Table of Contents

Introduction

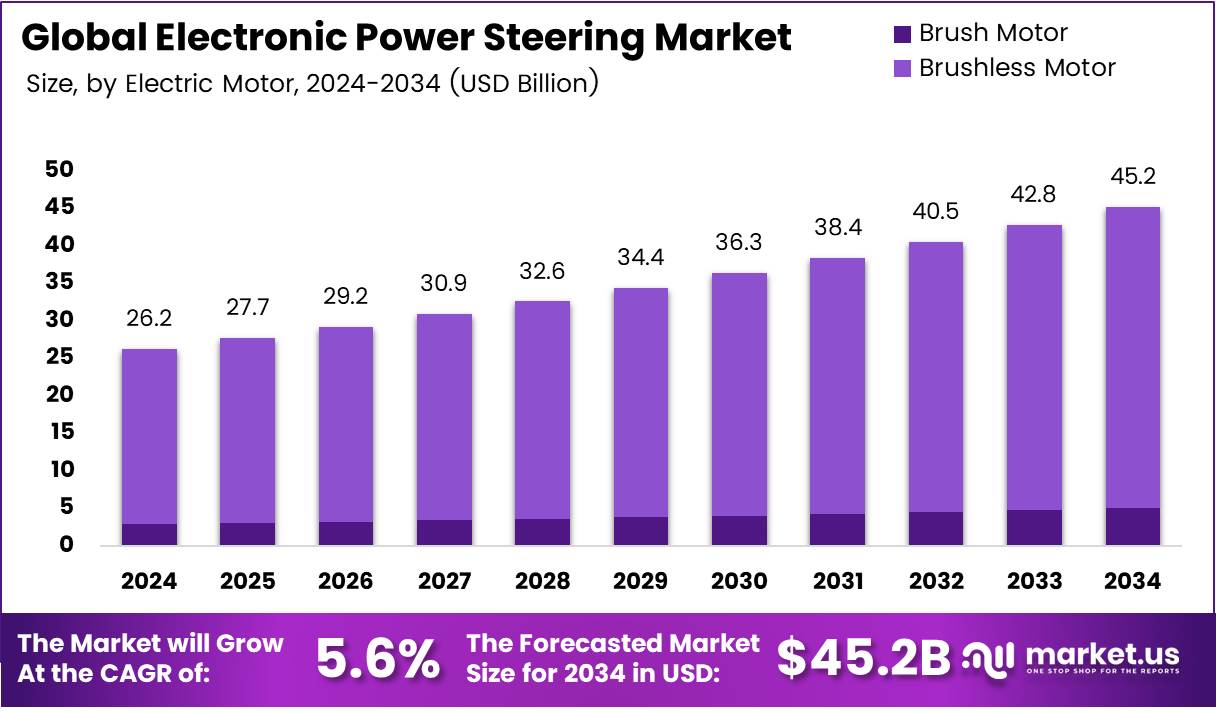

The Global Electronic Power Steering (EPS) market is poised for significant growth, with a projected market size of USD 45.2 Billion by 2034, up from USD 26.2 Billion in 2024, representing a CAGR of 5.6% from 2025 to 2034. The market’s rapid growth is attributed to the increasing demand for fuel-efficient vehicles, the rise of electric and autonomous vehicles, and advancements in steering technologies. As automotive manufacturers continue to prioritize vehicle performance, energy efficiency, and safety, EPS technology is becoming an essential component in modern vehicles.

Key Takeaways

- The global EPS market is projected to reach USD 45.2 Billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034.

- Passenger Cars dominate the market with a 78.2% share, driven by demand for enhanced comfort, safety, and fuel efficiency.

- The Column Assist Type (CEPS) leads the By Type segment with a 52.7% market share, valued for its precision and energy efficiency.

- Collapsible mechanisms hold a dominant 78.9% share in the By Mechanism segment due to their superior safety and space-saving benefits.

- The Asia Pacific region leads the global market, holding a 47.8% share, valued at USD 12.5 Billion in 2024.

Market Segmentation Overview

By Application:

- Passenger Cars (PC) hold the largest share at 78.2%, driven by consumer demand for enhanced driving comfort and fuel efficiency.

- Commercial Vehicles (CV), though holding a smaller share, are gradually adopting EPS due to the focus on modernizing steering systems and improving performance.

By Type:

- Column Assist Type (CEPS) dominates with a 52.7% share, known for precision, compactness, and better fuel efficiency.

- Rack Assist Type (REPS) and Pinion Assist Type (PEPS) have smaller shares but cater to specific vehicle needs, such as torque delivery and lightweight designs.

By Mechanism:

- Collapsible mechanisms lead with a 78.9% share, appreciated for safety features and efficient integration into vehicle designs.

- Rigid mechanisms hold a smaller market share, focusing on durability and strength in certain vehicle models.

By Electric Motor:

- Brushless Motors are increasingly popular due to their efficiency and reliability.

- Brush Motors continue to serve as cost-effective alternatives in certain vehicle types.

Drivers

- Fuel-Efficiency Demand: The increasing demand for fuel-efficient and low-emission vehicles is a primary driver. EPS systems reduce energy consumption compared to traditional hydraulic steering, making them ideal for environmentally-conscious consumers and manufacturers.

- Rise of Electric Vehicles (EVs): The growth of the EV market presents new opportunities for EPS systems. EVs require energy-efficient steering solutions, and EPS plays a critical role in enhancing steering performance while conserving battery power.

- Government Regulations: Stricter environmental regulations, particularly in regions like Europe and North America, have led to a greater emphasis on fuel-efficient technologies. These regulations encourage automakers to adopt EPS to meet emissions standards.

- Advancements in Smart Technologies: The integration of EPS with autonomous driving and Advanced Driver-Assistance Systems (ADAS) is another driver, as these systems require high-precision steering capabilities.

Use Cases

- Passenger Cars: As the leading segment, passenger cars benefit significantly from EPS by offering superior steering precision, enhanced driver comfort, and improved fuel efficiency. The system’s ability to adapt to different driving conditions further enhances the driving experience.

- Electric Vehicles (EVs): EPS is crucial for EVs due to its role in conserving energy and enhancing vehicle handling. With the increasing adoption of EVs, the demand for EPS systems is expected to rise, as these vehicles require energy-efficient steering solutions.

- Autonomous Vehicles: With the development of self-driving cars, EPS systems are integral to the precise control of the vehicle. Autonomous vehicles require steering systems that can seamlessly integrate with the vehicle’s automated driving system, making EPS essential for future mobility.

Major Challenges

- Integration Complexity: Integrating EPS with existing vehicle architectures, especially in older vehicle models, can be complex and costly. Manufacturers may face difficulties adapting EPS technology to traditional vehicle designs, delaying adoption and increasing costs.

- Raw Material Price Volatility: The cost of key components, such as electric motors, semiconductors, and sensors, can fluctuate due to raw material price volatility. These cost increases may impact the overall price of EPS systems and, consequently, vehicle prices.

- Higher Initial Costs: While EPS systems offer long-term savings in fuel efficiency, the initial cost of installation remains higher than traditional hydraulic steering systems. This cost barrier may limit the adoption of EPS in low-cost vehicle models.

Business Opportunities

- EV Market Expansion: As electric vehicles become more widespread, the demand for energy-efficient steering systems like EPS will continue to increase. EPS manufacturers can capitalize on this trend by developing tailored solutions for EVs that maximize energy efficiency while enhancing vehicle handling.

- Partnerships with Automakers: Key players in the EPS market, such as JTEKT Corporation, Denso Corporation, and Hitachi Astemo, can forge strategic partnerships with automakers to supply EPS systems for next-generation vehicles. These partnerships are critical to capturing a larger share of the growing EV and autonomous vehicle markets.

- Smart Steering Systems: The integration of EPS with ADAS and other smart technologies presents new avenues for growth. As ADAS features like lane-keeping assist and adaptive cruise control become more prevalent, EPS systems will need to evolve to provide greater levels of precision and responsiveness.

Regional Analysis

- Asia Pacific: The Asia Pacific region leads the global EPS market with a market share of 47.8%, valued at USD 12.5 Billion. Rapid automotive production, rising demand for fuel-efficient vehicles, and the expansion of the EV market in countries like China, Japan, and India are key drivers of growth in this region.

- North America: North America remains a strong player, driven by technological advancements and high demand for performance vehicles with advanced safety features. The U.S. continues to be a significant contributor to the EPS market due to its large automotive production and consumer preference for advanced driving technologies.

- Europe: Europe’s demand for EPS is largely driven by stringent environmental regulations and the push for sustainable, fuel-efficient vehicles. With major automotive manufacturers focused on reducing carbon emissions and improving vehicle performance, the European market is expected to maintain steady growth.

Recent Developments

- In March 2024, TELO secured funding to scale up its electric truck production, focusing on sustainable transportation solutions. The funding will accelerate the development of electric steering systems.

- In April 2025, Nexteer Automotive launched a high-output column-assist EPS technology, designed to enhance performance in electric vehicles.

- Knorr-Bremse expanded its German truck plant in July 2025, focusing on producing electric steering systems to reduce CO₂ emissions in Europe.

- Rane NSK Steering Systems became a wholly-owned subsidiary of Rane Holdings in July 2024, strengthening its market position and expanding its global footprint.

Conclusion

The Global Electronic Power Steering market is experiencing significant growth driven by the rising demand for fuel-efficient vehicles, the expansion of electric and autonomous vehicles, and ongoing advancements in automotive technologies. With increasing adoption across Asia Pacific, North America, and Europe, the EPS market is set to witness continuous innovation and opportunities for manufacturers. Despite challenges such as integration complexity and raw material price volatility, the future of the EPS market looks promising, with numerous business opportunities in both the EV and autonomous vehicle sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)