Table of Contents

Introduction

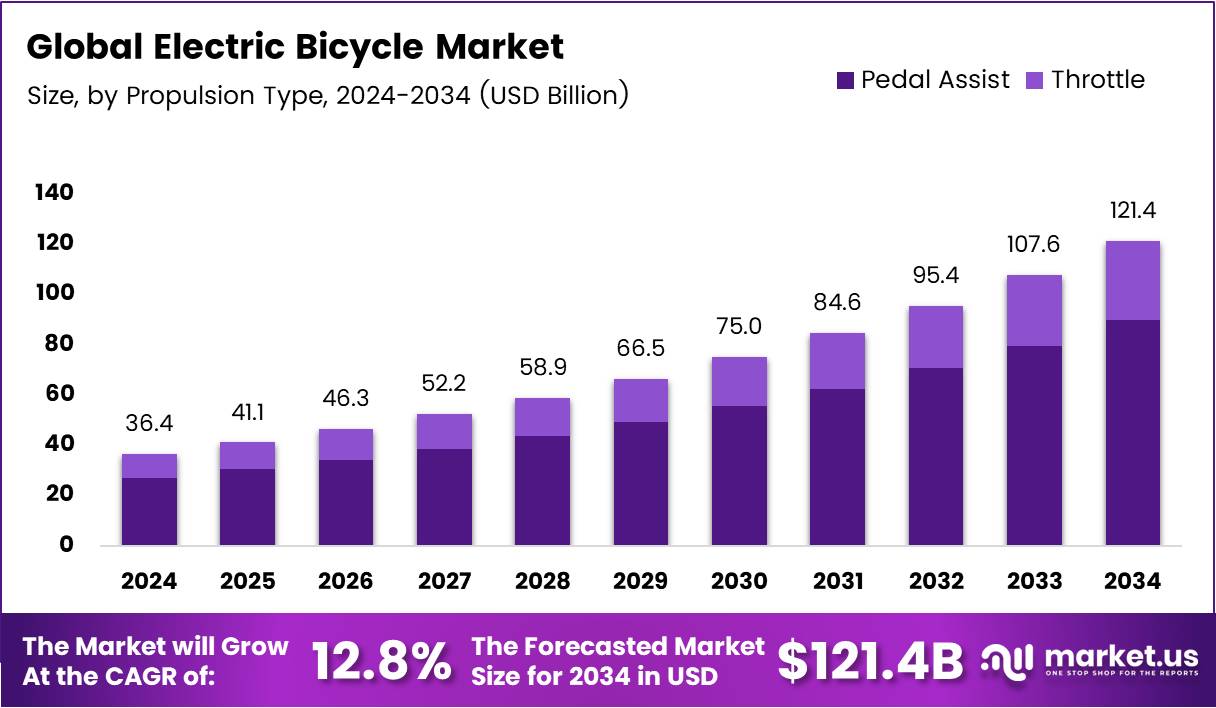

The Global Electric Bicycle Market is witnessing unprecedented growth as sustainability and innovation reshape urban mobility. The market size is projected to reach USD 121.4 Billion by 2034, rising from USD 36.4 Billion in 2024. This remarkable expansion represents a compound annual growth rate (CAGR) of 12.8% between 2025 and 2034.

As global cities face increasing congestion and environmental challenges, electric bicycles (e-bikes) are emerging as efficient and eco-friendly solutions. These vehicles combine traditional cycling with electric assistance, providing a versatile, affordable, and sustainable transport option. Consequently, they are redefining urban commuting across both developed and developing economies.

Moreover, government incentives promoting green mobility and technological advances in battery efficiency are accelerating adoption. Supported by continuous innovation and consumer demand for sustainable transportation, the e-bike market is set to transform the global mobility landscape in the coming decade.

Key Takeaways

- The Global Electric Bicycle Market is projected to reach USD 121.4 Billion by 2034 from USD 36.4 Billion in 2024, growing at a CAGR of 12.8%.

- Pedal Assist leads the By Propulsion Type segment with a 73.9% share due to energy efficiency and balanced performance.

- Lithium-ion batteries dominate the By Battery Type segment with a 58.3% share, driven by superior energy density and fast charging.

- Hub Motor holds the top position in the By Motor Type segment, accounting for 69.5% of the market.

- Below 250W capacity dominates the By Battery Capacity segment with a 39.8% share, suitable for urban commuting.

- Asia Pacific dominates regionally with a 38.6% market share, valued at USD 14.0 Billion in 2024.

Market Segmentation Overview

By Propulsion Type, the Pedal Assist category dominates with a 73.9% market share. This preference is fueled by its hybrid design that enhances energy efficiency and promotes physical activity. As governments encourage eco-friendly commuting, pedal-assist bicycles continue to gain strong global traction.

By Battery Type, Lithium-ion batteries lead with a 58.3% share due to superior energy density, rapid charging, and long lifespan. Manufacturers favor lithium-ion technology for high-performance e-bikes, enabling lightweight designs and extended range that appeal to both commuters and recreational users.

By Motor Type, Hub Motors command a 69.5% share, driven by affordability, quiet operation, and low maintenance. These motors are ideal for city commutes and integrate seamlessly with existing bicycle frames, making them the top choice among manufacturers and consumers alike.

By Battery Capacity, models Below 250W dominate with a 39.8% share. This segment thrives under regional regulations in Europe and Asia that favor low-power designs. These e-bikes are lightweight, energy-efficient, and ideal for urban commuting, ensuring accessibility for a wide range of riders.

Drivers

Rising Adoption of Sustainable Urban Mobility: Growing environmental awareness and urban congestion are pushing consumers toward cleaner transport alternatives. E-bikes reduce carbon emissions and offer a practical solution for short to medium-distance commutes, providing an eco-friendly and cost-effective substitute for conventional vehicles.

Advancements in Lithium-Ion Battery Technology: Continuous innovation in battery technology is revolutionizing the e-bike industry. Modern lithium-ion batteries deliver longer range, faster charging, and enhanced durability. These improvements not only boost performance but also reduce maintenance costs, making electric bicycles more appealing for daily users.

Use Cases

Urban Commuting: Electric bicycles serve as a reliable and sustainable alternative to cars and public transport. They enable faster travel during peak hours, reduce traffic congestion, and help commuters save on fuel costs, making them ideal for densely populated metropolitan regions.

Commercial Delivery and Logistics: E-bikes are increasingly used for last-mile delivery and logistics. Businesses benefit from lower operating costs and greater efficiency, especially in congested areas. Their ability to carry moderate loads with minimal emissions aligns perfectly with e-commerce growth and green logistics initiatives.

Major Challenges

High Initial Cost: The price of electric bicycles remains higher than that of conventional bicycles due to advanced motors and batteries. This cost barrier limits accessibility, particularly in price-sensitive markets, despite long-term savings on fuel and maintenance.

Limited Charging Infrastructure: In many developing regions, insufficient charging stations and weak infrastructure restrict e-bike adoption. This limitation raises concerns about range and convenience, slowing down the pace of market expansion in emerging economies.

Business Opportunities

Growth in Shared E-Bike Platforms: Expanding micro-mobility solutions are creating new opportunities for market growth. Shared e-bike programs in urban centers reduce vehicle ownership and promote sustainable travel. This trend is attracting public and private investments in smart mobility ecosystems.

Integration of Smart and Connected Features: The emergence of IoT-enabled electric bicycles offers significant potential. Features such as GPS tracking, mobile app connectivity, and performance analytics enhance user experience and safety. These innovations open avenues for premium product development and service-based business models.

Regional Analysis

Asia Pacific: Dominating the market with a 38.6% share valued at USD 14.0 Billion, the Asia Pacific region remains the hub of global e-bike production and consumption. Countries such as China, Japan, and India lead due to supportive policies, expanding infrastructure, and rising fuel costs driving sustainable mobility.

Europe: Europe continues to lead in sustainable transport initiatives, supported by government subsidies, cycling infrastructure, and environmental regulations. Nations like Germany, France, and the Netherlands are witnessing increased adoption, driven by the demand for high-performance and connected electric bicycles.

Recent Developments

- In August 2025, Yamaha completed a €30 million takeover deal of Brose’s e-bike business, expanding its European market presence.

- In March 2025, Yamaha Motor acquired the bicycle eKit division of German manufacturer Brose to strengthen its premium e-bike component portfolio.

- In March 2025, Yamaha finalized an agreement to integrate Brose’s e-bike drive business, enhancing innovation and global competitiveness in electric mobility.

Conclusion

The Global Electric Bicycle Market is on a trajectory of robust growth, driven by environmental awareness, innovation, and supportive government policies. With continuous technological advancements and expanding infrastructure, e-bikes are poised to become a mainstream mobility solution. As consumers increasingly prioritize sustainability, the industry will continue to evolve, transforming the future of global transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)