Table of Contents

Market Overview

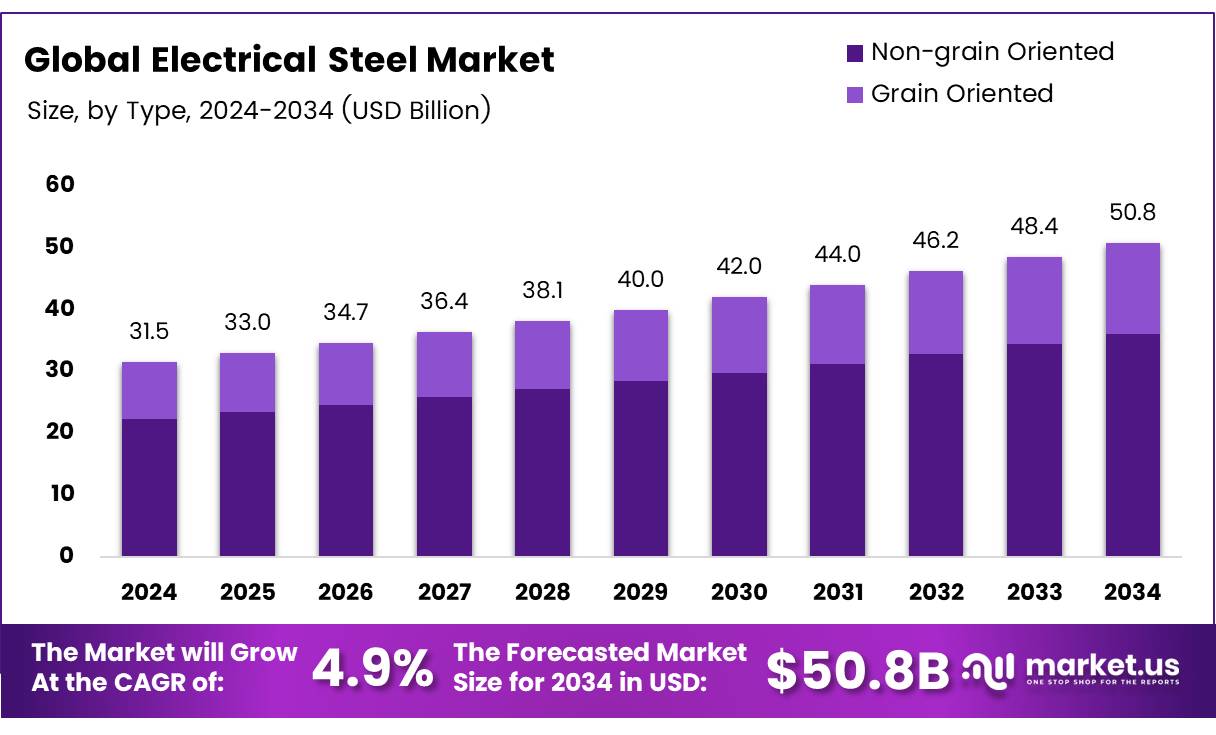

The Global Electrical Steel Market size is expected to be worth around USD 50.8 Billion by 2034, from USD 31.5 Billion in 2024, growing at a CAGR of 4.9% during the forecast period.

The Electrical Steel Market is growing steadily due to rising demand in automotive and power sectors. Electrical steel helps reduce energy loss in transformers and electric motors. In July 2025, electrical steel caused 4.5% of total energy loss in the U.S. This shows room for improvement and market opportunity. Energy efficiency drives market growth globally.

Government investments boost the electrical steel industry. Policies favor renewable energy and electric vehicle adoption. Regulations push for lower carbon emissions and better energy standards. These laws encourage innovation in electrical steel products. Companies investing in high-quality steel gain a competitive edge.

The market offers strong opportunities for manufacturers and investors. Demand for efficient electrical steel will rise with green energy trends. Businesses focusing on sustainable and advanced solutions will benefit. The electrical steel market outlook remains positive and promising. Growth is driven by technology, regulations, and global energy goals.

Key Takeaways

- The global Electrical Steel Market is expected to reach USD 50.8 billion by 2034 with a CAGR of 4.9%.

- Non-grain Oriented (NGO) electrical steel held a dominant 71.3% market share in 2024.

- The Transformer segment led the market with a 52.6% share in 2024, fueled by power infrastructure investments.

- Asia Pacific commands the largest market share at 72.3%, valued at around USD 22.6 billion.

Market Drivers

- Renewable energy projects drive demand for electrical steel in wind turbines and solar inverters.

- Electric vehicle growth boosts electrical steel use in motor cores for better efficiency.

- Infrastructure upgrades increase need for electrical steel in transformers and motors.

- Advanced manufacturing improves electrical steel quality, reducing energy losses.

Challenges

- Raw material price volatility impacts production costs and margins.

- High manufacturing costs for advanced electrical steel limit growth.

- Alternative materials like amorphous steel compete in specialized applications.

- Environmental regulations raise costs by pushing for cleaner production methods.

Segmentation Insights

Type Analysis:

In 2024, Non-Grain Oriented (NGO) electrical steel leads with 71.3% market share due to its versatility and cost-effectiveness. It’s widely used in motors, transformers, and appliances. Grain Oriented (GO) steel, though smaller in share, is important for high-efficiency transformers. NGO steel’s broad use keeps it dominant.

Application Analysis:

Transformers hold the largest share at 52.6% in 2024, driven by rising power infrastructure investments. They need electrical steel to reduce energy loss. Motors also use electrical steel, especially with growing electric vehicle demand, but transformers remain the main market driver.

Regional Insights

Asia Pacific: Leads with 72.3% share due to industrial growth and EV production, led by China, Japan, and India.

North America: Steady growth from EV adoption and energy-efficient motors, supported by major manufacturers.

Europe: Driven by automotive demand and green policies, with Germany, France, and the UK leading.

Middle East & Africa and Latin America: Smaller but growing markets thanks to energy projects and rising EV use.

Recent Developments

- In August 2025, JSW Steel and JFE Steel announced a joint investment of $669 million to expand electrical steel production capacity in India, aiming to support growing demand from the electric vehicle and renewable energy sectors. This move strengthens India’s manufacturing base and boosts local supply chains for advanced steel products.

- In January 2025, SAIL partnered with John Cockerill to invest Rs 6,000 crore to establish a new electrical steel plant in India. This project is set to enhance India’s position in the global electrical steel market by increasing domestic production capabilities.

- In February 2025, Governor Kay Ivey announced that ArcelorMittal will invest $1.2 billion in Mobile County, Alabama, to build an advanced manufacturing facility. The plant will produce specialty electrical steel used primarily in electric vehicle motors and other high-tech applications, bolstering the U.S. steel industry.

- In February 2024, JSW Steel and JFE Steel formed a joint venture valued at ₹5,500 crore to produce electrical steel in India. This partnership aims to boost production capacity and support the development of green technologies and sustainable manufacturing in the country.

Conclusion

The Global Electrical Steel Market is set to grow steadily, reaching USD 50.8 billion by 2034 at a CAGR of 4.9%, driven by rising demand in automotive, power, and renewable energy sectors. Asia Pacific leads the market with strong industrial growth and EV production. Government policies supporting clean energy and electric vehicles further boost demand. Key players are investing heavily in expanding production capacity, especially in India and the U.S. Despite challenges like raw material price fluctuations and competition from alternative materials, the market outlook remains positive, fueled by technological advancements and global energy goals.