Table of Contents

- Introduction

- Editor’s Choice

- Global Edge Computing Market Size

- Regional Breakdown of the Edge Computing Market

- Applications of Edge Computing Statistics

- Edge Computing Industry-Specific Statistics

- Edge Computing Device Statistics

- Edge Computing Investment Statistics

- Edge Computing Statistics by Infrastructure

- Edge Computing Statistics by Benefits

- Recent Developments

- Conclusion

- FAQs

Introduction

Edge Computing Statistics: Edge computing is a computing model that decentralizes data processing, reducing delays and improving performance.

It has become important due to the needs of applications such as autonomous vehicles and IoT, which rely on immediate processing.

Edge computing also saves bandwidth, enhances data security, and allows growth. It is critical in areas like autonomous vehicles, industrial IoT, smart cities, 5G networks, and healthcare.

It enables faster decision-making and real-time data analysis at the network’s edge, leading to industry transformation and increased effectiveness.

Editor’s Choice

- The revenue generated by the Edge Computing market is projected to experience substantial growth over the next decade at a CAGR of 18.3%.

- In 2022, it stood at $40.0 billion, expected to climb to $47.0 billion in 2023.

- By 2031, the market is expected to reach $171.0 billion; in 2032. It is projected to reach an impressive $206.0 billion.

- North America, Europe, and East Asia are predicted to generate 88% of edge computing revenue by 2030.

- In 2026, approximately 26% of all network edge sites will be in China.

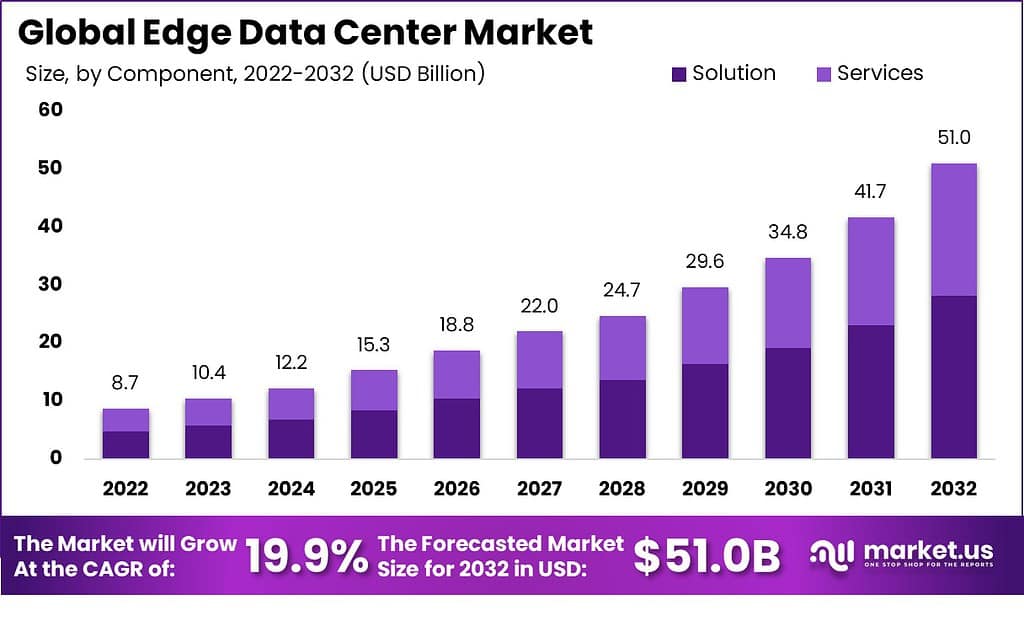

- By 2023, the edge data center market is expected to reach $10.4 billion, followed by $12.2 billion in 2024.

- Currently, over 15 billion edge devices are deployed in the field.

- In addition, A survey by Edgegap found that 97% of online gamers experience latency issues.

Global Edge Computing Market Size

- The revenue generated by the Edge Computing market is projected to experience substantial growth over the next decade at a CAGR of 18.3%.

- In 2022, it stood at $40.0 billion, expected to climb to $47.0 billion in 2023.

- The growth trend continues, with anticipated revenues of $55.0 billion in 2024 and a significant jump to $68.0 billion in 2025.

- As the adoption of edge computing technology continues to expand. Revenues are forecasted to reach $82.0 billion in 2026 and $94.0 billion in 2027.

- The upward trajectory persists, with estimated revenues of $105.0 billion in 2028, $124.0 billion in 2029, and $144.0 billion in 2030.

- By 2031, the market is expected to reach $171.0 billion; in 2032. It is projected to reach an impressive $206.0 billion.

- These figures illustrate the substantial and continuous growth in the Edge Computing market over the coming years.

(Source: Market.us)

Global Edge Computing Market Revenue- by Component

- The market for Edge Computing is poised for robust growth in the coming years. With significant revenue projections across various components.

- In 2022, the total market revenue reached $40.0 billion, comprising $18 billion from hardware. $11 billion from software, and $11 billion from services.

- As we move into 2023, the market is expected to expand to $47.0 billion. With hardware contributing $21 billion, software $13 billion, and services $13 billion.

- This upward trend continues throughout the forecasted period, with total market revenue reaching $206.0 billion in 2032.

- The hardware, software, and services segments also experience consistent growth. With hardware revenue projected to reach $93 billion, software $58 billion, and services $55 billion by 2032.

- These numbers underscore the increasing significance of Edge Computing. Reflecting the demand for hardware and software solutions and associated services in this evolving technology landscape.

(Source: Market.us)

Regional Breakdown of the Edge Computing Market

- North America, Europe, and East Asia are predicted to generate 88% of edge computing revenue by 2030.

- These regions have advanced economies, leading to more aggressive edge technology adoption.

- Major telecom companies like AT&T, Verizon, Vodafone, Tencent, and China Unicom drive edge deployments in these areas.

- In 2026, approximately 26% of all network edge sites will be in China.

- China’s mobile operator, China Mobile, is actively rolling out edge computing to reduce backhaul costs.

- In contrast, European mobile operators are expected to be more conservative in deploying edge data centers.

(Source: Market Sizing Forecast, Edge Capacity Forecast)

North America

- As per Statista’s findings, North America held the top position as the largest regional market for edge computing in 2020, commanding a substantial 35% market share.

- The report also anticipates a continued expansion of the North American edge computing market, with a projected value of $94.3 billion by 2025.

- The United States emerged as the primary market within the region, contributing significantly to the overall market share.

(Source: Statista)

Europe

- Europe is another significant market for edge computing. According to the same Statista report, Europe accounted for a 28% market share in 2020.

- The report predicts that the European edge-computing market will continue to grow. Reaching a value of 82.5 billion USD by 2025.

- Germany, the United Kingdom, and France are the largest markets in the region.

(Source: Statista)

Asia-Pacific

- The Asia-Pacific area represents another substantial market for edge computing.

- As outlined in the Statista report, this region held a noteworthy 28% share of the market in 2020, with China emerging as its primary market.

- Projections from the same report indicate a sustained expansion of the Asia-Pacific edge computing market, estimated at $91.5 billion by 2025.

(Source: Statista)

Rest of the World

- Outside of the major regions of North America and Asia-Pacific, which held significant market shares. The rest of the world, encompassing Latin America, the Middle East, and Africa, contributed a 9% share of the edge computing market in 2020, as indicated in the Statista report.

- The report’s projections indicate ongoing growth in the edge computing market for the rest of the world, with an expected value of $23.4 billion by 2025.

(Source: Statista)

Applications of Edge Computing Statistics

- The market for edge computing applications is diversified, with various sectors harnessing its capabilities to drive innovation and efficiency.

- Among these, the Industrial Internet of Things (IoT) holds the largest market share at 30%. Utilizing edge computing for real-time data analysis and predictive maintenance in manufacturing and industrial settings.

- At 23%, smart cities leverage edge computing for enhanced urban management, traffic optimization, and public services.

- Content Delivery follows closely at 17%, improving multimedia content delivery with low latency.

- Remote Monitoring, accounting for 15%, employs edge computing for real-time monitoring of assets, infrastructure, and even healthcare devices.

- Augmented Reality (AR) and Virtual Reality (VR) applications claim 11%, benefiting from edge computing’s low-latency processing for immersive experiences.

- The remaining 4% encompasses various other applications that also harness the power of edge computing for specific use cases. Reflecting the versatility and growing significance of edge technology in today’s digital landscape.

(Source: Market.us)

Edge Computing Industry-Specific Statistics

Healthcare

- Edge computing holds significant promise within the healthcare sector. The edge computing market’s size in healthcare reached a valuation of $1.12 billion in 2021 and is projected to experience substantial growth at a compounded annual rate of 38.1% between 2022 and 2028.

- The rising utilization of IoT devices drives this remarkable expansion. The imperative for immediate patient monitoring, and the burgeoning requirements for telemedicine services.

Manufacturing

- The manufacturing sector stands out as a prominent adopter of edge computing technology.

- Statista reports that, in the United States, manufacturing represents the largest share of the edge computing market, making up 24% of the market size in 2025.

- Integrating edge computing in manufacturing can diminish downtime, boost productivity, and enhance operational effectiveness.

(Source: Statista)

Retail

- Edge computing is steadily gaining ground within the retail sector.

- As reported by Statista, the global value of the edge computing market within the retail industry reached $0.37 billion in 2021 and is forecasted to experience a significant compound annual growth rate (CAGR) of 38.7% from 2022 to 2028.

- In addition, the application of edge computing in the retail landscape has the potential to enhance supply chain management. Streamline inventory management, and elevate the overall customer experience.

(Source: Statista)

Transportation

- The transportation sector is witnessing a rising trend in the adoption of edge computing.

- The reports that the global edge computing market’s size within transportation was assessed at $0.24 billion in 2021. It is poised for substantial growth with an anticipated compound annual growth rate (CAGR) of 38.3% from 2022 to 2028.

- The application of edge computing in transportation can enhance safety measures. Alleviate traffic congestion, and optimize the efficiency of logistics operations.

Edge Computing Device Statistics

Growth of IoT Devices at the Edge

- From 2020 to 2030, the global landscape of edge-enabled Internet of Things (IoT) devices is poised for remarkable expansion across commercial and enterprise markets.

- In 2020, there were approximately 2,303 million commercial edge-enabled IoT devices and 401 million in the enterprise sector.

- This growth trend continued in 2021, recording 2,629 million commercial and 473 million enterprise devices.

- The subsequent years witnessed a steady surge, with 2022 registering 3,009 million commercial devices and 554 million enterprise devices.

- The figures for 2030 are projected to reach an impressive 6,469 million for commercial IoT devices and 1,233 million for enterprise IoT devices. Highlighting the widespread adoption and integration of edge computing technologies in various industries.

- This growth underscores the pivotal role played by edge-enabled IoT devices in driving innovation and efficiency across both commercial and enterprise domains.

(Source: Statista)

Number of IoT Connected Devices

- The global ecosystem of Internet of Things (IoT) connected devices has been rapidly expanding.

- In 2019, there were 8.6 billion IoT devices worldwide, which continued to surge in subsequent years.

- By 2020, it had grown to 9.76 billion; in 2021, it reached 11.28 billion.

- The momentum persisted, with 13.14 billion IoT devices in 2022 and a projection of 15.14 billion for 2023.

- The IoT landscape is anticipated to grow exponentially, with 17.08 billion devices projected for 2024, 19.08 billion for 2025, and 21.09 billion for 2026.

- This upward trend continues, and by 2030, it is estimated that there will be a staggering 29.42 billion IoT-connected devices globally. Underscoring the pervasive integration of IoT technology across various industries and sectors.

(Source: Statista)

Edge Computing Investment Statistics

- Organizations are expected to distribute investments across critical services when allocating resources for their primary edge computing use case.

- The largest portion, at 29.8%, is designated for network-related expenses, encompassing network infrastructure design, deployment, and ongoing maintenance.

- Strategy and planning for edge computing initiatives account for 23.4% of the total investment, indicating a significant focus on overall strategy and execution.

- Security, which includes designing, deploying, and maintaining security measures, accounts for 22% of the investment, emphasizing the importance of safeguarding data and systems at the edge.

- Application development and maintenance, a key aspect of edge computing, receive 21.7% of the investment, highlighting the commitment to optimizing edge applications.

- Lastly, 3.1% of the investment is allocated to other areas, underscoring the versatility and adaptability required for successful edge computing implementations.

- This allocation strategy reflects organizations’ comprehensive approach when investing in their primary edge use cases.

(Source: Statista)

Edge Computing Statistics by Infrastructure

Edge Data Centers

- The edge data center market has grown substantially, reflecting the increasing demand for low-latency computing and data processing capabilities.

- In 2022, the market generated approximately $8.7 billion in revenue, and this upward trajectory continued in subsequent years.

- In 2023, it is expected to reach $10.4 billion, followed by $12.2 billion in 2024.

- As businesses and industries continued to invest in edge computing infrastructure, the market revenue surged to $15.3 billion in 2025 and $18.8 billion in 2026.

- Looking ahead, the market is expected to experience even more significant expansion, with projected revenues of $22.0 billion in 2027, $24.7 billion in 2028, and $29.6 billion in 2029.

- By 2030, the edge data center market is estimated to reach $34.8 billion, and it is forecasted to continue growing substantially, with revenues expected to reach $51.0 billion by 2032.

- This growth underscores the pivotal role that edge data centers play in supporting the evolving needs of modern computing and connectivity.

(Source: Market.us)

Edge Device Deployment

- Currently, over 15 billion edge devices are deployed in the field.

- Edge devices, such as smart cameras and IoT devices, process and analyze data on-site, reducing the need for long-distance data transmission.

- This leads to faster data processing (a few milliseconds or less) and lower costs, enhancing security.

(Source: IBM)

Gaming Latency Issues

- A survey by Edgegap found that 97% of online gamers experience latency issues.

- About 34% of these gamers quit games or sessions due to lag.

- Edge computing can help reduce latency between the user’s device and the cloud where the game is hosted.

(Source: Edgegap)

Edge Computing Statistics by Benefits

- The benefits of edge computing are evident from the responses gathered.

- A significant portion of respondents, 54%, highlighted the flexibility it offers in handling both present and future AI demands.

- Moreover, 46% emphasized that computing at the edge effectively bypasses network latency, enabling quicker responses.

- As the number of devices continues to grow, 44% recognize the necessity of edge computing for conducting complex processing tasks that traditional cloud infrastructure cannot adequately support.

- Additionally, 43% pointed out that edge computing eliminates the need for costly network connectivity to remote locations, reducing expenses.

- Furthermore, 35% acknowledged that most of the data collected do not require transfer elsewhere, making local processing at the edge a practical choice.

- Notably, 32% recognized that local control of critical infrastructure is mandated by regulations.

- In summary, these responses underscore the diverse advantages of edge computing, ranging from improved performance to cost savings and regulatory compliance.

(Source: Forrester)

Recent Developments

Acquisitions and Mergers:

- IBM acquires Turbonomic: In mid-2023, IBM completed its acquisition of Turbonomic, an AI-powered application resource management company, for $1.5 billion. This acquisition aims to enhance IBM’s edge computing and hybrid cloud capabilities by integrating Turbonomic’s technology for optimizing application performance across edge environments.

- Microsoft acquires CloudKnox Security: In late 2023, Microsoft acquired CloudKnox Security, a company specializing in identity and access management (IAM) for hybrid and multi-cloud environments, for $300 million. This merger strengthens Microsoft’s security offerings in edge computing by providing advanced IAM solutions.

New Product Launches:

- Amazon Web Services (AWS) IoT Greengrass 3.0: AWS launched IoT Greengrass 3.0 in early 2024, an updated version of its edge computing service that enables developers to build, deploy, and manage applications on edge devices. The new version includes improved machine learning capabilities and enhanced security features.

- NVIDIA Jetson Orin: NVIDIA introduced Jetson Orin in mid-2023, a powerful edge AI platform designed for robotics, autonomous machines, and embedded applications. It offers significant improvements in processing power and energy efficiency compared to previous models.

Funding:

- EdgeConneX raises $600 million: EdgeConneX, a leading provider of edge data centers, secured $600 million in a funding round in 2023 to expand its edge infrastructure and support the growing demand for edge computing services.

- Vapor IO secures $250 million: Vapor IO, a company specializing in edge colocation and interconnection services, raised $250 million in early 2024 to accelerate the deployment of its edge data centers and enhance its Kinetic Edge platform.

Technological Advancements:

- AI Integration in Edge Devices: Advances in AI technology are being integrated into edge devices, enabling real-time data processing and analytics at the edge. This reduces latency and bandwidth usage while improving the efficiency of applications like autonomous vehicles and smart cities.

- 5G and Edge Computing: The rollout of 5G networks is significantly boosting edge computing capabilities by providing faster data transfer rates, lower latency, and more reliable connections. This combination enables new applications and services that require real-time processing.

Market Dynamics:

- Growth in Edge Computing Market: The global edge computing market is projected to grow at a CAGR of 26.5% from 2023 to 2028, driven by the increasing adoption of IoT devices, the proliferation of data, and the need for real-time processing.

- Adoption in Industrial Sectors: Edge computing is seeing rapid adoption in industrial sectors such as manufacturing, energy, and transportation, where real-time data processing and low latency are critical for operational efficiency and safety.

Regulatory and Strategic Developments:

- Data Sovereignty Regulations: Governments are enacting data sovereignty regulations that require data to be processed and stored within national borders. This is driving the adoption of edge computing solutions that can comply with these regulations.

- Edge Computing Standards: Industry groups are working on establishing standards for edge computing to ensure interoperability, security, and scalability across different platforms and devices, fostering a more cohesive ecosystem.

Research and Development:

- Enhanced Security Solutions: R&D efforts are focusing on developing advanced security solutions for edge computing environments, addressing challenges such as data encryption, secure data transmission, and threat detection at the edge.

- Edge AI and Machine Learning: Researchers are exploring new algorithms and frameworks for deploying AI and machine learning models at the edge, aiming to improve the performance and accuracy of edge-based AI applications.

Conclusion

Edge Computing Statistics – Edge computing is a revolutionary approach that disperses data processing, minimizes delays, and empowers immediate decision-making.

It has gained extensive acceptance in healthcare, manufacturing, retail, and transportation sectors, delivering advantages such as improved patient care, reduced operational interruptions, streamlined supply chains, and more efficient logistics.

However, the projections from market analyses suggest substantial growth in the global edge computing arena, fuelled by the proliferation of IoT devices and the demand for swift data processing applications.

In essence, edge computing marks a significant shift in computing innovation, promising swifter decision-making, heightened operational efficiency, and a future marked by seamless connectivity and real-time insights across diverse industries.

FAQs

Edge computing is a distributed computing paradigm that brings data processing and computation closer to the data source or “edge” of the network. It reduces latency, enhances real-time processing, and improves the efficiency of data-intensive applications.

Edge computing processes data locally, near the source, whereas cloud computing centralizes data processing in remote data centers. Edge computing is designed for low-latency, real-time applications, while cloud computing is well-suited for tasks requiring extensive computational resources.

Edge computing is used in various industries, including healthcare (remote patient monitoring), manufacturing (predictive maintenance), retail (inventory management), transportation (autonomous vehicles), and smart cities (traffic management), among others.

Edge computing offers several benefits, including reduced latency, improved data privacy and security, bandwidth optimization, real-time processing, and enhanced scalability. It is particularly valuable for applications requiring quick decision-making.

Challenges include managing a distributed infrastructure, ensuring data security at the edge, dealing with limited computing resources, and maintaining consistency in data processing across edge devices.

Edge computing is essential for IoT because it enables real-time data analysis at the source, reducing the need to transmit vast data to centralized cloud servers. This reduces latency and conserves bandwidth.

The rollout of 5G networks further complements edge computing by providing high-speed, low-latency connectivity. Edge computing and 5G are often integrated to support applications like augmented reality, autonomous vehicles, and smart cities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)