Table of Contents

Introduction

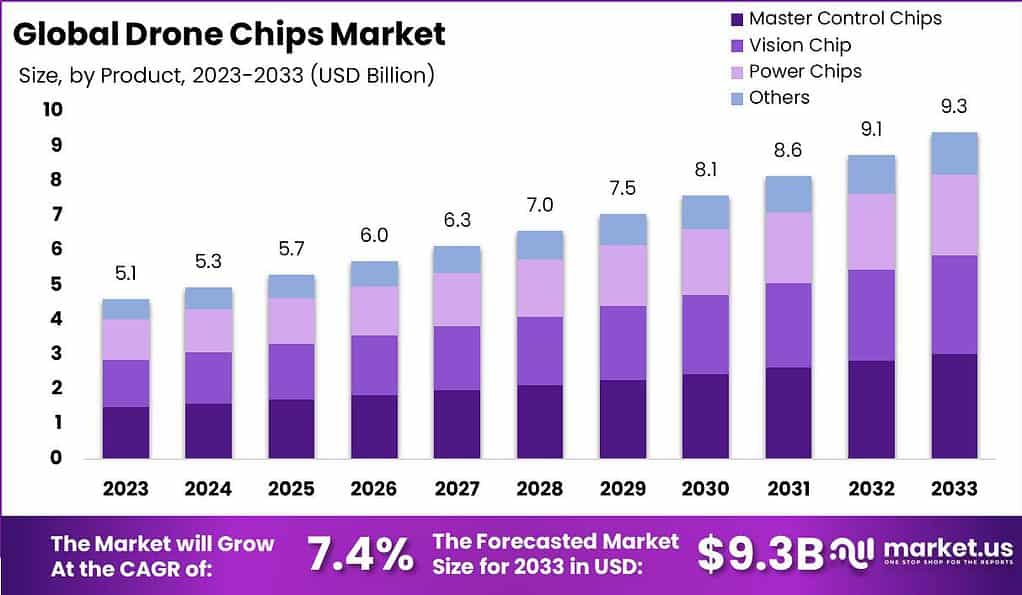

According to Market.us, The Drone Chips Market is projected to reach a value of USD 9.3 Billion by 2033, with a compound annual growth rate (CAGR) of 7.4% during the forecast period from 2024 to 2033. The Drone Chips Market is experiencing significant growth, driven by the expanding use of drones in various sectors such as agriculture, delivery services, and surveillance. These chips are crucial for enhancing the functionalities of drones, including navigation, data processing, and communication. As technology advances, the demand for sophisticated, high-performance drone chips that support increased operational efficiency and better connectivity continues to rise.

One of the key growth factors for the drone chips market is the expanding applications of drones across multiple sectors. Drones are being utilized in industries such as agriculture, construction, logistics, aerial photography, and surveillance, among others. These applications require advanced drone chips capable of processing data quickly and efficiently, enabling drones to perform complex tasks with precision.

Furthermore, the advancements in chip technology have led to the development of smaller, lighter, and more powerful drone chips. This has contributed to the miniaturization of drones and improved their overall performance. Compact and efficient drone chips have opened up opportunities for the use of drones in areas with limited space or challenging environments.

However, the drone chips market also faces certain challenges. One of the significant challenges is the regulatory framework surrounding drone operations. Many countries have implemented strict regulations to ensure the safe and responsible use of drones, which includes guidelines for drone chip specifications. Adhering to these regulations and obtaining necessary certifications can be a hurdle for drone chip manufacturers.

Key Takeaways

- The Drone Chips Market is projected to reach a value of USD 9.3 Billion by 2033, with a compound annual growth rate (CAGR) of 7.4% during the forecast period from 2024 to 2033.

- In 2023, the Master Control Chips segment dominated the market, accounting for more than 32.3% of the market share.

- Similarly, the Civilian Drones segment held a significant market position, capturing over 37.5% of the market share.

- North America led the market with a substantial position, representing more than 35.7% of the market share and generating USD 1.8 billion in revenue in 2023.

Drone Chips Statistics

- The Drone Market size is projected to be worth around USD 101.1 Billion by 2033, growing from USD 34.5 Billion in 2023, at a CAGR of 12.7% during the forecast period from 2024 to 2033.

- Over 40 drone companies are currently operating in the US.

- Analysts indicate that China’s DJI dominates the global drone market with a 70% share.

- Despite being based in Shenzhen, China, 80% of DJI’s drones and other products are sold internationally.

- In the US market, DJI holds a 77% share.

- Intel follows with a 3.7% share in the US market.

- Popular brand GoPro ranks fifth with a 1.8% share, while Kespry holds the bottom position with a 0.3% share.

- The average cost of a professional drone is approximately $2,000.

- It is estimated that 26% of Americans have flown a drone.

- Consumer drones account for approximately 95% of the total global drone market.

- Drones have contributed to a 75% reduction in the time required to inspect a roof.

- In the logistics sector, drones are predicted to reduce delivery times by 85%.

Emerging Trends

- Integration of AI and Machine Learning: Drone chips are increasingly incorporating AI and machine learning capabilities. This integration allows drones to process large amounts of data in real-time, enhancing their decision-making abilities and enabling more autonomous operations. This trend is particularly significant in applications such as geographical surveys and wildlife monitoring.

- Advancements in IoT Connectivity: The Internet of Things (IoT) is transforming drone operations by enabling seamless communication between drones and other devices. This connectivity supports remote monitoring and smart agriculture, where drones can monitor crop health and environmental conditions, thus optimizing resource usage.

- 5G Technology Adoption: The implementation of 5G technology in drone chips is a game-changer, providing high-speed connectivity essential for real-time data transfer. This is crucial for applications requiring instant communication, such as emergency response and aerial deliveries.

- Enhanced Material Science: There have been significant advancements in the materials used for drone chips, including ultra-lightweight composites and self-healing materials. These innovations improve flight efficiency, duration, and the overall resilience of drones, making them more suitable for challenging environments.

- Electric Propulsion Systems: The shift towards electric propulsion systems is notable, with drones now featuring quieter and more environmentally friendly engines. Innovations in battery technology have also led to longer flight times, and the exploration of solar-assisted drones is expanding the operational capabilities of drones.

Top Use Cases for Drone Chips

- Agriculture: Drones equipped with advanced chips are revolutionizing precision farming. They provide detailed insights into soil health, irrigation needs, and pest control, helping farmers optimize resource use and improve crop yields.

- Construction and Urban Planning: In construction, drones facilitate site surveying and project monitoring, reducing the need for manual surveys and enhancing safety and efficiency. Urban planners use drones for detailed aerial views, aiding in sustainable city development.

- Emergency Response: Drones are increasingly used in emergency situations for search and rescue operations, disaster management, and delivering medical supplies. Their ability to quickly reach and survey affected areas makes them invaluable in crisis scenarios.

- Logistics and Delivery: The logistics sector benefits from drones for inventory management and last-mile deliveries. Companies like Amazon and UPS are exploring drone deliveries to improve efficiency and reduce delivery times.

- Infrastructure Inspection: Drones are used for inspecting critical infrastructure such as bridges, power lines, and pipelines. Equipped with high-resolution cameras and sensors, they provide detailed images and data, allowing for timely maintenance and reducing the risk of failures.

Major Challenges

- Regulatory Obstacles: Stringent and evolving regulatory frameworks pose significant challenges. Rules around drone traffic management (UTM), remote identification (Remote ID), and beyond visual line of sight (BVLOS) operations are complex and differ across regions, making compliance difficult for manufacturers and operators alike.

- Technological Complexity: The rapid advancement in drone technology necessitates continuous innovation in chip design. Integrating advanced functionalities such as AI, real-time data processing, and enhanced connectivity into compact, power-efficient chips is a significant technical challenge.

- Economic Factors: High inflation rates and economic downturns can impact the affordability and investment in drone technology. Economic instability also affects the supply chain, leading to increased costs and potential delays in production and delivery.

- Security Concerns: Ensuring the cybersecurity of drones is critical, especially as they are increasingly used in sensitive applications. Chips must be designed to prevent hacking, data breaches, and unauthorized access, which requires advanced security features and continuous updates.

- Supply Chain Disruptions: The global semiconductor shortage has affected the availability of essential components for drone chips. Supply chain disruptions, geopolitical tensions, and export restrictions can further exacerbate these issues, impacting production timelines and costs.

Market Opportunities

- Emerging Markets: Expanding into emerging markets presents a significant opportunity. Regions like Asia-Pacific, Latin America, and Africa are witnessing increased adoption of drones for agriculture, healthcare, and infrastructure monitoring, driving demand for robust and cost-effective drone chips.

- Technological Advancements: Continuous innovation in semiconductor technology can enhance the capabilities of drone chips, allowing for more sophisticated applications such as automated delivery systems, advanced aerial surveillance, and precision agriculture.

- Commercial Applications: The growing use of drones in commercial sectors such as logistics, construction, and media provides a substantial market opportunity. The need for high-performance chips that can handle complex tasks efficiently is rising in these industries.

- Increased Investment: Investment in drone technology is increasing, driven by both private and public sectors. Funding for research and development in drone chips can lead to breakthroughs that improve performance, reduce costs, and expand application areas.

- Sustainability and Efficiency: Developing energy-efficient chips that extend drone flight times and reduce operational costs can attract significant market interest. As sustainability becomes a priority, there is a growing demand for chips that support eco-friendly drone operations.

Recent Developments

Qualcomm

- January 2023: Qualcomm announced the launch of its latest drone chip, the Snapdragon Flight RB5 5G, designed to enhance AI capabilities and 5G connectivity in drones. This new chip aims to provide superior processing power and extended flight range for commercial and consumer drones .

Intel

- March 2023: Intel unveiled its new Movidius Myriad X VPU, which integrates AI and computer vision capabilities, specifically targeting drone applications. This chip focuses on providing enhanced autonomous navigation and obstacle avoidance for drones.

STMicroelectronics

- May 2023: STMicroelectronics introduced the STM32WBA series, a wireless microcontroller designed for IoT and drone applications. The new series offers improved energy efficiency and connectivity, catering to the growing demand for smarter and more efficient drones.

Texas Instruments (TI)

- July 2023: Texas Instruments released its latest radar sensors, designed to improve the safety and navigation of drones. These sensors are part of TI’s efforts to advance autonomous functionalities in drones, providing better real-time environmental sensing.

Samsung

- September 2023: Samsung announced the launch of its Exynos 2100, a high-performance chip optimized for drone applications. This chip focuses on enhancing computational power and energy efficiency, crucial for prolonged drone operations .

Ambarella

- November 2023: Ambarella introduced the CV5 AI Vision Processor, specifically designed for drone and robotics applications. This chip aims to deliver advanced AI processing for real-time video analysis and autonomous navigation.

NVIDIA

- January 2024: NVIDIA launched the Jetson Orin Nano, a compact AI supercomputer designed for drones and robotics. It provides enhanced AI capabilities, enabling complex computations and real-time processing for autonomous drones.

Conclusion

In conclusion, the drone chips market is poised for substantial growth, driven by the increasing integration of drones into various industries and the continuous advancements in chip technology. While the market faces challenges such as regulatory hurdles and high development costs, the opportunities for innovation and expansion remain vast. The development of more efficient, powerful, and cost-effective chips will be crucial in meeting the growing demand for sophisticated drone applications. As companies continue to invest in research and development, the drone chips market is expected to thrive, playing a pivotal role in the evolution of drone technology and its widespread adoption across multiple sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)