Table of Contents

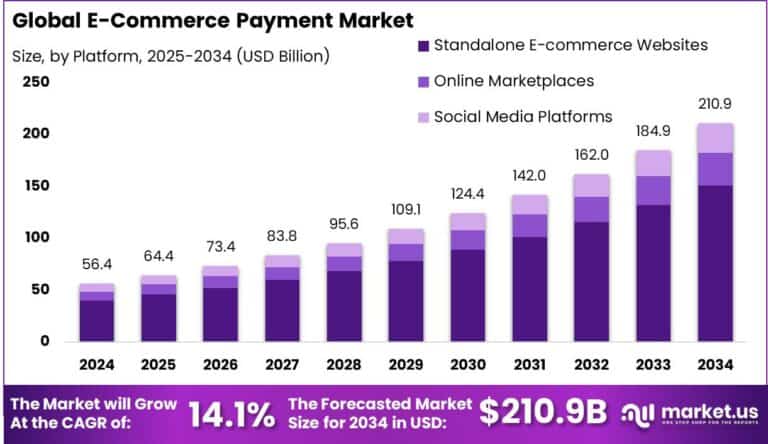

The Global E-Commerce Payment Market is projected to grow from USD 56.4 billion in 2024 to USD 210.9 billion by 2034, registering a CAGR of 14.1% during 2025-2034. Asia-Pacific dominates with a 42.8% market share in 2024, generating USD 24.1 billion revenue. China, a key market, holds USD 8.44 billion with a CAGR of 15.7%. This growth is driven by rising online retail penetration, digital payment adoption, and enhanced security technologies, making e-commerce payments more seamless and secure globally.

How Tariffs Are Impacting the Economy

Tariffs on cross-border goods and digital services introduce additional costs, affecting the overall economy by increasing prices and disrupting supply chains. Higher tariffs on imported goods result in increased duties passed on to consumers, reducing purchasing power and slowing online transactions. For e-commerce payment providers, tariffs can affect transaction volumes as cross-border trade becomes more expensive. Moreover, tariffs introduce uncertainty in international trade, delaying goods clearance and increasing logistical complexities, which can hinder timely payments and settlements.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/e-commerce-payment-market/free-sample/

(Use corporate mail ID for quicker response)

These challenges force businesses to reconsider their supply chains and market strategies. However, tariffs can incentivize local manufacturing and fintech innovation to reduce dependency on imports. Over time, this could foster economic resilience and diversification despite short-term trade disruptions.

Impact on Global Businesses

Rising tariffs increase costs for global e-commerce merchants, payment processors, and logistics providers. These costs reduce profit margins and can cause higher fees for consumers, potentially decreasing demand. Supply chain disruptions lead to delays and increased inventory costs, particularly impacting fast-moving consumer goods and electronics sectors.

Businesses are shifting to diversify suppliers and regionalize operations to mitigate tariff risks. Payment providers must ensure compliance with evolving regulations while enhancing transaction security to retain customer trust. Companies that adapt their strategies to tariff pressures can sustain growth and maintain competitive advantages in the expanding e-commerce landscape.

Strategies for Businesses

To address tariff impacts, businesses are implementing strategies such as:

- Diversifying supply chains across multiple regions to avoid tariff-heavy zones.

- Establishing regional payment and fulfillment centers to reduce cross-border complexities.

- Investing in advanced payment technologies like AI for fraud detection and faster processing.

- Collaborating with governments and trade bodies to leverage tariff exemptions.

- Enhancing transparency and compliance to streamline cross-border transactions.

These approaches optimize costs, improve customer experience, and enhance operational resilience.

Key Takeaways

- The e-commerce payment market will reach USD 210.9 billion by 2034, growing at 14.1% CAGR.

- Asia-Pacific leads with 42.8% market share, with China growing rapidly at 15.7% CAGR.

- Tariffs raise costs and create trade uncertainties, impacting cross-border e-commerce payments.

- Businesses respond with supply chain diversification, regionalization, and tech investment.

- The market’s growth is driven by digital adoption, security enhancements, and global trade expansion.

➤ Get full access now @ https://market.us/purchase-report/?report_id=148496

Analyst Viewpoint

The Global E-Commerce Payment Market is positioned for sustained growth, fueled by increasing online commerce and digital payment innovation. While tariffs present cost and logistical challenges, businesses are adapting through strategic sourcing and technology upgrades. The outlook is positive, with continued demand for secure, efficient payment solutions worldwide. Companies embracing AI-driven payment processing and regional expansion will secure long-term success in this competitive landscape.

Regional Analysis

Asia-Pacific dominates the e-commerce payment market with a 42.8% share in 2024, driven by rapid digital adoption, mobile payment popularity, and government initiatives. China leads with USD 8.44 billion revenue and strong CAGR growth. North America and Europe represent mature markets focusing on security and seamless user experiences. Emerging regions like Latin America and the Middle East are expanding quickly due to improving digital infrastructure and rising consumer internet penetration.

➤ Discover More Trending Research

Business Opportunities

Expanding e-commerce, mobile penetration, and consumer demand for convenient payment options create significant opportunities. Providers offering AI-powered fraud detection, multi-currency support, and seamless omnichannel payment solutions stand to gain market share. The rise of Buy Now, Pay Later (BNPL) and digital wallets also drives innovation. Companies that cater to regional preferences and regulatory frameworks will capture new customer segments and grow in diverse markets globally.

Key Segmentation

Payment Type

- Digital Wallets

- Credit/Debit Cards

- Bank Transfers

- Buy Now, Pay Later (BNPL)

End-User

- Retail

- Travel & Hospitality

- Healthcare

- Consumer Electronics

- Others

Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

This segmentation highlights the broad applicability and growing demand across sectors and regions.

Key Player Analysis

Leading players in the e-commerce payment market focus on enhancing security features, improving transaction speed, and expanding global reach through partnerships and acquisitions. They invest in AI and machine learning to combat fraud and optimize payment processing. In response to tariffs and regulatory complexities, companies strengthen compliance frameworks and develop localized solutions. Innovation in user experience and multi-currency support remains critical to maintaining market leadership.

Top Key Players in the Market

- Apple Pay

- Adyen

- CyberSource

- Worldpay

- Stripe

- 2Checkout

- PayPal

- Braintree

- Checkout.com

- Square

- Google Pay

- Amazon Payments

- Mercado Pago

- Others

Recent Developments

- In 2025, several companies launched AI-driven payment fraud detection platforms.

- Cross-border payment solutions expanded in emerging markets with localized currency support.

- Regulatory bodies introduced frameworks to streamline e-commerce payments and enhance security.

Conclusion

The Global E-Commerce Payment Market is set for robust growth, propelled by digital commerce and innovation in payment technologies. Despite tariff-induced challenges, strategic adaptations and technology investments will sustain momentum. Businesses that prioritize security, compliance, and regional customization will thrive in this dynamic market.