Table of Contents

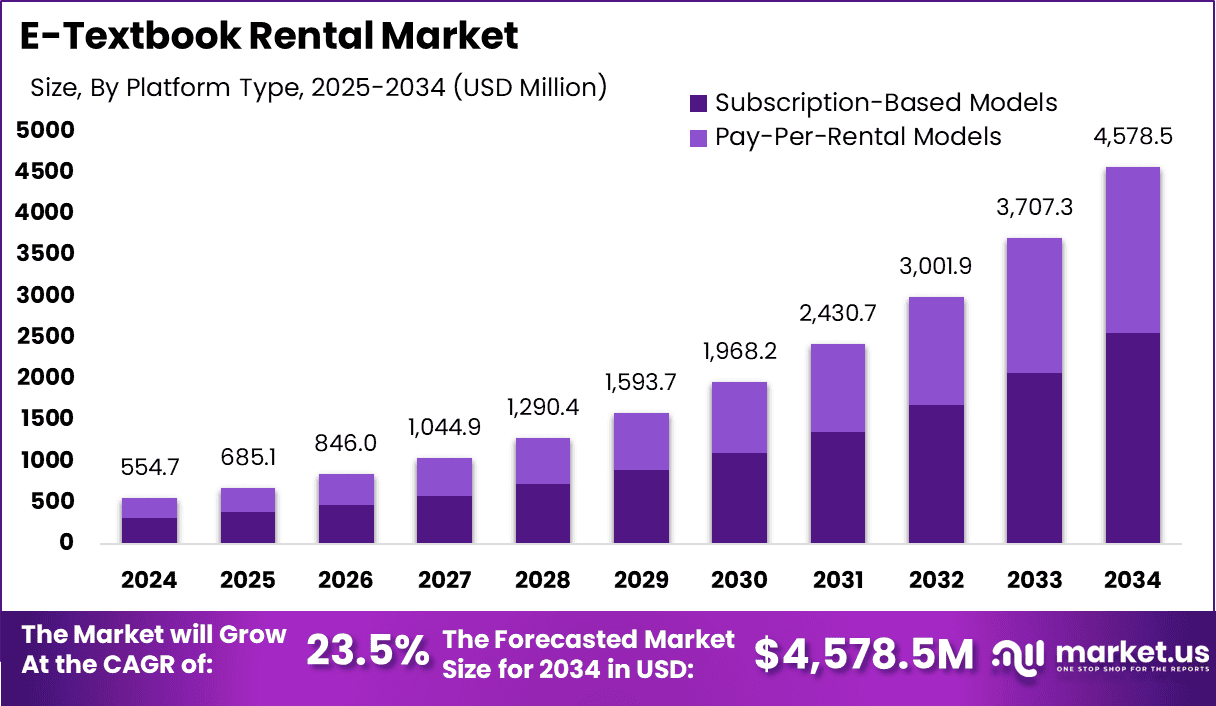

The global E-Textbook Rental Market is projected to grow from USD 554.7 million in 2024 to USD 4,578.5 million by 2034, reflecting a CAGR of 23.5%. North America led the market in 2024, capturing over 38% of the share, generating USD 210.7 million in revenue.

The rapid digital adoption in educational institutions, coupled with the increasing shift toward remote and blended learning, is fueling the growth of this market. The subscription-based model, which offers flexible access to e-textbooks, has gained significant traction, especially in higher education, where it accounts for over 70% of the market.

How Tariffs Are Impacting the Economy

Tariffs are influencing various sectors of the economy, particularly industries reliant on global supply chains, such as education technology. The increased cost of imported electronics, components, and materials, common in digital textbooks and devices used for e-learning, has raised production costs.

For businesses involved in digital textbook rentals, this has led to higher operational expenses, particularly as the cost of digital devices and e-readers rises due to tariffs. As companies face higher expenses, some may pass on these costs to consumers, raising prices for end-users. This could deter the adoption of digital learning tools, as students may find themselves priced out of the market.

Additionally, tariffs on software and technology development tools may hinder innovation in digital platforms for education, slowing the introduction of new and more affordable solutions. On the positive side, the disruption caused by tariffs could lead to more localized production and investment in developing domestic solutions for e-textbook delivery, ultimately driving innovation and long-term efficiency in the market.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/e-textbook-rental-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Tariffs have escalated costs for businesses in the e-textbook rental market, particularly those that rely on importing hardware and software components for digital textbook platforms. These cost increases are pushing companies to either absorb the higher expenses or pass them on to consumers, leading to higher prices for digital textbooks and devices.

Furthermore, businesses are reevaluating their supply chains, seeking alternative suppliers or even reshoring production to reduce reliance on foreign components subject to tariffs. The shift to local manufacturing or sourcing could help mitigate some of the cost pressures caused by tariffs, though it may take time to implement effectively.

Sector-Specific Impacts

In the education sector, the impact of tariffs is felt in the production of digital devices and the development of e-learning platforms. As higher education institutions increasingly adopt digital textbooks, any increase in the cost of electronic devices such as tablets and e-readers directly impacts the affordability of e-textbook rentals.

Similarly, educational software developers are facing higher costs for development tools and digital content, which could limit their ability to innovate and provide affordable solutions for students. This sector-specific impact is slowing the expansion of digital textbook rental services, particularly in emerging markets where cost sensitivity is a major barrier to adoption.

Strategies for Businesses

To mitigate the effects of tariffs, businesses in the e-textbook rental market are adopting various strategies:

- Supply Chain Diversification: Sourcing components and software from regions with lower tariff rates or considering domestic suppliers to avoid tariff increases.

- Technology Integration: Leveraging cloud-based solutions and digital platforms to streamline operations and reduce reliance on hardware imports.

- Cost Optimization: Streamlining operations, enhancing platform efficiency, and optimizing pricing models to absorb tariff-induced cost increases without heavily burdening end-users.

- Consumer Engagement: Increasing the value proposition by offering additional features such as bundled courses, interactive content, or integrated study tools to enhance customer loyalty.

➤ Explore more strategies get full access now @ https://market.us/purchase-report/?report_id=147790

Key Takeaways

- Market Growth: The global e-textbook rental market is expected to grow at a CAGR of 23.5%, reaching USD 4.58 billion by 2034.

- Regional Dominance: North America held 38% of the market share in 2024, with USD 210.7 million in revenue, led by the U.S.

- Subscription-Based Models: Dominating the market with a 56% share in 2024, these models are highly favored for their flexibility and cost efficiency.

- Higher Education Focus: The higher education sector is the primary driver, accounting for more than 70% of the global share in 2024.

Analyst Viewpoint

The e-textbook rental market is poised for substantial growth, driven by increasing digital adoption across educational institutions, particularly in North America. The subscription-based model offers substantial flexibility for students and remains a popular choice.

Despite tariff-related challenges, including rising costs and supply chain disruptions, the market is likely to see continued growth due to the increasing shift toward digital learning and remote education. As tariffs lead to innovation in local production and sourcing, the market will adapt, and the long-term outlook remains positive for businesses offering cost-effective and innovative digital solutions.

Regional Analysis

North America remains the dominant region in the global e-textbook rental market, accounting for over 38% of the global share in 2024. The U.S. alone contributed USD 1.62 billion, driven by strong demand for digital learning solutions in higher education.

The market in the U.S. is expected to continue its growth trajectory, driven by institutional partnerships and rising digital curriculum mandates. Other regions, particularly Europe and Asia-Pacific, are also showing growth potential, with increased adoption of digital learning tools and a shift towards remote learning formats in higher education.

➤ Discover More Trending Research

- AI in FP&A Market

- Blockchain for Cold Chain Logistics Market

- Deepfake Detection Market

- Digital Fashion Market

Business Opportunities

The e-textbook rental market presents numerous opportunities for businesses to innovate and expand. As higher education institutions increasingly adopt digital platforms for course delivery, there is growing demand for cost-effective, flexible, and scalable e-textbook rental solutions.

Subscription-based models present an opportunity for long-term customer retention, as they offer students affordable access to digital textbooks and other educational resources. Additionally, as remote and blended learning continue to rise in popularity, businesses can tap into new market segments by offering e-textbooks for diverse disciplines, including vocational training and professional development courses.

Key Segmentation

The global e-textbook rental market is segmented by business model, region, and industry:

- Business Model: Subscription-based models dominate the market with a 56% share, offering flexibility and affordability for students.

- Region: North America leads with 38% market share, driven by high demand in the U.S. and Canada’s higher education sectors.

- Industry: Higher education remains the largest sector, accounting for more than 70% of the global market share in 2024, reflecting growing adoption in universities.

Key Player Analysis

Leading players in the e-textbook rental market are focusing on providing digital solutions that cater to the needs of students and academic institutions. These companies invest heavily in technology, offering flexible pricing models, such as subscriptions, to make digital learning more accessible.

They also enhance user experience by integrating advanced features such as interactive content, cloud-based platforms, and mobile compatibility. Partnerships with educational institutions, governments, and publishers are essential for expanding market reach and content availability. The competitive landscape is marked by ongoing innovation in content delivery and digital textbook management systems.

Top Key Players in the Market

- Bloomsbury

- CengageBrain

- Chegg

- TextbookRush

- Alibris

- Amazon Kindle Unlimited

- BookRenter

- Barnes & Noble

- IndiaReads

- iFlipd

- Oyster

- Scribd

- Others

Recent Developments

In 2024, the U.S. e-textbook rental market continued to expand, driven by higher education’s increasing adoption of digital curriculum. Subscription models gained traction, and new partnerships formed between textbook providers and academic institutions to further drive market penetration.

Conclusion

The e-textbook rental market is growing rapidly, driven by the increasing digital transformation of education, especially in North America. Subscription models remain the most popular choice, and the market’s future is positive, with numerous growth opportunities in emerging markets and new academic sectors. Despite tariff challenges, businesses can innovate to capture a larger share of this expanding market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)