Table of Contents

Introduction

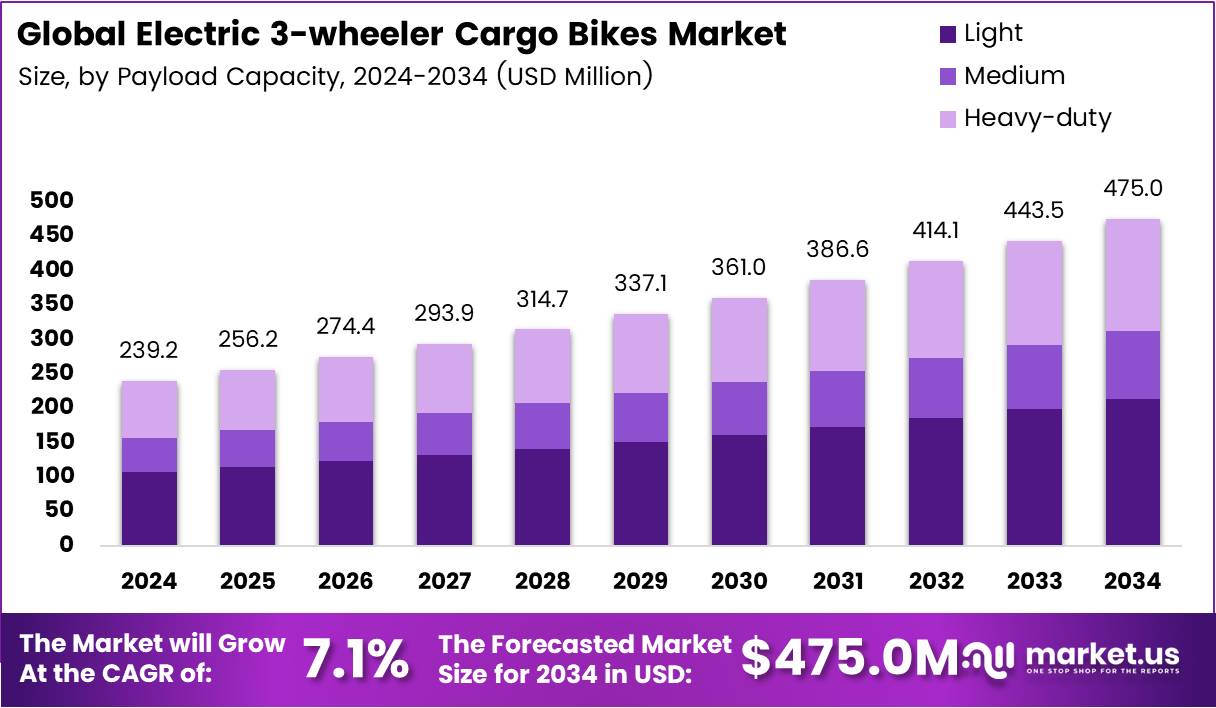

The Global Electric 3-Wheeler Cargo Bikes Market is gaining remarkable traction, driven by rapid urbanization and the global shift toward sustainable transport solutions. Valued at USD 239.2 Million in 2024, the market is projected to reach USD 475.0 Million by 2034, expanding at a CAGR of 7.1% from 2025 to 2034.

Furthermore, the market’s growth is fueled by rising environmental awareness, government incentives, and advancements in electric mobility technologies. As cities become increasingly congested, electric 3-wheeler cargo bikes are emerging as an efficient, eco-friendly alternative for urban logistics and last-mile deliveries.

In addition, businesses and consumers are turning toward electric cargo vehicles to reduce emissions and operational costs. This accelerating adoption signals a promising decade ahead for manufacturers, investors, and logistics operators in the electric 3-wheeler segment.

Key Takeaways

- The Global Electric 3-Wheeler Cargo Bikes Market is expected to reach USD 475.0 Million by 2034, growing at a CAGR of 7.1% from 2025 to 2034.

- In 2024, the Light payload capacity segment holds a 44.8% market share.

- Lithium-ion batteries lead the market with a 67.1% share.

- 1000W to 3000W power output segment holds a 55.3% share.

- The Logistics & Delivery segment leads with a 48.9% share.

- Asia Pacific (APAC) dominates with a 44.1% market share, valued at USD 105.4 Million in 2024.

Market Segmentation Overview

The Light payload capacity segment dominates with 44.8% share, reflecting the growing preference for compact, efficient vehicles suited for dense urban areas. These bikes offer agility and cost-efficiency, making them ideal for short-distance deliveries and e-commerce applications where quick navigation and low operating costs are critical.

The Lithium-ion battery segment leads with a 67.1% share due to its superior energy density and durability. Its fast-charging capabilities and extended life cycles make it the preferred choice among commercial operators. Declining battery costs and improved thermal management continue to enhance its market position globally.

The 1000W to 3000W power output segment dominates with a 55.3% share, balancing energy efficiency with robust performance. These mid-range motors provide sufficient torque and range for diverse commercial uses, from food delivery to logistics, making them the most practical option for fleet operators.

The Logistics & Delivery end-use segment commands a 48.9% share, driven by the surge in e-commerce and last-mile delivery demand. Electric 3-wheelers enable businesses to navigate urban centers efficiently while meeting emission reduction goals, making them a key player in the sustainable logistics revolution.

Drivers

Rising Demand for Zero-Emission Urban Delivery Solutions

Urban pollution and traffic congestion have spurred a global movement toward zero-emission transport. Electric 3-wheeler cargo bikes provide a viable solution by replacing fuel-based delivery vehicles. Governments are actively supporting this shift through subsidies, grants, and low-emission transport policies, accelerating market penetration worldwide.

Technological Advancements in Battery and Motor Efficiency

Innovations in lithium-ion battery technology and electric motor design are extending vehicle range and load capacity. Modern systems enable higher energy efficiency and faster charging, reducing downtime and maintenance costs. These advancements make electric cargo bikes increasingly reliable for daily commercial operations.

Use Cases

E-commerce and Food Delivery Operations

E-commerce and food delivery platforms are integrating electric 3-wheelers to optimize last-mile logistics. Their compact design and low operational cost allow companies to deliver goods faster in congested areas while reducing carbon footprints. Major cities worldwide are seeing rapid deployment of such eco-friendly delivery fleets.

Municipal and Utility Services

Local governments and urban service providers are adopting electric 3-wheelers for waste collection, maintenance, and mobile vending. Their maneuverability and low noise levels make them suitable for narrow streets and residential zones. This growing use case demonstrates the vehicle’s versatility beyond commercial logistics.

Major Challenges

Limited Charging Infrastructure

Despite rapid growth, the market faces significant constraints due to inadequate charging infrastructure, particularly in developing regions. Without widespread access to reliable charging stations, operators experience downtime and reduced productivity, hindering the adoption of electric cargo vehicles at scale.

High Initial Investment Costs

While operating costs are low, the upfront expense of purchasing electric 3-wheelers remains a hurdle for small businesses. Battery replacement and maintenance costs add to long-term financial concerns, making financing and leasing models essential for broader market accessibility.

Business Opportunities

Integration of Solar Charging Systems

The integration of solar-powered charging systems offers a major growth avenue. Solar-assisted electric cargo bikes reduce dependency on grid power and enhance operating range, especially in regions with limited infrastructure. This eco-friendly innovation aligns with global renewable energy goals.

Cold-Chain Logistics Expansion

Electric 3-wheelers equipped with refrigeration units are creating new possibilities in cold-chain logistics. They are increasingly being used for food delivery, pharmaceutical transport, and fresh produce distribution. This niche market promises strong returns as demand for temperature-controlled logistics grows.

Regional Analysis

Asia Pacific Leads with 44.1% Market Share

The Asia Pacific (APAC) region dominates the global market, valued at USD 105.4 Million in 2024. Rapid urbanization, rising fuel costs, and strong government initiatives in India and China are accelerating adoption. The booming e-commerce industry further supports large-scale deployment of electric 3-wheelers in urban logistics.

Europe and North America Experience Rapid Growth

Europe and North America are witnessing steady growth driven by sustainability mandates and advancements in EV infrastructure. European cities are promoting clean mobility through incentives and emission restrictions, while the U.S. benefits from strong logistics networks and emerging micro-mobility initiatives.

Recent Developments

- In July 2025, Vok Bikes raised $6 million to expand its electric cargo fleet across Europe, enhancing its position in sustainable logistics.

- In June 2024, WeSports acquired Cargobike to strengthen its footprint in the European e-cargo market, expanding its product portfolio and distribution.

- In April 2025, Today acquired Dockr after securing €4 million in funding, aiming to scale operations and solidify its European market presence.

Conclusion

The Global Electric 3-Wheeler Cargo Bikes Market is on a robust growth trajectory, driven by sustainability goals, policy support, and technological innovation. As cities prioritize zero-emission logistics, these vehicles are set to redefine urban mobility. With a projected market value of USD 475.0 Million by 2034, the sector presents lucrative opportunities for manufacturers, investors, and logistics providers alike. The next decade promises to be transformative, positioning electric 3-wheeler cargo bikes at the heart of green urban transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)