Table of Contents

Introduction

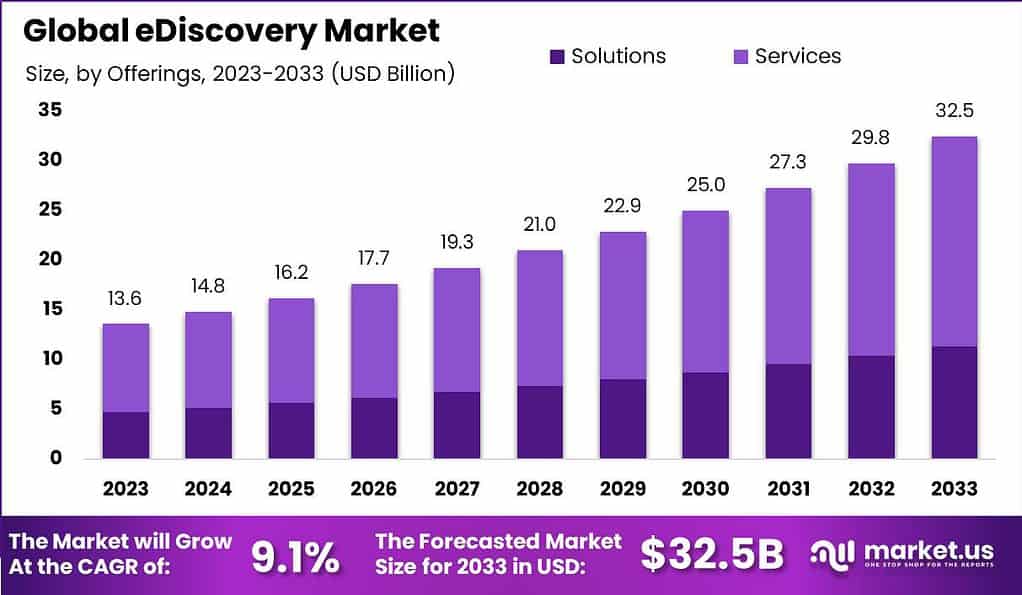

The eDiscovery market is anticipated to witness substantial growth, with a projected value of USD 32.5 billion by 2033, exhibiting a steady Compound Annual Growth Rate (CAGR) of 9.1% from 2023 to 2033. In 2023 alone, the market recorded a value of USD 13.6 billion. eDiscovery, or Electronic Discovery, is the process of identifying, collecting, and producing electronically stored information (ESI) for legal proceedings or regulatory investigations. As businesses increasingly digitize their operations, the demand for efficient eDiscovery solutions to manage vast volumes of electronic data continues to rise.

The growth of the eDiscovery market is fueled by several factors. Firstly, the exponential expansion of electronic data, driven by the digitization of business operations and widespread digital communication platforms, underscores the need for robust eDiscovery solutions. Regulatory requirements and the complexities of modern litigation further contribute to the demand for eDiscovery services, particularly among Fortune 1000 companies that allocate significant budgets for e-discovery expenses annually.

Technology-assisted review (TAR) tools are gaining prominence, with over 70% of eDiscovery projects expected to utilize them by the end of 2024. Additionally, the adoption of bring-your-own-device (BYOD) policies for eDiscovery purposes and the integration of cloud-based applications and storage systems into eDiscovery workflows are notable trends shaping the market landscape.

Key Takeaways

- eDiscovery Market is anticipated to be USD 32.5 billion by 2033. It is estimated to record a steady CAGR of 9.1%

- In 2023, the services segment held a dominant position in the eDiscovery market, capturing more than a 65% share.

- In 2023, Cloud-Based deployment held a dominant position in the eDiscovery market, capturing more than a 65% share.

- In 2023, Large Enterprises held a dominant position in the eDiscovery market, capturing more than a 70% share of spending.

- Small and medium enterprises (SMEs) make up the remaining 30% eDiscovery market share.

- The banking, financial services and insurance (BFSI) sector held a leading 35% share of the eDiscovery market in 2023 based on end use vertical segmentation.

- North America commands a substantial share of the eDiscovery market (38.9%), driven by its robust adoption of eDiscovery solutions and services. The United States plays a pivotal role due to its complex legal landscape and increasing demand for efficient data management solutions.

eDiscovery Statistics

- Over 70% of eDiscovery projects are expected to use technology-assisted review (TAR) tools by the end of 2024, as mentioned by Deloitte. This reflects a significant reliance on technology to help review and analyze documents.

- Exterro’s research suggests that over 75% of law firms will have a bring-your-own-device (BYOD) policy for eDiscovery purposes by 2024. This means lawyers and staff can use their personal devices for work, making data access more flexible.

- According to Relativity, it’s projected that over 70% of eDiscovery projects will involve data from cloud-based applications and storage systems by the end of 2024. This shows a shift towards using online platforms for storing and managing data.

- The use of TAR in eDiscovery is projected to increase by 40% between 2022 and 2024. This trend highlights the growing importance of TAR in the legal review process.

- Approximately 55% of legal professionals expect an increase in the use of predictive coding and continuous active learning (CAL) in eDiscovery by 2024. These technologies help automate and improve the accuracy of document review.

- The inclusion of mobile device data in eDiscovery is expected to rise by 35% between 2022 and 2024. As mobile devices become more central to our lives, their data becomes more relevant in legal cases.

- About 60% of legal professionals anticipate a growth in the volume of data subject to eDiscovery by 2024. This suggests an overall increase in the amount of information that needs to be reviewed in legal proceedings.

- It’s estimated that over 60% of legal firms will have adopted cloud-based eDiscovery solutions by 2024, up from around 45% in 2022. Cloud solutions offer scalable and accessible data management options.

- The application of AI and ML in eDiscovery is expected to grow by over ~30% annually between 2022 and 2024. These technologies can significantly streamline the review process by automating tasks.

- By 2024, over 50% of legal departments in Fortune 500 companies are expected to have dedicated eDiscovery teams or personnel. This indicates a recognition of the complexity and importance of eDiscovery in corporate legal operations.

Emerging Trends

The eDiscovery market is experiencing a dynamic shift with several emerging trends that promise to redefine the landscape in 2024 and beyond. These trends reflect advancements in technology, shifts in legal and regulatory environments, and evolving business needs.

- Adoption of SaaS and Cloud-Based Solutions: There’s a growing preference for Software as a Service (SaaS) and cloud-based eDiscovery solutions, driven by their scalability, efficiency in data management, and cost benefits. These technologies provide automatic updates and enhancements, offering a competitive edge to organizations by improving their data management capabilities.

- Increased Utilization of Structured Data: The eDiscovery process is becoming more complex with the vast amount of unstructured data available. There’s a significant shift towards utilizing structured data for its ease of organization, management, and security. This shift is crucial for ensuring data authenticity and reliability during the discovery process.

- Complexity and Volume of Data: The exponential increase in data generation and its complexity poses a considerable challenge in eDiscovery. The advent of new platforms, tools, and technologies necessitates the adoption of advanced solutions for data management and review.

- Rise in AI and Machine Learning: Artificial intelligence (AI) and machine learning are increasingly being integrated into eDiscovery processes for automating data analysis and review. These technologies help in identifying patterns, trends, and anomalies in large datasets, making the review process more efficient and cost-effective.

- Data Privacy Concerns: With the increasing importance of data privacy, eDiscovery projects are facing stringent regulations globally. Laws like the GDPR and the CCPA require careful handling of personal data, especially when crossing national borders, necessitating advanced solutions for compliance.

- Blockchain Technology in eDiscovery: Blockchain technology is expected to play a more significant role in eDiscovery, offering enhanced data integrity and automation in compliance. However, its decentralized nature presents challenges, especially in applying local laws across different jurisdictions.

- End-User and Vertical Market Insights: Government and federal agencies, along with legal and regulatory firms, have been the largest end-users of eDiscovery solutions. The government sector, in particular, represents the largest market share across various verticals including BFSI, healthcare, IT, and telecommunications.

Use Cases of eDiscovery

Electronic Discovery (eDiscovery) refers to the process by which electronic data is sought, located, secured, and searched with the intent of using it as evidence in a civil or criminal legal case. eDiscovery has become increasingly important with the exponential growth of electronic data, necessitated by advancements in technology and the widespread use of digital communication platforms. Below are several key use cases for eDiscovery, reflecting its pivotal role in modern legal practices, compliance, and information governance.

1. Legal Litigation and Investigations

The primary use of eDiscovery is in the context of legal litigation and investigations. eDiscovery tools enable legal teams to efficiently process, review, and produce electronic documents as part of the discovery process in lawsuits or regulatory investigations. This includes the handling of emails, documents, presentations, databases, voicemails, audio and video files, social media posts, and web sites.

2. Regulatory Compliance

Organizations must comply with various regulatory requirements that mandate the retention, management, and, when necessary, production of electronic records. eDiscovery processes and tools help organizations respond to regulatory inquiries and audits efficiently, ensuring compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA), the Sarbanes-Oxley Act, the General Data Protection Regulation (GDPR), and other industry-specific regulations.

3. Information Governance

eDiscovery tools are utilized in the practice of information governance, which involves the management of corporate information to meet regulatory, legal, and business requirements. These tools can help in identifying redundant, obsolete, or trivial data (ROT) and sensitive or critical business information, facilitating effective data management and reducing risks and costs associated with data storage and retrieval.

4. Data Privacy and Security

With the increasing emphasis on data privacy, eDiscovery tools play a crucial role in identifying and protecting sensitive information within an organization’s electronic storage. This is particularly relevant in light of regulations such as GDPR, which require organizations to know what personal data they have and to ensure its protection. eDiscovery processes can aid in the detection of breaches and unauthorized disclosures of personal information.

5. Internal Audits and Business Intelligence

eDiscovery technologies are employed in conducting internal audits and gathering business intelligence. By analyzing the vast amounts of electronic data, organizations can uncover insights related to business operations, employee conduct, and market trends. This supports strategic decision-making and operational efficiencies.

6. Merger and Acquisition Due Diligence

During mergers and acquisitions, eDiscovery tools are used to perform due diligence by reviewing a vast amount of electronic documents. This helps in assessing the assets, liabilities, and risks associated with the transaction, ensuring informed decision-making.

Recent Developments

- Zylab Technologies (May 2023): Launched “Zylab Cortex,” a cloud-based platform for managing and analyzing large volumes of eDiscovery data.

- Xerox Corp. (January 2023): Launched “Xerox DocuShare Capture for Legal,” a solution for automated document capture and indexing during eDiscovery.

- Xerox Corp. (July 2023): Acquired “Redwood Software,” a legal technology company providing eDiscovery and compliance solutions.

Conclusion

In conclusion, the eDiscovery market is experiencing significant growth and transformation driven by technological advancements and the increasing complexity of digital data in legal proceedings. The adoption of technology-assisted review (TAR), predictive coding, and machine learning algorithms is expected to rise, enabling more efficient and accurate document review processes.

The use of mobile device data in eDiscovery is also projected to increase, reflecting the growing importance of data generated from smartphones and tablets. As the volume of data subject to eDiscovery continues to expand, legal professionals are seeking scalable solutions, leading to the adoption of cloud-based eDiscovery platforms.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)