Table of Contents

Introduction

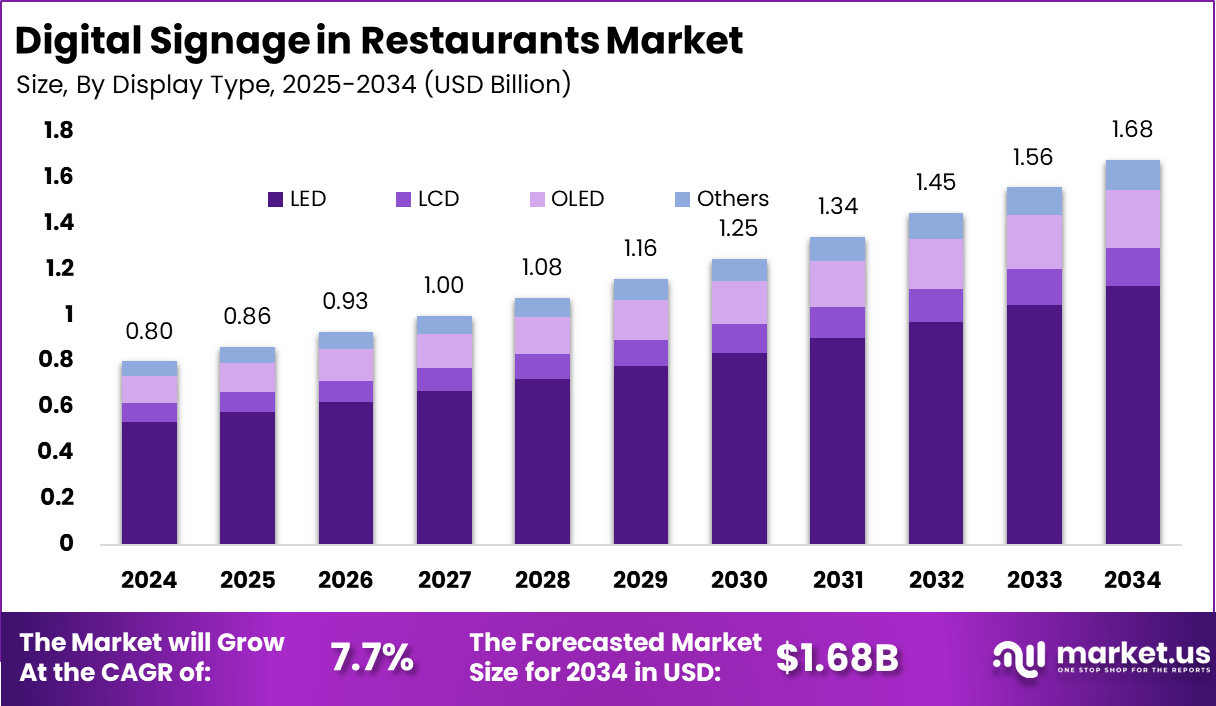

The Global Digital Signage in Restaurants Market is on a promising growth trajectory, projected to reach USD 1.6 billion by 2034, up from USD 0.80 billion in 2024. This reflects a strong CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific (APAC) region held a dominant market share of 42.7%, generating USD 0.3 billion in revenue.

The increasing adoption of digital signage solutions in the restaurant industry, driven by their ability to enhance customer engagement, streamline operations, and boost sales, is propelling market expansion. As technology continues to evolve, digital signage is expected to become a vital tool for restaurants to improve service delivery and enhance brand visibility.

How Growth is Impacting the Economy

The growth of the digital signage market in restaurants is having a noticeable impact on the economy. As more restaurants adopt digital signage systems, the demand for related hardware, software, and content management services is driving growth across the technology, manufacturing, and service sectors. Digital signage helps restaurants streamline their operations by providing real-time updates, promotional content, and menu boards, reducing the need for printed materials.

Furthermore, the ability to target specific customers with dynamic content improves customer engagement and drives higher revenue. This, in turn, contributes to job creation in the technology, marketing, and installation industries. As digital signage adoption expands, both large chains and small independent restaurants benefit from the increased operational efficiency and enhanced customer experiences.

➤ Unlock growth! Get your sample now! – https://market.us/report/digital-signage-in-restaurants-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

As the demand for digital signage grows in restaurants, the associated costs of hardware, installation, and content management solutions are rising. While initial investments can be substantial, the long-term benefits of improved operational efficiency and increased sales often outweigh these costs. Digital signage systems are expected to streamline supply chains by providing real-time inventory updates and promoting limited-time offers, reducing waste, and optimizing stock levels.

However, the growing demand for digital signage hardware has also caused supply chain disruptions, leading to increased prices for digital screens and related components. This may impact smaller restaurants with limited budgets but offers opportunities for industry players to invest in cost-efficient solutions.

Sector-Specific Impacts

In the restaurant sector, digital signage plays a significant role in enhancing customer experience by showcasing dynamic menus, promotional offers, and seasonal items. Quick-service restaurants (QSRs) are leveraging digital signage to reduce wait times and provide a more engaging customer experience.

Additionally, digital signage helps improve operational efficiency by automating tasks like menu updates and promotions, freeing up restaurant staff to focus on other duties. The hospitality sector, including hotels and cafes, also benefits from digital signage by providing digital wayfinding and event announcements, thereby improving guest experiences.

Strategies for Businesses

To capitalize on the growth of the digital signage market, restaurants should focus on integrating user-friendly content management systems that enable easy updates and real-time promotional content. Additionally, adopting interactive digital signage solutions, such as touchscreens and self-service kiosks, can enhance the customer experience and streamline ordering processes.

Restaurants should also consider adopting energy-efficient and cost-effective digital signage displays to reduce long-term operational expenses. Strategic partnerships with digital signage solution providers and software developers will be key to staying ahead of the competition and ensuring seamless integration of digital signage into existing restaurant systems.

Key Takeaways

- The global digital signage in restaurants market is expected to reach USD 1.6 billion by 2034, growing at a CAGR of 7.7%.

- APAC holds a dominant market position with 42.7% of the share in 2024.

- Digital signage enhances customer engagement, boosts sales, and streamlines operations.

- Restaurants, especially quick-service establishments, are increasingly adopting digital signage for dynamic content delivery.

- Rising costs of hardware and supply chain disruptions are challenges that may affect smaller restaurants.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=156285

Analyst Viewpoint

The digital signage market in the restaurant industry is poised for significant growth. The adoption of these solutions offers numerous benefits, from improving customer experiences to boosting sales and operational efficiency. As digital signage technology becomes more advanced and cost-effective, it will continue to shape the way restaurants operate, creating new opportunities for innovation and growth. Moving forward, the market is expected to maintain a positive outlook, driven by technological advancements and increased restaurant digitalization.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Quick-Service Restaurants (QSRs) | Real-time menu updates, improved order accuracy, and enhanced customer engagement |

| Fine Dining | Dynamic menus and event promotions for an enhanced customer experience |

| Hotels & Cafes | Digital wayfinding, event announcements, and improved guest engagement |

| Chain Restaurants | Consistent branding across locations, operational efficiency, and promotional campaigns |

Regional Analysis

In 2024, the APAC region held a dominant market share of 42.7%, generating USD 0.3 billion in revenue. The region’s growth is driven by the increasing adoption of digital signage in restaurants, particularly in countries like China, Japan, and India, where restaurant chains are embracing technology for operational efficiency and customer engagement.

The North American and European markets are also growing, driven by the high adoption of digital signage in fast-casual and quick-service restaurants. The growing interest in interactive signage and self-ordering kiosks in these regions is expected to fuel further market growth.

Business Opportunities

As digital signage technology continues to grow in the restaurant sector, businesses have several opportunities to innovate and expand. Restaurants can explore interactive signage solutions that allow customers to engage with menus, promotions, and order placements. There is also an opportunity to develop energy-efficient signage solutions to cater to the sustainability demands of the market.

Software providers focusing on content management systems and integration solutions have significant growth potential. Additionally, companies involved in hardware manufacturing, such as digital displays and touchscreens, stand to benefit from increasing demand in the restaurant industry.

Key Segmentation

The digital signage in restaurants market can be segmented by application, type, and deployment model.

- By Application: Menu boards, Digital advertising, Customer engagement, Wayfinding

- By Type: Hardware (displays, screens), Software (content management, analytics)

- By Deployment Model: On-premise, Cloud-based

Key Player Analysis

Leading players in the digital signage market are focusing on expanding their portfolios by providing integrated solutions, including hardware and software. Companies are continuously investing in research and development to deliver high-quality digital displays, intuitive content management systems, and enhanced interactivity for restaurants. The market is competitive, with large firms and smaller niche players offering innovative signage solutions tailored to the restaurant industry’s unique needs.

- Samsung Electronics Co. Ltd Company Profile

- LG Electronics

- NEC Corporation

- Elo Touch Solutions

- BrightSign

- Peerless-AV

- Panasonic Corporation Company Profile

- Zeno Technologies

- Sharp Corporation

- ViewSonic

- AOPEN

- YCD Multimedia

- Others

Recent Developments

- Increased adoption of interactive digital signage solutions in quick-service restaurants (QSRs).

- Partnerships between software providers and restaurant chains to enhance content management systems.

- Introduction of energy-efficient digital signage solutions to reduce operational costs.

- Rise of cloud-based platforms for seamless content updates and real-time promotions.

- Expansion of digital signage applications into additional restaurant segments like fine dining and cafes.

Conclusion

The digital signage market in the restaurant industry is set to grow steadily. Driven by the increasing demand for enhanced customer experiences and operational efficiency. As digital signage technologies evolve and become more accessible, restaurants across the globe will increasingly adopt them to stay competitive and engage customers effectively.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)