Introduction

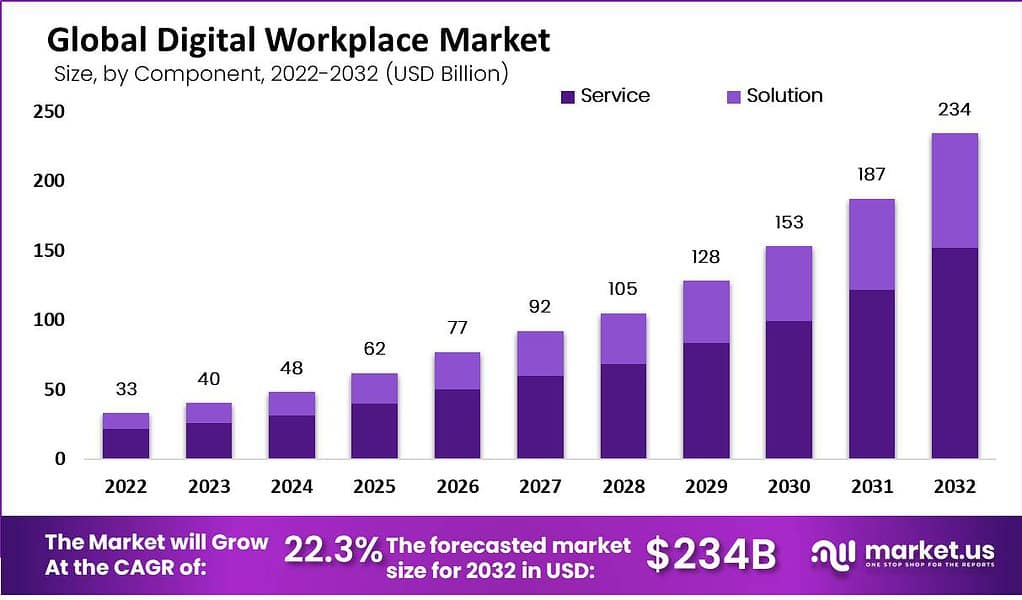

The global digital workplace market was valued at USD 40 billion in 2023, and it is expected to reach USD 234 billion by 2032, representing a CAGR of 22.3% during this period. This growth is fueled by various factors, such as the adoption of flexible and remote work models, the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies, and advancements in cloud computing, which are enhancing the agility and responsiveness of digital workplaces. The ongoing pandemic has intensified the demand for digital solutions that facilitate collaboration, communication, and productivity across dispersed teams, leading to an increasing shift towards hybrid work environments.

The market faces various challenges, including ensuring robust cybersecurity measures to protect sensitive data in a digital environment, navigating the complexities of integrating diverse digital tools to ensure interoperability, and overcoming organizational resistance to change. These challenges highlight the complex dynamics of the digital workplace market.

North America dominates the market, attributed to the increasing adoption of emerging technologies such as AI, BYOD (Bring Your Own Device), and enterprise mobility management solutions, among others. The Asia Pacific region is anticipated to experience significant growth due to the rapid adoption of digitization across various industry sectors and the growing adoption of cloud platforms among enterprises.

Notable mergers, acquisitions, and funding activities have recently taken place in the Digital Workplace Market, demonstrating the sector’s dynamic and evolving nature.

Accenture has completed the acquisition of Work & Co, a renowned digital product company known for its innovative approach to creating breakthrough products and experiences. This strategic move is aimed at strengthening Accenture Song’s capabilities in digital products and experience transformation, enabling clients to grow, innovate, and maintain relevance in their respective markets.

In another significant development, La Française des Jeux Société anonyme (FDJ), based in France, announced its acquisition of Kindred Group plc, a Malta-based online betting group. The acquisition is valued at EUR 2.6 billion (approximately USD 2.83 billion), and it positions FDJ at the forefront of online betting operators within France, paving the way for international expansion. The deal is expected to notably increase FDJ’s online business revenue from 14% to 29%, highlighting the strategic importance of digital transformation in the gambling sector.

Sanofi, through its subsidiary Aventis Inc., has also made headlines with its plan to acquire Inhibrx, Inc., a U.S. biotech firm. This acquisition, valued between USD 1.70 to USD 2.20 billion, is part of Sanofi’s strategy to enhance its drug development portfolio by incorporating Inhibrx’s experimental treatment for Alpha-1 Antitrypsin Deficiency (AATD). The acquisition reflects a broader trend in the pharmaceutical sector towards mergers and acquisitions aimed at bolstering pipelines with promising assets.

Moreover, Roper Technologies, Inc. has agreed to acquire Procare Solutions for a net purchase value of USD 1.75 billion. Procare, a leading provider of cloud-based software for managing early childhood education centers, represents a strategic addition to Roper’s portfolio of software products in the industrial technology sector. The acquisition is anticipated to significantly contribute to Roper’s Application Software segment, emphasizing the value of integrating high-quality, market-leading technology enterprises.

Key Takeaways

- The global digital workplace market was valued at USD 40 billion in 2023 and is projected to reach USD 234 billion by 2032, representing a robust CAGR of 22.3% over the forecast period.

- The services segment dominates the market with a significant 65% market share, indicating a strong preference for service-oriented digital workplace solutions.

- Large enterprises hold a commanding 63% market share, showcasing their readiness to adopt advanced technologies and invest in digital workplace solutions.

- IT & Telecom sector leads in market share with 24%, driven by factors such as IoT adoption, AI integration, and the transition to remote work culture.

- North America holds the largest market share at 35%, driven by the rapid adoption of AI and enterprise mobility solutions, particularly in industries like manufacturing and retail.

- The Asia Pacific region is poised for substantial growth, with a projected CAGR of 23.6% during the forecast period, fueled by rapid digitization across various industries.

- The market is dominated by key players such as IBM, Accenture, and Infosys, who are actively investing in R&D and strategic partnerships to enhance their product offerings.

Digital Workplace Statistics

- The Information Technology and Telecommunications (IT & Telecom) sector holds a dominant share of 24%, indicating its pivotal role in driving digital workplace advancements.

- Traditional web technologies exhibit a high adoption rate, with 85% of respondents from successful transformation companies actively incorporating them.

- Service operations optimization leads among commonly adopted AI use cases, with a notable adoption rate of 24%.

- Digital transformation emerges as the leading initiative, with a persistent commitment shown by 56% of companies in 2021.

- Spending on digital transformation technologies and services is expected to reach USD 2.92 trillion in 2025 and further expand to USD 3.4 trillion by 2026.

- Cloud migration experiences a significant surge, jumping from 40% in 2020 to 48% in 2021, reflecting growing recognition of its benefits.

- Customer experience, although slightly diminishing, remains a substantial area of concentration, with 29% of companies prioritizing it in 2021.

- A majority of companies, totaling 64.5%, express confidence in their capacity to effectively adjust to technological disruptions.

- Overall, 50.4% of organizations maintain a positive outlook regarding the influence of technology disruption, indicating optimism in the market.

- The adoption of a digital model in business operations offers a spectrum of advantages, with 40% citing improvement in operational efficiency as the foremost benefit.

- The introduction of new revenue streams is acknowledged by 21% of respondents, demonstrating the potential of digital models for innovation.

- Companies prioritize digital transformation, cybersecurity, and cloud migration for competitiveness, aligning with market trends.

Use Cases

- User Preference-based Lighting and Temperature Control: Digital workplaces are adopting technologies that allow employees to personalize their workspace environments. This includes applications for adjusting office temperature and smart lighting systems that save energy while improving comfort, such as Cisco’s partnership with Philips on connected lighting and HVAC systems.

- Digital Building Management System: Implementing a digital building management system facilitates the convergence of various building systems (lighting, HVAC, security) onto a single platform for efficient monitoring and management, leading to cost savings and environmental benefits.

- Intelligent Workspace Allocation: Technologies enabling intelligent workspace allocation allow employees the flexibility to select workstations based on their needs, which not only enhances satisfaction but also aids in efficient space utilization and planning for future expansions.

- 3D Holographic Telepresence: Utilizing high-definition 3D holograms for meetings and town halls can save time and travel costs. Accenture’s tech team, for instance, has developed a 3D holographic telecast technology to facilitate digital presence in key meetings without physical attendance.

- Smart Writing Boards: Replacing traditional whiteboards with smart boards facilitates real-time content sharing and collaboration, enhancing meeting efficiency and ensuring data captured during discussions is not lost due to manual transcription errors.

- Intelligent Amenities: Modern digital workplaces are embedding intelligent amenities such as automated locker systems and adjustable desks to improve the overall health and productivity of employees.

- Policies and Data Rules for Workplace Operation: As buildings become more digitalized, establishing clear policies and data rules is essential for automated decision-making and ensuring systems like room booking and facilities management respond efficiently to user needs.

- Integration of Technical Solutions: The integration of various technical solutions within smart buildings is key to enhancing user experiences. This includes optimizing control systems and ensuring seamless connectivity across IoT devices and cloud solutions, as demonstrated by smart office developments with converged network systems (CNS).

- Empowering Remote Work: Digital workplaces facilitate effective remote work by providing employees with cloud-based access to work resources, allowing for real-time collaboration and communication, and ultimately leading to cost savings on maintenance and transport.

- Improved Customer Experience: By enabling facilities like live chat, digital workplaces help improve the customer experience by providing swift access to customer services, thereby increasing the likelihood of repeat purchases.

Recent Developments

Recent developments in the Digital Workplace sphere are marked by a variety of trends, including mergers and acquisitions, strategic collaborations, and significant investments in AI and sustainability-focused initiatives. Here are some notable developments:

- Gartner’s 2024 M&A Trends: Gartner highlights a renewed focus on technology as a driving force in M&A activities for 2024, particularly emphasizing the role of AI in improving M&A processes and the strategic acquisition of AI-based businesses amidst macroeconomic ambiguity.

- Cross-Border M&A Resurgence: There’s an expected increase in cross-border M&A activities as companies seek growth opportunities and diversification, with a deep understanding of global regulations and cultures becoming essential.

- Sustainability in M&A: ESG (Environmental, Social, and Governance) integration is taking center stage in M&A transactions, reflecting a growing demand for sustainability and ethical practices in business operations.

- Infosys’ Strategic Collaborations and Acquisitions: Infosys announced a series of collaborations and acquisitions, including a partnership with Musgrave to drive IT transformation and the acquisition of InSemi, a semiconductor design services provider.

- Largest M&A Deals Data: Recent significant M&A transactions include AbbVie’s acquisition of ImmunoGen for $10 billion and Cisco’s acquisition of Splunk for $28 billion, indicating robust activity across various sectors.

- Deloitte’s Industry Outlook: Tech, Media, and Telco lead 2023 deal volumes, with a notable shift towards investments in energy transition-related activities reflecting a global emphasis on clean energy and sustainable practices.

Conclusion

The digital workplace market presents a landscape of opportunities and challenges, with cloud technologies, remote work, and mobile integration driving growth, while security concerns and infrastructural limitations act as constraints. Nonetheless, continuous innovation and strategic partnerships are expected to further propel the market’s expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)