Table of Contents

Overview

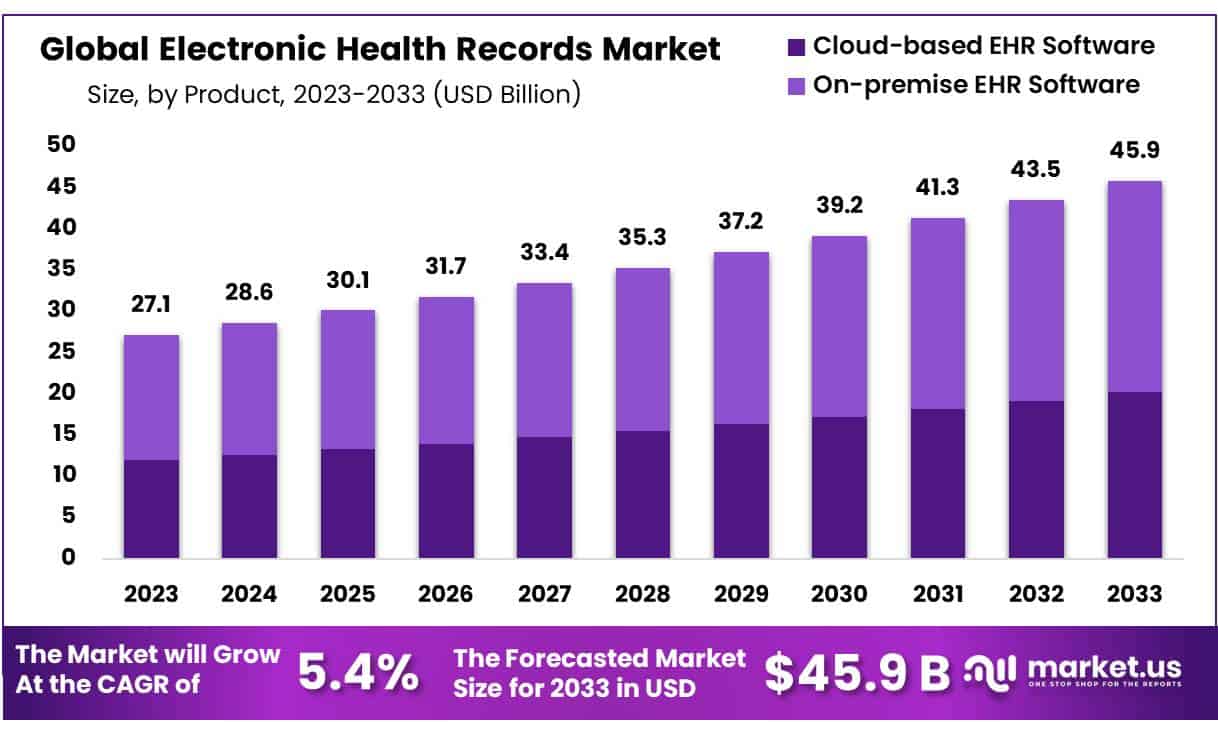

New York, NY – Oct 16, 2025 – The Global Electronic Health Records Market size is expected to be worth around USD 45.9 Billion by 2033 from USD 28.6 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2033.

The global Electronic Health Records (EHR) sector is witnessing strong growth, primarily driven by policy support, government funding, and digital transformation initiatives in healthcare. The World Health Organization’s Global Strategy on Digital Health 2020–2025 has encouraged countries to create national digital health platforms, including EHR systems. In 2023, the WHO launched the Global Initiative on Digital Health to assist governments in scaling these systems, setting a coordinated approach for digital health worldwide. These initiatives have strengthened confidence and investment in EHR infrastructure.

Regulatory measures are also accelerating EHR adoption. In the European Union, the European Health Data Space (EHDS) , effective from March 2025, established a legal framework for using and exchanging electronic health data. It enhances individuals’ rights to access and share their records across EU member states, driving demand for interoperable EHR platforms and cross-border data-sharing systems.

Government funding continues to play a vital role. In the United Kingdom, NHS England invested over £400 million in 2024 to support 150 trusts in implementing or upgrading Electronic Patient Records, with 189 trusts already using modern systems. Such public investments reduce financial barriers, encourage vendor innovation, and enhance healthcare efficiency through better data integration.

In the United States, data from the Office of the National Coordinator for Health IT (HHS) show that hospitals have significantly improved electronic access for patients since the HITECH Act. The government’s ongoing emphasis on interoperability ensures steady investment in certified EHR technologies and digital interfaces.

Patient-driven demand is rising globally as digital health awareness increases. OECD data show that 60% of adults aged 16–74 searched for health information online in 2022, up from 40% in 2012. Teleconsultations more than doubled between 2019 and 2021, leading healthcare providers to adopt EHR systems that enable secure documentation and data sharing.

EHR demand is also supported by the rising burden of chronic diseases. According to WHO, noncommunicable diseases accounted for about 43 million deaths in 2021, or nearly three-quarters of all non-pandemic deaths. Managing these conditions requires continuous, data-driven care, which EHRs enable effectively.

Furthermore, improving digital infrastructure such as increased broadband and internet penetration reported by the World Bank is expanding the technical base for EHR systems. Despite progress, OECD surveys show that only 15 of 27 countries have unified EHR systems, revealing opportunities for vendors focused on standardization and interoperability.

Key Takeaways

- Market Overview: Global Electronic Health Records Market size is expected to be worth around USD 45.9 Billion by 2033 from USD 28.6 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2033.

- Product Analysis: The on-premise EHR software segment accounted for the largest market share, representing approximately 54% in 2023, driven by its enhanced data control and security advantages.

- Type Analysis: Inpatient EHR systems dominated the market with a 55% share in 2023, owing to their widespread use in hospital-based healthcare settings for comprehensive patient data management.

- Application Analysis: The practice management segment emerged as the leading application, capturing 30% of the total market share, supported by the increasing need for administrative efficiency and workflow optimization in clinical operations.

- End-Use Analysis: By end use, hospitals held the largest share of 40% in 2023, reflecting the high adoption of integrated EHR platforms to improve patient outcomes and care coordination.

- Regional Analysis: North America remained the dominant regional market in 2023, accounting for 39% of total revenue, supported by advanced healthcare IT infrastructure and strong regulatory support.

- Key Trends: The rising adoption of cloud-based EHRs is reshaping the market landscape due to their cost-efficiency, scalability, and remote accessibility. Additionally, EHR expansion in specialty centers is accelerating as providers seek customized solutions for enhanced operational efficiency and specialized patient care.

What Technological Advancements Driving EHR system Development?

Technological advancements have significantly accelerated the development of Electronic Health Record (EHR) systems, enhancing their functionality, efficiency, and interoperability. One of the key innovations is cloud computing, which enables real-time data access, storage scalability, and cost efficiency, allowing healthcare providers to share patient information securely across multiple facilities. The integration of artificial intelligence (AI) and machine learning (ML) has further advanced EHR systems by enabling predictive analytics, automated data entry, and clinical decision support, thereby reducing administrative burden and improving diagnostic accuracy.

Additionally, the adoption of interoperability standards such as HL7 FHIR (Fast Healthcare Interoperability Resources) has improved seamless data exchange among diverse healthcare platforms. Blockchain technology is being explored to enhance data security, integrity, and traceability in patient information management. Mobile health (mHealth) integration allows patients and clinicians to access and update health records remotely, fostering patient engagement and continuity of care. Furthermore, natural language processing (NLP) tools are enabling structured extraction of data from unstructured clinical notes, enhancing data usability.

Overall, these technological innovations are transforming EHR systems into intelligent, connected platforms that support data-driven healthcare delivery, personalized medicine, and improved patient outcomes while ensuring compliance with privacy and security regulations.

Segmentation Analysis

- Product Analysis: In 2023, on-premise EHR software accounted for about 54% of the market share due to strong data control, enhanced security, and customization flexibility. These systems are favored by organizations prioritizing data sovereignty and avoiding subscription costs. Conversely, cloud-based EHR solutions are expanding steadily, driven by lower costs, ease of remote access, and reduced IT demands. Increasing adoption among small and medium healthcare providers indicates a rising trend toward flexible, accessible, and collaborative cloud-based EHR systems in the coming years.

- Type Analysis: Inpatient EHR systems held a dominant 55% market share in 2023, underscoring their importance in managing complex hospital workflows and continuous patient care. These systems ensure comprehensive data access for multidisciplinary care teams. Outpatient EHR systems, though smaller in share, are increasingly vital for clinics and telemedicine, supporting scheduling, billing, and routine patient management. The rising shift toward outpatient and remote healthcare delivery is expected to accelerate the adoption of outpatient EHR solutions, enhancing efficiency and patient engagement outside hospitals.

- Application Analysis: Practice management led the EHR market in 2023 with a 30% share, driven by its ability to improve administrative efficiency, scheduling, billing, and overall financial performance in healthcare facilities. Patient management applications followed with 25%, supporting the organization of patient data and care coordination. Population health management held 20%, emphasizing analytics-driven healthcare delivery. Other applications, such as referral management, play supporting roles, reflecting the ongoing evolution of EHR systems toward integrated, data-driven tools that enhance healthcare outcomes and operational performance.

- End-User Analysis: Hospitals dominated the EHR market in 2023 with a 40% share, owing to their need for integrated systems that manage complex care processes and ensure accurate patient information flow. Clinics accounted for 30%, benefiting from improved scheduling, billing, and patient management efficiency. Specialty centers, including oncology and cardiology units, captured 20%, relying on tailored EHR systems to address specific clinical needs. The remaining 10% came from small practices and outpatient facilities, highlighting EHRs’ expanding role across diverse healthcare settings.

Regional Analysis

North America

In 2023, North America accounted for 39% of the global Electronic Health Records (EHR) market, reflecting the region’s advanced healthcare infrastructure and strong focus on health information technology (IT) innovation. This leadership position is supported by the extensive adoption of EHR systems across hospitals, clinics, and specialty care centers. Regulatory initiatives such as the Health Information Technology for Economic and Clinical Health (HITECH) Act have played a critical role in promoting EHR implementation and compliance, thereby improving patient data management and interoperability.

Moreover, the strong presence of leading EHR vendors and sustained investments in digital healthcare solutions continue to strengthen the region’s dominance, enhancing operational efficiency and the overall quality of patient care.

Europe

In Europe, the Digital Single Market Strategy introduced by the European Commission is facilitating seamless online access to goods and services, thereby supporting the digital integration of healthcare systems. This initiative is expected to create a favorable environment for the growth of the EHR market by promoting cross-border data sharing, digital connectivity, and innovation in health IT infrastructure, contributing to the overall expansion of the European digital economy.

Asia-Pacific

The Asia-Pacific region is projected to record substantial growth in the EHR market over the forecast period, driven by rising demand for high-quality healthcare services and accelerated digital transformation initiatives. In China, the Ministry of Health’s e-Health Action Plan aims to expand the adoption of electronic health records and promote nationwide data sharing across healthcare institutions and insurance systems, fostering greater efficiency and accessibility in patient care delivery.

Frequently Asked Questions on Electronic Health Records

How do EHRs benefit healthcare providers and patients?

EHRs improve efficiency, accuracy, and coordination in healthcare delivery. For providers, they reduce paperwork, support evidence-based decisions, and minimize medical errors. For patients, EHRs enable better engagement and communication, faster access to personal health data, and improved continuity of care across multiple healthcare settings.

What is the difference between an EHR and an EMR?

An Electronic Medical Record (EMR) is a digital version of the paper charts in a single clinician’s office, primarily used for diagnosis and treatment within one practice. In contrast, an EHR is designed for interoperability, allowing data sharing across different healthcare organizations, specialists, laboratories, and hospitals to support coordinated and holistic patient care.

What are the main challenges in EHR implementation?

Key challenges include high initial investment costs, complex integration with legacy systems, data privacy and security concerns, and user resistance due to workflow disruptions. Additionally, ensuring interoperability among various EHR systems remains a significant technical and regulatory barrier in many healthcare markets.

How do EHRs ensure data security and patient privacy?

EHR systems employ advanced security protocols, including data encryption, access control, audit trails, and user authentication, to safeguard patient information. Compliance with regulations such as HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR (General Data Protection Regulation) in the EU is essential to maintain confidentiality and prevent unauthorized access.

Conclusion

The global Electronic Health Records (EHR) market is experiencing steady expansion, driven by supportive government initiatives, regulatory frameworks, and technological innovation. The integration of AI, cloud computing, and interoperability standards such as HL7 FHIR is transforming EHRs into intelligent, connected systems that enhance clinical efficiency and patient outcomes.

Increasing public investments, rising digital literacy, and growing healthcare digitization across regions such as North America, Europe, and Asia-Pacific are further accelerating adoption. Despite challenges related to cost and system integration, strong policy backing and demand for secure, data-driven healthcare solutions continue to propel market growth. As healthcare systems worldwide prioritize digital transformation, EHRs are positioned to remain a foundational component of modern, patient-centered, and efficient healthcare delivery.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)