Table of Contents

Market Overview

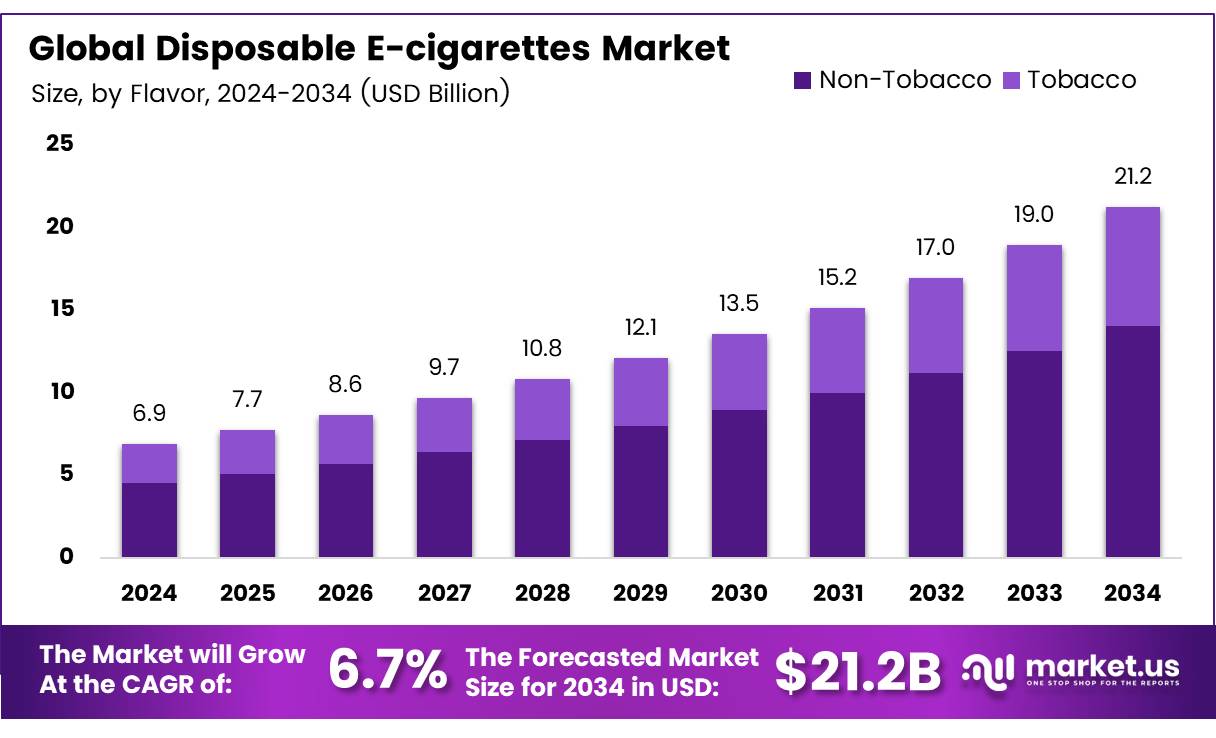

The Global Disposable E-cigarettes Market size is expected to be worth around USD 21.2 Billion by 2034, from USD 6.9 Billion in 2024, growing at a CAGR of 11.9% during the forecast period.

The Disposable E-cigarettes Market is growing rapidly. Many young people are driving this growth. In March 2025, 41.8% of vapers started between ages 15 and 17. Also, 63.6% of vapers use disposable e-cigarettes. These products are popular due to convenience and flavors. This fuels strong demand worldwide.

Government regulations impact the market heavily. In January 2024, flavored e-cigarette bans took effect. These bans caused about 3 to 4 new daily cigarette smokers for every 5 fewer daily vapers.

This shows challenges regulators face. Despite bans, many still vape or smoke. By July 2024, 46.2% of people reported using tobacco or nicotine products.

The market holds many opportunities. Companies can innovate safer, compliant products. Targeting adult smokers looking for alternatives is key. Government funding for smoking cessation also supports market growth. Businesses adapting to rules and health trends will succeed. Overall, the Disposable E-cigarettes Market shows strong potential for expansion.

Key Takeaways

- The Global Disposable E-cigarettes Market is expected to reach USD 21.2 Billion by 2034.

- The market will grow at a CAGR of 11.9% from 2025 to 2034.

- The Non-Tobacco flavor segment led with a 66.9% market share in 2024.

- High Nicotine Strength products held 58.2% of the nicotine strength market in 2024.

- Online Retail accounted for 45.2% of the distribution channel market in 2024.

- North America held 41.2% of the global market share in 2024, valued at USD 2.8 billion.

Market Drivers

- Disposable e-cigarettes offer hassle-free, ready-to-use convenience for users.

- Smokers increasingly prefer vaping as a safer nicotine alternative.

- Diverse flavors attract a broad, especially younger, consumer base.

- Stricter tobacco regulations and health awareness boost vaping adoption.

Segmentation Insights

Flavor Analysis

In 2024, non-tobacco flavors led the market with 66.9% share, as consumers prefer more exciting options like fruit and menthol over traditional tobacco flavors.

Nicotine Strength Analysis

High nicotine strength held 58.2% of the market, driven by users wanting a stronger hit, while medium and low strengths serve those seeking milder experiences.

End-Use Analysis

Recreational vaping dominated with 73.4% share, fueled by ease of use and flavor variety, while smoking cessation and other uses remain smaller segments.

Distribution Channel Analysis

Online retail led with 45.2% share due to convenience and variety, followed by specialty stores, convenience stores, and supermarkets.

Regional Insights

North America leads the disposable e-cigarette market with 41.2% share, worth USD 2.8 billion, driven by strong demand and growing use as a smoking alternative. The US plays a major role despite some regulatory limits.

Europe holds a solid position with steady growth, helped by health awareness and supportive policies, though stricter rules in some countries may slow growth.

Asia Pacific shows the fastest growth potential due to rising incomes and shifting consumer habits, even though some countries like India ban e-cigarettes.

Latin America and the Middle East & Africa have smaller markets but show early signs of growth in places like Brazil and the UAE.

Recent Developments

- In October 2023, disposable vapes were found to contribute nearly $10 billion worth of ‘invisible’ e-waste annually, highlighting growing environmental concerns linked to single-use vaping devices.

- In March 2024, a College of Medicine secured a $20 million grant aimed at researching alternative tobacco products, signaling increased government investment in public health innovation.

- In August 2024, Japan Tobacco made a strategic acquisition of Vector for $2.4 billion, strengthening its foothold in the booming U.S. e-cigarette market and underscoring confidence in sector growth.

- In June 2024, the FDA authorized the first menthol-flavored e-cigarettes for adult use, marking a pivotal regulatory shift as the agency attempts to balance public health priorities with consumer demand.

Conclusion

The disposable e-cigarette market is positioned for robust growth due to its convenience, appeal as an alternative to smoking, and ongoing product innovation. Regulatory and environmental challenges, however, require companies to adapt through compliance and sustainable practices. Continued diversification of flavors, nicotine formulations, and device designs, combined with expanding distribution channels, will drive the market forward. As consumer preferences evolve, disposable e-cigarettes remain a key segment in the broader shift toward reduced-risk nicotine products.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)