Table of Contents

Introduction

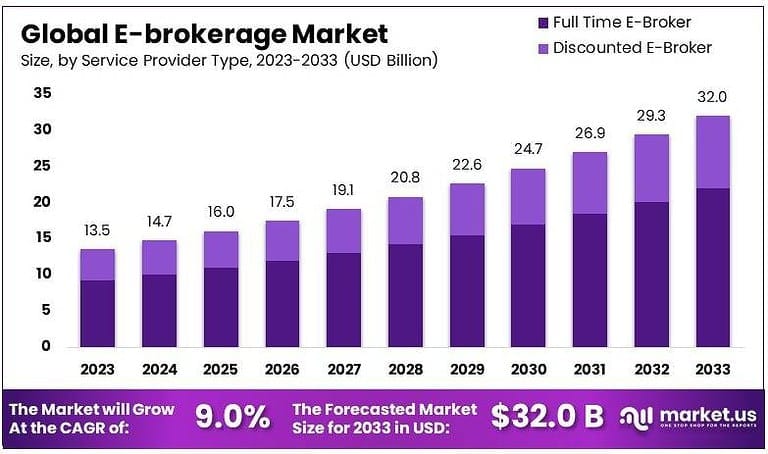

The global e-brokerage market is projected to grow from USD 13.5 billion in 2023 to USD 32.0 billion by 2033, at a robust compound annual growth rate (CAGR) of 9.0%. This growth is driven by increasing digitalization in financial services, the growing preference for online trading, and advancements in technology, including artificial intelligence (AI) and machine learning.

E-brokerage platforms offer users convenient and cost-effective ways to access financial markets, driving demand among retail and institutional investors. The expansion of mobile trading applications and lower transaction fees are expected to further fuel market growth, making it an attractive segment for investors.

How Growth is Impacting the Economy

The expansion of the e-brokerage market is having a profound impact on the global economy, primarily by democratizing access to financial markets. As retail investors increasingly participate in stock trading, the flow of capital into various sectors is accelerating. The rise of digital trading platforms is reducing entry barriers for individual investors, fostering financial inclusion. This increased participation helps drive market liquidity and contributes to capital formation.

Moreover, as e-brokerage platforms scale, they drive the growth of technology and financial sectors, generating new job opportunities and increasing economic activity in fintech and related industries. The overall shift toward online trading is also enabling faster decision-making and more efficient capital allocation, benefiting businesses globally.

➤ Uncover best business opportunities here @ https://market.us/report/e-brokerage-market/free-sample/

Impact on Global Businesses

The growth of the e-brokerage market has wide-reaching implications for global businesses, particularly in terms of rising costs and shifting supply chains. With the increasing popularity of online trading platforms, financial institutions must adapt to new competition and ensure that their services remain relevant. Rising transaction volumes may result in higher operational costs for businesses in the e-brokerage space, necessitating investments in cutting-edge technology and infrastructure.

Supply chain shifts are also expected as brokerages invest in cloud computing, cybersecurity, and data analytics to manage the growing volume of data and maintain user trust. Sector-specific impacts include the financial services, fintech, and tech sectors, where there is increased demand for innovative solutions and strategic partnerships to capture a share of the growing market.

Strategies for Businesses

To thrive in the growing e-brokerage market, businesses must focus on providing seamless, user-friendly platforms and adopting the latest technologies to stay ahead of the competition. This includes integrating AI and machine learning to offer personalized trading experiences, enhance customer support, and automate processes.

Additionally, businesses should invest in cybersecurity measures to build consumer trust and safeguard sensitive financial data. Expanding services into emerging markets and offering educational tools for retail investors can help capture new customer segments. Businesses that prioritize customer experience and innovation will maintain a competitive edge and continue to thrive as the market grows.

Key Takeaways

- The global e-brokerage market is expected to reach USD 32.0 billion by 2033, growing at a CAGR of 9.0%.

- Increased participation by retail investors and advancements in technology are driving the market’s growth.

- The rise of mobile trading platforms is enhancing accessibility to financial markets globally.

- E-brokerage businesses must innovate and adopt AI, machine learning, and cybersecurity to remain competitive.

- The market expansion is expected to continue, driven by technological advancements and financial inclusion efforts.

➤ Buy Report Here @ https://market.us/purchase-report/?report_id=128925

Analyst Viewpoint

The e-brokerage market is experiencing substantial growth, primarily fueled by the increasing shift toward digitalization and online trading. Presently, this market is characterized by technological innovations, such as AI-driven personalized trading and mobile-first platforms.

In the future, the market is expected to expand significantly, with e-brokerage platforms becoming even more integrated into daily financial activities. The rise of retail investors and a continued push toward financial inclusion will likely accelerate this growth. As the market matures, businesses that invest in cutting-edge technologies, enhance security, and improve user experience will secure a strong position in this growing sector.

Regional Analysis

The e-brokerage market shows diverse regional growth patterns. North America leads the market, driven by the widespread adoption of online trading and technological advancements in financial services. Europe is also witnessing strong growth, supported by regulatory frameworks that promote transparency and access to financial markets.

The Asia-Pacific region is expected to experience the highest growth rate, fueled by increasing urbanization, digital adoption, and rising disposable incomes, especially in countries like China and India. Meanwhile, Latin America and the Middle East are showing gradual but promising adoption of e-brokerage platforms, with potential for significant market penetration.

➤ Discover More Trending Research

- AI in Tourism Market

- Quantum Dot (QD) Display Market

- Semiconductor Laser Market

- Data Center Liquid Cooling Market

Business Opportunities

The global e-brokerage market offers numerous opportunities for businesses, especially in technology-driven solutions for trading platforms. Companies that specialize in developing mobile-first trading applications, cybersecurity solutions, and AI-based trading tools stand to benefit significantly from market growth.

Additionally, expanding e-brokerage services into emerging markets presents a lucrative opportunity, as these regions are seeing an increasing number of retail investors eager to access global financial markets. Educational platforms and tools that help demystify trading and investment are also gaining traction, presenting another business opportunity in the market.

Key Segmentation

Service Type:

- Full-Service Brokerages – 55%

- Discount Brokerages – 45%

Platform Type:

- Web-Based – 60%

- Mobile-Based – 40%

User Type:

- Retail Investors – 70%

- Institutional Investors – 30%

Key Player Analysis

Key players in the e-brokerage market are focusing on providing diverse and intuitive trading platforms that cater to both retail and institutional investors. These players are increasingly leveraging artificial intelligence and data analytics to improve trading experiences, offering personalized services and smart decision-making tools.

Many companies are also expanding their services to include financial education and customer support, ensuring a more user-friendly experience. Moreover, partnerships with fintech firms are enabling e-brokerages to diversify their offerings and enter new markets, further driving growth and strengthening their market presence.

- Bank of America Corporation

- Robinhood Markets, Inc.

- Fidelity Investments

- Interactive Brokers LLC

- The Charles Schwab Corporation

- E*TRADE

- IG Group Holdings Plc

- Plus500 Ltd.

- XTB Group

- Ally Financial Inc.

- Other Key Players

Recent Developments

- In January 2025, a leading e-brokerage firm launched an AI-powered trading assistant to enhance user experience and improve trade accuracy.

- In March 2025, a major platform introduced a mobile-based app that allows real-time trading with low fees and enhanced security features.

- In May 2025, a global e-brokerage company expanded its operations into emerging markets in Asia-Pacific, offering localized trading solutions.

- In July 2025, an e-brokerage platform integrated blockchain technology to offer more secure and transparent transactions.

- In September 2025, a fintech company announced a partnership with a major bank to offer seamless trading and banking services through a single platform.

Conclusion

The e-brokerage market is experiencing significant growth, driven by technological innovation and increased retail investor participation. Businesses that prioritize customer experience, security, and technological advancements will find substantial opportunities for growth. As the market continues to evolve, the adoption of AI, mobile-first platforms, and emerging market expansion will define future success.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)