Table of Contents

Introduction

The global e-Commerce market is experiencing rapid growth, projected to reach USD 151.5 trillion by 2034, up from USD 28.29 trillion in 2024, reflecting a robust CAGR of 18.29%. In 2024, Asia-Pacific (APAC) led the market with a dominant 45.7% share, generating USD 12.8 trillion in revenue.

B2B eCommerce is the largest segment, capturing 70.7% of the market, underlining its critical role in global trade. Home appliances also stand out as a key category, accounting for 25.9% of total eCommerce sales. North America follows closely with a 29.8% share, and Europe holds 16.9%.

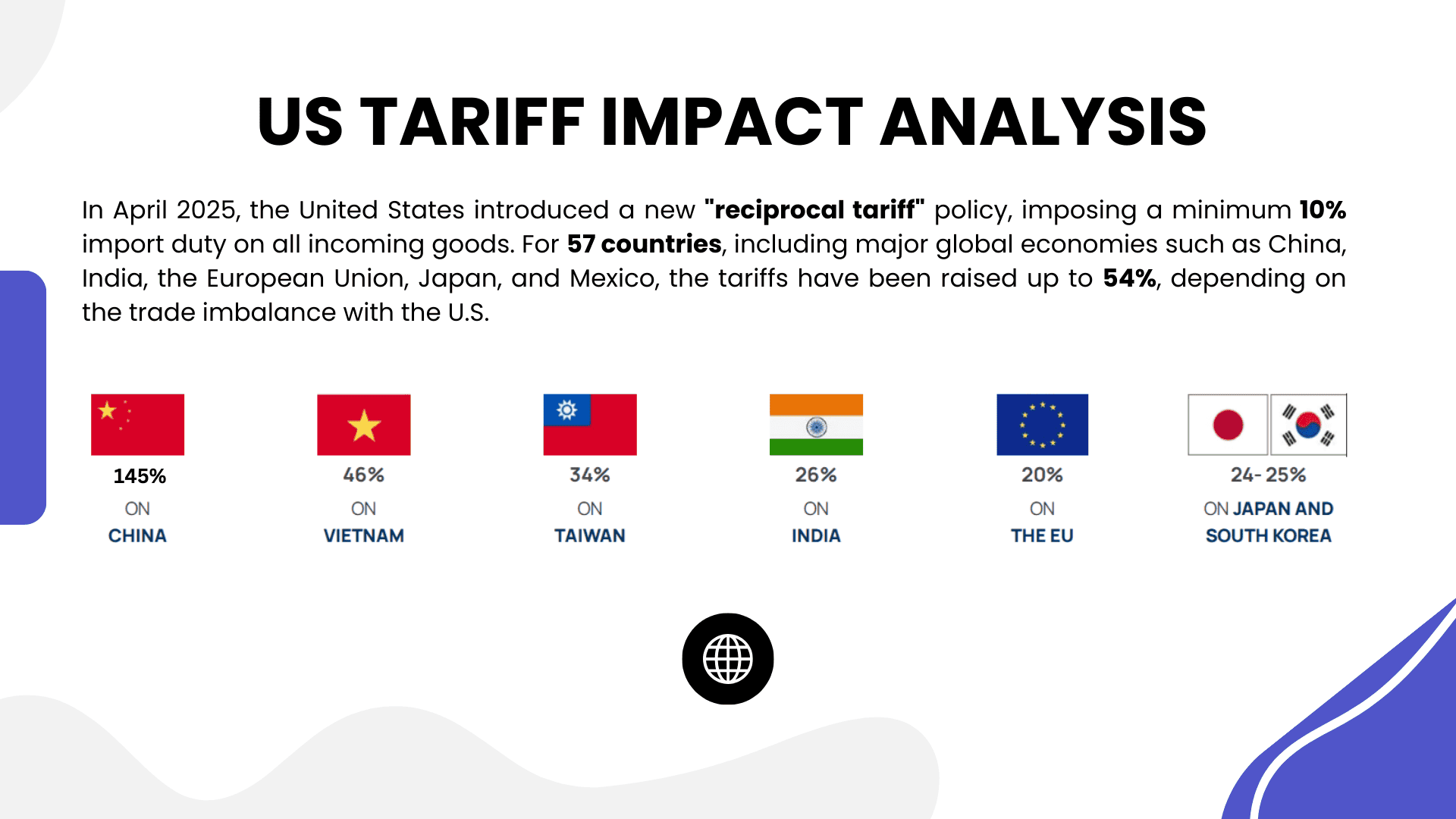

US Tariff Impact on Market

The imposition of tariffs, particularly on goods imported from China, has had a significant impact on the global eCommerce market, especially for businesses in the U.S. E-commerce companies that rely on imported goods, including electronics, apparel, and home appliances, have seen an increase in operational costs by approximately 8-10%.

These tariff hikes are particularly affecting B2C and B2B transactions, where price sensitivity is a key factor. The tariff burden has led many U.S. companies to raise product prices, which could potentially affect consumer purchasing behavior and disrupt the flow of cross-border trade.

➤➤➤ Experience the power of actionable insights – get a sample here @ https://market.us/report/e-commerce-market/free-sample/

As a result, some companies are adjusting their supply chains to mitigate the impact, including reshoring production and diversifying suppliers to countries less impacted by tariffs. While the short-term effect has been an increase in product costs, the long-term impact on the e-commerce market will likely depend on how quickly companies can adapt to these new trade dynamics.

Tariff Impact Percentage: 8-10% increase in operational costs due to tariffs on imported goods.

Economic Impact

Tariffs have increased costs for U.S. e-commerce businesses, particularly those relying on international suppliers for home appliances, electronics, and apparel. Higher costs have pressured profit margins, and while larger companies can absorb these increases, smaller businesses face greater challenges. The long-term effect will depend on cost adaptation strategies.

Geographical Impact

North America, particularly the U.S., faces tariff-related cost increases, particularly in B2C and B2B transactions involving imported goods. While APAC remains the dominant region with a strong market share, it faces indirect effects as global demand for e-commerce goods may fluctuate due to higher prices. Europe and LAMEA are less affected.

Business Impact

The tariff imposition has led to increased operational costs for businesses, especially in sectors like home appliances and electronics. Companies are adjusting their strategies by exploring local manufacturing options, diversifying supply chains, and enhancing inventory management to mitigate the effects. The increased cost burden may slow the growth of small businesses.

Key Takeaways

- The global eCommerce market will grow from USD 28.29 trillion in 2024 to USD 151.5 trillion by 2034, at a CAGR of 18.29%.

- B2B eCommerce dominates, with a 70.7% share.

- APAC leads with 45.7% of the market share.

- U.S. tariffs raise costs by 8-10%.

- Home appliances account for 25.9% of sales.

Analyst Viewpoint

While the tariff-induced increase in operational costs is a challenge, the long-term outlook for the global e-commerce market remains highly positive. With e-commerce penetration rising globally, especially in emerging markets, businesses are adapting to tariffs by diversifying supply chains and reshoring production.

These adjustments will help mitigate short-term disruptions. Technological advancements in automation, AI-driven inventory management, and digital payment solutions will continue to propel the market. As consumer behaviors shift toward online shopping, the growing demand for cross-border eCommerce services will maintain the upward trajectory of market expansion, making the future of global eCommerce bright.

➤➤➤ Attention!!! Grab Limited Period Offer Now @ https://market.us/purchase-report/?report_id=142386

Regional Analysis

Asia-Pacific (APAC) dominates the e-commerce market, accounting for 45.7% of the global share in 2024. China and India play crucial roles in driving e-commerce growth, fueled by large populations, expanding middle classes, and robust digital infrastructure. North America follows with a 29.8% share, driven by the dominance of B2B eCommerce and strong consumer spending patterns.

Europe, with a 16.9% market share, continues to grow, driven by innovations in digital payment systems and mobile commerce. The LAMEA region, contributing 7.6%, shows promising growth prospects as internet penetration and mobile connectivity expand in emerging markets like Latin America and Africa.

Business Opportunities

The rapid expansion of the e-commerce market presents significant opportunities, particularly in emerging regions such as LAMEA and Asia-Pacific. Businesses can capitalize on growing internet penetration, mobile shopping trends, and the demand for a variety of goods, including home appliances and electronics.

With B2B eCommerce continuing to dominate, companies can benefit from expanding their digital platforms to streamline global trade. New business models, such as subscription-based services, localized warehousing, and automated fulfillment systems, present further opportunities for market growth. Additionally, increasing demand for seamless cross-border eCommerce transactions offers a chance to tap into new customer bases globally.

➤ Tariff effects on listed markets?

- Wheeled Humanoid Robots Market

- Edge AI Accelerator Market

- Esports Advertising Market

- E-commerce Predictive Analytics Market

Key Segmentation

The global e-commerce market is segmented by type, category, and region.

- Type: B2B eCommerce dominates with 70.7% market share, highlighting the importance of wholesale and bulk transactions in global trade.

- Category: Home appliances are a major segment, accounting for 25.9% of the market due to growing demand for electronics and household goods.

- Region: APAC holds 45.7% of the market share, with strong growth driven by China and India. North America follows with 29.8%, while Europe holds 16.9%.

- Platform: E-commerce websites remain dominant, but mobile commerce is growing rapidly, particularly in APAC and LAMEA regions.

Key Player Analysis

Leading companies in the e-commerce market focus on enhancing user experience, expanding logistics capabilities, and integrating advanced technologies such as AI, machine learning, and blockchain. These technologies streamline supply chain operations, improve personalized shopping experiences, and optimize inventory management.

Players are also increasing their presence in emerging markets, where the growth potential is immense. Strategic acquisitions, partnerships with local businesses, and investments in digital payment infrastructure are key strategies. Companies are also investing in automation and robotics to enhance warehousing and fulfillment, ensuring faster delivery times and reduced operational costs, ultimately driving market expansion.

Key E-commerce Companies

- Amazon.com, Inc.

- Alibaba.com

- ASOS

- Costco Wholesale Corporation

- Dangdang

- eBay Inc.

- Flipkart.com

- JD.com

- Lazada

- MercadoLibre S.R.L.

- Shopify

- Shopee

- Walmart

- Wayfair LLC

- Zalando

Recent Developments

Recent developments include the implementation of AI-powered tools for personalized shopping experiences and automated customer service. Companies are also increasing their investment in green logistics to meet sustainability goals. Additionally, there is a growing trend toward mobile-first platforms, particularly in emerging regions, to cater to the increasing use of smartphones for shopping.

Conclusion

The global e-commerce market continues to expand rapidly, driven by B2B transactions and the increasing demand for consumer goods, especially in home appliances. Moreover, despite tariff challenges, businesses are adapting by diversifying supply chains and leveraging technological advancements. The future remains bright, with global e-commerce poised for continued robust growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)