Table of Contents

Introduction

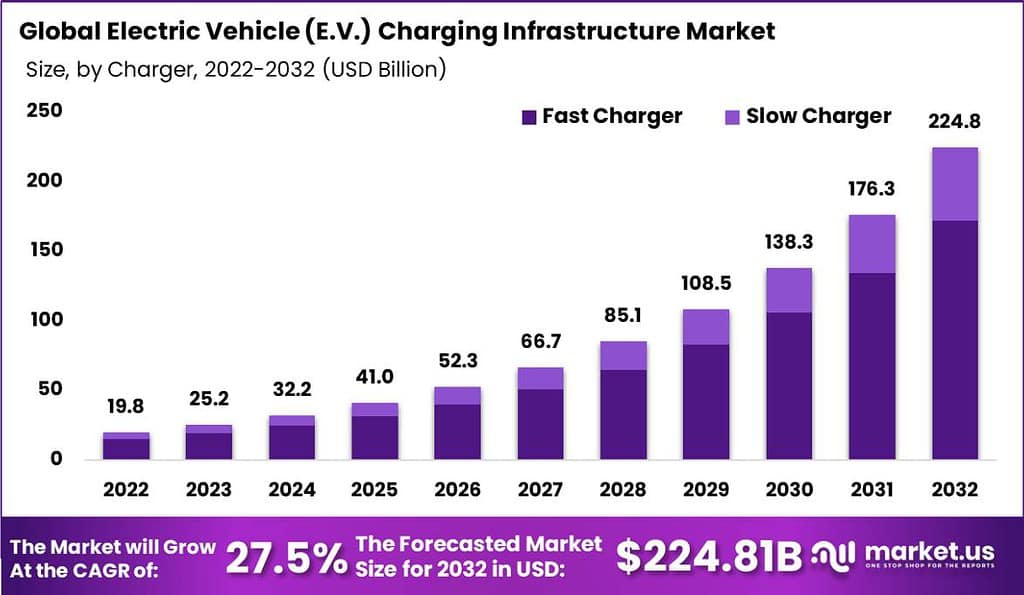

The Global Electric Vehicle (EV) Charging Infrastructure Market is poised for substantial growth, with projections indicating a surge from USD 25.2 Billion in 2023 to a remarkable USD 224.8 Billion by 2032, demonstrating a steady expansion at a noteworthy CAGR of 27.5% over the forecast period. The surge in demand for electric vehicles necessitates the development of a robust charging infrastructure network to support widespread adoption, facilitating the transition towards sustainable transportation solutions.

Electric vehicle (EV) charging infrastructure refers to the network of charging stations and related equipment that supports the charging needs of electric vehicles. It plays a crucial role in facilitating the widespread adoption of electric vehicles by providing convenient and accessible charging options for EV owners. The infrastructure includes various types of charging stations, such as home chargers, workplace chargers, public chargers, and fast chargers, each offering different charging speeds and capabilities.

The expansion of electric vehicle charging infrastructure is happening at a rapid pace to meet the increasing demand for electric vehicles. Governments and private companies are investing heavily in building more charging stations, with the aim of making them as common as traditional gas stations. This growth is not only about adding more chargers but also about improving the technology to make charging faster and more efficient.

In 2022 alone, the deployment of 330,000 fast chargers highlighted the aggressive push towards enhancing the EV charging network, with China leading the charge. The country accounted for nearly 90% of the global increase in fast chargers, boasting a total of 760,000 fast chargers, predominantly distributed across ten provinces. Meanwhile, Europe’s fast charger inventory surpassed 70,000 units, with Germany, France, and Norway at the forefront of this expansion.

The global average public charging power capacity per electric Light-Duty Vehicle (LDV) stands at around 2.4 kW per EV, showcasing the varied charging capabilities across regions. Notably, Korea presents the highest capacity ratio of 7 kW per EV, despite the majority (90%) of its public chargers being slow chargers. This indicates a strategic approach to balancing fast and slow charging options to cater to different user needs.

In a significant move to bolster the EV infrastructure, an agreement between the European Investment Bank and the European Commission has earmarked over EUR 1.5 billion for investment by the end of 2023. This funding is dedicated to alternative fuels infrastructure, including the expansion of electric fast charging networks. This financial injection is expected to further accelerate the growth of EV charging infrastructure, making electric mobility more accessible and convenient for users across the globe.

Key Takeaways

- The Global Electric Vehicle (EV) Charging Infrastructure Market is projected to expand from USD 25.2 Billion in 2023 to USD 224.8 Billion by 2032, demonstrating a robust CAGR of 27.5%.

- Fast Charger dominates the market with a significant revenue share of 70.8%.

- DC Charging leads the segment with a major revenue share of 58.6%.

- CCS holds the market lead with a notable revenue share of 39.8%.

- Level 2 dominates the market with a significant revenue share of 51.6%.

- Commercial application leads the segment with a major revenue share of 63.4%.

- Asia Pacific dominates the market with a substantial revenue share of 43.7%, driven by investments in EV adoption and infrastructure development.

- Prominent players in the Electric Vehicle Charging Infrastructure Market include AeroVironment Inc., ABB, BP Chargemaster, ChargePoint, Inc., and others.

Electric Vehicle Charging Infrastructure Statistics

- The global deployment of ultra-fast charging stations, boasting capacities of 350kW or more, is poised for a 40% increase between 2022 and 2024. This surge reflects the growing demand for rapid charging options among EV users.

- By 2024, it’s expected that more than 55% of new charging infrastructure will incorporate energy storage systems. These systems are crucial for load balancing and peak shaving, enhancing the efficiency of the electric grid (Source: Siemens).

- Around 45% of public charging stations are anticipated to enhance user experience by offering additional amenities, such as Wi-Fi hotspots and electric vehicle waiting lounges, by 2024 (Source: Electrify America).

- Over 70% of public charging stations are projected to support advanced features for charging management and load optimization by 2024, signaling a shift towards more sophisticated and user-friendly charging solutions (Source: ChargePoint).

- The adoption of wireless charging technology for EVs is expected to see a 35% growth among charging station providers from 2022 to 2024. This innovation allows for a more convenient and seamless charging experience (Source: WiTricity).

- By 2024, over 60% of new charging infrastructure installations are projected to be equipped with charging station management software and cloud-based monitoring solutions, ensuring efficient operation and maintenance (Source: EVgo).

- Approximately 40% of public charging stations are expected to feature on-site energy storage solutions by 2024. This approach is aimed at managing peak demand and reducing strain on the electric grid (Source: Rocky Mountain Institute).

- It’s anticipated that over 65% of public charging stations will integrate with smart grid technologies by 2024. This integration facilitates demand response and grid balancing, contributing to the overall stability and efficiency of power distribution (Source: Siemens).

- The deployment of mobile and portable charging solutions is projected to grow by 30% globally between 2022 and 2024, addressing the need for flexible and accessible charging options in various settings (Source: FreeWire Technologies).

Drive Your Growth Strategy! Purchase the Report to Uncover Key Insights

Emerging Trends

- Expansion of Charging Infrastructure: The rapid growth in electric vehicle (EV) adoption requires an equally swift expansion of charging facilities, including both hardware and software components. Innovations include electric road systems for dynamic charging and solar-powered stations with wireless charging capabilities.

- Plug and Charge Technology: Simplifying the charging process, this technology allows electric vehicles and charging stations to communicate directly, enabling automatic billing and eliminating the need for manual authentication each time.

- Vehicle-to-Everything (V2X) Communications: This encompasses technologies that enable energy flow from the vehicle to the grid, homes, and other energy consumers, optimizing energy usage and contributing to grid stability.

- Adoption of OCPP 2.0.1 Protocol: Facilitates improved management and operation of charging stations, ensuring secure firmware updates, better transaction handling, and support for smart charging and ISO 15118 standards.

Use Cases

- Public and Residential Charging: Fast chargers dominate the market, particularly for public use, while slow chargers are more common for residential, overnight charging.

- Commercial Applications: Includes fleet, destination, bus, and highway charging stations, significantly led by government and manufacturer initiatives.

- Vehicle Fleet Management: Leveraging EV charging for optimized fleet operations, including route planning and vehicle tracking.

- Energy Management: Through connected charging solutions, enabling advanced analytics, remote management, and integration with energy systems.

Major Challenges

- Grid Integration and Power Demand: The fluctuating power demand from EVs poses a challenge to the electric grid, necessitating smart grid management and data sharing.

- Interoperability of Charging Standards: With multiple connector types and charging levels, ensuring compatibility across EVs and charging infrastructure remains a challenge.

- Infrastructure Costs: Developing and deploying charging infrastructure, especially fast-charging stations, involves significant investment.

- User Concerns with V2G Technology: Despite its potential benefits, concerns about battery lifecycle impacts and unpredictability of charging needs may hinder V2G adoption.

Market Opportunities

- Fast Charging Infrastructure: As the leading segment, fast charging offers considerable growth opportunities, supported by governmental initiatives.

- Connectivity Solutions: The shift towards connected charging stations, offering benefits like remote management and driver convenience, presents a significant market opportunity.

- Residential Charging: With the growth of EV adoption, demand for home charging solutions is expected to rise, offering opportunities for charger manufacturers and service providers.

- Global Market Expansion: The Asia Pacific region leads in market share, with significant investments in charging infrastructure development. Europe and North America also present substantial growth opportunities.

Recent Developments

1. AeroVironment Inc.:

- February 2023: Launched the “SkyCharger,” a portable and foldable solar EV charger for outdoor adventures and emergency purposes.

- August 2023: Partnered with “Duke Energy” to deploy solar-powered EV charging stations in North Carolina, expanding access to renewable energy charging options.

- October 2023: Announced the development of a new high-power EV charging solution targeting fleet applications.

2. ABB:

- March 2023: Launched the “Terra 360,” an ultra-fast charging station capable of delivering up to 360 kW, significantly reducing charging times.

- June 2023: Signed a contract with “Ionity” to supply fast chargers for a major European highway network, boosting charging infrastructure across the continent.

- November 2023: Partnered with “Enel X” to develop and deploy smart charging solutions for commercial and industrial applications.

Top 13 Vendors

- AeroVironment Inc.: Known for its comprehensive range of charging solutions, AeroVironment has established itself as a pivotal player, particularly in North America, offering both residential and commercial charging stations.

- ABB: A global leader in electrification products, ABB offers a wide array of fast charging solutions and has been instrumental in deploying cutting-edge technology for electric vehicles worldwide.

- BP Chargemaster: As part of BP, BP Chargemaster operates a vast network of public charging stations in the UK and is expanding its presence to cater to the increasing demand for EV charging infrastructure.

- ChargePoint, Inc.: ChargePoint boasts one of the largest networks of independently owned EV charging stations across North America and Europe, providing innovative solutions for home, workplace, and public charging.

- ClipperCreek: Recognized for its reliable and user-friendly charging stations, ClipperCreek offers a variety of products suitable for both residential and commercial applications.

- Eaton: Eaton provides a broad portfolio of electrical solutions, including EV charging stations, emphasizing sustainability and energy efficiency in its offerings.

- GENERAL ELECTRIC: With a long-standing reputation in innovation, GE offers EV charging solutions that cater to both residential and commercial needs, focusing on smart and efficient technology.

- Leviton Manufacturing Co., Inc.: Leviton is a key player in the electrical industry, offering a wide range of EV charging products designed to be user-friendly and efficient for home use.

- SemaConnect, Inc.: SemaConnect delivers comprehensive EV charging solutions for commercial, residential, and fleet applications, focusing on smart technology and networked charging stations.

- Schneider Electric: A global leader in energy management and automation, Schneider Electric provides advanced EV charging solutions and services that support sustainability and operational efficiency.

- Siemens: Siemens offers a wide range of charging infrastructure technologies, including fast charging stations and solutions for residential, commercial, and urban settings.

- Tesla, Inc.: Tesla not only leads in the production of electric vehicles but also in the deployment of its Supercharger network, providing high-speed charging exclusively for Tesla vehicle owners.

- Webasto: Webasto is well-regarded for its innovative charging solutions, including portable chargers and home charging stations, catering to a wide range of EVs.

Conclusion

In conclusion, the growth of electric vehicle charging infrastructure is driven by the increasing adoption of electric vehicles, supportive government policies, technological advancements, and industry collaborations. However, challenges such as standardization, power capacity, and upfront costs need to be addressed to ensure a robust and accessible charging network. Overcoming these challenges will be crucial to meet the evolving needs of electric vehicle owners and promote the widespread adoption of electric vehicles as a sustainable mode of transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)