Table of Contents

Introduction

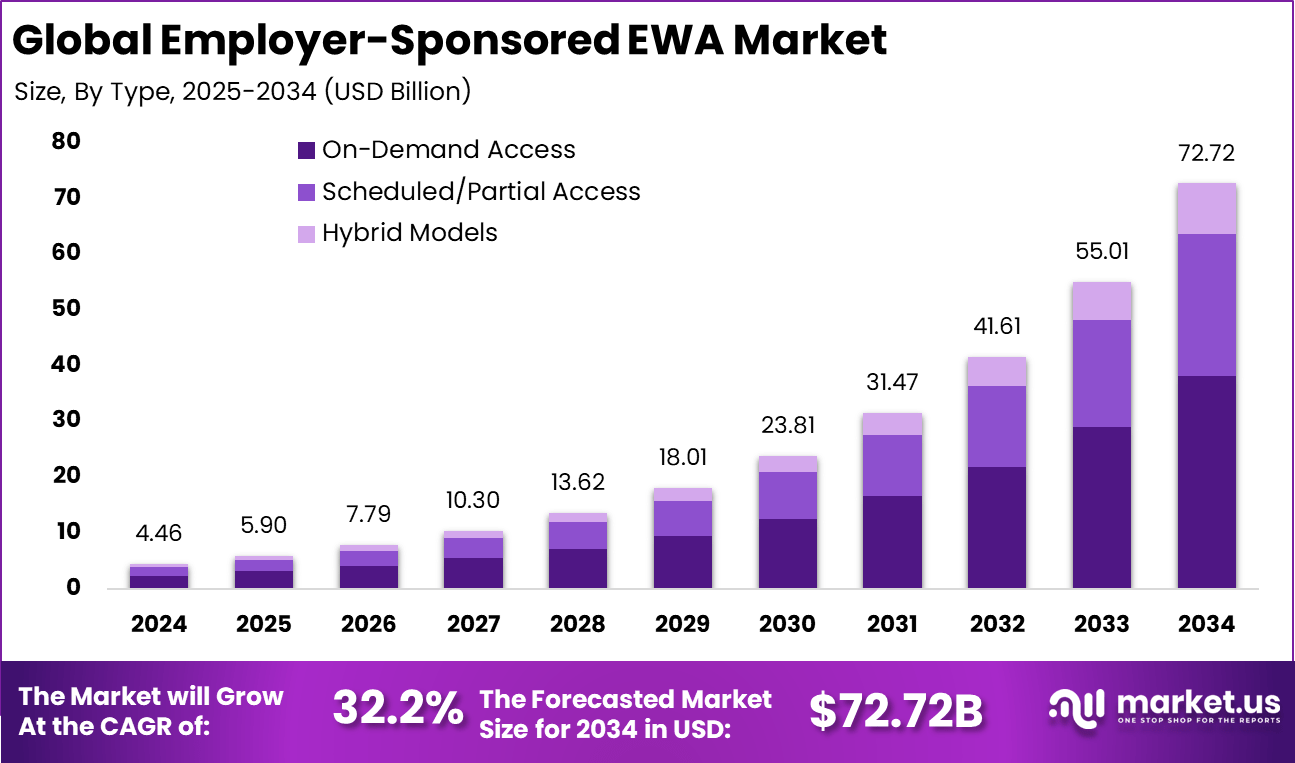

The Global Employer-Sponsored Earned Wage Access (EWA) Market is valued at USD 4.46 billion in 2024 and is projected to reach USD 72.72 billion by 2034, growing at a CAGR of 32.2%. North America leads with a 34.8% share worth USD 1.55 billion. Growth is driven by rising financial stress among employees, employer focus on retention, widespread digital payroll integration, and increasing demand for real-time wage access as a financial wellness benefit.

How Growth is Impacting the Economy

The expansion of employer-sponsored EWA solutions is reshaping the global economy by improving financial liquidity for millions of workers and reducing dependency on payday loans and high-interest credit. This leads to healthier household spending, improved financial resilience, and enhanced workforce productivity. The market promotes economic stability as real-time wage access stimulates predictable consumption patterns across essential goods, transportation, and services.

Employers benefit from lower turnover costs, reduced absenteeism, and stronger engagement, leading to higher business output. Increased adoption of EWA also accelerates growth in fintech infrastructure, mobile payments, and API-driven payroll systems. Governments are beginning to recognize EWA as a key component of financial inclusion, prompting discussions on regulatory frameworks that promote consumer protections while encouraging digital innovation. Overall, the market strengthens economic participation, supports digital transformation, and drives income stability across global labor markets.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/employer-sponsored-ewa-market/free-sample/

Impact on Global Businesses

Businesses experience rising integration costs as they adopt EWA-enabled payroll systems, strengthen cybersecurity measures, and manage compliance requirements. Supply chains shift as fintech providers partner with HR platforms, workforce management systems, and digital banking networks. Sector-specific impacts include improved retention in retail and hospitality, stronger workforce stability in logistics and manufacturing, enhanced financial wellness for healthcare workers, and accelerated adoption in gig and hourly labor markets.

Strategies for Businesses

Companies should evaluate EWA as a core employee benefit, integrate with secure payroll APIs, and ensure transparency in fee structures. Investing in digital onboarding, financial literacy programs, and real-time payroll analytics improves employee satisfaction. Partnering with trusted EWA providers, ensuring data privacy compliance, and piloting programs before large-scale rollouts enhances successful implementation and long-term competitive advantage.

Key Takeaways

- Market projected to reach USD 72.72 billion by 2034

- Strong CAGR of 32.2% across 2025–2034

- North America leads with 34.8% share

- EWA improves retention and reduces financial stress

- Integration of digital payroll and mobile payments is accelerating

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=166064

Analyst Viewpoint

The employer-sponsored EWA market exhibits strong momentum as businesses adopt financial wellness solutions to improve engagement and reduce turnover. Current growth is supported by digital payroll infrastructure, strong fintech innovation, and rising demand among hourly workers. Looking ahead, advancements in open banking, real-time payment rails, and AI-based financial coaching will expand EWA capabilities. As regulatory frameworks evolve and employers prioritize employee well-being, the market is expected to see broad global expansion. With increasing employer interest and technological progress, the future outlook remains very positive.

Use Case and Growth Factors

Use Cases Table

| Use Case | Description |

|---|---|

| Employer-Provided Early Wage Access | Employees access a portion of earned income before payday. |

| Workforce Retention Programs | EWA used to reduce turnover in high-churn sectors. |

| Financial Wellness Solutions | Integrates budgeting, savings, and instant pay tools. |

| Payroll API Integration | Direct connection between EWA providers and employer payroll systems. |

Growth Factors Table

| Growth Factor | Description |

|---|---|

| Rising Worker Financial Stress | Encourages employers to adopt EWA benefits. |

| Digital Payroll Adoption | Facilitates seamless real-time wage access. |

| Growth of Hourly & Gig Workforce | Increases demand for flexible earnings access. |

| Fintech–HR Platform Partnerships | Drives large-scale global expansion. |

Regional Analysis

North America leads due to strong digital payroll infrastructure, early fintech adoption, and a large hourly-worker population. Europe demonstrates rising growth through open banking frameworks and supportive employee welfare regulations. Asia Pacific is expanding quickly as smartphone penetration, fintech adoption, and youth workforce participation accelerate EWA integration. Latin America sees strong opportunities driven by financial inclusion needs, while the Middle East and Africa benefit from mobile banking growth and emerging workforce digitization trends.

➤ Want more market wisdom? Browse reports –

- Wireless Connectivity Chipset Market

- Autonomous Mining Drones Market

- Border Security Drone Market

- AI in Mining and Natural Resources Market

Business Opportunities

Key opportunities include employer-integrated EWA platforms, AI-powered financial planning tools, embedded payroll APIs, and partnerships with HR software providers. Expanding into gig platforms, SMEs, and emerging markets offers significant potential. Subscription-based EWA models, financial education add-ons, and instant settlement technology present new revenue streams. Companies can also innovate with savings-linked EWA features, credit-building tools, and cross-border wage solutions for migrant workers.

Key Segmentation

The market is segmented by type, business model, platform, industry vertical, and end user. Types include early paycheck access and daily pay models. Business models include employer-funded, fee-based, and subscription-based systems. Platforms include mobile apps, payroll integrations, and digital banking environments. Key industries adopting employer-sponsored EWA include retail, hospitality, healthcare, manufacturing, logistics, and gig economy sectors. End users include hourly workers, full-time employees, contractors, and frontline staff.

Key Player Analysis

Leading market participants prioritize building secure wage access platforms, strengthening integrations with HR and payroll systems, and enhancing user financial guidance. Their strategies include expanding employer partnerships, improving instant payment capabilities, and strengthening risk management. Players focus on transparent pricing, data privacy, compliance with wage regulations, and offering personalized financial wellness tools. Continuous innovation in AI-driven recommendations, real-time payroll analytics, and embedded finance capabilities strengthens their competitive positioning.

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others

Recent Developments

- Launch of new employer-integrated instant pay platforms

- Partnerships between EWA providers and major payroll software companies

- Expansion of financial wellness features such as automated savings tools

- Regulatory consultations to standardize EWA consumer protections

- Increased deployments of real-time payment infrastructure for instant wage transfers

Conclusion

The employer-sponsored EWA market is rapidly expanding as businesses prioritize employee financial wellness and digital payroll modernization. With strong growth, rising adoption, and ongoing fintech innovation, the industry is positioned for long-term global expansion and structural transformation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)