Table of Contents

Introduction

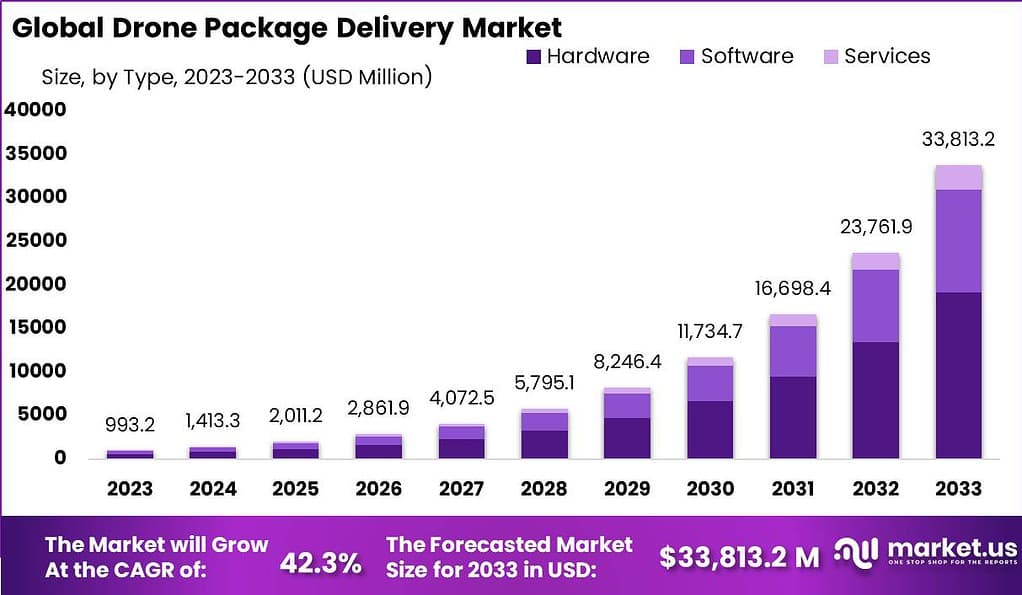

The Drone Package Delivery Market has been on an impressive trajectory, reaching a valuation of USD 33,813.2 Million by 2033, exhibiting a remarkable CAGR of 42.5% from 2023. This growth is fueled by the transformative impact drones have had on the logistics industry, offering faster, more cost-effective delivery solutions. Key players such as Alphabet Inc., DHL, FedEx, UPS, Amazon, and others have been instrumental in driving this market forward, leveraging advancements in technology and strategic partnerships to gain dominance.

One of the driving factors behind this growth is the increasing demand for remote delivery services, coupled with growing environmental consciousness. Drones provide a solution that not only speeds up deliveries but also reduces carbon footprints, aligning well with global sustainability efforts. Moreover, integration of AI and ML in drones for delivery operations is a prominent trend, enhancing efficiency and accuracy.

However, the market faces challenges due to a complex regulatory framework for drone operations. Navigating these regulations can be cumbersome and costly for businesses, hindering seamless cross-border logistics. Additionally, geopolitical tensions and economic downturns can negatively impact market growth, affecting supply chains and investments.

Key Takeaways

- The global drone package delivery market is projected to reach USD 33,813.2 Million by 2032, growing at an impressive CAGR of 42.3% from 2024 to 2033.

- Hardware leads the market with a dominant revenue share of 56.8%, playing a fundamental role in enabling drone operations.

- Multi-rotor wing drones dominate the market with a major revenue share of 68.4%, offering versatility and suitability for urban and short-range deliveries.

- Packages less than 2 kg lead the market with a major revenue share of 44.6%, aligning with the growing demand for swift and cost-effective delivery solutions.

- Deliveries less than 30 minutes hold a major revenue share of 60.4%, meeting the need for ultra-fast, on-demand deliveries in sectors like e-commerce and healthcare.

- Remotely piloted drones secure a major revenue share of 52.6%, offering human control and oversight, which are prioritized for safety and compliance.

- Food delivery dominates the market with a major revenue share of 38.6%, driven by increasing consumer demand for fast and contactless food deliveries, especially in urban areas.

- North America leads the market with a major revenue share of 35.6%, supported by a robust ecosystem of drone manufacturers, technology innovators, and delivery service providers. Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by rapid urbanization and a burgeoning e-commerce sector.

Drone Package Delivery Statistics

- By 2024, over 60% of big logistics companies are expected to use drone delivery services for some of their operations.

- The number of e-commerce retailers using drone delivery is set to go up by 45% between 2022 and 2024.

- About 50% of people will likely be okay with getting their packages via drone by the end of 2024.

- Over 65% of drone deliveries will likely be done by drones that can fly themselves, avoiding obstacles and finding their way.

- The use of drones to deliver things right to where you live, especially in cities, is expected to increase by 40% from 2022 to 2024.

- More than 60% of drone delivery services should offer a way for customers to see where their package is in real-time.

- Around 45% of logistics companies plan to mix drone delivery with other ways of getting packages around, like trucks and vans, by 2024.

- It’s predicted that more than 70% of drone delivery operations will use smart traffic systems and technologies to share the sky safely by 2024.

- The use of drones to carry medical supplies and help in emergencies could go up by 35% between 2022 and 2024.

- By 2024, over 55% of drone delivery services are expected to make sure packages are handled safely and protected against tampering.

Gain Immediate Access to Detailed Market Insights: https://market.us/purchase-report/?report_id=73454

Emerging Trends

- Hybrid Drone’s Rising Popularity: Hybrid UAVs, known for their quick vertical take-offs and landings as well as AI-based collision avoidance, are becoming increasingly popular for commercial and industrial applications.

- Growth in Less Than 2 Kg Package Deliveries: Packages weighing less than 2 kg dominate the market, largely due to regulatory approvals for such deliveries, particularly in the U.S. for food and medical supplies.

- Healthcare as a Leading Sector: The healthcare segment is expected to witness significant growth, driven by the demand for medical products, lab samples, vaccines, and instruments.

- Technological Advancements: Drones have evolved to incorporate advanced technologies like AI, 3D imaging, and sense & avoid systems, expanding their use in various industries.

Use Cases

- E-commerce and Logistics: Major e-commerce and logistics companies, such as Amazon and DHL, have launched drone delivery systems to expedite deliveries and reach areas inaccessible by traditional transport.

- Last Mile Deliveries: Drones are increasingly used for last-mile deliveries, offering a compact, quick, and environmentally friendly alternative to traditional delivery methods.

- Medical Supplies Delivery: Drones are deployed globally for delivering medical supplies, vaccines, groceries, and food items, showcasing their potential in emergency response and remote access.

- Smart Drone Delivery Solutions: Intelligent and fully automated drone delivery solutions are being developed for urban areas, enhancing the efficiency and cost-effectiveness of deliveries.

Major Challenges

- Operational Security: Concerns over the security of aerial delivery drones, including vulnerability to hacking and their use in illegal activities, pose significant challenges.

- Regulatory Framework: The need for drone operators to comply with aviation regulatory frameworks across different countries impacts the market’s growth and operational flexibility.

Market Opportunities

- Infrastructure Development: Partnerships aimed at building drone delivery infrastructure, particularly in urban areas and for e-commerce and logistics giants, present significant opportunities.

- Technological Integration: The incorporation of AI and sense & avoid systems in drones offers enhanced safety and autonomy, driving their adoption across various sectors.

- Revamped Government Regulations: Evolving regulatory frameworks that support drone services development, especially for BVLOS operations, are opening new avenues for the drone package delivery market.

Top 13 Vendors

- Amazon (Prime Time Air): Amazon is pioneering with Prime Air, aiming to deliver packages up to 5 pounds in 30 minutes or less using drones, having received FAA approval for drone deliveries.

- FedEx: FedEx has been exploring drone delivery, revealing its UAV research and planning to deploy drones for transporting parts and assessing conditions at Memphis International Airport.

- UPS (UPS Flight Forward): UPS Flight Forward received full approval to operate a drone airline in the U.S., collaborating with Matternet for medical deliveries and partnering with CVS for prescription drug delivery.

- DHL (Parcelcopter): DHL’s Parcelcopter can carry payloads up to 4.4 pounds, having conducted trial deliveries in Germany and East Africa for rapid response services.

- Alphabet (Wing): Alphabet’s Wing offers small drones for package delivery, having made over 100,000 deliveries across three continents, with a significant increase in demand during the pandemic.

- Walmart: Walmart is known for its interest in drone delivery, exploring various pilots to enhance its logistics and delivery services.

- Uber Eats: Uber Eats has expressed interest in using drones for food delivery to reduce delivery times and costs.

- Zipline: Zipline focuses on critical and lifesaving product deliveries, operating one of the largest automated delivery systems globally.

- Matternet: Specializes in drone delivery solutions for healthcare, e-commerce, and logistics, offering an end-to-end platform leveraging its drones, cloud platform, and stations.

- Flytrex: Provides a drone delivery service for retailers, online marketplaces, and restaurants, having begun operations in Iceland and conducting test programs in the U.S..

- Flirtey: Offers last-mile delivery services using drones, credited with the first legal drone parcel delivery in the U.S., focusing on safety and efficiency.

- Wingcopter: Produces drones for commercial and humanitarian services, including medical air services and logistics, with operations in international markets like Vanuatu and Ireland.

- EHang, Swoop Aero, Manna, and Cainiao were these companies are recognized for their contributions to advancing drone delivery technologies and applications across various sectors.

Recent Developments

- Zipline continued expanding its medical drone delivery services in Africa throughout 2023

- Wingcopter launched its delivery drone, the HAV.30, in Europe in July 2023

- EHang received approval for autonomous drone delivery trials in China in November 2023

- UPS partnered with Drone Delivery Canada to launch commercial drone delivery trials in Canada in September 2023

Conclusion

In conclusion, drone package delivery has the potential to transform the logistics and transportation industry by offering faster, more efficient, and environmentally friendly delivery options. The market is driven by advancements in drone technology, the growth of e-commerce, and the need for contactless and efficient delivery solutions. While challenges exist, addressing regulatory, privacy, and technical aspects will pave the way for the widespread adoption of drone package delivery, opening up new possibilities for the future of logistics.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)