Table of Contents

The global Electric SUV market is experiencing a significant transformation as electric vehicles (EVs) continue to gain traction among consumers and automakers alike. With growing concerns about environmental sustainability and advancements in battery technology, the market for electric SUVs is expected to surge in the coming years.

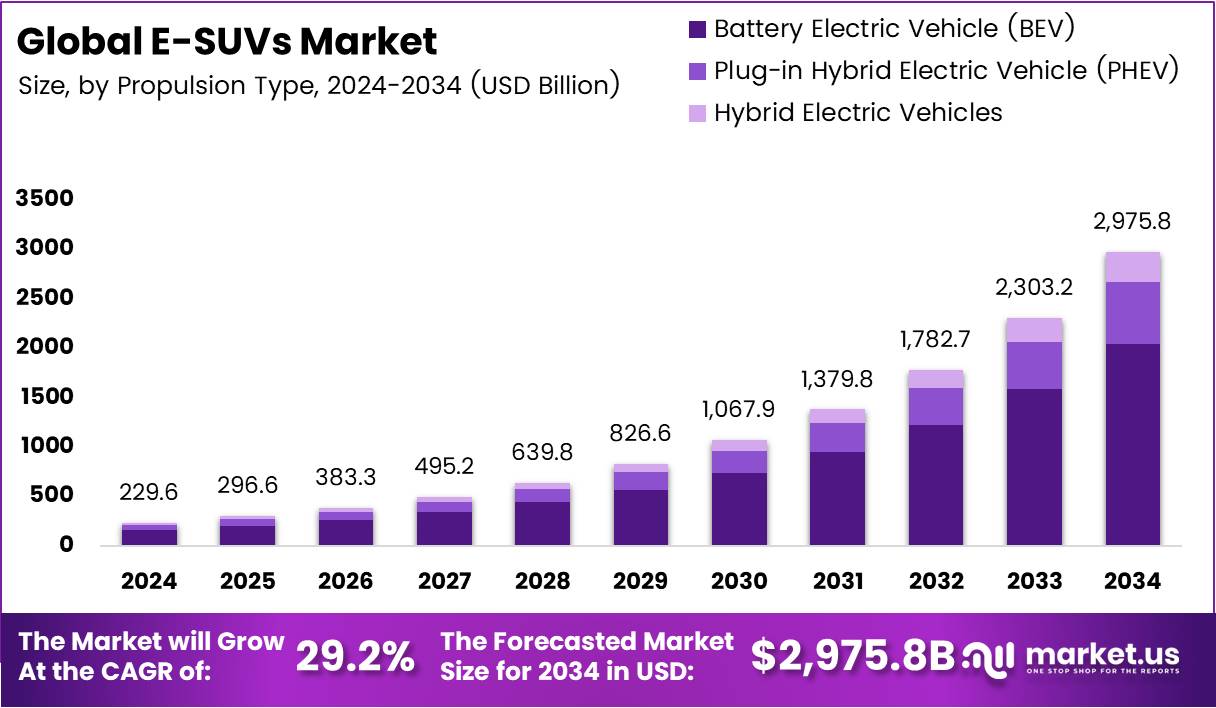

According to industry reports, the market is projected to grow from USD 229.6 billion in 2024 to USD 29.2 billion by 2034, reflecting a strong CAGR of 29.2% during the forecast period from 2025 to 2034. As the shift towards eco-friendly transportation continues, electric SUVs represent a promising and dynamic market segment that combines sustainability with advanced technology.

Key Takeaways

- The global Electric SUV market is expected to be valued at USD 29.2 billion by 2034, growing from USD 229.6 billion in 2024, at a CAGR of 29.2% from 2025 to 2034.

- In 2024, Compact vehicles dominated the market by vehicle type, holding 39.3% market share.

- The Battery Electric Vehicle (BEV) segment is projected to continue leading the market with 68.7% market share in 2024.

- 250-500 Km range vehicles are the dominant choice for consumers, capturing 57.1% of the market in 2024.

- Front-Wheel Drive (FWD) configurations lead the drive type category with a 45.9% share in 2024.

- Europe holds the largest regional market share at 43.8%, valued at USD 56.7 billion.

Market Segmentation Overview

By Vehicle Type

- Compact electric SUVs lead the market, accounting for 39.3% of the total share in 2024. These vehicles strike an optimal balance of affordability, maneuverability, and urban practicality, making them ideal for city dwellers.

- Mid-size electric SUVs, which appeal to families and those looking for more space, make up a significant portion of the market, offering the perfect blend of electric efficiency and practicality.

- Full-size electric SUVs cater to premium buyers, with a higher price point but also superior performance, spaciousness, and towing capabilities. This segment continues to expand as consumer confidence in electric vehicles grows.

By Propulsion Type

- Battery Electric Vehicles (BEV) lead the market, with a commanding 68.7% share in 2024, showcasing the growing confidence in pure electric technology.

- Plug-in Hybrid Electric Vehicles (PHEV) offer a transitional solution, appealing to consumers who seek electric driving benefits while retaining the convenience of a gasoline engine.

- Hybrid Electric Vehicles serve as an entry point for consumers new to electrification, providing enhanced fuel efficiency and reduced emissions.

By Vehicle Range

- 250-500 Km range vehicles dominate the market, capturing 57.1% of the share in 2024. This range strikes a perfect balance between usability and charging frequency, making it the most attractive option for a majority of consumers.

- Vehicles with up to 250 km range target urban users with shorter driving needs, while above 500 km range vehicles cater to premium consumers requiring long-range capabilities.

By Drive Type

- Front-Wheel Drive (FWD) vehicles take the lead in the market with a 45.9% share. This drivetrain configuration is cost-effective, providing adequate traction and efficiency for everyday usage.

- Rear-Wheel Drive (RWD) and All-Wheel Drive (AWD) configurations are typically found in premium or performance models, appealing to specific consumer needs, such as enhanced driving dynamics or all-weather capabilities.

Drivers

Government Support and Enhanced Infrastructure

Government policies and regulations play a critical role in accelerating the adoption of electric SUVs. With incentives such as tax credits and rebates for electric vehicle purchases, governments worldwide are making electric SUVs more affordable for consumers. Additionally, increasing investments in charging infrastructure, particularly fast-charging stations, are addressing concerns related to range anxiety and fueling the growth of the market.

Technological Advancements

Improving battery technology is a key driver of the Electric SUV market. Innovations in battery chemistry and design are leading to longer driving ranges, faster charging times, and better overall performance. These advancements are making electric SUVs more practical for consumers, reducing concerns over performance limitations and charging difficulties.

Consumer Preference for Sustainability

There is a growing shift in consumer preferences toward eco-friendly vehicles. As environmental awareness increases, consumers are increasingly seeking vehicles that produce zero emissions, particularly in the SUV category, which has traditionally been associated with high fuel consumption. Electric SUVs are seen as a responsible choice for environmentally conscious buyers.

Use Cases

- Personal Use: Many consumers are transitioning from traditional gasoline-powered SUVs to electric SUVs due to the environmental benefits and cost savings associated with electric driving.

- Fleet Services: With the growing interest in sustainability, fleet operators are increasingly adopting electric SUVs for commercial use, benefiting from lower operational costs and positive environmental branding.

- Ride-sharing Services: Companies like Uber and Lyft are exploring electric SUVs for their fleets, providing passengers with an eco-friendly and efficient alternative to traditional gas-powered vehicles.

Major Challenges

Infrastructure Limitations

One of the biggest challenges faced by the Electric SUV market is the lack of adequate charging infrastructure, particularly in rural and semi-urban areas. While major cities have seen significant improvements in the availability of charging stations, the same cannot be said for smaller towns or remote locations, which could deter potential buyers.

Performance Concerns

Despite advances in technology, some consumers still harbor doubts about the performance of electric SUVs in extreme weather conditions. In cold climates, for instance, battery efficiency can decline, reducing the range of electric SUVs. Similarly, in hot weather, battery performance and charging speeds may be affected, leading to concerns about reliability.

High Initial Costs

Although prices for electric vehicles are falling, the initial cost of electric SUVs remains higher than that of traditional gasoline-powered vehicles. While governments are offering subsidies and tax incentives, the upfront cost still poses a barrier for many potential buyers.

Business Opportunities

Vehicle-to-Grid (V2G) Technology

Vehicle-to-grid technology, which allows electric SUVs to send stored energy back to the grid, offers an innovative business model for automakers and consumers. This technology not only creates a new revenue stream for electric vehicle owners but also helps balance the energy grid, making electric SUVs even more valuable as energy storage solutions.

Luxury Electric SUVs

Luxury electric SUVs present a high-margin opportunity for automakers targeting wealthy consumers. These vehicles offer superior features, technology, and performance while maintaining zero emissions, making them an attractive option for environmentally conscious buyers who also demand premium comfort and performance.

Fleet Electrification

The growing trend of fleet electrification provides an excellent opportunity for electric SUV manufacturers to capture commercial market share. Businesses that operate fleets of vehicles can significantly lower operating costs by switching to electric SUVs, contributing to the demand for these vehicles in the commercial sector.

Regional Analysis

Europe

Europe dominates the Electric SUV market, holding 43.8% of the market share, valued at USD 56.7 billion in 2024. The region benefits from robust government policies, incentives, and a strong consumer base driven by environmental concerns. Additionally, established automotive manufacturers in Europe are accelerating the development and production of electric SUVs.

North America

North America holds a significant position in the Electric SUV market, driven by technological advancements, government incentives, and a strong consumer interest in electric mobility. The US in particular is expected to see continued growth, supported by an expanding network of fast-charging stations and growing investments in electric vehicle infrastructure.

Asia-Pacific

The Asia-Pacific region, led by countries like China and Japan, is witnessing rapid growth in electric SUV adoption. Investments in electric vehicle infrastructure, strong government support, and rising consumer demand are contributing to the expansion of the market in this region.

Recent Developments

- In August 2025, the UK government announced a £3,750 discount on electric cars to make them more affordable for a broader range of consumers.

- In August 2024, Lucid Motors secured up to USD 1.5 billion in funding to support the rollout of its electric SUVs, a move aimed at expanding its product line and scaling operations.

- In August 2025, Macquarie Asset Management raised USD 405 million for Vertelo, a fleet electrification company working to transform traditional fleets into electric ones.

Conclusion

The Electric SUV market is poised for substantial growth, driven by government incentives, technological advancements, and shifting consumer preferences toward sustainable and energy-efficient vehicles. With the market expected to grow at a CAGR of 29.2% over the next decade, the electric SUV sector presents tremendous business opportunities for automakers and related industries.

As consumer demand for eco-friendly transportation solutions increases, electric SUVs are positioned to become the vehicles of choice for a growing number of environmentally conscious buyers. With further advancements in battery technology and the expansion of charging infrastructure, the future of the Electric SUV market looks promising, offering both challenges and opportunities for industry stakeholders.