Table of Contents

- Introduction

- Editor’s Choice

- Drone Economy Analytics Overview Statistics

- Drone Analytics Market Statistics

- Applicability Analytics of Drones Statistics

- Drone-based Services Analytics and Activities Statistics

- Global Drone Analytics Spending Statistics

- Trade in Drone Statistics

- Import of Drone Analytics Statistics

- Export of Drone Analytics Statistics

- Usage of Drone Analytics in the Transportation Sector Statistics

- Rising Use of Commercial Drones

- Impact of Drone-Powered Solutions on Industries

- Investments in Drones

- Challenges and Concerns

- Public Opinion On the Use of Drone Strikes

- Regulations for Drones

- Recent Developments

- Conclusion

- FAQs

Introduction

Drone Analytics Statistics: Drone analytics involves collecting and analyzing data from drones equipped with various sensors and cameras.

This data, includes high-resolution imagery, thermal imaging, and LiDAR scans. It is processed through georeferencing, image stitching, and data cleaning to create accurate aerial maps and 3D models.

The analysis focuses on feature extraction, change detection, and predictive analytics to provide insights for applications in agriculture, construction, logistics, and environmental monitoring.

Tools such as photogrammetry software, GIS platforms, and advanced data analytics systems are employed to manage and interpret this data. Key challenges include ensuring data privacy, maintaining accuracy, and complying with regulations.

Editor’s Choice

- The global drone analytics market revenue reached USD 5.2 billion in 2023.

- The global drone market revenue is anticipated to rise to USD 54.6 billion by 2030.

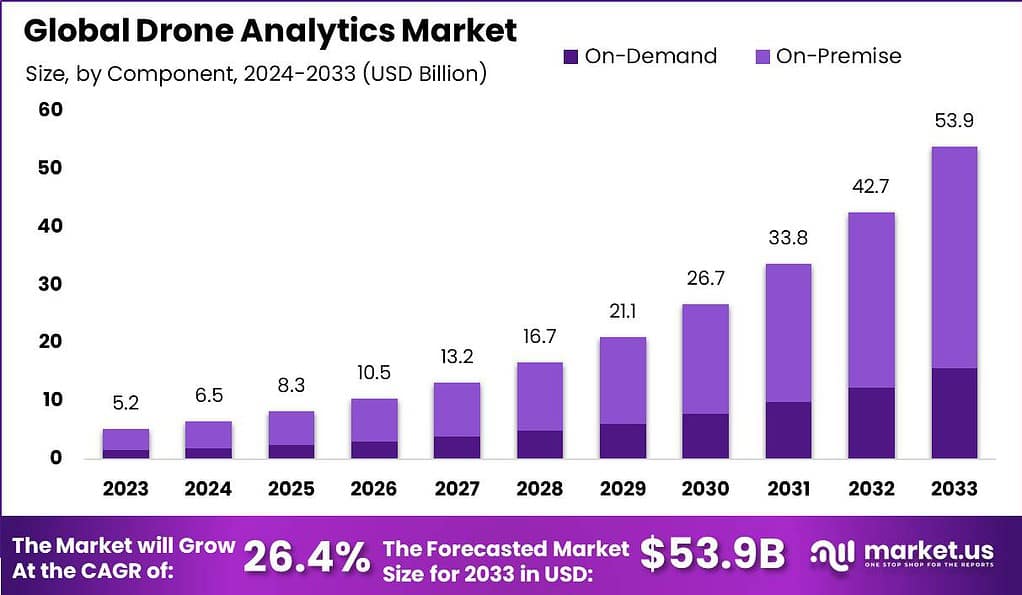

- By 2033, the total market revenue is expected to soar to USD 53.9 billion. With on-demand deployment accounting for USD 15.63 billion and on-premise deployment reaching USD 38.27 billion.

- North America leads with a substantial market share of 41.0%. Reflecting the region’s advanced technological infrastructure and high adoption rates.

- In 2020, the distribution of drone-based services worldwide varied significantly between drone service providers and business internal services. Inspection and maintenance emerged as the leading activity for drone service providers. Accounting for 35% of their operations, while it constituted 18% of business internal services.

- Between FY2017 and FY2021, global drone spending was led by the United States. Which invested USD 17.5 billion, reflecting its substantial commitment to drone technology.

- Between 2010 and 2014, the global unmanned aerial vehicle (UAV) export market was dominated by Israel. Which accounted for 60.7% of the UAVs traded worldwide.

Drone Economy Analytics Overview Statistics

Global Drone Analytics Market Size Statistics

- The global drone market has shown dynamic growth patterns over recent years. With revenue increasing from USD 26.3 billion in 2021 to USD 33.8 billion in 2023.

- Notably, the market experienced a decline in 2024, with revenue dropping to USD 25.7 billion.

- However, this setback was followed by a strong recovery. As revenues surged to USD 39.3 billion in 2025 and continued to grow, reaching USD 41.3 billion in 2026.

- Looking further ahead, the market is projected to achieve significant growth. With revenues anticipated to rise to USD 54.6 billion by 2030.

- This trajectory reflects the expanding applications and increasing adoption of drone technology across various sectors.

(Source: Statista)

Global Civil Drone Analytics Market Size Statistics

- The global civil drone market has exhibited steady growth from 2019 to 2027.

- In 2019, the market revenue stood at USD 7.41 billion.

- This figure increased to USD 8.38 billion in 2020 and further to USD 9.52 billion in 2021.

- The upward trend continued, with revenues reaching USD 10.83 billion in 2022 and USD 12.37 billion in 2023.

- Projections indicate that this growth trajectory will persist. The market is expected to generate USD 14.16 billion in 2024 and USD 16.25 billion in 2025.

- By 2026, the revenue is anticipated to rise to USD 18.72 billion. Culminating in an estimated USD 21.62 billion by 2027.

- This consistent growth underscores the expanding adoption and diverse applications of civil drones across various industries.

(Source: Statista)

Professional Drone Analytics Market Size Statistics

- The global professional drone market has shown robust growth from 2015 to 2020.

- In 2015, the market revenue was USD 1.384 million.

- This figure nearly doubled to USD 2.225 million in 2016 and continued its upward trajectory, reaching USD 3.092 million in 2017.

- The growth persisted, with revenues increasing to USD 3.911 million in 2018 and USD 4.718 million in 2019.

- By 2020, the market revenue had risen to USD 5.595 million.

- This consistent increase in revenue highlights the expanding use and integration of professional drones across various industries and applications.

(Source: Statista)

Professional Drone Analytics Market Distribution – By Geography Statistics

- The professional drone market distribution by world region experienced notable shifts between 2015 and 2020.

- In 2015, the Americas dominated the market with a substantial share of 64.8%. Which increased to 66.9% by 2020, reinforcing their leading position.

- Europe, however, saw a decrease in its market share from 16.9% in 2015 to 12.3% in 2020.

- Conversely, the Asia Pacific region showed growth, with its share rising from 12.5% in 2015 to 15.3% in 2020. Indicating a growing adoption of professional drones in that region.

- The rest of the world accounted for 5.8% of the market in 2015, slightly declining to 5.4% by 2020.

- This distribution highlights the evolving landscape of the professional drone market. With significant growth in the Americas and Asia Pacific regions.

(Source: Statista)

Drone Analytics Market Statistics

Global Drone Analytics Market Size Statistics

- The global drone analytics market has demonstrated significant growth from 2023 to 2033 at a CAGR of 26.4%, with revenue escalating from USD 5.2 billion in 2023 to a projected USD 53.9 billion by 2033.

- In 2024, the market is expected to generate USD 6.5 billion, followed by USD 8.3 billion in 2025.

- The upward trajectory continues, with USD 10.5 billion anticipated in 2026 and USD 13.2 billion in 2027.

- By 2028, the market revenue is predicted to reach USD 16.7 billion, increasing further to USD 21.1 billion in 2029.

- In 2030, the revenue is projected to be USD 26.7 billion, which will rise to USD 33.8 billion in 2031.

- The market is expected to maintain its growth momentum, reaching USD 42.7 billion in 2032 and culminating in USD 53.9 billion by 2033.

- This robust growth highlights the expanding applications and adoption of drone analytics across various sectors.

(Source: market.us)

Global Drone Analytics Market Size – By Deployment Statistics

2023-2027

- The global drone analytics market, segmented by deployment, exhibits substantial growth from 2023 to 2027.

- In 2023, the total market revenue was USD 5.2 billion, with on-demand deployment contributing USD 1.51 billion and on-premise deployment accounting for USD 3.69 billion.

- By 2024, the market is projected to reach USD 6.5 billion, with on-demand and on-premise deployments generating USD 1.89 billion and USD 4.62 billion, respectively.

- The trend continues, with the total market revenue expected to be USD 8.3 billion in 2025, comprising USD 2.41 billion from on-demand and USD 5.89 billion from on-premise deployments.

- In 2026, the market revenue is anticipated to be USD 10.5 billion, with on-demand contributing USD 3.05 billion and on-premise USD 7.46 billion.

- The growth trajectory persists with 2027 figures at USD 13.2 billion, split into USD 3.83 billion for on-demand and USD 9.37 billion for on-premise.

2028-2033

- By 2028, the market is forecasted to reach USD 16.7 billion, with on-demand and on-premise revenues of USD 4.84 billion and USD 11.86 billion, respectively.

- In 2029, total revenue is projected at USD 21.1 billion, with on-demand deployment at USD 6.12 billion and on-premise at USD 14.98 billion.

- The upward trend continues in 2030, with the market expected to reach USD 26.7 billion, split between USD 7.74 billion for on-demand and USD 18.96 billion for on-premise.

- By 2031, the market size is anticipated to be USD 33.8 billion, with USD 9.80 billion from on-demand and USD 24.00 billion from on-premise deployments.

- In 2032, the market is projected to achieve USD 42.7 billion in revenue, with on-demand contributing USD 12.38 billion and on-premise USD 30.32 billion.

- Finally, by 2033, the total market revenue is expected to soar to USD 53.9 billion, with on-demand deployment accounting for USD 15.63 billion and on-premise deployment reaching USD 38.27 billion.

- This growth underscores the increasing adoption and integration of drone analytics solutions in various industries.

(Source: market.us)

Competitive Landscape of the Global Drone Analytics Market Statistics

- Significant contributions from several key players characterize the drone analytics market.

- Pix4D holds the largest market share at 18%, followed closely by Airware, with a 17% share.

- PrecisionHawk and VIATechnik each command substantial portions of the market, with shares of 11% and 10%, respectively.

- AeroVironment and DroneDeploy both account for 9% of the market.

- Delta Drone and Esri have market shares of 8% and 6%, respectively.

- Collectively, other key players contribute 13% to the overall market.

- This distribution highlights the competitive landscape of the drone analytics industry, with multiple companies vying for market leadership.

(Source: market.us)

Regional Analysis of the Global Drone Analytics Market Statistics

- The global drone analytics market exhibits a diverse regional distribution.

- North America leads with a substantial market share of 41.0%, reflecting the region’s advanced technological infrastructure and high adoption rates.

- The Asia-Pacific (APAC) region follows with a notable 28.0% share, indicating significant growth potential and increasing investment in drone technologies.

- Europe holds a 22.0% share, driven by robust industrial applications and regulatory support.

- South America, the Middle East, and Africa (MEA) contribute smaller portions, with market shares of 5.7% and 3.3%, respectively, highlighting emerging opportunities and growing interest in drone analytics in these regions.

- This distribution underscores the global reach and varied regional adoption of drone analytics solutions.

(Source: market.us)

Applicability Analytics of Drones Statistics

Characterization of Drones Analytics – By Performed Tasks Statistics

- The characterization of drones by performed tasks reveals diverse applications across various sectors.

- Asset management emerges as the leading use, accounting for 17% of drone activities.

- Disaster relief follows, representing 13% of usage, while law enforcement utilizes 12% of drones.

- Military applications constitute 11% of drone tasks.

- Aerial delivery and aerial survey activities account for 9% and 8%, respectively.

- Science and development purposes represent 6% of drone use.

- Hobby, leisure, and entertainment activities contribute 4%, while aerial transport and high-tech applications each account for 3%.

- Lastly, aerial photography comprises 2% of drone tasks.

- This distribution underscores the wide-ranging utility of drones in both commercial and recreational domains.

(Source: Science Direct)

Characterization of Drones Analytics – By Drone Type Statistics

- The characterization of drones by type highlights the predominance of rotary-wing drones, which constitute 63% of the market.

- Fixed-wing drones account for 16%, reflecting their significant yet smaller share.

- Drones with any configuration represent 14% of the market, showcasing their versatile applications.

- Vertical take-off and landing (VTOL) drones make up 5%, while aerostats and other types of drones each comprise 1%.

- This distribution underscores the diverse technological configurations utilized in the drone industry, with a strong preference for rotary wing models due to their flexibility and widespread applicability.

(Source: Science Direct)

Drone-based Services Analytics and Activities Statistics

- In 2020, the distribution of drone-based services worldwide varied significantly between drone service providers and business internal services.

- Inspection and maintenance emerged as the leading activity for drone service providers, accounting for 35% of their operations, while it constituted 18% of business internal services.

- Mapping services were provided by 25% of drone service providers and represented 16% of business internal services.

- Photography and filming were also prominent, with 16% of service providers offering these services compared to 19% within businesses.

- Surveying was a major activity for internal business services, making up 33%, whereas it accounted for 15% of drone service providers’ activities.

- Spraying and seeding were relatively minor activities, with 4% of drone service providers and 7% of business internal services engaged in them.

- Other activities included monitoring (1% for service providers and 5% for businesses), localization and detection (1% and 2%, respectively), and various other services comprising 3% for service providers and 4% for internal business activities.

- This distribution highlights the diverse applications of drone technology across different sectors and uses.

(Source: Statista))

Global Drone Analytics Spending Statistics

Drone Spending – By Country

- Between FY2017 and FY2021, global drone spending was led by the United States, which invested USD 17.5 billion, reflecting its substantial commitment to drone technology.

- China followed with USD 4.5 billion in expenditures, while Russia allocated USD 3.9 billion.

- The United Kingdom and Australia also made significant investments, spending USD 3.5 billion and USD 3.1 billion, respectively.

- France, India, and Saudi Arabia each invested USD 2.5 billion in drone technology.

- Japan and South Korea allocated USD 2.2 billion and USD 1.9 billion, respectively.

- Turkey spent USD 1.5 billion, and both Germany and the United Arab Emirates invested USD 1.3 billion each. Brazil and Italy contributed USD 0.8 billion and USD 0.7 billion, respectively.

- The rest of the world collectively accounted for USD 8 billion in drone spending, underscoring the widespread and growing global interest in drone technology.

(Source: Statista)

Trade in Drone Statistics

Drone Trade (UAS/UAV)- International Transfer Volume

- Between 1985 and 2014, the international transfer volume of unmanned aerial vehicles (UAVs) and armed unmanned aerial vehicles (UAVs) demonstrated significant growth.

- From 1985 to 1990, a total of 185 UAVs were transferred.

- This number slightly decreased to 164 units between 1990 and 1994, before rising to 192 units in the 1995–1999 period.

- The early 2000s saw a notable increase, with 272 UAVs transferred from 2000 to 2004.

- The upward trend continued, with 317 UAVs transferred between 2005 and 2009, during which time the first armed UAVs were also transferred, totaling five units.

- The most substantial growth occurred between 2010 and 2014, with 428 UAVs and 11 armed UAVs being transferred internationally.

- This data underscores the increasing adoption and strategic importance of UAVs and armed UAVs in global defense and surveillance operations over the last three decades.

(Source: Statista)

Drone Trade (UAS/UAV) – Countries Receiving and Supplying Drones

- The international trade of unmanned aerial systems (UAS) and unmanned aerial vehicles (UAVs) saw significant expansion from 1985 to 2014, both in terms of the number of recipient and supplier countries.

- From 1985 to 1990, 8 countries received drones from 3 supplier countries.

- This trend saw a slight reduction in recipients to 4 countries while the number of suppliers remained constant at three from 1990 to 1994. However, the subsequent years marked substantial growth.

- Between 1995 and 1999, the number of recipient countries increased to 12, with five supplier countries.

- This growth accelerated between 2000 and 2004, with 24 recipient countries and eight suppliers.

- The period from 2005 to 2009 saw further expansion, with 26 countries receiving drones from 11 suppliers.

- The most significant increase occurred between 2010 and 2014, with 35 recipient countries and ten suppliers.

- This data highlights the expanding global reach and increasing importance of drone technology in international trade over nearly three decades.

(Source: Statista)

Import of Drone Analytics Statistics

Drone Trade (UAS/UAV) – Major Importing Countries

- Between 2010 and 2014, the major unmanned aerial vehicle (UAV) importing countries were led by the United Kingdom, which accounted for 33.9% of the global UAV trade.

- India followed with a significant share of 13.2%, while Italy imported 9.8% of the UAVs traded during this period.

- Azerbaijan and Germany were also prominent importers, with market shares of 7.8% and 7.3%, respectively.

- Turkey imported 6.2% of the UAVs, followed by France at 3.7% and Singapore at 3.2%.

- Brazil rounded out the list with 2.9% of the global UAV imports.

- This distribution underscores the diverse geographical demand for UAV technology during these years, with notable concentrations in Europe and Asia.

(Source: Statista)

Export of Drone Analytics Statistics

Drone Trade (UAS/UAV) – Major Exporting Countries

- Between 2010 and 2014, the global unmanned aerial vehicle (UAV) export market was dominated by Israel, which accounted for 60.7% of the UAVs traded worldwide.

- The United States was the second-largest exporter, with a market share of 23.9%.

- Canada followed with 6.4% of the exports.

- Russia and the Commonwealth of Independent States (CIS) contributed 1.9% to the global UAV trade.

- France and Austria accounted for 1.6% and 1.4%, respectively.

- Italy and Germany were also notable exporters, with market shares of 1.1% and 1%.

- China rounded out the list with 0.9% of the global UAV exports.

- This data highlights Israel’s leading role in the UAV export market during this period, with significant contributions from the United States and Canada as well.

(Source: Statista)

Usage of Drone Analytics in the Transportation Sector Statistics

- In 2021, drone usage in the transportation and warehousing industry was predominantly focused on mapping and surveying, which accounted for 68% of applications.

- Inspection activities represented 34% of drone use in this sector, highlighting their importance in maintaining infrastructure and ensuring safety.

- Delivery applications comprised 7% of drone usage, reflecting the emerging but growing role of drones in logistics.

- Localization and detection tasks accounted for 6%, while other miscellaneous applications made up 5% of the total drone usage in the industry.

- This breakdown illustrates the diverse functionalities of drones within the transportation and warehousing sector, with a strong emphasis on mapping, surveying, and inspection tasks.

(Source: Statista)

Rising Use of Commercial Drones

- The projected market growth for commercial drones from 2016 to 2025 indicates a robust expansion in both revenue and the number of drones sold.

- In 2016, the market generated USD 0.6 billion in revenue, with 110,000 drones sold.

- By 2017, revenue increased to USD 0.8 billion, with 159,000 units sold.

- This upward trend continued in 2018, reaching USD 1.1 billion in revenue and 246,000 drones sold. In 2019, the market saw a significant jump to USD 1.6 billion and 392,000 units sold.

- The growth accelerated in 2020, with revenue climbing to USD 2.4 billion and 634,000 drones sold.

- By 2021, the market revenue surged to USD 3.6 billion, with 996,000 units sold.

- The following year, 2022, saw revenues of USD 5.3 billion and 1,414,000 drones sold.

- In 2023, the market is projected to reach USD 7.6 billion, with 1,909,000 drones sold.

- By 2024, revenues are expected to rise to USD 10.1 billion, with 2,329,000 drones sold.

- Finally, in 2025, the market is anticipated to achieve USD 12.6 billion in revenue, with 2,679,000 drones sold.

- This data underscores the substantial growth and increasing adoption of commercial drones across various industries.

(Source: Tractica)

Impact of Drone-Powered Solutions on Industries

- In 2015, the value of drone-powered solutions across various industries was substantial. The infrastructure sector led the way, with solutions valued at USD 45.2 billion.

- Agriculture followed, with a market value of USD 32.4 billion, highlighting the significant impact of drones on farming and crop management.

- The transport industry saw drone solutions worth USD 13 billion, while the security sector valued these solutions at USD 10.5 billion.

- The media and entertainment industry utilizes drone technology, which is valued at USD 8.8 billion.

- In the insurance sector, drone-powered solutions were worth USD 6.8 billion, closely followed by the telecommunication industry at USD 6.3 billion.

- Lastly, the mining industry benefited from drone solutions, which were valued at USD 4.3 billion.

- This data underscores the diverse and growing applications of drone technology across various industries.

(Source: PwC)

Investments in Drones

- From 2017 to 2019, there was a significant increase in the share of supply chain leaders worldwide who planned to invest in drones.

- In 2017, 8% of respondents indicated their intention to invest in drone technology.

- This figure rose to 13% in 2018, reflecting growing interest and recognition of the potential benefits of drones in supply chain operations.

- By 2019, the share of respondents planning to invest in drones had nearly tripled from 2017 levels, reaching 22%.

- This trend highlights the escalating adoption of drone technology within the supply chain sector, driven by its promise to enhance efficiency, accuracy, and overall operational effectiveness.

(Source: Statista)

Challenges and Concerns

- Between 2001 and 2013, the U.S. military experienced a notable fluctuation in the number of drone crashes.

- In 2001, there were six reported crashes, which slightly increased to 7 in 2002.

- The number decreased to 4 crashes in 2003 but rose significantly to 9 in 2004.

- The trend continued upward, with 12 crashes reported in both 2005 and 2006.

- In 2007, the number of crashes increased to 16, followed by a substantial rise to 21 in 2008.

- The peak was observed in 2009 and 2011, each with 23 crashes.

- In 2010, there was a temporary decrease to 14 crashes.

- However, 2012 saw the highest number of crashes, reaching 26.

- By 2013, the number slightly decreased to 21 crashes.

- This data highlights the varying rates of drone crashes over the years, reflecting the growing use and operational challenges of military drones.

(Source: The Washington Post)

Public Opinion On the Use of Drone Strikes

High Disapproval

- Public opinion on the United States conducting missile strikes from pilotless aircraft, known as drones, to target extremists in countries such as Pakistan, Yemen, and Somalia varies significantly across different nations.

- In Venezuela, 92% of the people disapprove of such actions, with only 4% approving. Similar high disapproval rates are seen in Jordan (90% disapprove, 5% approve), Greece (89% disapprove, 8% approve), and Nicaragua (88% disapprove, 9% approve).

- Egypt, Brazil, and Argentina each have an 87% disapproval rate, with approval ranging from 4% to 7%. In Spain and Senegal, 86% disapprove, while 12% and 11% respectively approve.

- Colombia and the Palestinian territories also show high disapproval at 86% and 84%, respectively, with approval rates at 9% and 7%. In Turkey, 83% disapprove, and 7% approve, while in Japan, 82% disapprove and 12% approve. Peru and Mexico have disapproval rates of 81% and 80%, with corresponding approval rates of 10% and 14%.

- In Malaysia, 80% disapprove, and 10% approve, similar to Thailand, where 79% disapprove and 12% approve. Vietnam and Russia both show a 78% disapproval rate, with approval at 12% and 7%, respectively.

- Tunisia (77% disapprove, 17% approve), South Korea (75% disapprove, 23% approve), and Italy (74% disapprove, 18% approve) also reflect significant disapproval. Indonesia shows 74% disapproval and 10% approval, while El Salvador’s figures are 73% disapproval and 11% approval.

Less Disapproval

- In France, 72% disapprove, and 27% approve, and in Lebanon, 71% disapprove and 23% approve. Bangladesh reflects 70% disapproval and 22% approval, whereas Chile shows 68% disapproval and 15% approval.

- Tanzania and the Philippines both have a 67% disapproval rate, with 27% and 24% approval, respectively.

- Germany exhibits 67% disapproval and 30% approval, with Ukraine at 66% disapproval and 11% approval and Pakistan at 66% disapproval and only 3% approval.

- The United Kingdom has a lower disapproval rate at 59%, with 33% approving. In Uganda, 56% disapprove and 36% approve, while Poland has 54% disapproval and 32% approval.

- China’s disapproval is at 52%, with 35% in favor. Ghana and South Africa have lower disapproval rates at 47% and 46%, with approval at 29% and 27% respectively.

- In the United States, opinions are divided, with 41% disapproving and 52% approving. Nigeria shows a close split with 39% disapproval and 42% approval, while in Kenya, 38% disapprove and 53% approve. India has a 36% disapproval and 28% approval rate.

- Notably, Israel has the highest approval rate at 65%, with 27% disapproving. This data highlights the varying global perspectives on the use of drones for military strikes, with generally higher disapproval rates in many countries.

(Source: Statistics)

Regulations for Drones

- Drone regulations vary significantly by country, reflecting different approaches to safety, privacy, and technological innovation.

- In the United States, drones must be registered with the Federal Aviation Administration (FAA), flown below 400 feet, and within the operator’s visual line of sight.

- The European Union, governed by EASA regulations, categorizes drones based on risk, requiring different levels of certification and operational limitations.

- In countries like Japan and Canada, there are specific permissions for operations beyond visual line of sight (BVLOS), especially in sparsely populated areas, promoting the use of drones for delivery services.

- Meanwhile, countries like India and China impose stringent controls to address safety and security concerns.

- For instance, India’s DGCA mandates UAS operator permits and restricts drone flights over sensitive areas.

- These regulations are continually evolving to balance technological advancements with considerations of public safety and privacy.

(Sources: Drone Laws, Drone Gator, UAV Coach, European Union Aviation Safety Agency, RAND Corporation)

Recent Developments

Acquisitions and Mergers:

- AgEagle Aerial Systems acquires Measure: In early 2023, AgEagle Aerial Systems completed its acquisition of Measure, a leading provider of drone analytics software, for $45 million. This acquisition aims to enhance AgEagle’s capabilities in drone data analytics and expand its customer base in the agricultural sector.

- Delair acquires Airware: Delair, a global provider of drone-based solutions, acquired Airware, a drone analytics company, for $50 million in mid-2023. This merger is expected to strengthen Delair’s position in the drone analytics market by integrating Airware’s advanced analytics platform.

New Product Launches:

- DroneDeploy’s 3D Mapping Software: In early 2024, DroneDeploy launched a new 3D mapping software designed for construction and real estate applications. This software offers enhanced data visualization, real-time site monitoring, and detailed 3D models, improving project management and decision-making.

- PrecisionHawk’s TerraModeler: PrecisionHawk introduced TerraModeler in late 2023, a new analytics tool for precision agriculture. TerraModeler provides farmers with actionable insights through advanced data analytics, helping optimize crop yields and resource management.

Funding:

- Skycatch secures $70 million: In 2023, Skycatch, a provider of industrial drone data solutions, raised $70 million in a Series C funding round to expand its AI-driven analytics platform and enhance its global market presence.

- Kespry raises $50 million: Kespry, a drone-based aerial intelligence provider, secured $50 million in early 2024 to accelerate the development of its analytics platform and expand its services in the mining, construction, and insurance sectors.

Technological Advancements:

- AI and Machine Learning Integration: Advances in AI and machine learning are being integrated into drone analytics platforms to improve data processing, enhance predictive analytics, and provide more accurate insights, increasing the efficiency of drone operations.

- Real-Time Data Processing: The development of real-time data processing capabilities is enabling drone analytics platforms to deliver immediate insights during flight, allowing for faster decision-making and more efficient operations.

Market Dynamics:

- Growth in Drone Analytics Market: The global drone analytics market is projected to grow at a CAGR of 24.5% from 2023 to 2028, driven by the increasing adoption of drones in various industries such as agriculture, construction, and mining, and the growing need for data-driven decision-making.

- Rising Demand in Agriculture: The agriculture sector is seeing significant growth in the adoption of drone analytics for crop monitoring, soil analysis, and resource management, helping farmers improve yields and reduce costs.

Regulatory and Strategic Developments:

- FAA’s Remote ID Rule: The Federal Aviation Administration (FAA) implemented the Remote ID rule in early 2024, requiring drones to broadcast identification and location information during flight. This regulation aims to enhance airspace safety and improve the integration of drones into the national airspace system.

- EU Drone Regulations: The European Union updated its drone regulations in 2023 to include stricter requirements for data privacy, security, and operational safety, promoting the responsible use of drones and drone analytics across member states.

Research and Development:

- Advanced Imaging Technologies: R&D efforts are focusing on developing advanced imaging technologies such as multispectral, hyperspectral, and thermal imaging to provide more detailed and comprehensive data for drone analytics applications.

- Autonomous Drone Operations: Researchers are working on enhancing autonomous drone operations through advanced navigation and obstacle avoidance systems, enabling drones to operate more independently and efficiently in various environments.

Conclusion

Drone Analytics Statistics – The drone analytics market is experiencing rapid growth, with revenues expected to rise from USD 5.2 billion in 2023 to USD 53.9 billion by 2033.

This expansion is driven by advancements in technology and increased adoption across sectors such as infrastructure, agriculture, security, and media.

North America leads the market, followed by Asia-Pacific and Europe. Key players like Airware and Pix4D are significantly investing in on-demand and on-premise solutions.

Despite regulatory and safety challenges, the market’s diverse applications in asset management, disaster relief, and law enforcement highlight its critical importance.

Continued innovation and investment signal a promising future for drone analytics, revolutionizing data-driven decision-making and operational efficiency across industries.

FAQs

Drone analytics involves the use of data collected by drones for various purposes, such as mapping, surveying, inspection, and monitoring. This data is analyzed to provide actionable insights for industries like agriculture, infrastructure, security, and media.

Drones collect data through sensors such as cameras, LiDAR, thermal sensors, and multispectral sensors. This data is then processed and analyzed using specialized software to extract valuable information.

Industries that benefit significantly include agriculture (for crop monitoring), infrastructure (for inspections and maintenance), security (for surveillance), and media (for aerial photography and filming).

Drone analytics offer benefits such as increased efficiency, cost savings, enhanced safety, and improved accuracy in data collection and analysis. They enable real-time monitoring and faster decision-making.

Challenges include regulatory compliance, data privacy concerns, technical limitations such as battery life and data processing capabilities, and public perception regarding privacy and safety.