Table of Contents

Introduction

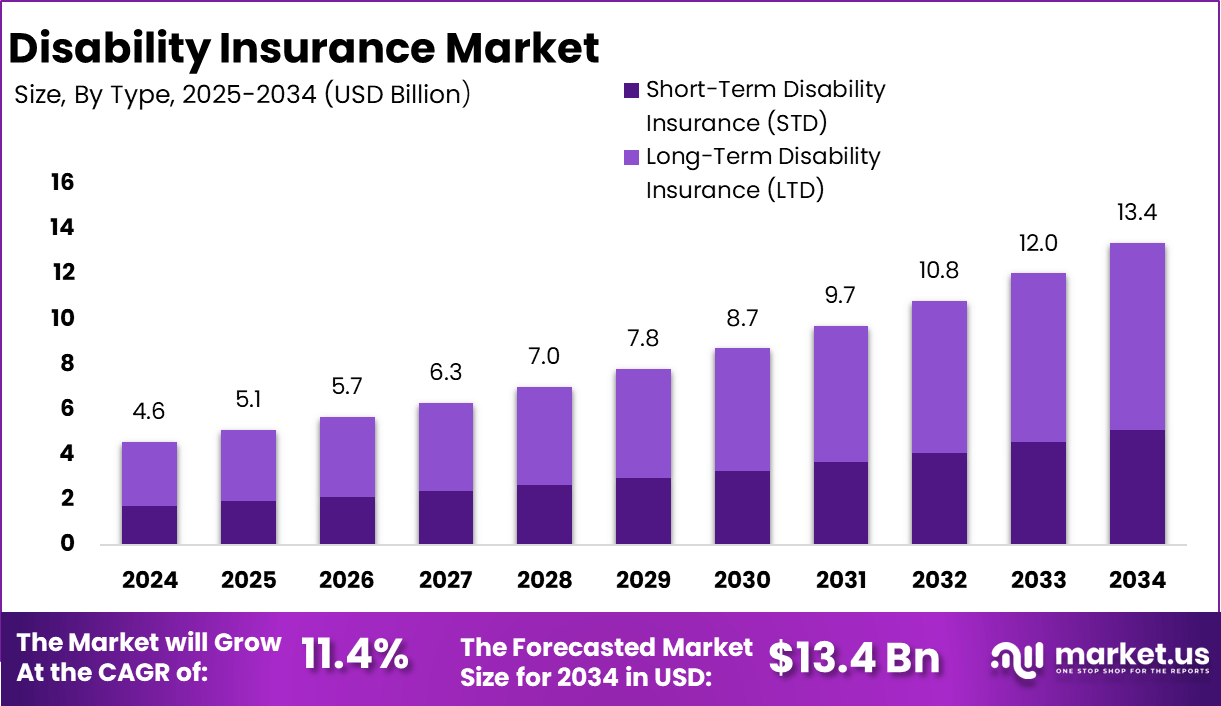

The Global Disability Insurance Market is poised for significant growth, with an estimated value of USD 13.4 billion by 2034, up from USD 4.6 billion in 2024, growing at a robust CAGR of 11.4% from 2025 to 2034. In 2024, North America dominated the market, holding a substantial 38.7% share, generating USD 1.8 billion in revenue.

The increasing awareness about the importance of financial protection against disabilities, coupled with growing healthcare costs, is driving the demand for disability insurance globally. As governments and private sectors recognize the need for financial safety nets, this market is expected to expand rapidly in the coming years.

How Growth is Impacting the Economy

The growth of the disability insurance market has broad economic implications, contributing to the financial stability of individuals and families facing disability-related challenges. As the market expands, it plays a crucial role in reducing the financial burden on healthcare systems, particularly in countries with aging populations. The increasing availability and affordability of disability insurance policies are enabling workers to secure their income in the event of illness or injury, thereby promoting economic resilience. This market also generates significant employment in insurance companies, actuarial services, healthcare, and related industries, further stimulating economic activity.

➤ Unlock growth! Get your sample now! – https://market.us/report/disability-insurance-market/free-sample/

Impact on Global Businesses

The rising demand for disability insurance is impacting businesses globally by increasing operational costs associated with providing employee benefits. Companies are under pressure to offer more comprehensive disability coverage as part of their employee wellness programs, driving up costs in the short term. Additionally, businesses may face higher premiums as insurers adjust their offerings to meet the growing demand for coverage. In sectors such as healthcare, construction, and manufacturing, where the risk of injury is higher, the need for specialized disability insurance products is also increasing. Consequently, these industries may see higher insurance premiums or more tailored coverage options to address specific risks.

Strategies for Businesses

To address the rising demand for disability insurance, businesses should enhance their employee benefit packages to include comprehensive disability coverage, ensuring they remain competitive in the talent market. Insurance providers can also develop specialized plans catering to different industries with varying risks, such as construction, healthcare, and IT. Collaboration between employers and insurance providers to craft more affordable, flexible plans will be key in managing costs while meeting employees’ needs. Moreover, businesses should focus on educating their employees about the importance of disability insurance, promoting financial security and well-being among the workforce.

Key Takeaways

- The Global Disability Insurance Market is projected to grow at a CAGR of 11.4%, reaching USD 13.4 billion by 2034.

- North America accounted for 38.7% of the market share in 2024, generating USD 1.8 billion in revenue.

- Increasing awareness and rising healthcare costs are driving demand for disability insurance.

- The market presents opportunities for growth in specialized coverage, particularly in high-risk industries.

- Businesses must enhance their employee benefit programs to remain competitive in a growing market.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=156625

Analyst Viewpoint

Currently, the disability insurance market is experiencing steady growth as more individuals and businesses recognize the need for financial protection against the risk of disability. As the market matures, demand is expected to accelerate, particularly in regions with aging populations and higher healthcare costs. The future outlook remains positive, with the development of new, more affordable insurance products tailored to specific industries and individuals, enabling a broader demographic to access necessary coverage. Businesses that strategically invest in disability insurance will not only foster employee satisfaction but also build long-term financial stability.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Employee Benefits | Increasing awareness of the need for financial protection in case of disability |

| Healthcare Sector Coverage | Rising healthcare costs and the growing number of workers in high-risk industries |

| Income Replacement | Economic uncertainty and the need for more comprehensive social security options |

| Financial Protection | Growing importance of long-term care and disability insurance as part of pension schemes |

| Specialized Plans | Demand for tailored insurance products to meet industry-specific needs |

Regional Analysis

In 2024, North America held the largest share of the disability insurance market, driven by comprehensive insurance offerings and a high demand for income protection. Europe follows closely with steady growth as countries strengthen their disability insurance systems in response to aging populations and rising healthcare costs. The Asia Pacific region is expected to experience rapid growth in the coming years, particularly in countries like China and Japan, where the elderly population is increasing. Latin America and the Middle East are also seeing emerging opportunities, driven by increasing awareness of disability insurance products.

➤ Don’t Stop Here—check Our Library

- Voice AI for Retail Market

- Maritime Big Data Market

- Analytics Cloud Market

- Serverless Security Market

Business Opportunities

As the disability insurance market grows, businesses can seize opportunities by developing new, flexible insurance plans that cater to the needs of different sectors, particularly those with higher risks such as construction, healthcare, and manufacturing. Insurers can also explore digital platforms for delivering disability insurance policies and managing claims efficiently. Additionally, partnerships with employers to offer customizable disability benefits packages will become more prevalent, enabling companies to attract and retain talent by providing robust financial safety nets. The market’s growth opens up new avenues for both established and emerging players in the insurance sector.

Key Segmentation

- By Type: Short-Term Disability, Long-Term Disability

- By End-Use Industry: Healthcare, Construction, Manufacturing, IT, Service Sector

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Player Analysis

The disability insurance market features a range of providers offering customized policies to meet the growing demand. Key players are focusing on developing specialized insurance products tailored to specific industries and individual needs, such as coverage for high-risk professions or workers with pre-existing conditions. As the market grows, these companies are also investing in digital solutions to streamline policy management, claims processing, and customer engagement, enhancing the overall customer experience.

- MetLife, Inc.

- Mutual of Omaha Insurance Company

- Guardian Life Insurance Company of America

- Aegon N.V.

- Unum Group

- Principal Financial Group

- Sun Life Financial Inc.

- AXA Group

- Nippon Life Insurance Company

- Zurich Insurance Group

- Others

Recent Developments

- January 2025: A leading insurer introduces flexible disability insurance plans tailored to gig economy workers.

- July 2024: A new partnership between an insurance provider and a tech company to launch a digital platform for managing disability claims.

- March 2025: Global insurer expands its offerings to include comprehensive disability insurance for remote workers.

- November 2024: A regulatory body introduces new standards for disability insurance to ensure equitable access for underserved communities.

- February 2025: A major insurer rolls out a disability insurance policy focusing on pre-existing conditions in high-risk industries.

Conclusion

The disability insurance market is experiencing strong growth, fueled by increasing demand for financial protection in the face of disability-related risks. As the market continues to expand, businesses have the opportunity to innovate and offer more tailored, affordable policies. The focus on digital solutions and flexible coverage will be key to capturing emerging market opportunities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)