Table of Contents

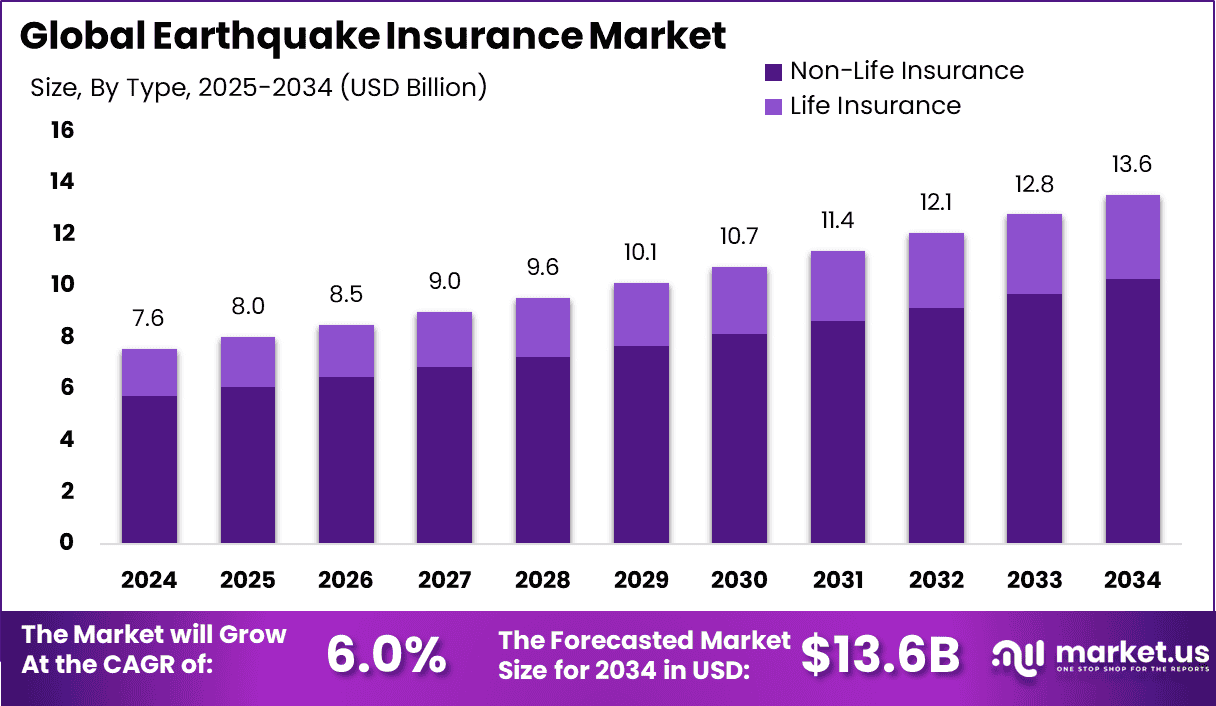

The global Earthquake Insurance Market is expected to grow from USD 7.6 billion in 2024 to USD 13.6 billion by 2034, reflecting a steady CAGR of 6.0%. North America dominated the market in 2024, capturing 38% of the market share with USD 2.8 billion in revenue.

The U.S. alone contributed nearly USD 2.7 billion in 2024 and is projected to reach USD 4.1 billion by 2034. Factors driving this growth include increasing awareness of seismic risks, a rise in natural disaster frequency, and growing concerns over asset protection, particularly in high-risk zones like California.

How Tariffs Are Impacting the Economy

The imposition of tariffs has significantly affected the global economy, leading to higher operational costs and disrupted trade flows. In the U.S., the introduction of tariffs on imported goods has led to higher prices for products ranging from electronics to agricultural goods. The inflationary effect has resulted in reduced household purchasing power, with the average U.S. household projected to lose around $3,800 annually.

Furthermore, the economy has been projected to experience a reduction of 1.1% in GDP by 2025, equating to a $170 billion loss in output. These tariffs also create supply chain challenges, as businesses are forced to rethink sourcing strategies and face increased transportation and raw material costs. While the tariffs aim to protect domestic industries, they can also lead to retaliatory measures from trade partners, which exacerbates global economic instability and uncertainty.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/earthquake-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Global businesses are grappling with rising costs as a result of tariffs, especially in industries that rely heavily on imported goods. Supply chains are becoming more expensive and inefficient, with businesses increasingly seeking alternative sources of supply to mitigate tariff exposure. Additionally, companies are facing disruptions as they reconfigure their global operations to comply with new trade policies, resulting in higher operational and logistics costs.

Sector-Specific Impacts

Sectors such as automotive, electronics, and agriculture are experiencing the most significant impacts due to tariffs. In the automotive industry, costs have risen due to tariffs on parts and raw materials, while electronics companies face challenges in sourcing affordable components. Similarly, agricultural producers are hit hard by retaliatory tariffs on their exports, leading to reduced market access and lower profit margins.

Strategies for Businesses

Businesses are employing various strategies to mitigate the adverse impacts of tariffs:

- Supply Chain Diversification: Shifting to alternative suppliers in regions with lower or no tariffs to reduce cost pressures.

- Nearshoring: Relocating manufacturing operations closer to home markets to cut down on transportation and tariff costs.

- Product Innovation: Creating or modifying products to reduce dependence on tariff-impacted materials.

- Cost Absorption: Absorbs a portion of the tariff-induced cost increases to avoid passing the full burden onto consumers.

➤ Get Full Access Purchase Now @ https://market.us/purchase-report/?report_id=147592

Key Takeaways

- Market Growth: The global earthquake insurance market is expected to grow at a CAGR of 6.0% from 2024 to 2034.

- Regional Leadership: North America, particularly the U.S., dominates the market, holding 38% of the global share.

- Sector-Specific Segments: The Non-Life Insurance segment accounted for over 76% of the market in 2024, with personal policies leading coverage types.

- Distribution Channels: Agents remain the leading sales channel, representing over 30% of the market share in 2024.

Analyst Viewpoint

Currently, the Earthquake Insurance Market is witnessing steady growth driven by rising awareness and a growing need for asset protection in seismic zones. The U.S. market, though slightly lagging the global growth pace, remains a key driver, particularly in high-risk states like California.

In the future, the market is poised for continued expansion as more homeowners and businesses seek protection against natural disaster risks. The rising frequency of earthquakes and natural disasters further supports the demand for earthquake insurance policies, ensuring long-term market growth.

Regional Analysis

In 2024, North America led the Earthquake Insurance Market with a 38% market share, driven by regions like California, which are highly susceptible to seismic activity. The U.S. alone contributed USD 2.7 billion in revenue and is expected to reach USD 4.1 billion by 2034.

Other regions, such as Europe and Asia-Pacific, are also experiencing growth, although at a slower rate due to less frequent seismic events. In these regions, increasing urbanization and awareness of earthquake risks are driving the adoption of insurance policies.

➤ Discover More Trending Research

- Zero Trust Security Models in ERP Market

- Voice-Activated Apps Market

- Sea Drones Market

- Multi Screen Advertising Market

Business Opportunities

The earthquake insurance market presents numerous opportunities, especially in regions with a high frequency of seismic activity. In North America, particularly in California, businesses can capitalize on growing consumer awareness by offering tailored insurance solutions for homeowners and businesses.

Additionally, the rising trend of digitalization provides an opportunity to enhance customer engagement and streamline the policy acquisition process through mobile platforms and online services. Developing new coverage options for businesses in seismic zones, such as comprehensive property and asset protection, also represents a key growth opportunity.

Key Segmentation

The earthquake insurance market can be segmented by coverage type, distribution channel, and region:

- Coverage Type: Personal policies, which held over 64% of the market in 2024, are driving market growth due to heightened awareness among homeowners in high-risk areas.

- Distribution Channel: Agents remain the dominant sales channel, accounting for over 30% of market share in 2024 due to their personalized approach in risk evaluation and advisory.

- Region: North America, especially the U.S., holds the largest market share due to high-risk seismic zones. Followed by other regions like Europe and Asia-Pacific, which are showing increasing interest in earthquake insurance solutions.

Key Player Analysis

In the Earthquake Insurance Market, leading companies are focusing on expanding their product offerings and improving customer experience. These players are innovating by providing personalized coverage options tailored to specific regions and consumer needs.

Additionally, insurers are integrating digital tools to streamline the policy purchase process and increase customer engagement. The growing focus on risk mitigation, combined with increased awareness of natural disasters, positions these companies to maintain a competitive edge in the market.

Top Key Players in the Market

- AIG

- Zurich Insurance Group

- Munich Re

- Swiss Re Group

- Berkshire Hathaway

- Allianz SE

- Lloyd’s of London

- Tokio Marine

- AXA

- Liberty Mutual Insurance

- Chubb

- State Farm

- Others

Recent Developments

In 2024, the U.S. earthquake insurance market saw strong growth driven by increased policy uptake in high-risk states like California. Insurers are introducing new coverage types and utilizing digital platforms to better serve customers in seismic zones.

Conclusion

The global Earthquake Insurance Market is poised for steady growth, with North America leading the way. Rising consumer awareness and increased demand for protection against seismic risks are driving this market expansion. As the frequency of earthquakes continues to rise, the future outlook for earthquake insurance remains positive, with significant opportunities for growth and innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)