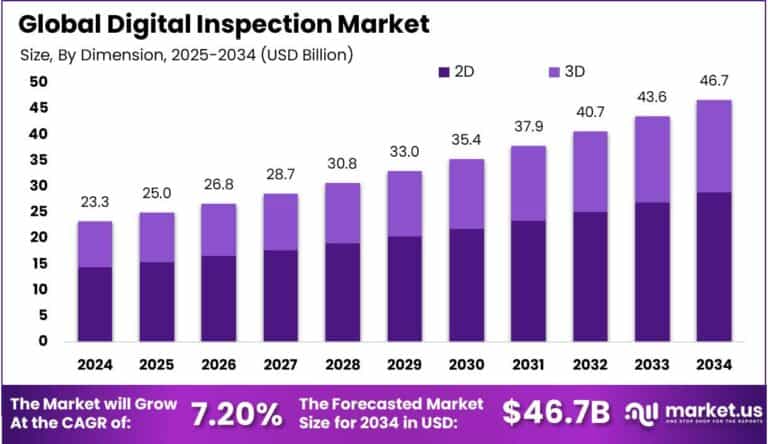

The global Digital Inspection Market is projected to grow from USD 23.31 billion in 2024 to USD 46.7 billion by 2034, registering a CAGR of 7.20%. North America led the market in 2024, contributing over 33% of the global share and generating USD 7.6 billion in revenue.

The U.S. digital inspection market, valued at USD 7.29 billion, is expected to grow at a CAGR of 5.8%. Key drivers of growth include rising demand for advanced quality assurance and compliance solutions, the increasing adoption of high-performance inspection tools, and the widespread use of machine vision in automated manufacturing processes.

How Tariffs Are Impacting the Economy

Tariffs have significantly impacted the U.S. economy, raising the cost of imported goods and raw materials. Industries reliant on global supply chains, including manufacturing and technology, have seen increased production costs. This has led to higher prices for finished products, which businesses often pass on to consumers, leading to inflation.

In the digital inspection market, tariffs on high-performance inspection tools, sensors, and other electronic components have increased operational costs for manufacturers and end-users. These increased costs are challenging businesses to maintain competitive pricing. Additionally, supply chain disruptions caused by tariffs lead to delays in product deliveries, further complicating business operations.

As a result, U.S. companies are reevaluating their sourcing strategies, exploring alternatives such as nearshoring or diversifying supply chains. While tariffs negatively impact the cost structure, they have also prompted innovation in automation and technological advancements, pushing industries toward adopting more efficient, automated solutions like digital inspection tools to minimize human error and improve operational efficiency.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Global businesses are facing rising operational costs due to tariffs on imported materials and components, which is especially impactful for industries like manufacturing, automotive, and technology. The increased cost of raw materials, such as sensors and electronic components used in digital inspection devices, is forcing companies to either absorb the additional cost or pass it on to consumers. This has led to inflationary pressures, particularly in sectors that rely heavily on advanced technology and automated solutions.

Sector-Specific Impacts

In the digital inspection sector, the manufacturing industry is significantly impacted by rising costs. As manufacturers face higher inspection tool prices due to tariff-induced price hikes, they are pressured to adopt more cost-effective and efficient inspection technologies.

Industries like automotive and electronics, where quality assurance is critical, are turning increasingly to digital inspection solutions like machine vision to automate processes and reduce dependency on human inspection labor. The market for digital inspection tools is expected to continue to grow as manufacturers seek higher precision and faster production times.

Strategies for Businesses

To navigate the challenges posed by tariffs, businesses are adopting several strategies:

- Supply Chain Diversification: Sourcing materials and components from multiple suppliers or alternative regions to reduce tariff exposure.

- Nearshoring: Moving production closer to home markets to reduce transportation and tariff costs.

- Technology Integration: Leveraging digital inspection tools like machine vision and automated quality control systems to reduce operational inefficiencies and human error.

- Cost Optimization: Streamlining processes and investing in automation to offset rising production costs caused by tariffs.

➤ Explore more strategies get full access now @ https://market.us/purchase-report/?report_id=147706

Key Takeaways

- Strong Market Growth: The global digital inspection market is projected to grow at a CAGR of 7.20%, reaching USD 46.7 billion by 2034.

- Regional Dominance: North America led the market with a 33% share in 2024, generating USD 7.6 billion in revenue.

- Technology Leadership: The machine vision segment captured 47% of the market in 2024, driven by its use in automated manufacturing processes.

- Industry Demand: The manufacturing sector holds over 27% of the market share, driven by demand for quality and compliance solutions.

Analyst Viewpoint

The digital inspection market is poised for strong growth, driven by increasing demand for automated quality assurance and precision in manufacturing processes. North America will remain a market leader, especially as U.S. companies continue to prioritize advanced digital inspection solutions to maintain high production standards and compliance.

The future looks positive, with increased investment in automation technologies driving efficiency gains across various industries, including manufacturing, automotive, and electronics. The market’s expansion is expected to be bolstered by ongoing technological advancements, particularly in machine vision and AI-based inspection systems.

Regional Analysis

North America dominated the digital inspection market in 2024, capturing more than 33% of the global market share, with USD 7.6 billion in revenue. The U.S. market alone was valued at USD 7.29 billion, with a projected CAGR of 5.8%. This growth is driven by the increasing demand for advanced quality assurance solutions in industries such as manufacturing and automotive.

Europe and Asia-Pacific are also experiencing growth, particularly in sectors like manufacturing, where the need for compliance and precision in production processes is driving the adoption of digital inspection solutions. North America is expected to continue leading the market, but the Asia-Pacific region is forecast to show significant growth due to increased industrialization.

➤ Discover More Trending Research

- Digital Inspection Market

- AI-powered Humanoid Robots Market

- Sports App Market

- E-Textbook Rental Market

Business Opportunities

The digital inspection market offers significant business opportunities, particularly in the manufacturing, automotive, and electronics sectors. As industries strive for higher operational efficiency and precision, there is increasing demand for advanced inspection tools, such as machine vision systems and automated quality control solutions.

The growing trend toward automation and the need for real-time data analytics provide opportunities for businesses to develop innovative solutions that improve inspection accuracy and speed. Additionally, the rise in consumer demand for high-quality, defect-free products is expected to further fuel the adoption of digital inspection technologies. Companies can capitalize on this demand by offering tailored inspection solutions that meet the unique needs of each industry.

Key Segmentation

The global digital inspection market is segmented by hardware, software, and industry:

- Hardware: The hardware segment dominates the market, accounting for over 48% in 2024, driven by the increasing adoption of high-performance inspection tools and devices in industrial applications.

- Software: Software solutions are crucial for analyzing inspection data, offering cloud-based services that enhance real-time monitoring and reporting.

- Industry: The manufacturing sector leads the market, holding over 27% share, as digital inspection is essential for quality control in production processes.

- Technology: The machine vision segment captured 47% of the market, reflecting its extensive use in automated quality assurance across industries.

Key Player Analysis

Key players in the digital inspection market focus on providing advanced hardware and software solutions, with a strong emphasis on machine vision and automation. These companies are driving innovation in real-time monitoring and quality assurance, offering cutting-edge solutions for industries such as manufacturing, automotive, and electronics.

They invest heavily in research and development to create more accurate and efficient inspection tools, and are expanding their market presence through strategic partnerships and acquisitions. The growing demand for precision and compliance in manufacturing environments has positioned these companies as leaders in the market.

Top Key Players in the Market

- Basler AG

- Carl Zeiss AG

- FARO Technologies, Inc.

- General Electric

- Hexagon AB

- MISTRAS Group, Inc.

- Nikon Metrology NV

- Omron Corporation

- Olympus Corporation

- Cognex

- Zetec

- Mitutoyo

- Others

Recent Developments

In 2024, the digital inspection market saw significant advancements in machine vision and AI-driven inspection technologies. The U.S. market for digital inspection solutions continued to grow, driven by increased adoption in manufacturing and the automotive sector.

Conclusion

The digital inspection market is on a strong growth trajectory, driven by rising demand for quality and compliance solutions across various industries. With North America leading the market, the future outlook remains positive, especially as technological advancements in machine vision and AI continue to enhance inspection accuracy and efficiency. Businesses in this sector are well-positioned for long-term success as demand for automated, real-time inspection solutions grows globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)