Table of Contents

Report Overview

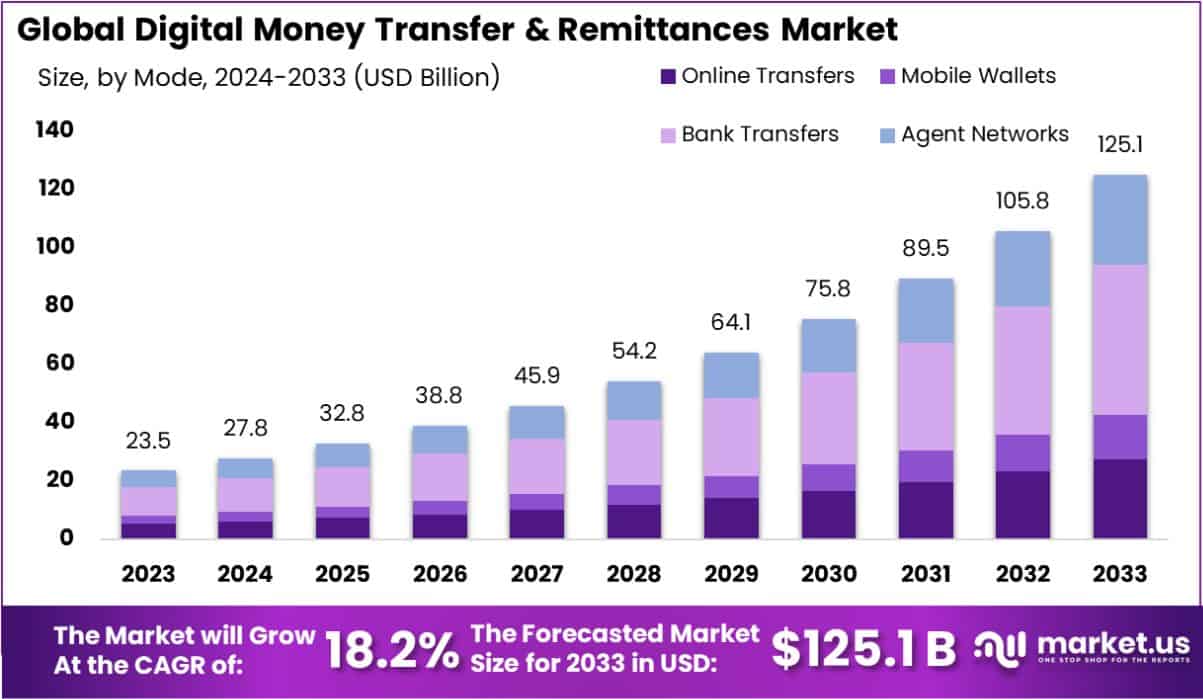

The global market for digital money transfer and remittances is poised for substantial growth. Experts forecast that by 2033, the market will reach an estimated value of $125.1 billion. This significant increase from $23.5 billion in 2023 indicates an impressive annual growth rate of 18.2% over the next decade. North America is at the forefront of this expansion, holding a dominant position with a 36.5% market share. In terms of revenue, this translates to $8.57 billion, underscoring the region’s pivotal role in the digital money transfer and remittances industry.

Digital money transfer and remittances involve the electronic movement of funds across borders, typically sent by individuals to family or friends in their home countries. This process bypasses traditional physical banking infrastructure, leveraging digital platforms like mobile apps, online portals, and digital wallets to facilitate rapid and cost-efficient transfers. These services are particularly critical for expatriates and immigrants, aiding in supporting families, fulfilling financial obligations, or conducting business internationally.

The market for digital money transfer and remittances is experiencing rapid growth, driven by increasing globalization and the rising number of migrants worldwide. This market includes various services offered through digital channels, which make remittances more accessible and cost-effective compared to traditional methods. Key players in this market range from fintech startups to established financial institutions, all competing to offer more reliable, faster, and cheaper services. As digital platforms become more user-friendly and accessible, more individuals are turning to these services for their remittance needs.

Key drivers of growth in the digital remittance market include the widespread adoption of smartphones and internet services, which has expanded access to digital financial services globally. The rising number of immigrants and expatriates who rely on sending money back to their home countries also significantly contributes to market growth. Technological advancements, such as blockchain and artificial intelligence, are improving the efficiency and security of transactions, making digital remittances more appealing to a broader audience.

Market demand is primarily fueled by the need for cost-effective, swift, and reliable money transfer methods. Digital remittance services meet these needs by offering lower fees and faster processing than traditional banking methods. The growth in global migration and the increasing employment of diaspora populations abroad are amplifying the demand for efficient remittance solutions. There’s a significant opportunity for market players to enhance service offerings by integrating advanced technologies and expanding into underbanked regions.

Technological innovations are central to the evolution of the digital money transfer and remittance industry. The integration of blockchain technology ensures transparency and security, reducing the risk of fraud in cross-border transactions. Artificial intelligence enhances customer service by providing personalized transaction experiences and real-time fraud detection. These technologies not only improve the security and efficiency of services but also help in complying with increasingly stringent regulatory requirements.

Key Takeaways

- The Digital Money Transfer & Remittances Market is on a significant upward trajectory. By 2033, it’s forecasted to reach a whopping USD 125.1 Billion, up from USD 23.5 Billion in 2023, marking an annual growth rate of 18.2% over the next decade.

- Breaking down the market, International Remittances emerged as the leading segment by type in 2023, securing over 39% of the market share. This demonstrates its pivotal role in the global remittance landscape.

- Regarding transaction methods, Bank Transfers were the most preferred mode of transferring money digitally in 2023, accounting for more than 41.5% of the market. This highlights the trust and reliability people place in traditional banking systems for international transactions.

- Personal Remittances led the application segment in 2023, taking up over 47.52% of the market. This shows how crucial digital remittance services are for individuals sending money back home across borders.

- In the regional outlook, North America stood out in 2023, holding a dominant 36.5% market share, which translated into revenues of approximately USD 8.57 Billion. This underscores the region’s strong adoption and integration of digital money transfer services.

Digital Money Transfer and Remittances Statistics

- The Global Digital Remittance Market is projected to reach a valuation of approximately USD 77.7 billion by 2032, growing at a CAGR of 15.0% between 2023 and 2032.

- Similarly, the Global Mobile Remittance Service Market is expected to expand from USD 17.5 billion in 2023 to USD 80.6 billion by 2033, with an impressive CAGR of 16.5% during the forecast period.

- In 2024, an estimated 770,000 people in the UK are using money transfer apps, showcasing the increasing reliance on digital remittance tools.

- India continues to dominate the market, receiving USD 125 billion in remittances in 2023, the highest globally due to its extensive diaspora population.

- The USA remains a critical player, with an inflow of USD 7.223 billion in 2023, while Pakistan saw remittance inflows of USD 24 billion, representing 7% of its GDP.

- Mexico followed India with USD 66 billion, reflecting strong U.S.-Mexico ties. The Philippines and China received USD 39 billion and USD 50 billion, respectively, highlighting their large overseas workforce and global networks.

- Over 53% of consumers now use digital methods for money transfers, compared to 34% who rely on traditional bank branches. This highlights a significant shift toward digital solutions.

- Surprisingly, 12% of users still prefer mailing cash, checks, or money orders, while 11% rely on friends or acquaintances to deliver money during travel.

- The average cost of sending USD 200 globally stood at 6.4% in Q4 2023, with banks being the most expensive option at 12%.

- Digital remittances are more economical, averaging 5%, while mobile operators lead with the lowest costs at 4.4%, driving demand for their services.

- Cross-border payments are growing at a steady rate of 5.4% annually, projected to reach a staggering USD 240 trillion by 2024.

- The adoption of cryptocurrencies for remittance is on the rise, with over 15% of surveyed users indicating they have used digital assets for cross-border transfers.

- By 2025, more than 50% of the global population is expected to use mobile wallets for money transfers, underscoring the growing preference for convenience.

- India’s mobile money transfer transaction value is projected to hit USD 46.08 billion by 2025, driven by technological advancements and widespread adoption.

- Despite advancements, over 1 billion people globally lack access to formal financial services, relying heavily on remittance services to meet basic financial needs.

- In 2023, global remittance flows were estimated at USD 860 billion, with USD 669 billion directed to low and middle-income countries, showcasing the critical role of remittances in supporting vulnerable populations.

Emerging Trends

- Embedded Finance and Seamless Transfers: The trend of embedded finance continues to gain traction, streamlining the money transfer process by integrating financial services into non-financial websites and apps. This integration is making transactions faster and more user-friendly.

- Rapid Adoption of Mobile Wallets: With the widespread use of smartphones, mobile wallets have become increasingly popular, especially in regions with high mobile penetration. This trend is crucial for enhancing the accessibility and convenience of remittances.

- Real-Time Payments: There is a growing expectation and implementation of real-time payments globally. This development allows for quicker money transfers, responding to the user demand for immediacy and convenience.

- Use of Blockchain and Cryptocurrencies: Some money transfer operators are incorporating blockchain technology and cryptocurrencies to reduce costs and improve the efficiency of cross-border transfers. This technology promises more direct and secure transactions by connecting senders and receivers without intermediaries.

- Eco-Friendliness in Operations: The remittance industry is also witnessing a shift towards more sustainable practices. Digital platforms are reducing their ecological footprint by minimizing the use of paper and optimizing their operational infrastructure to be more environmentally friendly.

Top Use Cases

- Support for Expatriates and Immigrants: Digital remittances are a financial lifeline for expatriates and immigrants, enabling them to support their families in their home countries efficiently and safely.

- Facilitation of International Business Payments: Businesses are increasingly relying on digital money transfer services for cross-border payments, which are critical for global trade and services.

- Financial Inclusion: Mobile and digital payment solutions are playing a pivotal role in driving financial inclusion, especially in underserved and unbanked regions, by providing accessible financial services.

- Disaster Response and Aid: Digital remittances can play a crucial role in disaster response, allowing for quick and direct financial assistance to affected individuals and communities.

- Payment Diversification in E-commerce: As e-commerce continues to grow, digital remittances are becoming an integral part of the payment landscape, enabling consumers around the world to make purchases across borders with ease and security.

Major Challenges

- Regulatory Compliance: Navigating the complex and varying regulations across different countries remains a significant challenge. Compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) standards can impose heavy burdens on remittance service providers, often increasing operational costs and complicating international transactions.

- High Transaction Costs: Despite technological advancements, transaction costs remain high, particularly in less competitive markets. The UN’s target is to reduce remittance costs to less than 3%, yet many regions still experience fees significantly above this goal, affecting the affordability of remittance services for low-income users.

- Technological Barriers: In some regions, especially in developing countries, the lack of technological infrastructure can limit the adoption and effectiveness of digital remittance services. This includes limitations in internet connectivity, mobile network coverage, and digital literacy among the population.

- Security and Fraud Risks: As digital remittance services expand, so do the opportunities for cyberattacks and fraud. Protecting against these risks requires sophisticated security measures, which can be resource-intensive for companies to implement and maintain.

- Market Saturation and Competition: The digital remittance market is becoming increasingly crowded, making it challenging for new entrants and existing players to maintain and grow their market share. Companies must innovate continuously to differentiate their services and capture customer loyalty in a highly competitive environment.

Attractive Opportunities

- Technological Innovation: There is a significant opportunity for companies that innovate with technologies like blockchain, AI, and mobile applications. These technologies can streamline processes, reduce costs, and enhance the security of remittance transfers, offering a competitive edge.

- Expansion into Emerging Markets: Many emerging markets remain underserved in terms of financial services. Companies that expand into these areas have the potential to tap into new customer bases eager for reliable and affordable remittance options.

- Partnerships with Local Banks and Fintechs: Collaborating with local banks and fintech companies can help remittance providers expand their reach and enhance their service offerings. These partnerships can provide access to local payment networks, improving service delivery and customer satisfaction.

- Product Diversification: Providers can diversify their offerings to include value-added services such as bill payments, mobile airtime top-ups, and insurance. These services not only attract a broader customer base but also improve customer retention by becoming a one-stop-shop for financial needs.

- Financial Inclusion Initiatives: There is a growing focus on financial inclusion as a significant opportunity within the remittance industry. Providing financial services to unbanked and underbanked populations can drive substantial market growth and contribute positively to economic development in these regions.

Recent Developments

- November 2023: Western Union teamed up with a blockchain technology company to revamp its cross-border payment services. The partnership is set to make sending money abroad smoother and more cost-effective, aiming to cut down on fees and reduce transfer times for users globally.

- October 2023: Euronet broadened its footprint in the digital payment space by acquiring a fintech startup specializing in mobile payments. This move will bolster Euronet’s capabilities and extend its offerings, particularly in emerging markets, aiming to capture a larger share of the digital remittance industry.

- September 2023: Ria introduced a new mobile application designed to facilitate fee-free international money transfers. The app offers zero charges for the first three transactions, targeting younger demographics and tech-savvy users looking for easy and affordable ways to send money overseas.

- August 2023: PayPal launched a new feature that allows users to make international transfers using cryptocurrencies. By integrating this option, PayPal taps into the increasing popularity of digital currencies, providing users with versatile and innovative ways to manage cross-border transactions.

- July 2023: Wise significantly expanded its instant transfer services to include more countries, enhancing its global reach. This strategic move is aimed at simplifying the process of international money transfers, making it faster and more convenient for users around the world to send and receive money.

Conclusion

In conclusion, the digital money transfer and remittances market is poised for substantial growth, driven by a combination of technological innovations, an expanding global migrant workforce, and a shift towards more digital financial solutions. As technology continues to evolve, the market is expected to offer enhanced services that are faster, more secure, and cost-effective, meeting the growing demand for reliable remittance solutions worldwide.

The integration of advanced technologies like blockchain and AI further strengthens the market’s capacity to transform financial transactions across borders, making digital remittances an indispensable tool for global financial inclusion. This ongoing evolution presents significant opportunities for both new entrants and established players in the financial sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)