Table of Contents

Introduction

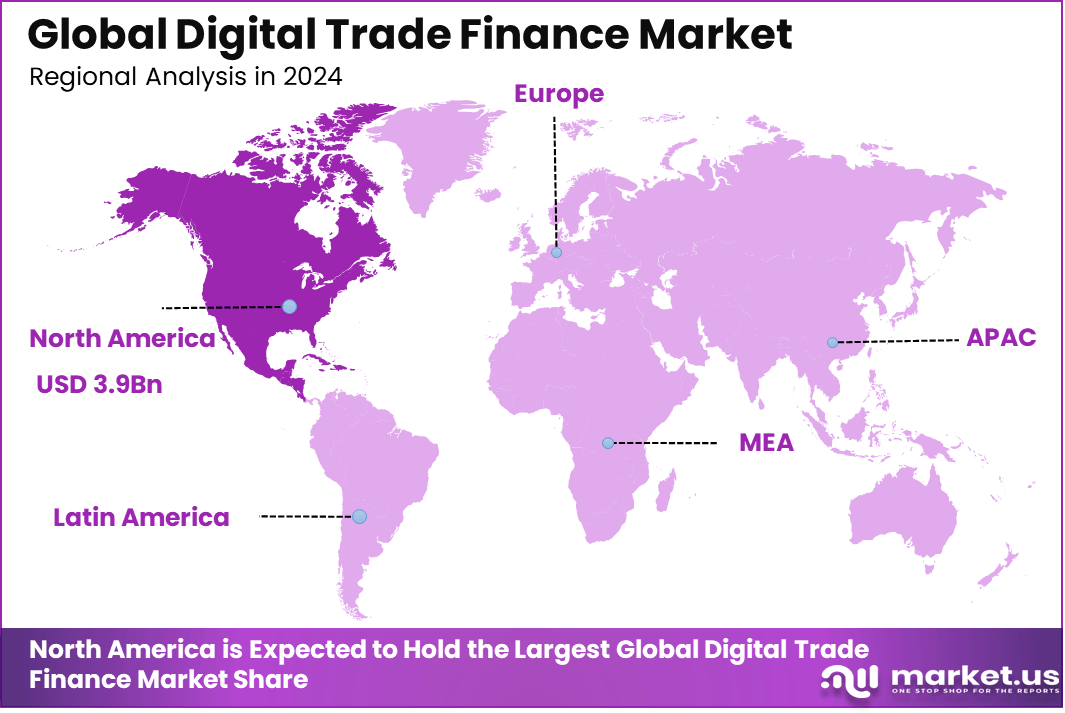

The Global Digital Trade Finance Market generated USD 101.22 billion in 2024 and is forecast to increase from USD 107.23 billion in 2025 to about USD 180.24 billion by 2034, reflecting a 5.94% CAGR across the period. In 2024, North America led the market with a 38.7% share, contributing USD 1.3 billion in revenue.

The digital trade finance market covers platforms and solutions that turn traditional, paper heavy trade finance into electronic, data driven workflows for importers, exporters, banks, and logistics players. In simple terms, it replaces couriered documents, manual checks, and branch visits with online applications, digital documents, and automated decisioning that support letters of credit, guarantees, supply chain finance, and other trade products end to end.

Digital trade finance grew out of long standing pain points in cross border trade, where slow document handling, errors, and limited transparency often delay shipments and tie up working capital. By digitizing core instruments and using tools like electronic bills of lading, digital signatures, OCR, and secure messaging, banks and fintechs can shorten processing times from days to hours, while giving all parties better visibility over status, risks, and cash flows in a transaction.

Quick Market Facts

- Digital letters of credit led with 36.4%, supported by strong uptake of automated verification tools and secure digital workflows.

- Domestic trade finance dominated with 63.7%, showing that most platforms are used to streamline local transactions and reduce document handling.

- Banks held 45.2%, reflecting rapid digital transformation across compliance, settlement, and trade operations.

- North America accounted for 38%, benefiting from robust financial infrastructure and fast adoption of digital transaction systems.

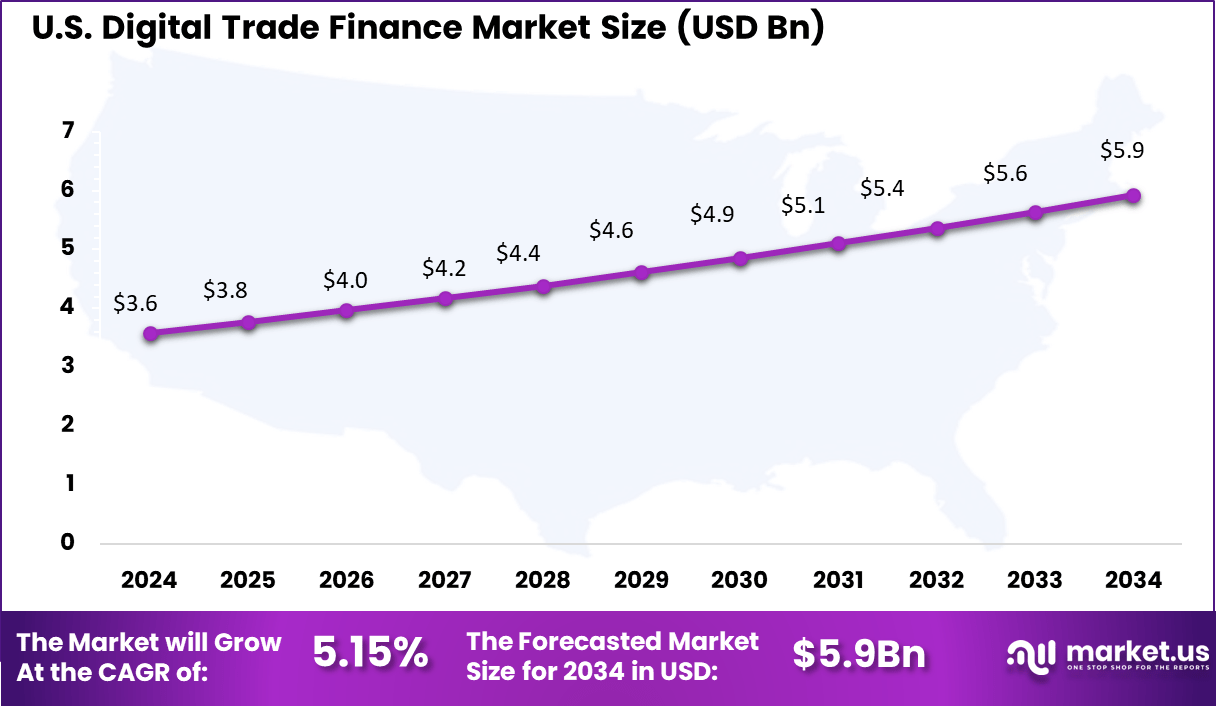

- The U.S. market reached USD 3.59 billion and is growing at 5.15%, indicating steady modernization of trade finance processes across financial institutions.

By Solution Type – Digital Letters of Credit (36.4%)

Digital letters of credit lead the solution segment with 36.4%, showing strong adoption of automated document verification and secure digital workflows. These solutions help reduce manual processing errors and improve transaction speed for both exporters and importers. Growth in this segment is supported by increasing demand for transparent, secure, and standardized trade documentation. Digital platforms provide faster validation, reduce fraud risk, and improve communication between trading partners and financial institutions.

By Application – Domestic Trade Finance (63.7%)

Domestic trade finance dominates with 63.7%, highlighting widespread use of digital systems to streamline local trade processes. Businesses rely on digital tools to reduce paperwork, automate invoice handling, and accelerate payment cycles within domestic markets. The dominance of this segment is driven by the need for faster settlement, improved working capital flow, and reduced administrative workload. Digital platforms make domestic transactions more efficient and dependable for both buyers and suppliers.

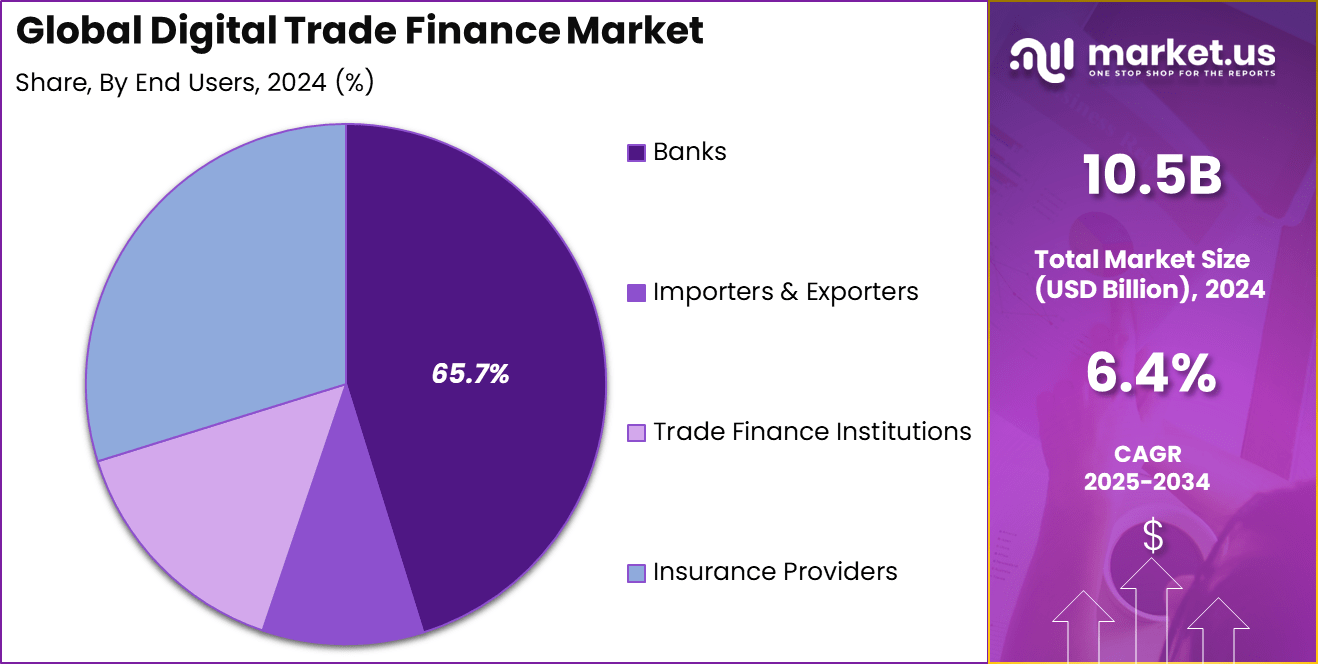

By End User – Banks (45.2%)

Banks hold a leading 45.2% share, reflecting their central role in digitalizing trade operations. Financial institutions use digital tools to manage documentation, assess trade risk, and improve compliance with regulatory standards. Adoption among banks is rising due to increasing transaction volumes and the need for secure, auditable digital workflows. Digital trade finance solutions also help banks offer faster services and reduce operational bottlenecks for business clients.

By Region – North America (38%)

North America accounts for 38%, supported by strong financial infrastructure and early adoption of digital transaction systems. The region benefits from high technology readiness, advanced banking networks, and well established compliance frameworks. Digital trade finance platforms continue to expand in the region as businesses seek efficient, paperless transaction processes. Financial institutions across North America are also modernizing their trade finance systems to improve processing speed and transparency.

Take advantage of our unbeatable offer - buy now!

United States – USD 3.59 Billion, CAGR 5.15%

The United States reached USD 3.59 billion with a steady CAGR of 5.15%, showing consistent modernization of trade finance operations. Banks and large enterprises in the country rely on digital platforms for secure document exchange, risk management, and automated transaction processing. Growth in the US market is supported by rising digital banking adoption, strong regulatory oversight, and demand for efficient supply chain financing. The shift toward paperless trade continues to improve accuracy, reduce delays, and enhance operational flexibility.

Key Market Segments

By Solution Type

- Digital Letters of Credit

- Supply Chain Finance Platforms

- Trade Payment Platforms

- Document Management Systems

By Application

- Domestic Trade Finance

- International Trade Finance

By End-User

- Banks

- Importers & Exporters

- Trade Finance Institutions

- Insurance Providers

Top Key Players in the Market

- HSBC

- JPMorgan Chase

- Citibank

- Standard Chartered

- BNP Paribas

- DBS Bank

- ANZ

- Banco Santander

- Barclays

- Mitsubishi UFJ Financial Group

- R3

- Marco Polo Network

- we.trade

- Contour

- Komgo

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 10.5 Bn |

| Forecast Revenue (2034) | USD 19.5 Bn |

| CAGR(2025-2034) | 6.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Solution Type (Digital Letters of Credit, Supply Chain Finance Platforms, Trade Payment Platforms, Document Management Systems), By Application (Domestic Trade Finance, International Trade Finance), By End-User (Banks, Importers & Exporters, Trade Finance Institutions, Insurance Providers) |

| Regional Analysis | North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA |

| Competitive Landscape | HSBC, JPMorgan Chase, Citibank, Standard Chartered, BNP Paribas, DBS Bank, ANZ, Banco Santander, Barclays, Mitsubishi UFJ Financial Group, R3, Marco Polo Network, we.trade, Contour, Komgo, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Purchase Options | We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)